Welcome to a new episode of our podcast series focused on impact, where August Soliv, author of Impact Supporters, and Douglas Sloan, Managing Director at Better Society Capital, talk with Marie Ekeland, Founder and CEO of 2050 and one of Europe’s most forward-thinking impact investors.

In this episode, Marie shares how her path, from coding at J.P. Morgan to founding France Digitale and now 2050, has been driven by a deep curiosity and a passion for building businesses that matter. She discusses why the classic VC model falls short in addressing today’s biggest challenges and how she is rewriting the rules with a regenerative, evergreen fund that aligns profit with purpose.

Here’s what’s covered:

05:53 Challenges and Systemic Issues in Tech and Impact VC

10:15 The Concept of Alignment in Impact VC

28:17 Reinventing the VC Model for a Sustainable Future

33:17 Rethinking the VC Model: Extending Time Horizons

37:14 Evergreen Model: Diversifying Risk and Liquidity

39:53 Understanding the Science Behind Climate Change

Watch it here or add it to your episodes on Apple or Spotify 🎧, with chapters for easy navigation available on the Spotify/Apple episode.

Join ImpactVC, a global community of 900+ VCs driving change and using venture capital to tackle the world’s biggest challenges—explore their community, resources and training at impactvc.co.

✍️ Show notes

A look at the person behind - who is Marie Ekeland?

Mathematician & computer scientist from background, I started my career at JPMorgan, Wall Street, end of the nineties, at the beating heart of the digital transformation of the finance industry. I did not find my purpose there and went back to studies. After studying economics & corporate finance I ended up, year 2000, in one of the first venture capital teams in France.

The French Tech was built copycatting Silicon Valley and I was coming from Wall Street and had already taken what I love from American culture and left what I did not want to embark. So I was not in that movement. More, I was the only woman in the room for 10-15 years and had no role model, neither in France, nor in Silicon Valley. So I had an incredible freedom to question the VC role and define it in the way that I felt the most useful and impactful. This has never left me and is how I eventually became an entrepreneur in the impact venture space.

To find my way, I used my mathematician & computer science skills, as well as my empathy as I began to realize the biggest value I could bring to founders was to help them frame the problems they were facing and help them align their board on solutions. By doing so I soon realized that a lot of the problems faced by my portfolio companies were systemic (lack of digital or scale-up talents in Europe, Digital Single Market, data regulation…), and that even the biggest French Tech success at the time (Criteo) could not solve it alone. This is when I launched and co-piloted the France Digitale initiative and understood the power of ecosystems and of building commons.

France Digitale brought me out of the tech bubble. I saw the bigger problems as the French government or the European Commission were asking for my advice, as a French Tech spokesperson, for the European innovation strategy or the French health & education strategies. And I understood the deeper transformation of the economy we were living in was the sustainable transformation.

After 25 years of working with money, I know the power of money. I have seen it at work. I know how investing is not predicting but shaping the future. How the investment decisions we make today are defining the world we will live in tomorrow. And how if we continue investing on historical data and reproducing existing patterns we will augment the problems created by the hyper growth at all costs model. So I have decided to start 2050, an investment company which is dedicated to shape the future I want to live in by investing in solving the essential challenges of our times. Our mission is to shape a fertile future, where everyone can eat enough, eat healthfully, where we can all live and produce in a sustainable manner, where we can take care of our body & mind, where learning & creativity are empowered and trust is put at the heart of our economy and society.

Backcasting from a fertile future has made me built a very different breed of venture company which is investing holistically into keystone solutions all along their value chain, manages a regenerative fund, aligns its financial interests with those of society and the planet, and holds this alignment in time thanks to a steward-ownership and a stakeholders’ governance.

Why Alignment Is the Secret Sauce of Impact

Alignment is a concept that talks to everyone as it embraces 3 meanings historically:

To stand upright: do what you think and feel you should do → be aligned with yourself

Put on the same line: be aligned in interests with your stakeholders, starting from the team, the company as a moral person, its stakeholders, society and the planet

Indicate your lineage: be aligned in interests with the future generations. This, from a company standpoint mean to set the right governance to maintain its alignment in time.

We talk to the founders about alignment which is a win-win framework between profit and impact. It talks to them as an inspirational goal, but they need to have operational tools to put that mindset at work and also need a tension to solve to start using them and dedicate the time. So we start by identifying which tension should be solved on a short-term basis (prepare for the next fundraise, solve founders’ or leaders’ role evolution, align the board on long, mid and short-term strategy, build an aligned value chain positioning and strategic relationships, set an aligned decision-making framework to empower the team, …). We then use this trigger to select which micro-method is adapted.

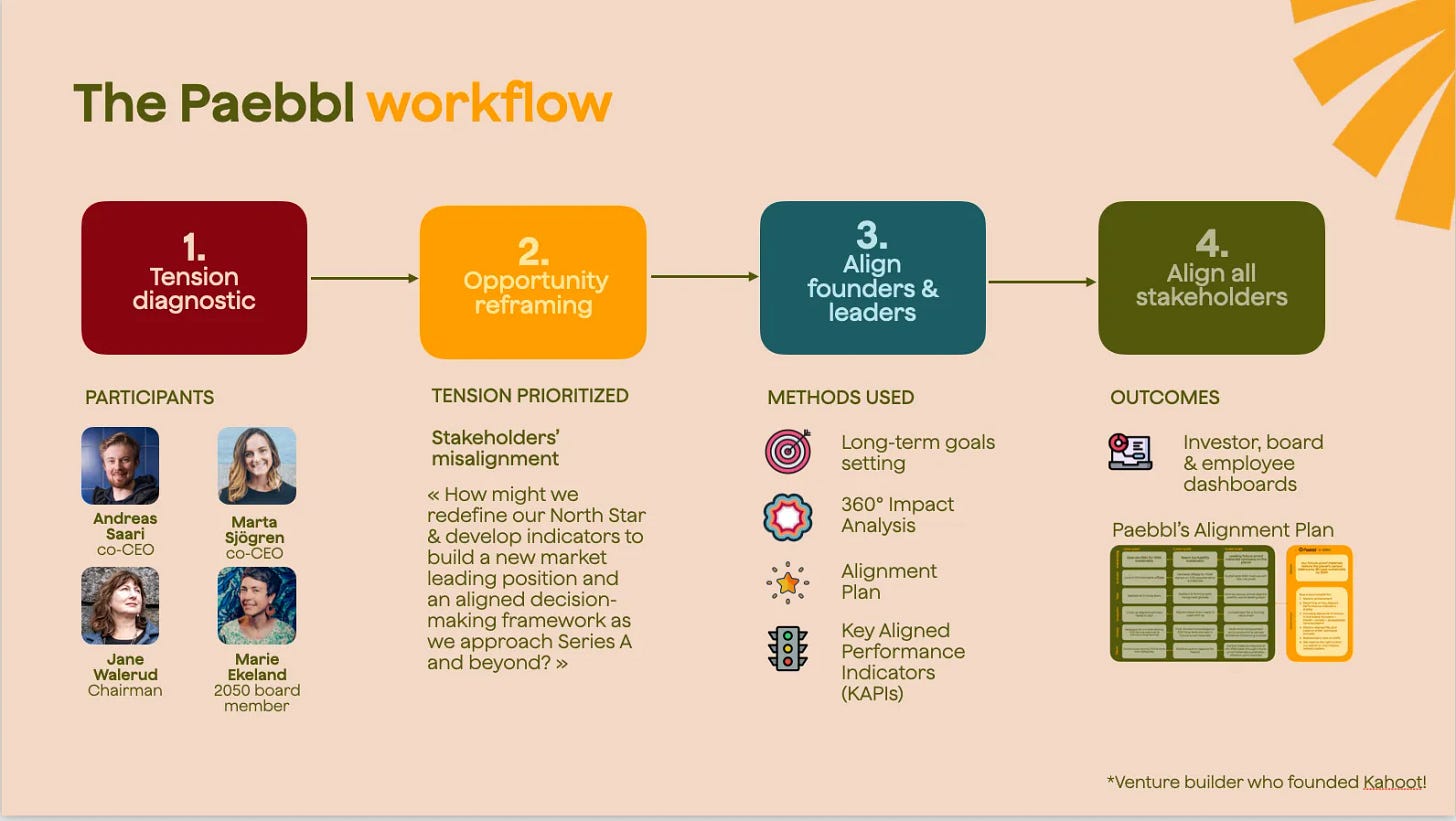

We then, work through a deeper tensions analysis and go through the whole method and with the founders/leaders to have them find their answers before framing them and sharing with the team and the board to align them. Impact comes as a consequence to this process, as compliance, when we work on defining the Key Aligned Performance Indicators (KAPIs) which are initiated from this strategic thinking but we enhance this process with the latest scientific results to measure impact coming from our partners Stockholm Resilience Centre & Upright and with the relevant regulation indicators (SFDR-Article 9), soon CSRD. Here is a video on the Paebbl case 👇

Breaking the VC mold and how 2050 is rethinking the model

Value Chain Shift: The venture capital industry has been shaped, since 2000 to invest in the digital transformation of the economy. Focusing on software disruptions, it has built a “growth-at-all-costs” model, “breaking things and moving fast”, in order to support “software eating the world”. If digital startups could disrupt the economy, it is because they were not dependent on the shift of existing value chains dominated by incumbents to grow. The sustainable transformation of the economy will require incumbents to move together with startups as we need to transform our physical, chemical and biological footprint on the planet. Production chains need to shift to new materials and processes, resources need to be limited and usage needs to become as circular as possible and investors need to invest in transformative companies all along the value chain. This shift will also not happen without tackling the systemic blockers holding value chains back (regulation, common data, indicators & tools, shared sustainable intelligence…) and we need to invest in shared ecosystem assets, “commons”.

Triple Performance: The venture capital industry is relying today on a “growth at all costs” model which optimizes for financial performance within ESG constraints, without managing neither adverse or positive impacts, nor associated risks. The sustainability transformation requires to optimize for triple performance: financial, environmental & social. This also allows to reduce risk, and optimizes the risk/reward ratio of the companies and the portfolio. To allow for triple performance, two important topics need to change:

There needs to be a holistic understanding of the complete company’s impact, not just on a couple of indicators linked to its mission, in order to ensure solving problems in one place is not creating others elsewhere

The incentive of the general partners needs to rely on this net triple performance, and not only on financial performance.

Long-term & semi-liquid: it usually takes longer to build an industrial company, a climate or ocean tech startup or a circular economy platform than an e-commerce site or a SaaS B2B business. It also takes longer to build an aligned software company ensuring it is growing without breaking things but, on the contrary, participating to the shift of its own value chain to provide for a triple performance. The 10year closed fund model is therefore not suited to support sustainable champions and benefit from their full potential as we need more time to reach full potential. The fund model therefore needs to be redesigned, in order to free founders for artificial liquidity pressure but give access to fund investors to regular liquidity returns so that they can be more patient. We designed ours as a regenerative fund.

Value Chain: if digital startups could disrupt companies, it is because they were not dependent on the shift of existing value chains dominated by incumbents to grow. The sustainable transformation of the economy is the opposite as we need to transform our physical, chemical and biological footprint on the planet. Production chains need to shift to new materials and processes, resources need to be limited and usage needs to become as circular as possible. So shifting value chains entirely and not disrupting them thanks to technological productivity.

This is how we designed 2050’s model to adjust to these three major changes:

How do the Commons you invest in at 2050, intertwine with the rest of your work as a VC?

The Ecosystem Assets we co-build aka “Commons” help us be better investors all along our VC journey

Identify champions:

understand deeply the current wave of sustainable transformation, starting from academic & field research thanks to our key partnerships with research labs & field actors, as we did by co-writing a 360° Climate Course together with Université Paris Dauphine, and are now co-building a Sustainable Ocean Platform together with Waves of Change where the introductory scientific knowledge defined by Université Paris Dauphine, University of British Columbia & Stockholm Resilience Centre

deep dive of the essential markets, including a bottom-up data driven approach to identify keystone actors providing the most impactful solutions like we did on regenerative agriculture & aquaculture with partners like Solagro (French field & research institute)

Support & value portfolio companies: through our Alignment Method, co-built with the venture builder We Are Human who founded Kahoot!, we research alignment best practices and develop open source tools, for the emergence of new industry standards to align economic interests with those of society & the planet in time, including regenerative business models, aligned governance & dealmaking practices or team incentives, value chain mapping & positioning… We also research impact valorisation methods & risks evaluation, to sharpen our performance, valuation and risk analysis and forecasts. It goes all the way to co-designing Key Aligned Performance Indicators (KAPIs) for our portfolio companies, based on the latest discoveries, including the Essential Environmental Impact Variables from the Stockholm Resilience Centre and the social impact architecture from the Upright project to ensure a 360° and efficient net impact performance measurement and start valuing their triple performance.

Build fair collaborative advantages for our portfolio companies by understanding, crowd-sourcing and tackling systemic blockers of their value-chains like the need for regulation evolution, for open sustainability intelligence or open data platforms and tools, net impact research per sector and defining the right benchmarks …

Engage our full ecosystem (startups, research labs, corporates, NGOs, institutional investors, HNWI & family offices) to learn, thrive & build together and allow for real value chains shift. To do so, we leverage our media website, open initiatives like the Alignment Method or the open platform for Sustainable Investments in the Blue Economy.

How impact drives performance and why transforming industries starts with aligned business models

Both increase in revenue growth through regenerative business models (cf Michelin example) and cost reduction, therefore profitability increase through frugality in the use of resources and limitation of rare resources utilisation by diversifying sources and materials, and recycling

Strategic & long-term robustness through newly designed alliances: value-chain collaboration (SRC with aquaculture coalition) or investments. Resilience driven by limitation of sustainability, value chain & geopolitics risks

Complete Example of Fifteen (change of business model needed to align interests of the whole value chain both on financial & impact results), Paebbl (equity strategy used to align value chain interests and optimize for long-term success) ****and Sweep (limiting adverse impact leading to cost reductions and greater profitability through full understanding of company’s data & extra-financial measurements)

Business building lessons from the frontlines and what impact founders can learn from scaling with purpose

Keep the right tempo: essential to understand when is the right time to accelerate, when is time to build resiliency, depending on the company’s flow, strategic or execution issues and health check, but also on market’s conditions. Example of Swile (Series B acceleration internally due to market momentum)

Always go back to understanding and syncing on longer term win/win situation and proof points to be demonstrated to reach the next key milestone for the company before making important short-term decisions. Example of Zoe (redesigning team, product strategy to achieve greater ambition and mission of improving the lives of millions)

Board alignment & governance are key but usually completely underestimated and can lead to suboptimal results. Example of first Withings (sold to Nokia against the co-founder/CEO will). Board members also needs to understand it works at the service of achieving the vision of the CEO/founders and not push for their own. Example of Allmyapps (strong-headed directors influencing too much on strategic decisions not owned by the management team)

Build robustness and network effects through ecosystem alignment by strategic alliances. Example of Criteo (defensibility & scalability through strategic deals with Yahoo! Japan & Microsoft)

Main learnings from fundraising in impact VC

Similarities:

Need to convince on both financial performance (Top Tier track record) and impact performance (no impact washing permitted)

Impact performance communication has to be clear and powerful

Need to convince on targeted markets depth, trends & growth, dealflow quality and companies potential

Need to comply to best-in-class on the latest SFDR regulations

Differences:

No access to classic pockets of asset allocations when raising for a new fund design as it does not fit in the classic Venture Capital, 10Y closed fund asset class

Need to talk to decision-makers understanding the sustainable shift and convinced the evolution of the model is good to embrace the full potential of the sustainability transformation of the economy and invest in tomorrow’s champions and the transformation of its own value chain.

Greater value of the learnings, ecosystem, tools, intelligence and research it gives access to and deeper willingness to build value from that within their company or family office.

Need to translate the fund & strategy differences into the existing DDQ frameworks

Strongly held belief you’ve recently had to change your mind on

I thought sustainability inaction was deeply linked to a lack of awareness on the true nature and causes of the challenges we were facing, on the urgency we were in and on the existence of efficient solutions that could be scaled quickly. And that being an insightful and accessible source of knowledge could shift and accelerate the movement, and we still had time to reverse it and would.

Listening to Johan Rockström at the NYC Climate Week in September, demonstrating very scientifically how we only had 5 years left before the Earth System left irreversibly the “corridor of life” it has been in for millions of years, in which humanity could thrive. And seeing how the world is constantly moving to the opposite direction since, I had to change my mind.

What is your best tip for generalist VC investors on impact?

Sustainability is not a marketing trend, it is also a complete transformation of the economy like digital transformation. Except this time it will go faster! So you must integrate sustainability and its positive driver, impact, to your investment strategy. What are the common characteristics to have in mind?

It is enforced by the same signals as the digital wave: we see a growing change towards responsible consumption, an increasing demand for jobs in purpose-driven companies in the talent market (sustainability is the #1 destination for tech talents in the latest Atomico report!), especially among the youth, a rush of experienced and savvy entrepreneurs towards building climate startups and an unsatisfied demand from individual investors towards sustainable investments, accentuated by the shift of wealth towards women and younger generations.

However, the resemblance with the digital revolution stops here. There are four core differences which are making the sustainability wave very different in essence:

Geopolitics: globalisation was the rule for the golden years of digital transformation. We are now facing a world where deep geopolitical tensions have forced governments and corporations to rethink their strategy on a multi-local basis, ensuring greater localisation and avoiding potential single-points of failure through a diversified supply strategy.

Nature: the world having reached 6 out of the 9 planetary boundaries, companies now understand they will face climate change issues, lack of key industrial resources like water or metals or affordability of others like energy. They know that they need to quickly adjust and adapt.

Regulation: if regulation was late compared to digital innovation, in the case of sustainability, it is quite the opposite with regulation and incentives pushing for sustainable behaviors through rules and incentives all over the world: from Europe (CSRD, green new deal), to the US (IRA) and China.

This will apply restrictions to the growth of all sectors including the most trendiest ones like AI as forecasts predict 40% of industrial water needs will not be fulfilled in 2030. And Gartner predicts “40% of existing AI data centers will be operationally constrained by power availability by 2027 due to rapid increases in electricity consumption driven by AI and generative AI (GenAI), with data center forecasts over the next two years reaching as high as 160% growth”

What’s your best tip for other impact VC investors?

As impact VC investors, we need to have a holistic view of impact and report on it in order to ensure our net impact is positive and we are not, even unconsciously, impact washing. This requires assessing overall net impact at the moment of investment and monitoring it yearly to maintain alignment in time. It is both an inside-out approach to build the right decision-making framework and KAPIs at each portfolio company level but also an outside-in approach to benchmark it with where tools like the Upright Platform, capable of approximating a 360° net impact based on sectorial data & scientific research.

Some things are made for platforms - music, cabs & pizzas. But fund solutions aren’t one of them. Their individual client focus and regulation-first approach is your guarantee for flexible solutions accommodative to a broad range of deal and client specifics. The kicker? Prices that match any of the shelf-products in the market.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

💬 Community event | LP AMA with James Heath | ⏰ May 19, 1:00 PM - 2:00 PM GMT+2 | 💻 Online

Ever wonder how LPs actually think about fund strategies, especially in a world leaning toward specialisation? Join our next members-only LP AMA with James Heath, Investment Principal at dara5 and author of Why Specialists Will Win the Next Decade of Venture.

This is a small-group, interactive session where you’ll get the chance to ask candid questions and hear James’s unfiltered take on where LPs are placing their bets—and why.

Why attend?

Hear directly from a leading LP who’s investing in both specialist and generalist VC funds across Europe

Learn how LPs evaluate fund strategies—and why some are doubling down on focused, high-conviction theses

Get a behind-the-scenes look at what’s working in European VC, what’s not, and what LPs are watching next

Available for Members Only, Subscribe below

Join us at the EUVC Summit & Awards Show

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

0100 Emerging Europe 2025 | 📆 14-16 May 2025 | 🇭🇺 Budapest, Hungary

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🇩🇪 Berlin, Germany