Being a founder-led VC in Europe, looking right vs. being right, and more

Learn directly from Robin Capital, Nebular VC, Wolrd Fund, PreSeed Now and other leading European VCs.

Today's email is packed with great insights. To kick things off, we’ve got you the following:

And then we’ve got some new submissions on the community insights platform we wanna share with you & new upcoming workshops inside the EUVC community.

📝 Deep dive: World Fund and Katapult VC on seaweed as an essential climate solution

📝 Ada Ventures wants to help VC break free of pattern matching

Robin Capital's Robin Haak on the solo GP path and being a founder-led VC in Europe

In this episode of the EUVC podcast, Andreas is joined by Robin Haak, the solo GP behind Robin Capital, to share his unique journey through venture capital and entrepreneurship.

Robin opens up about his extraordinary path, from building a coffee shop in Bhutan to fighting Muay Thai in Thailand, and how these experiences shaped his investing philosophy. Andreas and Robin discuss the realities of being a solo GP in Europe, the challenges of fundraising, and the importance of community-driven LP relationships. Robin shares why he chose the solo GP route after co-built Revaia, a €250 million growth fund, and why staying small and boutique matters to him.

This episode goes beyond the typical investment talk. It dives deep into what drives Robin, the principles behind his investments, and the personal journey that shaped him into the investor he is today. Robin’s story is one of resilience, growth, and a deep desire to serve founders in ways that go beyond just financial backing.

Watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation available on the Spotify/Apple episode.

100% Automated, 100% Accurate Portfolio Intelligence

Private funds spend ~4 hrs on avg. analyzing every single PortCo update. That's 800 hrs per year for a fund with 50 startups in their portfolio (50 PortCos x 4 updates/year x 4 hrs)!

How about 0 hours?

Synaptic’s PortfolioIQ is your single source of truth for portfolio data, auto-updated from decks, excels, forms and emails. ZERO work for you or your PortCos.

✍️ Show notes

Embrace the Journey: Lessons from Robin Haak

Robin Haak, a solo GP at Robin Capital, joins us in this episode to share his remarkable journey, both as an investor and as a human being. From traversing the globe with an 8kg backpack to buying a coffee shop in Bhutan, Robin’s experiences are far from ordinary and have shaped the way he approaches venture capital today.

Robin’s spiritual journey included everything from taking the Trans-Siberian train to Mongolia, trekking the mountains of Peru with shamans, to practicing Muay Thai in Thailand. He’s walked the Camino de Santiago three times and explored spiritual teachings like Zen meditation, Kabbalah, and Tibetan practices. These experiences have profoundly influenced his values and his perspective on investing.

Read this in-depth piece on Robin’s travels and his incredible journey in Bhutan. To stay in the loop, sign up for Robin’s newsletter at Robincap.com.

The Professional Arc: From Corporate Career to Solo GP

Robin began his career in the corporate world at Axel Springer, donning a suit and tie and working 100-hour weeks. He worked in Mergers and Acquisitions, reviewing opportunities such as GetYourGuide, Lieferando, and more. However, since Axel Springer focused on late-stage investments, he couldn’t pursue earlier-stage opportunities. When the chance to build the Axel Springer Plug and Play Accelerator arose, he joined as a co-founder.

Afterward, he became a founder himself, building tech companies from scratch, including Jobspotting, which utilized machine learning and AI to reach 3 million users across 12 countries. The AI company Jobspotting became profitable, and Robin, along with his co-founders and team, exited to the San Francisco-based company SmartRecruiters, an Applicant Tracking Suite. Robin became a shareholder and Managing Director, partially relocating to the U.S. and taking on responsibilities in global GTM and Operations, including fundraising for Series D and E with Insight Partners and Silverlake. During his time, SmartRecruiters grew from $4 million to $35 million in ARR and has since become a profitable centaur with $100 million in ARR.

Robin Capital: Building the Firm Around Values

Robin Capital is built on authenticity, collaboration, and a deep understanding of founders' needs. With a €10 million target for Fund I and a focus on B2B SaaS, Robin aims to invest in 35 companies, with a heavy focus on mid-market and enterprise sales. He’s already made 24 investments and is on the fundraising trail for Fund II, all while embracing the solo GP model to maintain a highly personalized and flexible approach.

The firm is more than just Robin; it’s backed by a network of 100 operators and four Venture Partners, including two unicorn founders and a manager of €800 billion AUM firm. Robin Capital's focus remains on Europe—50% DACH, 40% broader Europe, and 10% YOLO investments, all in B2B SaaS, where Robin’s expertise can make the most impact.

Why Europe Needs Robin Capital

Only 8% of VCs in Europe are former founders or operators, and even fewer have gone from €20 million ARR to a successful exit. Robin brings a unique perspective to the European VC ecosystem, combining founder experience, operational know-how, and a history of institutional investing. He aspires to be the kind of investor he needed most during his darkest times as a founder—someone who can help not just with funding but also with sanity, support, and a deep understanding of the challenges founders face.

Personal Philosophy: Serve, Support, and Grow Together

Robin didn’t just decide to be a solo GP; he chose to build a venture product uniquely focused on supporting founders. For Robin, investing isn’t about competition; it’s about collaboration and community. He deliberately keeps Robin Capital small, boutique, and personalized to ensure he wakes up every day with a sole purpose: to serve the founders he works with.

He often says, "I want to be the person I needed most in my darkest times," and it’s not just a tagline—it’s his driving force. Whether it’s taking a late-night call to discuss a struggling founder’s worries or being a true partner in growth, Robin is committed to walking the walk.

The Importance of Community and Lifetime Relationships

Robin speaks about the value of lifetime relationships, drawing inspiration from mentors like Saeed Amidi at Plug and Play, who taught him that treating everyone like family can lead to lifelong collaboration. Robin’s approach to venture capital goes beyond traditional metrics, focusing on fostering trust, community, and the belief that venture capital should be a long-term, human-centric endeavor.

Top Tips from Robin Haak

Embrace the Pain: Whether it’s fighting Muay Thai in Thailand or trekking to Bhutan’s remote monasteries, Robin believes in embracing challenges head-on. For founders, that means facing the hardships of startup life and fundraising, but doing it with resilience.

Build for the Long Term: Venture is about long-term relationships. Whether with LPs, founders, or fellow GPs, Robin emphasizes the importance of thinking in terms of decades, not years.

Stay Authentic: As a solo GP, Robin believes in being unapologetically himself. He wants to build a firm and a product that reflect his values and strengths—not following a cookie-cutter model but one that is deeply rooted in his personal journey and mission.

Looking Right vs. Being Right

Guest post by Finn Murphy, GP at Nebular VC. | Originally published on Linkedin.

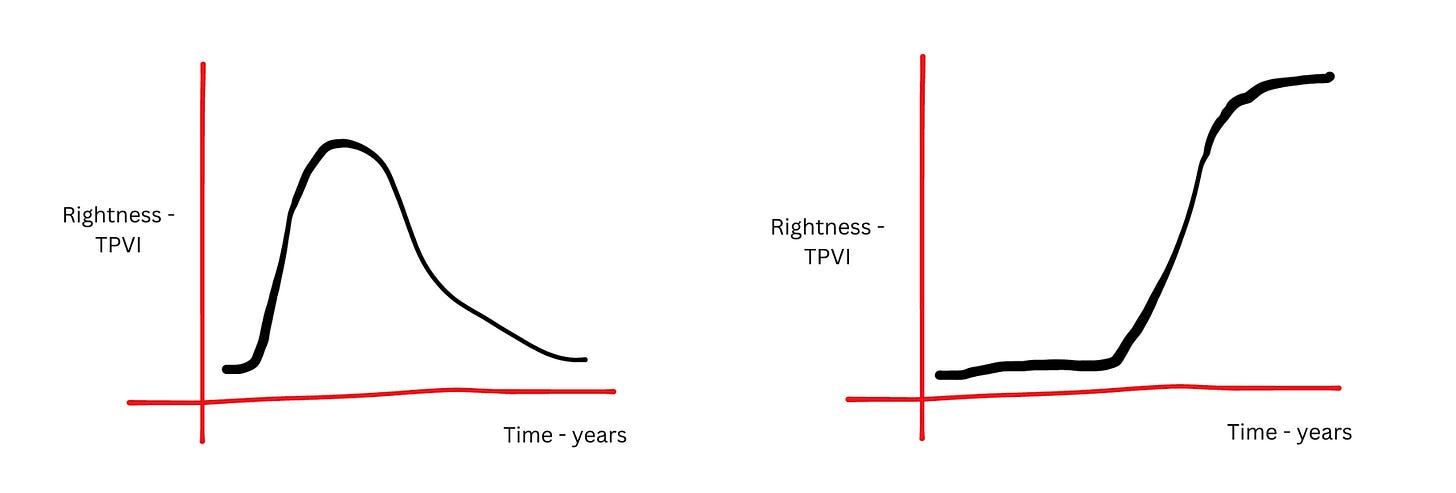

There’s a huge difference between ‘looking right’ and ‘being right’ in venture capital and startups. But because of the duration involved in building these companies, you sometimes have to make sure to be looking, even if it’s at the expense of being.

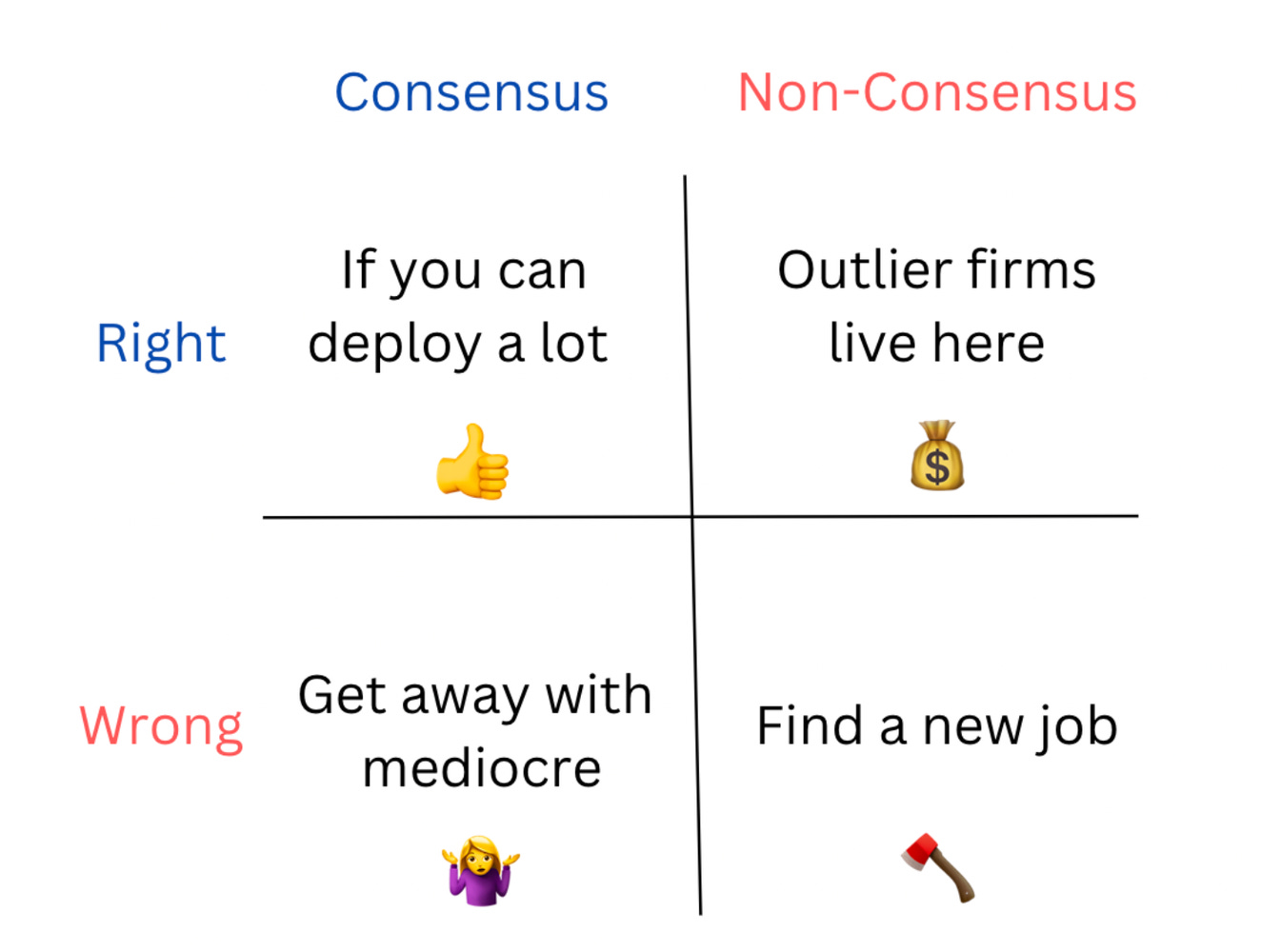

We’re in an industry heavily driven around brands, momentum and hype. Those that understand this know that being right (also known in the business as ‘making money’) is always a function of time. Those in the business also know you can look right without ever really being right and still raise billions of dollars.

Often what determines the difference is the exit point. In venture historically the illiquidity of the asset class locked you in for the full ride. Companies get sold, go public or rarely had opportunities to sell secondary. Despite this, should we spend more time thinking about when to get out of a company, industry or fund? Should we be thinking more like traders?

One of the all time great traders George Soros said — “When I see a bubble forming, I rush in to buy, adding fuel to the fire,”’- just as the creator economy folks turned to crypto and are now turning to generative AI. There is no shortage of bubbles forming at any point in time in the startup world. We sniff blood in the water and capital in the air. The denizens of twitter lean in.

This is not an irrational action. Despite the eye rolls it generates from the long term believers in those trends. The reality is, even if you’re not the first person in the bubble, if you’re plugged in you’re highly unlikely to be the last. Timing getting into a hype-cycle is the looking right part, timing getting out is where you get to be right.

The temptation to ‘look right’ is extremely powerful as an investor though. Successful new venture capital firms are usually built on the premise that someone is appearing to be hitting on all the right notes.

But there have been some incredible technology super-cycles over the past decade that ripped and are now bust but could yet rip bangers again. The see-saw of time cycled returns waits for no-market.

Fintech was the trade of the century, until it wasn’t. Crypto? Generational returns. Until it wasn’t. Even AI, potentially the next industrial revolution in terms of productivity gains and wealth creation will too see its light one day shimmer to dark.

Paradigm and Ribbit built two of the greatest emerging brands in venture over the past decade by riding waves. Someone will do similar in AI.

But, all that ‘looking right’ can make you start ‘feeling right’ as opposed to the goal, ‘being right’. You have to remember that all good things come to an end.

Recently, a large institutional LP opined to me that Benchmark are great long duration traders. They get in and get out of companies and industries like clockwork — they were in all the good social co’s, then they’re in all the good cloud infrastructure, now they’re getting into the hottest AI companies.

While on the other hand Sequoia are great company builders, they think about what carries a company to perpetual success and rarely lean into market cycles early, usually waiting until the opportunity for building a legendary company becomes clear. This is even reflected in their fund structures.

Both work and elements of the style of investing come from the people at the wheel of those firms and the tools these firms develop as they grow. Once you build a brand you can make an awful lot more money consistently by moving from having to shoot for non-consensus to consensus right. You just need to deploy a lot more capital as the multiples get expanded quickly and you compensate with size. It’s lower risk, still chunky reward.

Once you look good there’s also an element of self full-filling prophecy. You get to become the influencer on what is consensus right — where the cost of capital is lowest and momentum strongest.

Our industries highest public accolade is literally called ‘The Midas List’ — those with the golden touch. If you were early in a Hopin, Gorillas, FTX etc… You were on that list last year. That momentum helps you get into better companies and helps your existing investments by drawing more attention to your taste. You looked right, ended up wrong, but bought yourself enough momentum to potentially still come out on top.

It’s the founders job to build companies. It’s the investors role to help for sure, but really it’s to generate returns.

I wonder if you spent a little bit more time thinking in trades, rather than just thinking about the company. Would you end up making better investments or would founders even end up picking better ideas?

Maybe the next market cycle will go on forever. Maybe this one will be different. Or maybe just like many that came before it’ll rise and fall and those that had the good sense to depart along the way will be the ones laughing.

As in the end, the challenge with making money in equity investing is you eventually need someone to buy your bags. Choosing the right bags is the most important piece, but knowing how and when to sell them puts you on another level. Else you be left holding them when in the fullness of time, most things go to shit.

Thanks to the assorted pals that read & gave feedback on this most ponderous of topics — lean into the hype or maintain your intellectual high horse. It’s honestly not that easy a decision.

Deep dive: World Fund and Katapult VC on seaweed as an essential climate solution

Guest post by Craig Douglas, Partner at World Fund, Ross Brooks, General Partner at Katapult Ocean, and Alp Katalan, Fellow at World Fund.

Macroalgae, commonly known as seaweed, are multicellular, photosynthetic, marine organisms visible to the naked eye. Unlike their microscopic cousins, microalgae, macroalgae have complex structures resembling plants.

Over 10,000 macroalgae species have been classified, and are generally subdivided into three groups based on their pigmentation: red (e.g. dulse), green (e.g. sea lettuce) and brown algae (e.g. kelp and sargassum). These will vary in shape, size, and nutritional content, as well as affinity for coastal (30-50m) or deeper waters (up to 250m deep).

Ada Ventures wants to help VC break free of pattern matching

Guest post by Martin SFP Bryant, Founder of PreSeed Now. | Originally published on PreSeed Now.

Today we have one of our popular investor interviews for you. This time, we meet Check Warner from Ada Ventures, which backs founders who don’t fit the traditional tech founder stereotypes.

She started her career in VC after hanging out in the tech-focused conversations on Twitter. Fun fact: That’s exactly how I started my career in tech media too!

Some things are made for platforms - music, cabs & pizzas. But fund solutions aren’t one of them. Their individual client focus and regulation-first approach is your guarantee for flexible solutions accommodative to a broad range of deal and client specifics. The kicker? Prices that match any of the shelf-products in the market.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

🧠 Upcoming EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

✍🏻 EUVC Masterclass | Marketing & VC Fund Narrative

Your brand is everything. It’s what sets you apart, helps you win the best deals, attract LPs, and ultimately drive your growth. For emerging fund managers, building a credible brand and establishing the right marketing foundations early on are game-changers. Yet, many don’t know where to begin.

Your fund’s narrative is what makes the difference between an LP glancing at your deck or deciding they’re ready to write a check. It’s your brand that makes LPs feel confident they’re partnering with someone who knows how to make magic happen.

We’re planning a masterclass on building strong marketing foundations with a top industry leader. If enough people show interest, we’ll make it happen.

✍🏻 EUVC Masterclass | Benchmarketing for GPs & LPs

Join us for an in-depth session on VC Fund Terms & KPIs: Mastering Metrics for Fund Success. This workshop will focus on the key performance indicators (KPIs) that drive VC fund performance and the critical timing for measuring these metrics. You’ll gain insights into what matters most to Limited Partners (LPs) and what General Partners (GPs) should focus on internally for effective fund management.

The session will also cover how to set up a comprehensive dashboard, including portfolio tracking, to streamline your reporting and ensure your fund’s success.

Special offer: Join the EUVC Community for 25€ per month and get 100€ off while enjoying access to on-demand masterclasses, tools & templates and monthly AMAs with leading GPs, LPs & experts.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

culttech summit | 📆 5-6 November | Vienna, Austria

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany