Blockchain Meets The Energy Grid: Exploring Energy DePIN's Potential

by Hélène van Berchem, Head of Sustainability/ Manager at Reference Capital. | Originally published on 🔥 Reference Newsflash.

Guest post by Hélène van Berchem, General Partner at Reference Capital. | Originally published on 🔥 Reference Newsflash.

Blockchain's potential extends far beyond digital assets or financial transactions—it has the power to revolutionize real-world economies. One of the most exciting examples is DePIN, or "Decentralized Physical Infrastructure Networks." While we explore many applications, this newsletter focuses on one particularly compelling opportunity: DePIN's potential to transform energy systems. This intersection is both timely and critical as the global energy landscape evolves to address pressing challenges.

⛓️ First things first, what is DePIN?

DePIN is a new way to create and manage infrastructure by sharing ownership and control among individuals instead of relying on centralized entities like corporations or governments. It uses blockchain to coordinate resources, secure transactions, and reward participants for contributing assets like hardware or data.

For example, consider Hivemapper, a platform that rewards users with tokens for collecting map data through dashcams mounted on vehicles. This innovative approach allowed Hivemapper to map the same number of unique kilometers in just one-sixth the time it took Google Maps, showcasing the remarkable efficiency of user-driven networks.

So, as you may have gathered, DePIN projects share these key features:

Decentralized Governance: Collective decision-making replaces centralized control.

Distributed Ownership: Users own and operate infrastructure, fostering shared responsibility.

Tokenized Incentives: Blockchain-based tokens reward participants for deploying and maintaining infrastructure.

Transparency: Blockchain ensures auditable, tamper-proof operations.

Cost Efficiency: Decentralization reduces overhead, lowering costs for users.

Today, the sector is drawing significant interest from crypto investors. As shown by Messari’s data, funding for DePIN has surged year-over-year, underscoring its importance in the blockchain ecosystem.

💥 Understanding the Power Grid Problem

The traditional power grid has worked in a straightforward way for decades: electricity moves in a one-way flow from large power plants, through transmission lines and distribution systems, to consumers. This centralized system made it easy for utilities to balance supply and demand within a stable market. However, the resilience of this model is now being tested.

The energy landscape is evolving, driven by innovations such as rooftop solar panels, home batteries, wind turbines, and electric vehicles – collectively called Distributed Energy Resources (DERs). These technologies allow consumers to generate and store their own energy, effectively transforming them into "prosumers" who both consume and produce electricity. This shift to bi-directional energy flows contributes to adding pressure on the grid.

Reports from CTVC and a16z highlight how these changes expose weaknesses in the century-old centralized grid model, including:

Grid Congestion: Proliferation of energy-producing devices (e.g., solar pannels) and the growth of Electric Vehicles (EVs) are overloading aging infrastructure designed for one-directional energy flows.

Intermittent Renewables: Sources like solar and wind, provide a growing amount of global electricity, but their variability require flexible and adaptive grid management, especially since renewable generation often misaligns with peak demand.

Rising Demand: Electrification of transport, heating, and computing is projected to drive a 50% increase in electricity usage by 2040.

Fragmented Grid Structure: The U.S. grid is divided into three major regions (East, West, Texas) and managed by 17 grid operators, with local utilities handling generation and delivery. This fragmentation makes upgrades challenging and creates vulnerabilities, like the 2021 Texas winter storm that caused $200 billion in damages and left 4.5 million homes without power.

These challenges are compounded by ambitious renewable energy goals, such as the EU’s plan to source 40% of its energy from renewables and the U.S.’s target of 30 GW of offshore wind capacity by 2030. To meet these goals, the grid must transition to a more resilient, flexible, and decentralized system.

🏆 How Can We Leverage Blockchain Technology to Address Energy Challenges?

Blockchain technology has the potential to aid the energy industry by addressing inefficiencies in both traditional power grid systems and novel peer-to-peer (P2P) energy markets.

In centralized energy systems, intermediaries handle tasks like trading and distribution, driving up costs and causing delays. Blockchain streamlines these processes using smart contracts – self-executing agreements that automate transaction validation and settlement. Simply put, this reduces costs, speeds up transactions, and enables real-time trading and credit issuance.

Peer-to-peer energy markets face two main challenges: trust and transparency. Today, these markets often rely on intermediaries or centralized databases to manage transactions, leading to inefficiencies and a lack of accountability. In other words, users must trust each other based on assumptions about fair behavior, data accuracy, or timely payment. Blockchain solves this by providing a secure, transparent ledger where all transactions are tamper-proof and verifiable. This creates a trustworthy system, reduces fraud, and makes energy markets more efficient. It also empowers smaller players, like owners of Distributed Energy Resources (DERs), to trade energy or environmental credits securely and independently.

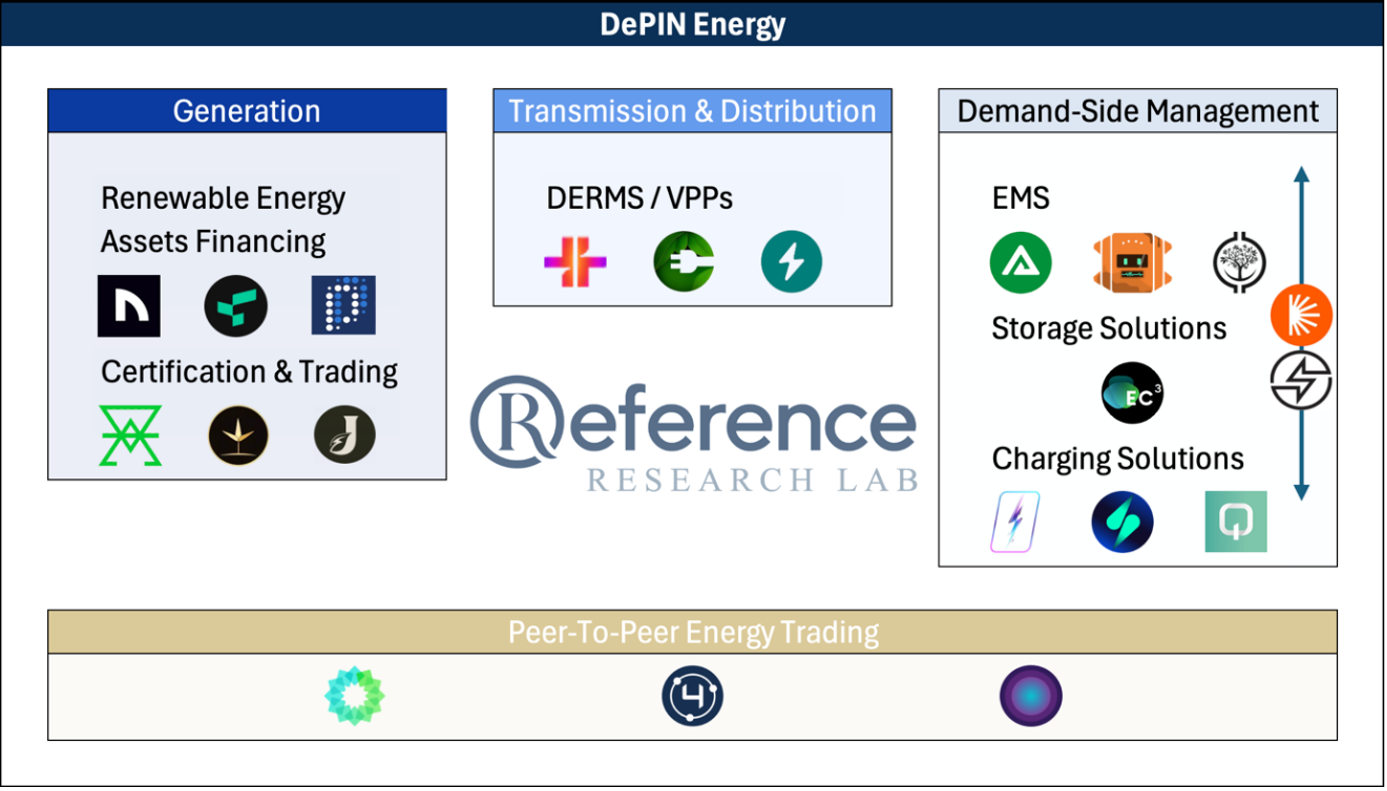

🔎 DePIN Energy: Mapping the Innovation Ecosystem by Reference Research Lab

From a practical standpoint, how does this concretely impact the energy system? After reviewing DePIN startups in the energy sector, we identified three key ways they are driving transformation:

Empowering Individuals: People can contribute to the energy system with resources like rooftop solar panels or home batteries and earn rewards (often in tokens). This not only provides financial incentives but also encourages sustainable practices.

Enhancing System Resilience: By spreading out energy resources, DePIN reduces the risk of major failures caused by disasters, cyberattacks, or system issues. It uses microgrids, small local energy systems that can work independently during outages, and Virtual Power Plants (VPPs), which connect and manage energy from many small sources to act like a traditional power plant. This makes the grid more reliable and efficient.

Streamlining Environmental Markets: DePIN uses blockchain to turn carbon credits and Renewable Energy Certificates (RECs) into digital tokens (i.e. tokenization). This makes trading and managing these environmental assets easier, more transparent, and accessible to everyone.

Here are the key takeaways from the mapping for each category:

1. Generation

The category, Generation, includes protocols that support energy generation by financing renewable assets or certifying and trading green energy production.

Renewable Energy Assets Financing: Protocols focus on enabling financing for renewable energy projects, such as solar farms, through tokenized models allowing for broader participation in funding and ownership. Examples include Nova Real Chain, Penomo and Plural Finance (SEC compliant).

Certification & Trading: These protocols certify renewable energy production and tokenize it into tradable assets like carbon credits or Renewable Energy Certificates (RECs). Examples:

Jasmine Energy: Focuses on managing RECs, ensuring that renewable energy production is verifiable and tradeable.

Glow Labs: Incentivizes solar energy production and converts it into verified carbon credits, that can be transferred for use.

KlimaDAO: Specializes in carbon credits, allowing participants to buy, hold, and use tokenized credits to offset emissions.

2. Transmission & Distribution

Transmission and Distribution covers protocols that facilitate energy movement across the grid, manage distributed systems, and enhance grid efficiency for final delivery to consumers.

DERMS / VPPs (Distributed Energy Resource Management Systems and Virtual Power Plants): Protocols that aggregate, manage, and optimize energy from devices like solar panels, batteries, and EVs to create a flexible and balanced energy network. Examples:

CPIN: Focuses on VPP functionality, aggregating distributed resources for efficient grid integration and energy trading.

Sourceful Energy: Accelerates renewable energy adoption by creating distributed energy networks.

Combinder: Connects energy devices to its network, rewarding users with $BIND tokens for sharing energy data to optimize consumption and improve grid management.

3. Demand-Side Management

The Demand-Side Management includes protocols that have a consumer-facing component, focusing on energy consumption, optimization, and management.

EMS (Energy Management Systems): EMS platforms optimize energy use at the property level. Rowan Blockchain focuses on homes, providing smart metering for solar panel owners. M3tering Protocol targets buildings, helping businesses reduce costs through consumption tracking. Arkreen serves both residentials and communities by integrating batteries and smart meters for better energy management.

Storage Solutions: Focused on providing batteries (hardware) for managing energy storage, either at the grid or individual levels (e.g., EC-Cube).

Charging Solutions: Primarily focused on EV charging (e.g., DeCharge, QoWatt), though some platforms extend to other forms of charging solutions, like power banks (e.g, GoCharge). It’s worth mentioning two other companies with more comprehensive product offerings:

Starpower: Offers smart plugs that provide real-time consumption at the appliance level. They’ll also ship batteries and EV chargers in the future.

Daylight: Offers a wide range of tools that are part of the global Demand Side Management. Daylight will eventually act as a VPP, optimizing the use of the grid.

4. Peer-to-Peer (P2P) Energy Trading

Peer-to-Peer Energy Trading platforms enable direct energy transactions without intermediaries, fostering decentralized and transparent energy markets. Power Ledger facilitates trading of renewable energy credits and direct energy sales, leveraging blockchain for trust and traceability. C4E (Chain for Energy) focuses on carbon-neutral energy markets, integrating P2P trading with sustainability goals. Dione Protocol enhances P2P trading by coordinating decentralized energy resources within local grids.

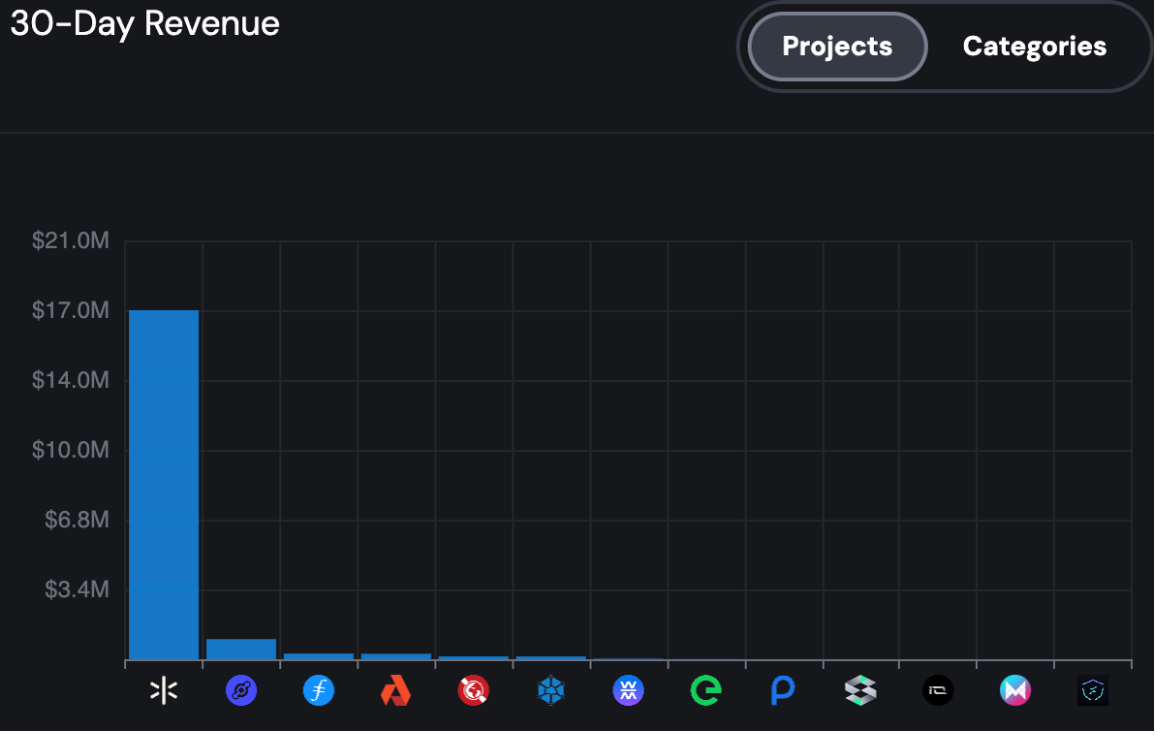

⏳ Early Momentum in DePIN Energy

The proliferation of use cases within Energy DePIN underscores the growing inflow of talent into the space, supported by dedicated crypto VCs (e.g., EV3, Crucible Capital, etc.). This momentum is further validated by early signs of product-market fit, with companies like Daylight and Glow Labs recently graduating from Seed to Series A, raising $9M and $30M respectively. Adding to this excitement, Glow Labs recently showcased impressive traction, generating $17M in revenue over the last 30 days – corresponding to the production of 20 megawatts of energy, enough to power 34,000 homes in India. These developments point to a maturing market with tangible impact and strong investor confidence.

🔮 Reference Viewpoint & Expectations

While DePIN Energy has shown early momentum, it remains a nascent sector, making it challenging to draw definitive conclusions about which models or projects will ultimately succeed. Looking ahead, we anticipate the emergence of localized competition, as communities and regions develop tailored solutions that address their unique energy challenges.

Timing is critical, and we believe that the current momentum in energy innovation supports DePIN’s emergence. The rising electrification of transportation, industry, and homes presents a unique opportunity set and we believe that DePIN will capitalize on this inflection point by unlocking previously untapped capabilities in accelerating the programmability of the grid.

Read more on the topic ⬇️

Investing in the Data Center Economy (Crucible Capital)

DePIN’s Imperfect Present (Compound VC)

The Great Coordination Problem (Multicoin Capital)

Messari’s X Thread on Energy DePIN or full report (Messari)

Meme of the Month

In case you missed it...

General Technologies 🚀

⚖️ Antitrust Moves Against Google – The DOJ is pushing Google to sell its web browser, Chrome, as part of efforts to tackle its search monopoly. The remedies trial is set for April in DC federal court. Big implications for the future of the internet! Read more here.

🚨 How Trump's Win Reshapes the Tech Landscape– Trump's return boosts crypto, Musk, and AI, but stirs trouble for Google and bring uncertainty in the Silicon Valley. Dive into the details here.

🌡️ AI Enhancing Climate Predictions – Artificial intelligence is transforming climate modeling, allowing for more accurate forecasts and inform better policy decisions. A step forward in the fight against climate change. Dive into the details here.

👩⚖️ Empowering AI Startups Through Policy – Andreessen Horowitz shares policy ideas to help AI startups innovate, collaborate, and compete in a rapidly evolving tech landscape. Explore the insights here.

🎧 What We've Been Listening To This Month

🌏 The Geopolitics of Chips– The Financial Times dives deep into the global power dynamics of chip manufacturing in a brilliant 3-episode series. Listen here.

👨🏭 Cobots & The Future of Work – Freakonomics explores how collaborative robots could transform workplaces worldwid. Learn more here.

🤖 AGI & Humanity’s Future – Lex Fridman interviews Anthropic's CEO in a thought-provoking discussion about AGI and what lies ahead for humanity. Listen here.

Sustainability 🌍

🌍 A New Era in Climate Geopolitics – Time explores how shifting geopolitics are reshaping global climate policy as COP29 takes center stage. Discover how countries are jockeying for influence in the green transition. Read more here.

🚨Trump 2.0 and the Climate Tech Impact – CTVC analyzes the implications of Trump's return on climate tech. Expect a mix of disruption and opportunity as policies shift under his leadership. Dive into the analysis here.

⚡️ Europe's Cleantech Reality Check – Breakthrough Energy examines the challenges facing Europe's cleantech sector, highlighting the gaps between ambition and implementation. What does it take to make sustainable innovation scalable? Explore the insights here.

🔋 The Hidden Emissions of Grid-Scale Batteries – MCJ Collective dives into the overlooked carbon footprint of grid-scale battery production, exploring ways to balance the trade-offs and ensure a sustainable energy transition. Learn more here.

Blockchain & Crypto 💸

Impact of US elections – The election of Donald Trump, coupled with a Congress dominated by pro-crypto lawmakers, has ignited optimism in the cryptocurrency sector. Bitcoin has surged to record highs near $100,000, driven by expectations of favorable regulatory reforms. With 247 crypto-friendly representatives in the House and 15 in the Senate, the industry anticipates clearer policies, including potential U.S. adoption of a bitcoin reserve and expanded crypto ETF approvals. This political alignment marks a transformative era for digital assets, boosting investor confidence and setting the stage for significant growth in the U.S. crypto market.

⚖️ Regulation

Brazil’s Congress propose to allocate up to $18B in Bitcoin.

Gary Gensler plans to step down as SEC chair.

Dan Gallagher (Robinhood’s Legal Chief) is being considered for SEC chair shortlist.

Coinbase, a16z and others have donated more than $78m to support pro-crypto candidates for the 2026 mid-term.

Immutable X received a Wells Notice from the SEC.

🏦 Financial Institutions

Blackrock’s Bitcoin ETF’s options trading volume pushes BTC to all time highs.

Goldman Sachs will spin out their Digital Asset business into a new company.

Bitwise, VanEck and Canary Capital have filed for spot Solana ETF.

Coinbase launches the Coinbase 50 Index (COIN50), a benchmark representing the top 50 digital assets listed on Coinbase Exchange.

Microstrategy bought 27,200 Bitcoin and plans buy more with their latest $3B offering.

Anchorage Digital, Bullish, Galaxy Digital, Kraken, Nuvei, Paxos and Robinhood partner to launch a new stablecoin.

Citigroup, Fidelity International Unveil Proposal for On-Chain Fund With Real-Time FX Swaps.

UK Pension advisor Cartridge has started to recommend 3% allocations to Bitcoin for defined benefit plans.

UBS launches their first tokenized investment fund.

🔥 Top Stories

FBI raided the apartment of Polymarket’s CEO.

$SKY (formerly $MKR) launches USDS on Solana.

Crypto industry faces a fresh round of layoffs.

Solana DEXes Trading Volume Hits $100B.

🔎 Research

📄 6MV has published an evaluation framework for DePIN investments.

📄 Parsec Research published an article about the current state of Maple Finance.

📄 Lattice published their retrospective State of Seed 2022.

📄 Matti (Zee Prime) published a “state of crypto industry”.

📄 Patrick Mayr (Cherry Crypto) discusses the implications of crypto and AI agents.

Videos

🎙️ Blockworks welcomed Bridge founder to discuss their recent acquisition by Stripe.

📹 Bankless invited Ejaaz Ahamadeen to discuss how crypto and AI will “take over the world”.

Life Sciences 🔬

Cracking the Code of Aging – Aging research is advancing with AI and biomarkers, but for now, lifestyle tweaks still reign supreme. Read more here.

🧬 The first CRISPR treatment – Casgevy is rolling out as the first CRISPR-based therapy, despite challenges like chemotherapy, complex preparation, and limited treatment centers. Learn more.

☣️ AI in the Lab: Revolutionizing Science, Risking Biosecurity – AI is transforming biological research, from speeding up experiments to designing antibodies. However, it brings risks—potential misuse to create harmful pathogens. Governments and tech leaders are stepping in to set safety standards. Explore here.