Today we have Simon Lohmann, Head of Platform & Investor Relations at Cavalry Ventures, an early-stage generalist venture fund in Germany to back European Software companies with a huge LP network and a sizeable platform team in place.

Cavalry is investing out of Fund 3 with a total of 250m AUM and an established portfolio of 50+ companies and notable investments including Usercentrics (Consent Management), Planradar (Real-Estate Construction Management), Forto (Digital Freight Forwarder), and Aleph Alpha (Generative Enterprise AI), which just raised an enormous Series B.

At Cavalry, Simon focuses on Fundraising and Investor Relations now and built up the platform before.

Scroll ⏬ for the episode chapters and core learnings from Simon 🧠

This episode is brought to you in partnership with… Affinity

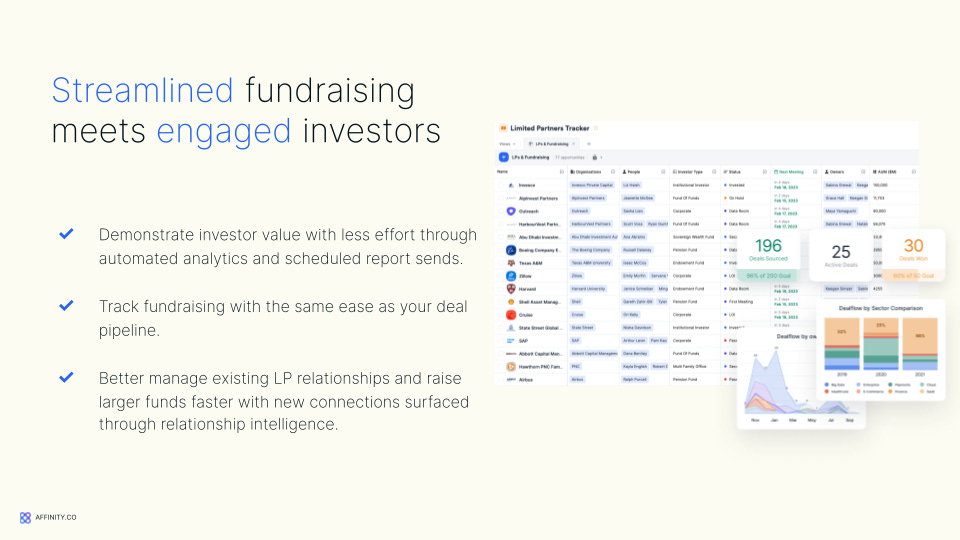

Feel you must be able to level up your LP game? Check out the below resources from our friends at Affinity 👀

📑 ROI for your investor CRM across the firm - go to page 4 for a deep dive on Platform teams

👇 Finally, checkout the Affinity platform for LP mgmt!

Chapters:

00:00:00 - Introduction and Sponsor Message

00:03:30 - Investment Announcement with German Corporates

00:06:58 - From Sales to VC: My Journey in the Industry

00:10:15 - The Importance of Education and Learning

00:13:47 - Investing in Talent and Consolidation in the VC Space

00:17:29 - The Challenges in the VC Industry

00:21:09 - Adjusting Valuations and Interacting with LPs

00:24:35 - The Beginning of Cavalry and the Platform Activities

00:28:11 - Structured Approach to Platform Development

00:31:40 - Using an App for Communication

00:35:04 - Using Affinity as our CRM

00:38:30 - Tracking the Success of Introductions

00:41:59 - The Value of a Platform Team in Venture Capital

00:45:28 - Importance of Value Add and Trust

00:48:45 - Supporting Portfolio Companies

00:52:14 - Shoutouts to Christian Du and Hannah from Don Capital

00:55:49 - Strategic Work and Scalability

00:59:20 - Capacity Management and Scalability Techniques

01:02:53 - Advice for First-Time Founders and Long-Term Thinking

01:06:27 - Communicating Clearly with LPs in Venture Capital

01:10:15 - European Unity and Values

Q: Give a shout-out to someone you love in the industry

On the LP-side, gotta give it to Christian Duve.

On the co-investor side; Hannah from Dawn

And finally, while not a person, but a community: The Global VC Platform Community

Q: 3 key pieces of advice when thinking about building out your platform to leverage your LP base

Define your platform and strategy. At Cavalry e.g. the four strategic goals are: winning deals, increasing portfolio success, supporting deal flow generation, and supporting fundraising activities.

Try to focus on the most pressing topics - each platform activity should pay on one of your strategic goals (Ask your customers aka portfolio companies).

Use tools such as the VC Platform Matrix tool and work data-driven and strategically from the start. Complete surveys and interviews with LPs and Portfolio founders. Understand their real needs.

Share it with the team internally, and get as much buy-in as possible. E.g. Bi-weekly platform report at CV incl. gamification

Implement a great CRM and work with tags (super important if you have to hand over the network to a new team member and create lists for your port cos).

Act data-driven and measurable from the beginning, if you don’t, it is so much work in the aftermath.Execution: Organization and Workflow

Separated work streams next to the investment team, build your own relationship with founders, be proactive, read all company reports (doesn't matter how well a company is performing and how much ownership we have), and then reach out to the founders, most of our companies have a section in their report called “request to investors” or something similar.

Understand it and try to help as efficiently as possible (”Do your job”), you should always be respectful of the time of the entrepreneurs. Do an onboarding with each new company and introduce the platform activities / network aka where you can support and where not (expectation management), be as transparent as possible, and discuss the working relationship going forward (e.g. frequent calls vs more ad hoc). Try to be as scalable as possible with your resources. Try to automate processes and use software tools.Set up a culture and first principles in your Platform team

Build general work principles of your platform team. E.g. at Cavalry, we use the following: Quick turnaround times, availability, no ghosting, upfront communication, and high quality. And live them every day.

As a final 4th bonus advice: Be a good networker

Q: What advice would you give your 10 year younger self?

Boring but true: Patience, long-term thinking, do not overthink things, if you do something well and with pleasure, financial success comes by itself. Tough learning as I wanted to be as successful as soon as possible (also typical for my generation).

In Germany, you say that successful people also only boil with water, which is tremendously true in our industry (a lot of alpha people), where people are failing to build a round wheel, you don’t have to reinvent the wheel. Just go out every day and hustle and build a round wheel and don't be too impressed or scared by successful people.

Q: What are your top tips for emerging VCs across Europe who are fundraising?

It is all about long-term thinking and consistency. Everything in venture is about people business. We have extremely long feedback cycles but you should always make a good impression and be a networker. Principle of “Favour box” - always try to go in advance.

Going the extra mile, get (very) warm intros to the right people, start as soon as possible, you are always in fundraising, structured CRM, newsletter/update list, quarterly update calls, co-investment opportunities, views and opinions of the current markets, build a relationship as early as possible (can easily take over 18 months with institutions), which is Enterprise Premium Sales - Sales ;)

Q: What’s the most counterintuitive thing you’ve learned in venture?

Power law (hit and loss ratios) / Pareto (comp. exponential growth)

LP cycles / denominator effect, hype vs. good vintages in down cycles

Specializing is not always the best outcome

Q: What do you believe that most people around you disagree with you on?

Europe will not sleep through the next technology wave (AI platform shift). Europe will soon have independent software champions that no longer necessarily have to expand to the U.S. or Asia to be a global VC-ecosystem success (comp. Personio).

We in Europe must not miss the next wave of technology (like we did before w. the internet, mobile, or cloud) and decrease our dependence on the US or Asia.

B2B and manufacturing are becoming more important (again) and AI is playing a major role here. Germany is particularly strong here and has a lot of experience.

Spread AI as an example, Sequoia, IVP, ICONIQ, all coming to Europe and more and more US investors will enter the EU market going forward. There will be a European B2B software Decacorn in the industrial space and we will need a European tech stock exchange to be more independent in the future.

Upcoming events

📺 Virtual events we’re hosting

Acing LP Relationships | Feb 12, 2024, 12:00 PM - 1:00 PM

The O.G. Roundtable of the Year | Jan 29, 2023, 12:00 PM - 1:00 PM

Data-Driven Portfolio Modeling | Jan 17, 2024, 12:00 PM - 1:30 PM

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg, Sweden

Odense Investor Summit | 📆 13 - 15 March | 🌍 Odense, Denmark

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany