Decarbonization, consumer sector as the underdog in VC and more!

Learn directly from Origins Fund, Regeneration.VC, Ascension VC and SeedBlink.

Today's email is loaded with a bunch of nuggets. First, we have two full-featured deep dives for you (#infinity scroll):

And then we’ve some amazing new submissions on the community insights platform we wanna share with you:

Join us for Expand North Star in Dubai - the world’s largest startup and investor connector event.

Discover the tech and investment opportunities fuelling growth across UAE, MENA, and APMEA regions at Expand North Star, inspired by GITEX GLOBAL, on 13-16 October 2024 at Dubai Harbour.

Origins Fund's Salomon & Blaise on why consumer sector is the underdog in venture capital

Today, we welcome the amazing duo Salomon Aiach, co-founder & General Partner, and Blaise Matuidi, General Partner from Origins Fund.

Origins is a new type of venture capital fund backing legendary consumer founders with an unfair advantage from pre-seed to series A. They invest $100k to $500k in consumer tech startups and come with the power of influence of LP’s community and their 160,000,000 followers.

We invite you to listen to this discussion below for some inspiring stories; besides the actionable advice, you can have a sneak peek at the below.

Watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation available on the Spotify/Apple episode.✍️ Show notes

✍️ Show notes

We believe in giving you our guests' thinking directly and unaltered. Therefore, no changes, no AI, no nothing has been done to the following sections.

Blaise’s journey as an angel investor.

I was 27 years old, and for me, it was super important to think about what I can do after. As an athlete, especially if you are a soccer player when your active years come to an end, you realize your career has to change.

My father always told me, «You need to prepare yourself!»

I wanted to do something for my kids and try my best.

Why Blaise became the GP of a venture capital fund.

We always start from something, right?

I started as a business angel, and this is how I got the chance to meet some people, and one of my Partners now at Origin. We felt the desire to bring together both of our worlds, and I realized I can provide added-value to companies through social media, and help companies enhance their communication power. We, now represent an audience of 160M and our athletes are recognized worldwide.

I sport, I always liked that together we are stronger, and I think there is a huge value in connecting athletes with the business world.

Salomon on discipline and work ethic.

The life of an athlete looks glamorous from the outside. You go to a stadium, watch a game, then watch his lifestyle on Instagram, and everything looks glamorous.

But, it’s more than that, it’s about the work ethic those people have and the discipline to be the best.

For example, when we have a partners meeting at Origin, and Blaise is driving the team to what matters most. Our job is to invest, so if we haven’t seen new companies in December, we have to focus on that no matter what.

So, life can look glamorous from the outside, but deep down, it requires a strong work ethic, discipline, and mental resilience to become the best.

Salomon on why the consumer sector is the underdog in the VC world.

A legendary VC told me that being a consumer investor is the best way to have a short career in the industry.

Consumer is really hard, and we are aware of that. That’s why we given the high-profile of our LPs, right now, we, and the entire team has an immense amount of pressure to not only return the money to our LPs, but returning a really high-value.

The way we structure our portfolio is to “derisk” what consumer means.

I just looked at a company today, who has crazy numbers in retention. But in the end I am asking myself what is this company gonna look like in 6-months or a year from now? It’s gonna be just another Clubhouse? It’s going to be another company in the market?

I think consumer is very binary, and we’re building the portfolio by taking a risk on binary bets.

Cambridge Scientists Secure $5M from Leading Global Venture Capital Funds and Corporations to Transform Scope 3 Decarbonization

Guest post by Michael Smith, General Partner of Regeneration.VC.

Regeneration.VC leads Neutreeno’s Seed round alongside Remarkable Ventures Climate Fund (RVC), Closed Loop Partners, Prequel Ventures, Scania Invest, and Beacon Venture Capital.

CAMBRIDGE, UK, Oct. 3, 2024—Neutreeno, a pioneering deep tech startup based at the University of Cambridge, has secured a $5 million Seed round with support from a global syndicate of mission-aligned investors.

On average, companies have over 90% of emissions in their value chain (Scope3), and 93% will fail to achieve their net zero goals unless they double the pace of emissions reduction by 2030. This is challenging due to a lack of primary value chain data, the inability to influence suppliers, and the high cost of decarbonization.

Neutreeno’s proprietary process networks, based on mass and energy flow research, significantly minimize the primary data burden on suppliers and allow enterprises to map product lines faster and with greater precision than existing tools. Their easy-to-use and affordable digital system automatically pinpoints solutions that reduce emissions and costs across 1,000s of suppliers. Neutreeno’s customers span Europe, North America and Asia, including S&P 500 and FTSE 250 companies across multiple industries and a wide range of SMEs.

Fredrik Nilzén, Head of Sustainability at Scania Group, one of Europe’s largest commercial vehicle manufacturers, emphasized:

“Neutreeno offers a unique and innovative solution that is crucial for tackling sustainability challenges with improved efficiency and cost-effectiveness at scale. Scania Invest’s support emphasizes the strategic importance of advancing Neutreeno’s pioneering technology in the sustainability landscape.”

Dr Spencer Brennan, Neutreeno’s founder, assembled a team of scientists who over two decades pioneered concepts of circularity and resource efficiency in complex supply chains, informing international climate policy. Spencer remarked:

“We take a completely novel, robust engineering approach to challenge the Scope 3 status quo.”

Professor Jonathan Cullen, Head of Climate Science at Neutreeno and Lead Author for the IPCC AR6 Industry Chapter, stated:

“Neutreeno breaks away from the noisy landscape of tedious, form-filling accounting-based carbon software.”

Neutreeno delivered groundbreaking results for a multi-billion-dollar enterprise customer, identifying a 35% emissions reduction potential across Scope 3 for one of its suppliers and automatically pinpointing actions leading to new product designs, procurement changes, and substantial emissions reductions — all in just four weeks.

Markus Börner, General Partner of Prequel Ventures, commented on the company’s key role in supporting Europe’s Fit for 55 target:

"Decarbonizing supply chains is critical, and with EU regulations like CBAM, it has direct business implications for companies. However, it’s a formidable challenge. Neutreeno brings cutting-edge industrial manufacturing process expertise, making decarbonization achievable at the product level. This game-changing approach adds immense value to suppliers, recognizing their crucial role in the solution. It aligns perfectly with our mission to empower sustainable supply chains, and we’re excited about its impact on companies in Europe and beyond."

Enthused by the company’s mission to democratize emissions reductions for millions of businesses, Michael Smith, General Partner of Regeneration, commented:

“Neutreeno has the first technical system able to move beyond Scope 3 reporting to systematically decarbonize industry, unlocking the US$130 trillion of capital waiting to fund the low-carbon transition.”

With its innovative approach and strong industry backing, Neutreeno is poised to make a significant impact on global decarbonization efforts, helping companies achieve their climate goals faster than ever before.

About Neutreeno

Utilizing proprietary process networks and engineering models, Neutreeno identifies and eliminates emissions at source. Neutreeno partners with leading businesses wanting to move beyond carbon accounting and take decisive action to decarbonize Scope 3 emissions. Learn more here.

Finding the right partner beyond the VC dream

by Ionut Patrahau, Managing Partner and Corporate Development at SeedBlink. | Originally published on SeedBlink blog.

The harsh truth is that less than 1% of startups globally are successful in securing VC funding.

As a first-time tech founder, you’re no stranger to the highs and lows of bringing an innovative idea to life. While your industry knowledge and passion drive you forward, the reality of needing financial backing to fuel your vision becomes increasingly pressing.

After bootstrapping with your savings and small investments from supportive friends and family, you’re ready to enter the world of business angels and venture capitalists (VCs).

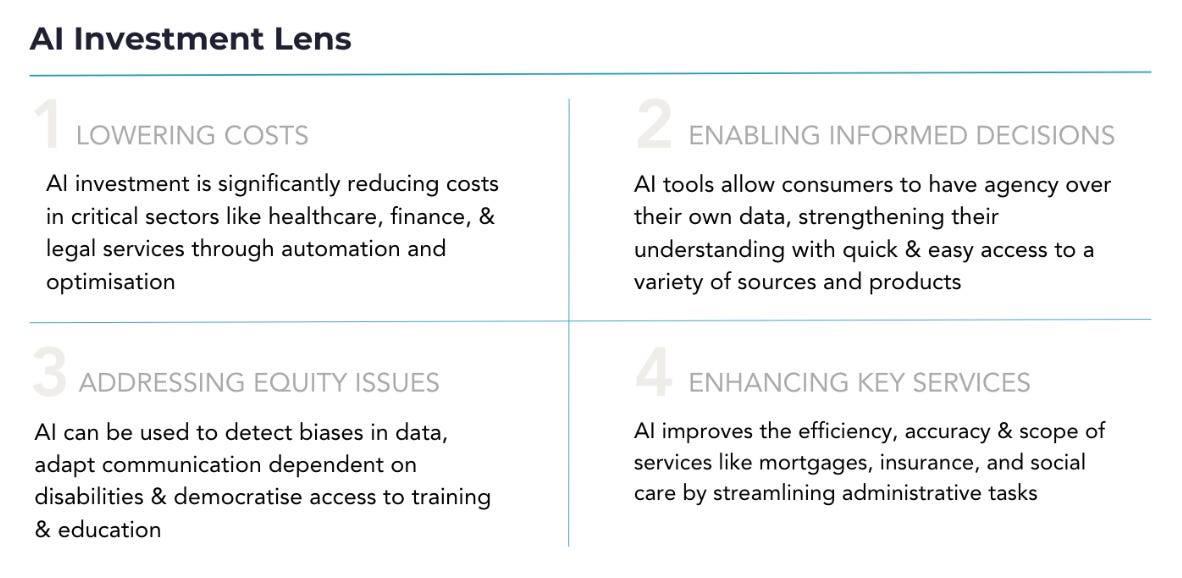

Ascension VC's AI investing lens

by Iulia Tudor, Ascension Fund III Partner. | Originally published Ascension VC.

The first reaction when thinking of AI and impact might be one of conflict. However, Ascension views this as a huge opportunity, offering a unique and exciting focus – AI is undeniably driving the next systemic shift, much like cloud computing did in its day. This isn’t just a technological advancement, but a chance to make a real, positive impact on the world.

Join us for Expand North Star in Dubai - the world’s largest startup and investor connector event.

Discover the tech and investment opportunities fuelling growth across UAE, MENA, and APMEA regions at Expand North Star, inspired by GITEX GLOBAL, on 13-16 October 2024 at Dubai Harbour.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

🧠 Upcoming EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

Venture Debt: Structuring & Deal Terms

📅 Tue, October 8 | 11:00 AM - 1:00 PM CET | Lecturer: Hemal Fraser-Rawal, White Star

Benchmarking Session for GPs & LPs

📅 TBD - preregistration open now | Lecturer: To be announced 🤫

In-person Comprehensive Portfolio Modelling Masterclass

🌍 London 📅 Thu, Oct 24 | 10:00 AM - 1:00 PM BST | Lecturer: Marc Penkala

🌍 Milan 📅 Tue, Oct 29 | 10:00 AM - 1:00 PM CET | Lecturer: Marc Penkala

Got ideas or requests for future topics to cover? Let us know here.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 October | 🌍 Dubai, UAE

Invest in Bravery | 📆 21th of October | 🌍 Kyiv, Ukraine

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

culttech summit | 📆 5-6 November | Vienna, Austria

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany