Diary of an Emerging Manager - Part 1: The Decision

XoXo, Venture Whisperer (The VC Gossip Girl)

Editor’s Note – Andreas Munk Holm, co-founder of eu.vc

Venture capital is tough—no matter where you start or how you go about it. Every journey is different, and every fund manager has their own war stories. What you’ll read here is one European emerging manager’s candid, unfiltered account of what it’s really like to build a fund from scratch. We’re not here to say he’s right or wrong, just that he’s sharing his truth.

Some of his takes are spicy. He critiques public money’s role in venture, calls out VC accelerators for prioritizing their own success over the managers they support (with some edging dangerously close to outright fraud), and questions whether money chasing “impact” can ever deliver real returns. And that’s just the start.

We’re sharing this because we believe in open discussion. Whether you agree, disagree, or see things differently, we invite you to join the conversation. Drop your thoughts in the comments or take it to VC LinkedIn—healthy debate only makes us all better.

Let’s get into it.

In this diary—well, let’s call it "Diary of an Emerging Manager"—I’ll share key lessons, insights, and practical advice on building a venture capital firm. While we’re still in the process, you can follow our story (anonymised and with mixed timelines for privacy).

It’s been quite a journey since we first considered taking equity in the startups we worked with as an accelerator. At first, we debated the best structure—maybe a syndicate? (Easier to set up, sure, but harder to manage in the long run - hmmm, cannot wait) Coming from venture capital and accelerator backgrounds, we explored several models. Yet, over the past few years, we’ve observed significant setbacks in the venture capital industry.

Traditional models from the past 5–10 years started to feel increasingly “outdated”. (Maybe it’s the survivalist mindset—COVID-19, the Ukraine conflict, and other crises setting the tone?) It seems like the core purpose of venture capital—buying low and selling high—has been altered.

While working with several government-backed VCs, especially in the eastern part of the world, we saw a tendency to prioritise quantity over quality. These investors have their own purpose, but increasingly, it seemed to us that private actors have started to think the same way.

[Do you guys know that we could tokenise it? But let’s not.

Something like this: Family Guy - (S4xE1) British Porn

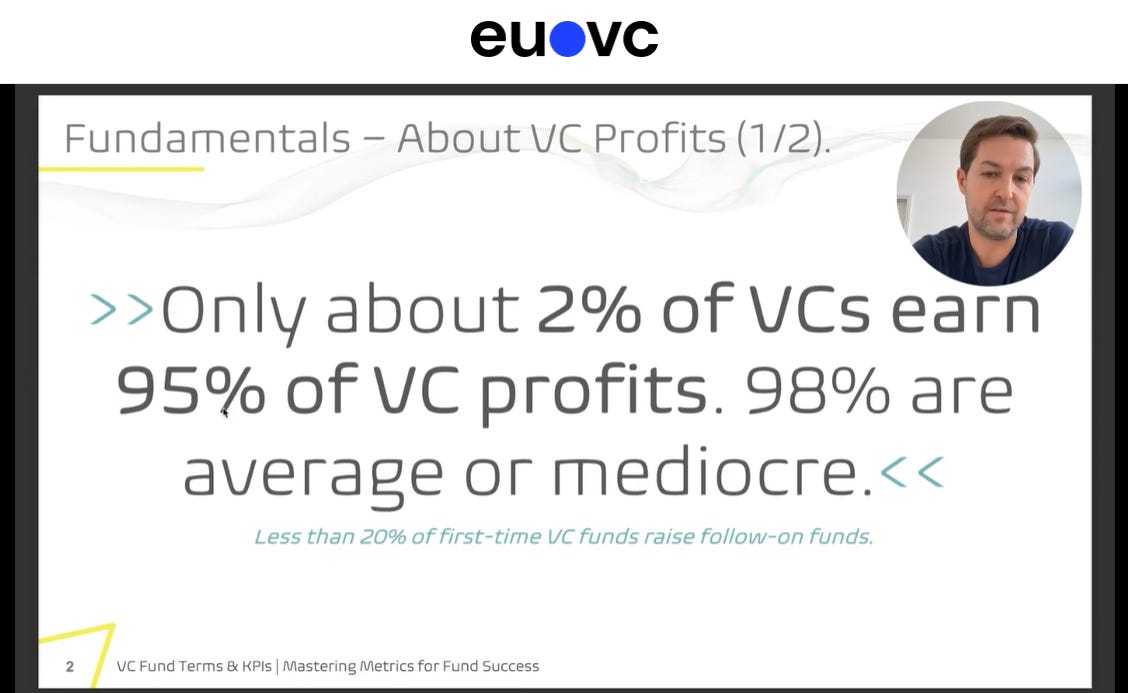

Back to the story.. Although the industry claims to focus on goals like tangible impact and “change”, many actors seem to prioritize meeting societal expectations over delivering real, measurable results. (Why not both?) Along our journey, we’ve met many VCs frustrated by the relentless pressure to "hit the numbers," regardless of quality. This approach leads to weaker portfolio support and keeps alive the depressing statistic that 9 out of 10 startups fail. It makes us ask: what’s the point of venture capital if this is the outcome?

We decided to do SOMETHING ABOUT IT. The industry is about innovation - then let’s do what we do best; solve problems and innovate.

Once we crystalised the idea, we received the well-needed nudge from the universe to get the wheels in motion when a friend in Singapore invited us to join an emerging VC-focused program. So we began a new chapter in our journey…

In this diary—well, let’s call it "Memoirs of an Emerging Venture Capital Manager"—I’ll share key lessons, insights, and practical advice on building a venture capital firm. While we’re still in the process, you can follow our story (anonymised and with mixed timelines for privacy).

Embarking on raising the fund

When we started, we had little idea how much effort would be required to raise a venture capital fund. Overoptimistic and excited, we eagerly applied to the program and were accepted within a few days. At the time, it didn’t seem strange to us that we lacked many of the foundational elements we’d need to begin, yet somehow felt ready to take on the challenge.

The first step was assembling a team with the right mix of skills: an angel investor (the one who recommended the program), someone with VC experience (me or not me), a sales expert (my business partner from the accelerator, because everything relies on sales), and a numbers wizard (a former colleague from a VC or not). With this team, our journey began.

The first major task was crafting a killer investment thesis—a challenge since everyone had different ideas. My business partner and I were clear about one thing: we didn’t want to start a VC fund just for the sake of doing it.

That said, we knew that no matter what we submitted to the program, we’d stick with the thesis we’d developed earlier - that might open a new chapter in the VC industry “a thesis which shall be adopted by many later” (as a visionary). It was tailored to our strengths and focused on winning strategies, minimising risks, maximising returns, and creating meaningful impact.

We consciously avoided jumping on the greenwashing or AI hype trains. While I can’t share the specifics of our thesis - as I want to publish this diary anonymously (at least for now) - here are two key takeaways from those early weeks:

Work on a thesis that stands out, can be validated before fundraising and offers a sustainable competitive advantage in a crowded market.

The fact that 9 out of 10 startups fail shouldn’t be accepted as an industry benchmark—it’s a sign of systemic failure. As VCs, our mission should be to improve these outcomes, not normalise them.

XoXo, Venture Whisperer (The VC Gossip Girl)

Upper East Side Ventures

Bold initiative -a much needed discussion! Looking forward to the next one.

Another fascinating case study: Indie VC and Bryce Roberts