Eight Roads and āltitude release results of the first EU SME Vertical SaaS 50 Competition

Guest post by āltitude

Guest post by āltitude

Venture capital investors Eight Roads and āltitude have teamed up to launch the first-ever competition that spotlights Europe’s top 50 SME Vertical SaaS companies. The final selection recognises the best European entrepreneurs that are redefining how business is done in a variety of industries.

„At Eight Roads, we’re passionate about the transformative power of Vertical SaaS and the massive potential it holds to reshape industries. From construction to beauty, hotels, restaurants, and beyond, SMEs are being revolutionized by modern, intuitive cloud and mobile solutions,” said Lucile Cornet, Partner at Eight Roads Ventures. „That’s why, in partnership with our friends at āltitude, we’re excited to launch the SME Vertical SaaS 50 — spotlighting the trailblazers driving innovation in these verticals“.

“At āltitude, we’re delighted to have partnered with Eight Roads to launch the inaugural 'EU SME Vertical SaaS 50' competition. Vertical SaaS is reshaping the SME landscape across Europe, offering tailored solutions that address industry-specific challenges with precision and scalability. Our joint initiative highlights the incredible talent and innovation in this space, and we’re proud to acknowledge these firms as they redefine the future of SMEs – which are the backbone of the European economy" said Videesha Böckle, General Partner at āltitude.

Why SME Vertical SaaS?

SME vertical SaaS (VSaaS) refers to companies developing specialised software tailored to specific industries, ranging from construction, manufacturing, to restaurants or fitness studios. Both investors foresee a marked acceleration in both innovation and investment into SME vertical Saas in the coming years, driven by 3 main trends:

Generational change: Younger generations of business owners have taken up the reins, leading industries that were once considered traditional or "old-school" towards a more digital future. One in three businesses is expected to transfer ownership in the next decade. Additionally, staff shortage exacerbates the pressure on these businesses to adopt technology, not only to stay competitive but also to compensate for a shrinking workforce.

The emergence of embedded finance: Technological and regulatory progress has made it much easier to embed financial services into vertical SaaS, covering payments, lending, account management, and more.

To stay competitive, small businesses have no choice but to modernise: SMEs seek more comprehensive and user-friendly tools to compete in a landscape often dominated by large multinational giants with advanced pricing strategies, sophisticated demand forecasting, and exceptional customer experiences.

Competition Highlights:

The EU SME Vertical SaaS 50 aims to spotlight entrepreneurs building software for SMEs that is specifically enhancing daily operations and processes for the 26 million SMEs across Europe.

SMEs act as the backbone of our economy, employing 100 million people and acting as a force for economic growth and job creation.

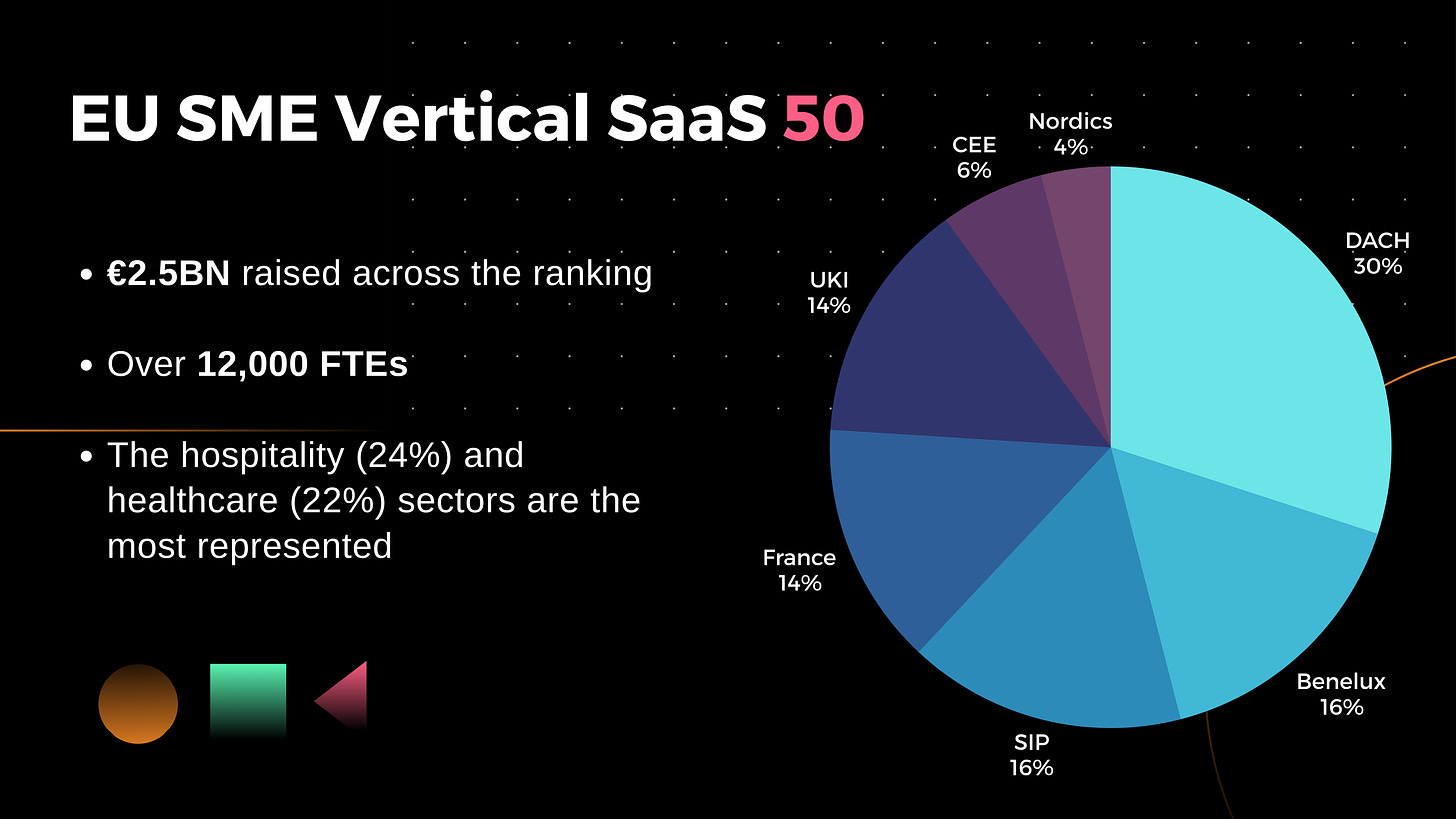

Within the top 50 selected scale-ups, the most represented verticals are the hospitality industry (24%) and the healthcare industry (22%).

What makes the Top 50 startups particularly noteworthy is their economic impact besides serving the backbone business of the economy:

In total, €2.5bn in funding has been raised between them all since inception.

Europe’s leading SME Vertical SaaS startups employ over 12,000 people, with an average team growth rate in year 2 of their existence of 153% (according to their LinkedIn data).

Smaller countries like the Benelux states are playing a vital role in SME Vertical SaaS in Europe, underscoring that many other tech ecosystems besides London, Berlin, and Paris are growing in importance.

What makes the Top 50 startups particularly noteworthy is their economic impact besides serving the backbone business of the economy:

In total, €2.5bn in funding has been raised between them all since inception.

Europe’s leading SME Vertical SaaS startups employ over 12,000 people, with an average team growth rate in year 2 of their existence of 153% (according to their LinkedIn data).

Smaller countries like the Benelux states are playing a vital role in SME Vertical SaaS in Europe, underscoring that many other tech ecosystems besides London, Berlin, and Paris are growing in importance.

The Results: EU SME Vertical SaaS 50

Europe’s top 50 companies that are building vertical SaaS solutions for SMEs.

The analysis conducted by āltitude and Eight Roads unveiled the following insights about this specialised software segment:

30% of the Top 50 SME Vertical SaaS startups are based in the German-speaking (DACH) markets, with Benelux and Southern Europe (Spain, Italy, Portugal) coming in second with 16% each – but other markets like France are not far behind and are home to some category leaders like Doctolib.

German speaking startups that were selected show an inclination towards delivering solutions for manufacturing SMEs, even though the industrial sector in Europe is somewhat underserved with only 8% of all startups that were chosen for the Top 50 being active in this field.

The agriculture sector is seemingly underserved as only 2% of all selected companies are catering to the needs of farmers and food producers.

“Geographical expansion in Europe for vSaaS players will be significantly easier in the upcoming years: Unified APIs, the strong development of LLMs, and upcoming vertical AI solutions, as well as regulation at the EU level like e-invoicing, will lower the hurdles for conquering multiple countries in Europe.“, said, Michael Kessler founder and CEO of HERO Software, the leading SaaS platform for tradesmen SMEs in the DACH region. „However, we still deal with close to 50 countries, 60 languages, and structural & cultural differences in Europe: In order to compete with the huge US- or the Chinese Market, policymakers need find ways to implement a premium for vSaaS entrepreneurs who are willing to take the risk of expanding from their home market to additional geographies. This will support European entrepreneurs & investors in building relevant tech players with global relevance.“

“Our ambition has always been to be a verticalised operating system - the system the entire business runs on. If this is your mission, it means multi-product needs to be a ‘Day 1’ mindset. This means identifying, validating and then serving multiple functions and user personas from the get go. In Nory's case, we launched our second product within just 9 months of the first, allowing us to deliver the breadth of value necessary to gain the traction required to establish ourselves as the central operating system” said Conor Sheridan, founder and CEO of nory.ai, an AI-native restaurant management platform active in Europe and North America. Going forward, Eight Roads and āltitude are planning to publish an updated snapshot of the current status of SME Vertical SaaS in Europe on an annual basis.

Competition Methodology:

The now published list includes emerging SME Vertical SaaS companies that have been chosen after a thorough analysis by the teams of venture capital firms Eight Roads and āltitude. To be eligible, startups had to meet the following criteria regarding their scale, momentum, and strategic positioning:

Vertical SaaS focus: Companies building software tailored for a specific industry (e.g., construction, hospitality, healthcare, manufacturing). The software should ideally serve as a mission-critical operating system for small- and medium-sized enterprises.

Operating in the SME space: Annual Contract Values (ACV) of less than €60k.

Europe-based: Must be headquartered or primarily operating in Europe & the UK.

The expert jury from both firms have evaluated both operational performance and market positioning of more than 150 European startups that were nominated for the competition, ranging from pre-revenue to growth stage companies.

Additional Quotes from selected SME Vertical SaaS founders and CEO:

„There will be an interesting evolution of SME-focused Vertical SaaS in the next five years. I believe that we can go deeper into the market while moving from capturing the tech stack of our client to transforming the workforce tech solution. There will be strong momentum for European Vertical SaaS players going forward. Even though in Europe, each market has its particularities, I think that strong internal processes with a machine-like mentality in order to manage volume is necessary. SME is a numbers game“, said Zakaria Mansour, Co-founder and CEO of Bsport, a Paris-based comprehensive suite of software tools for boutique fitness studios.

“Our ambition is to be the indispensable operating system for salons across Europe—the first system they turn on and the last they rely on daily. By focusing deeply on the salon industry, we deliver a hyper-verticalized platform that goes beyond bookings to power every aspect of their business. Our mission is clear: to help Europe’s SMEs, the backbone of the economy, embrace digital transformation and thrive. Today, thousands of salons across six countries trust Salonkee to run smarter and grow faster”, said Tom Michels, CEO of Salonkee, a Luxembourg-based digital platform for the management of hair and beauty salons.

"At Arke, we believe technology’s success is defined by its ability to serve those who need it most. This is why we’re dedicated to empowering manufacturing SMEs with the tools to thrive. As the driving force behind global economies, their resilience and innovation are crucial for the world’s growth”, said Michela Andreolli, CEO of Arke, an operating system for manufacturing SMEs in Italy.