As an ardent admirer of Speedinvest's exceptional work in Europe, we’re stoked to share with you our conversation with Andreas Schwarzenbrunner, partner at Speedinvest and author of the newly launched report “Inside the Minds of European VCs.” Here's some of what awaits you:

🔗 We'll unravel the intriguing similarities and differences between European and US venture capital, shedding light on the diverse landscapes and unique opportunities each holds.

📌 Prepare for a deep dive into the realm of policy changes and the vital role of lobbying. Discover how it shapes the very fabric of the European tech ecosystem, influencing its growth and transformation.

🤝 Join us as we explore the burning need for European tech to showcase its true value beyond mere paper worth. It's time to uncover the untapped potential and untamed forces that drive this dynamic realm.

Hold on tight, my fellow techies, and read on and subscribe to the pod to not miss out 🎧

Why Andreas Left Politics for the Fast-Paced World of Startups.

Andreas was a former Economic Policy Advisor for the District Council Member in Vienna.

“I love politics, but it’s very hierarchical and slow-moving.”

“I guess I was lucky because back then, VC was not as cool as it is now. Many people were unaware of what venture is, and there were few job applications.

I had my interview with Oliver from Speedinvest, and one of the main reasons I got hired was that we had a lot of fun during the interview. And this is how I joined Speedinvest as an Analyst.”

The Intersection of Politics and Venture Capital

Having a policy background, few could provide a better perspective on how government policies and regulations significantly affect fintech, health, and the climate tech industries.

One need only look at how the COVID-19 pandemic upended every part of daily life as we knew it - or for something very close to our world of VC: the Inflation Reduction Act, which over-night did away with free money and started a cascade of changes in our industry.

Without it, we’d probably still all be busy feeding unicorns 🦄

“I had to dig my way into the venture capital ecosystem, which still sticks with me.

I don’t know how to code, and I don’t know many things about technology, but this keeps me curious. It also helps me stay humble and show founders how hard one should work.”

Discussing the findings from “Inside the Minds of European VCs” 🧠

Download the report here.

How Collaboration Can Overcome Fragmentation in the European Market

Europe is a patchwork quilt of markets, with its players and local authorities calling (too many of?) the shots. Solidifying the importance of this, a whopping 90% of investors believe Europe comprises various regional ecosystems instead of one unified ecosystem. To some, it's like a jigsaw puzzle with missing pieces.

We all strive for better collaboration, but Andreas insists there's room for improvement. We must tear down these barriers and unite as one united force in the European market. Let's break bread, share ideas, and work hand in hand toward a future where synergy reigns supreme.

And it’s worth it, even though the below chart leaves me wishing a little more than 42% thought “interesting startups” was a defining strength of Europe 😂

“Geographical distance doesn’t play a role. We can all hop on a plane or train; you are everywhere in Europe.

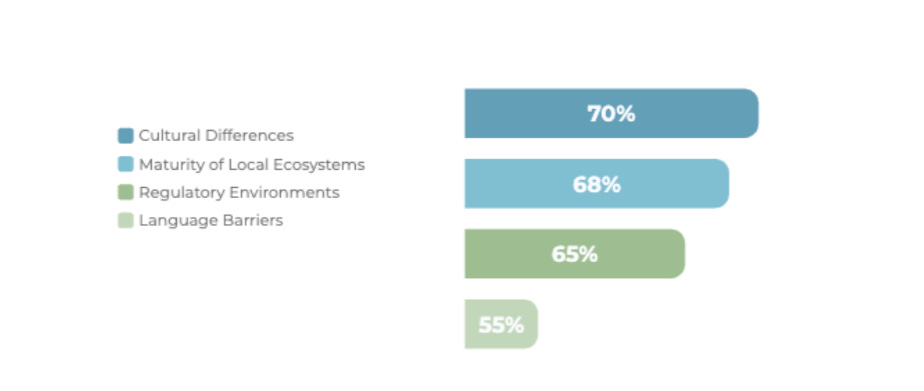

It’s about the regulatory environment, different maturity levels in each ecosystem, our cultural background, and language differences.”

Power Law Influences Venture Capital

The European venture capital ecosystem is moving towards a more optimistic and growth-oriented approach.

Andreas shares his experiences and observations on how the mindset in Europe has evolved over the years, focusing more on the upside rather than minimizing the downside.

We discuss the factors contributing to this shift and how it has impacted the venture capital ecosystem.

“Optimize for the upside. Everything else will never try to return.”

VC Research - Still a US Business.

We need more visibility on the European Venture Capital ecosystem if we want to understand the ins and outs of it.

Research papers, just like Andreas published Inside The Minds of European VCs, will help us change the perception of the European tech ecosystem and bring more attention to its macroeconomic implications.

How European VCs pick winners

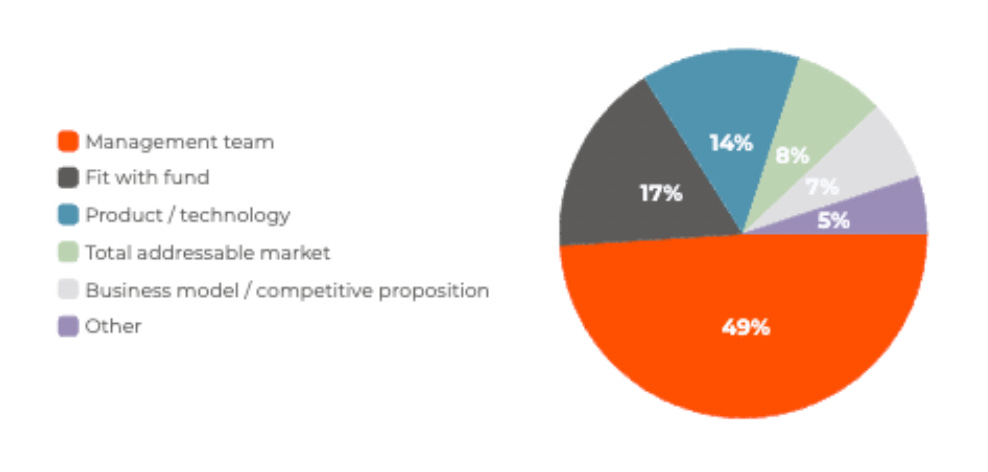

42% of investors in the Speedinvest report say that they’ve made the investment decision right after the first meeting and here’s what they look for:

EU vs. US

Europe’s strengths: Europe boasts a strong educational system, universities, talented individuals, technological know-how, and intellectual property.

Investor perception: European investors perceive Europe to have a more collaborative and founder-friendly environment than the US. They believe European startups focus more on sustainable growth and profitability than solely chasing massive valuations.

Funding landscape: While the US dominates VC funding, Europe has rapidly caught up. European startups are attracting more investment, and the funding gap between Europe and the US is closing.

Regulatory field: Europe has a more complex regulatory environment than the US, which can challenge startups. However, some European regulations, such as GDPR, have fostered a data privacy mindset and provided opportunities for innovative solutions in areas like cybersecurity.

If there are a few things I want you to remember from our discussion with Andreas and his report, these are the following:

Collaboration is the key to overcoming a fragmented market. By joining forces, we can work towards better ecosystems and frameworks.

Venture capital is all about the Power Law. Investors should prioritize upside potential rather than ensuring returns across the board.

Pay attention to valuations. European tech companies need to demonstrate their value beyond mere paper valuation.

Also, don’t forget you can listen to the full episode on Spotify 👇