Today we have Johannes Weber, Founding Partner of Ananda Impact Ventures with us. Johannes is a serial entrepreneur and a pioneer in the field of impact venture capital in Europe. With his team in Munich, Berlin and London, he manages over €200M and invests in technology-based companies in areas such as climate, health and education (the so-called impact unicorns). Johannes has been interested in the interface between entrepreneurship and "personal mastery" for many years and is enthusiastic about bringing and passing on his knowledge to the companies he finances.

Ananda Impact Ventures are investing out of Fund IV with a total 200€ AUM and an established portfolio of 35 companies and notable investments including E-DNA Company Nature Metrics, New Space Company OroraTech and Education Company One Day. At Ananda Impact Ventures, Johannes focuses on TechBio, Education and Climate in Europe and led the investments into Closed Loop Medicine, One Day and Auticon.

Table of Contents

Time stamps & full video conversation

The Take A Stance

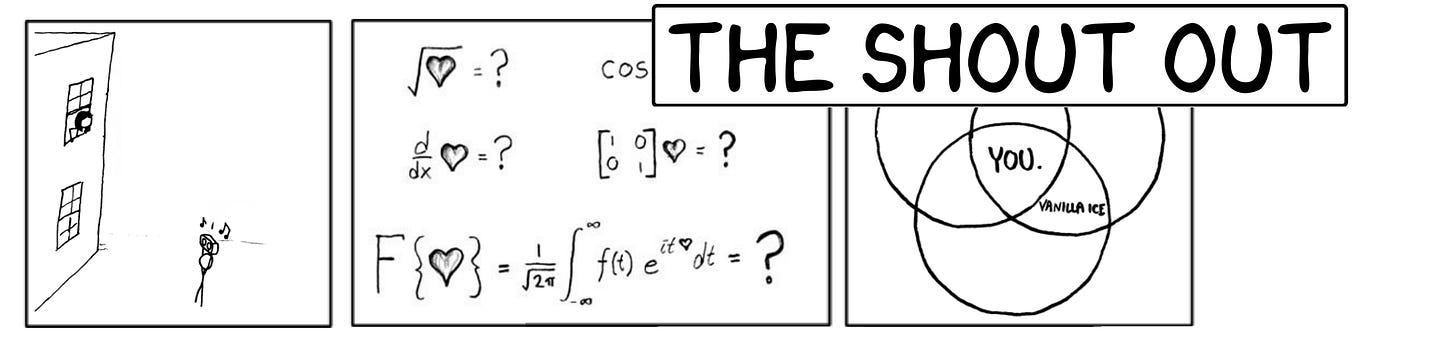

The Shout out

Three life learnings

The Quick Fire Round

The WTF you said that?

This episode is brought to you in partnership with… Synaptic

Spot promising deals faster, before anyone else!🚀

Synaptic’s alternative data and intelligence platform lets you surface high-growth opportunities that were invisible earlier. Easily filter companies by your choice of industry, funding stage, geography and 100+ company performance metrics like user traffic, employee data, product reviews, and more! Our AI/Ml-based insights and automated alerts let you stay on top of your portfolio.

Join the tribe of data-driven investors! Start your free trial today.

Time stamps

00:00:00 - Introduction to Johannes and Ananda Impact Ventures

00:02:15 - From Entrepreneur to VC

00:04:18 - Recognizing the Superpowers Connected to Being on The Spectrum

00:06:52 - Creating Impactful Companies without Trade-offs

00:08:44 - Kindness as a Core Value in Business

00:13:29 - Helping Founders' Mental and Physical Health

00:15:47 - The Development of the Impact Carry Model in VC

00:18:25 - Setting Impact Goals for Companies

00:20:24 - The Importance of Impact Beyond ESG

00:22:24 - Challenges of Measuring Impact in Early Stage Venture

00:24:40 - Tracking Impact Indicators and KPIs

00:27:01 - Alignment and Potential Pivots

00:31:02 - Creating Something Good

00:33:05 - Transparency and Impact Hurdles

00:36:32 - The Importance of Diversity and Collaboration in Venture

00:38:30 - The Importance of Healthy Role Models in Society

00:46:53 - Miles Morales and Rabbit Holes

Quote by Sabine Wizander from CREANDUM:

VCs add way less value than they think.

Johannes’ take:

Completely agree. We max out our network within 6 months - If we are excellent 12 months.

There is no way a VC understands the founders market or company better than the founder and trying to is a burden on the company. We look for entrepreneurs that are smarter ad better than we are.

But once we overcome this ego battle with ourselves as VCs I do think that there is room for being very helpful.

We can be helpful with Founders Health / Staying focussed / Just being a good and trustful person to talk to.

Seems pathetic to do a shoutout for EIF but in our case its really true.

Cyril Gouiffès, now Head of Impact Investments backed us when we were not yet backable now EIF is in three funds

We defined together what impact vc means, co-developed the impact carry model which is applied by > 80 funds now

Challenged us in a kind way on our strategy and when we were taking wrong turns as a VC. I think he should be EIF CEO one day 😃

VC takes humility and lacks humbleness: always leave some space for the chance that you were just lucky and not smart (makes you a better investor)

Building a great company can only be done in a honest team effort and the more diverse this team is the more successful it can be

Pick your role-models wisely, mine are less the one-discipline superstars but more the silent heroes / regular people that wear the black belt in the interdisciplinary sport called life

Q: What advice would you give your 10 year younger self?

Appreciate your kids even more when they are really small, you don’t have to be on every stage and event

Stay in the blue ocean. Dont compare yourself to others - I struggled a bit when I started to wanting to be a great VC and to compared myself to the greatest traditional VC firms out there

If the deal somehow feels wrong although DD says “go” - don’t do it

Just be authentic in everything you do

Q: What are your top tips for emerging VCs across Europe who are fundraising ?

Just get started with whatever amount of money you were able to raise

Build you track record / then raise a fund

Focus on getting the partnership right

Focus on diversity as great strength and resilience comes with that

Q: What’s the most counterintuitive thing you’ve learned in venture?

You can be successful without being a jerk. You can also be successful by being a jerk as well. But the former is more fulfilling.

Johanne’s controversial statement:

“If you don't have an impact carry hurdle, then you don't really care about your impact”