Joining us today for a deep dive on the state of diversity in European venture, we have Kinga Stanislawska from European Women in VC and Juliet Rogan from HSBC Innovation Banking.

Juliet works in the investor coverage team at HSBC Innovation Banking – Providing support and access to the HSBC platform to investors and their portfolio companies. Prior to joining HSBC, Juliet spent 10 years at Barclays where she co-founded the female founders forum.

Kinga is a co-Founder of the leading CEE (Poland based) VC fund - Experior VC with investments in data driven CEE startups with global ambitions. She is also an Investment Committee Member at EIC as well as the EIC Fund, the largest deep-tech fund in Europe and a board member at fast growing companies.

As one of Europe's first VC funds to be be founded by women, Kinga also co-initiated the European Women in VC Community which publishes an annual report on the state of diversity in European Venture - which we dive into today 👀

Table of Contents

Watch the full conversation & chapters of the pod

Key Findings of The Report

Superior Financial Returns Linked to Female Leadership

Quantifying the Impact of Gender Diversity

Enhanced Stability with Female Representation

Persistent Gender Disparities

The Ripple Effect of Limited Financial Clout

Implications for the Broader VC Ecosystem

Navigating Gender Disparity

A Gradual Shift Towards Gender Diversity

Existing Disparities in Investment Leadership

The Gender Gap Among Decision-Makers

Inadequate Corporate Strategies for Gender Diversity

Overlooking the Financial Potency of Female-led Startups

How can we move forward?

This week’s partner: HSBC Innovation Banking

HSBC Innovation Banking provides commercial banking services, expertise and insights to the technology, life science and healthcare, private equity and venture capital industries.

From first-time founders to the funds that back them, innovators rely on us for deep expertise, endless energy, agility, and connections that help them to build organisations that better our world.

Watch the full conversation 👀

Chapters:

00:00:00 - Introduction to The Episode

00:02:07 - Increasing Female Presence in Tech and Venture

00:04:16 - Launching the Report at TechBBQ

00:06:13 - The Foundation Of The Survey

00:08:27 - The Importance of Diversity in Funding

00:12:24 - The Performance of Mixed Teams

00:14:53 - The Importance of Getting More Women into the Industry

00:16:37 - Equity in Investments and Succession Planning

00:18:38 - Affordability of General Partnerships for Women

00:20:40 - The Importance of Diversity in Management Teams

00:22:26 - Progression and Measurement in Impact Investing

00:26:15 - Equality and Support in Venture Capital

00:28:26 - The Rise of Female Emerging Managers in VC

00:32:24 - Reflections on VC Accelerators & VC Lab in Particular

00:34:28 - Broadening Access to Venture Capital for Women

00:38:27 - Investing in Diversity for Long-Term Success

00:40:25 - Personal Choice and Taxpayer Institutions in Europe

00:42:32 - The Speed of Change and Female-led Startups

00:44:36 - Collaboration and Unity

Dive into the report’s core findings

In an era where data-driven insights hold the key to transformative change, the importance of continuous learning and knowledge sharing cannot be overstated. Research endeavors, such as the commendable work by Kinga and her dedicated team at The European Women in VC Community, play a pivotal role in shaping our understanding of pressing issues. Their findings not only shed light on the current landscape but also guide future initiatives to foster growth and inclusivity.

By delving into their comprehensive report, we stand at the forefront of change, equipped with the tools to make informed decisions. Yet, the onus of leveraging this knowledge lies with each one of us. Let's amplify the reach of this invaluable research. Share the report with your network and mark your calendars to participate in next year's survey.

Before we get into it, a note on methodology

The insights in the report come from a study involving 104 VC firms headquartered in Europe, collectively managing 220 funds with a total value close to €12 billion, alongside data from PitchBook encompassing 558 such European firms handling assets worth €148 billion (each managing over €25 million). The financial performance review specifically focused on a subset of 100 VC firms and 220 funds, with a cumulative asset value approaching €34 billion, selected due to the accessibility of detailed fund performance data.

Key Takeaway: Empowering Women Enhances VC Fund Performance

Notably for any subscriber reading this, the report underscores a compelling correlation between the financial performance of VC funds and the gender composition of their senior management teams. Let’s dive in 👀

1. Superior Financial Returns Linked to Female Leadership: The study reveals that European VC funds witness a significant increase in financial performance with increased female representation in their senior echelons. Notably, funds with a predominant female presence or balanced gender mix in management roles outshine their male-only counterparts, boasting a remarkable 9.3 percentage points higher in annual internal rate of return (IRR).

2. Quantifying the Impact of Gender Diversity: The data suggests a tangible metric: for every 10 percentage point uptick in female representation, the IRR of a VC fund experiences a 1.3 percentage point boost. This statistic not only quantifies the benefits of gender diversity but also highlights its significance in driving investment success.

3. Enhanced Stability with Female Representation: Beyond just boosting returns, having more women in decision-making roles correlates with reduced volatility in fund returns. This stability is crucial, as it implies a more predictable, less risky investment environment, which is often more appealing to stakeholders and potential investors.

4. Persistent Gender Disparities: Despite these clear advantages, gender disparity within the VC sector remains a glaring issue. As of 2023, women constitute a mere 16% of general partners (GPs) in European VC firms, a statistic that has seen only a marginal increase from the previous year. This underrepresentation is even more pronounced when examining the actual investment capital they control—female GPs are responsible for just 9% of total assets under management (AUM).

5. The Ripple Effect of Limited Financial Clout: The report posits a consequential effect of this imbalance: with less financial 'firepower,' female GPs find themselves unable to raise substantial funds. Their limited presence in the investment teams of major European VC and growth funds further restricts their influence and capacity to effect change.

6. Implications for the Broader VC Ecosystem: The financial disparity extends beyond mere fund performance, impacting customary practices within the VC sector. Typically, successful investors reinvest in the ecosystem, a practice known to foster innovation and growth. However, with restricted earnings, women are less positioned to contribute significantly. This trend is particularly concerning given that female investors are two to three times more likely to fund female-led startups, suggesting that current disparities could be self-perpetuating.

In conclusion, the report clearly advocates a pressing need for the European VC industry to not only recognize but actively harness the demonstrable benefits that come with higher female representation.

Navigating Gender Disparity

The 2023 survey of the venture capital (VC) and growth fund market in Europe unveils critical insights into the evolving role of gender diversity in venture. While there are positive signs of change with more women anticipated to enter the realm, systemic challenges persist, underscoring the need for a more concerted approach to fostering inclusivity.

1. A Gradual Shift Towards Gender Diversity: Encouragingly, the European VC scene is poised for a gradual shift towards more gender-balanced teams. The current expansion of the market acts as a catalyst for this change, with survey data indicating that nearly half (47%) of VC firms foresee an increase in female General Partners (GPs) within their ranks over the forthcoming five years. This projected rise in female participation signals a positive trend towards a more inclusive industry landscape.

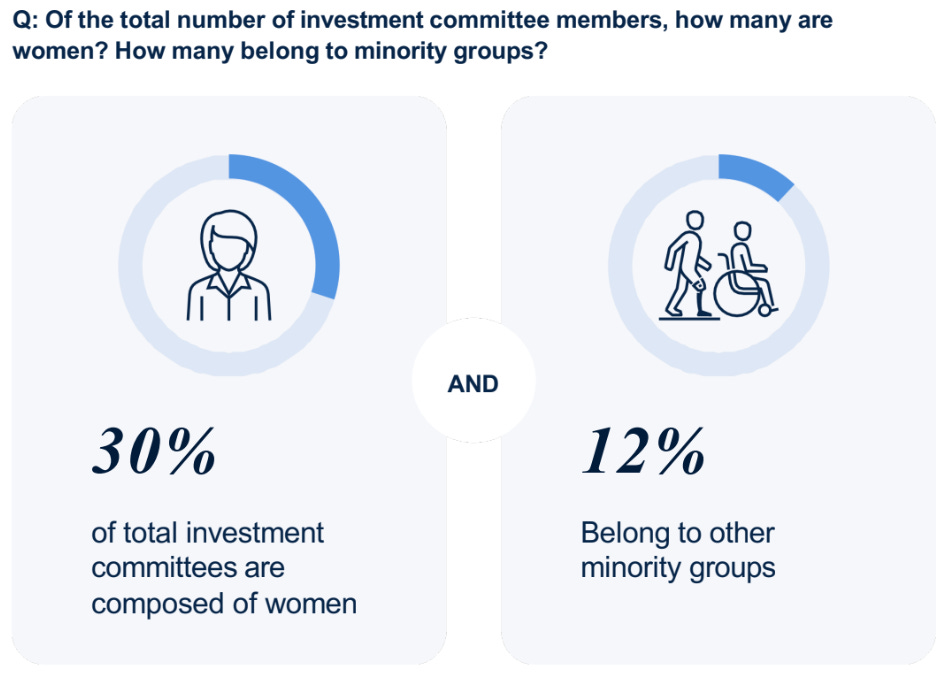

2. Existing Disparities in Investment Leadership: Despite these optimistic projections, there's an evident lack of diversity within the core decision-making bodies. A mere 30% of investment committees include women, and representation from other minority groups is even lower at 12%. These figures, while specifically pertaining to the survey respondents, likely reflect a broader industry trend, suggesting a more pronounced disparity across the entire VC and growth fund sector.

3. The Gender Gap Among Decision-Makers: The gender imbalance extends significantly within the circle of Limited Partners (LPs), who are crucial decision-makers, predominantly male. This skew poses distinct challenges for female fund managers, particularly in a sphere like VC, where relationship-building and networking are pivotal for capital raising.

4. Inadequate Corporate Strategies for Gender Diversity: Alarmingly, only half of the respondent VC firms acknowledge having strategies in place to address gender diversity. Those that do often fall short in sculpting clear career trajectories and leadership opportunities for women. Furthermore, existing Diversity and Inclusion (D&I) initiatives lack robustness, often failing to be effectively communicated externally or measured internally through concrete Key Performance Indicators (KPIs).

5. Overlooking the Financial Potency of Female-led Startups: In investment decision-making, elements such as having female founders/co-founders or robust D&I strategies in portfolio companies are frequently relegated to secondary consideration. This trend persists despite compelling evidence that startups established or co-led by women often outperform their male-only counterparts in revenue generation, highlighting an underutilization of potentially lucrative investment opportunities.

So how can we move forward?

The Report provides some strong guiding principles and actions for us all 👀.

Before we go, give a shoutout to the partners supporting this year’s report✊