Today we have Fady Saad with us. Fady is a Founding GP at Cybernetix Ventures, a 50m$ pre-seed, seed and Series A venture fund in Boston to back North American and European companies within manufacturing, logistics, construction, and healthcare.

Cybernetix are investing out of Fund 1 with a total 50m$ AUM and an established portfolio of 13 companies and notable investments including Realtime Robotics, AirWorks, Bionomous, and Kewazo.

Chapters

00:00:00 - Intro

00:01:42 - New Beginnings in Venture

00:03:44 - Overcoming Challenges and Achieving Success

00:05:51 - The Impact and Expectations of Gen AI

00:07:58 - The Impact of Generative AI on Industries

00:09:46 - Robotics as a Technology

00:11:50 - Manufacturing in the Age of Smart Automation

00:13:44 - Automation in Manufacturing and Healthcare

00:15:47 - Technological Capability vs. Business Model

00:17:36 - The Challenges of Humanoids in the Job Market

00:19:29 - Investing in Robotics, Automation, and Industrial AI

00:21:31 - The Success Story of Universal Robots in Denmark

00:25:31 - Considerations for Product Deployment

00:29:41 - The Rise of Robotics in Boston and Europe

00:31:47 - The Importance of Specialized People in Robotics Investment

00:33:54 - Investing in Smart Machines for the Future

00:36:11 - Investing in Robotics Solutions

00:38:27 - Building a Strong Team in Venture

00:40:21 - Robotics Revolutionizing Our World

00:42:21 - The Rise of Collaborative Robots in the Robot Cluster

00:44:04 - The Rise of Robotics in Odense

Today’s episode is brought to you in partnership with… Odense Seed & Venture

In Odense, we work actively to establish connections between the right investors and the right investment opportunities. We focus on the fields of robotics, drones, and automation.

Particularly notable is that these sectors in Odense are surrounded by a very strong community which has reached a global position that attracts high-potential entrepreneurs, industrial players, and investors.

You can experience the community and the investment landscape in Odense, at our annual events – The Odense Investor Summits.

HOW WE WORK

We work hard to ensure quality investment cases, so we screen and train companies before introducing you to them. Whether you are an investor or a company seeking capital, need assistance setting up your business in Odense, or want to learn more about the industry, we would be happy to assist you. Feel free to contact us at any time via the below!

Quote by Chris Smith from Playfair Capital

Generative AI is not going to have the impact that people expect

Fady’s take:

Generative AI has taken the world by storm, with its ability to create realistic and engaging text, images, and even music. However, as with any new technology, there is a tendency for expectations to run high, sometimes unrealistically so. Fady, a leading expert in artificial intelligence, believes that we are currently in the midst of a generative AI hype cycle, much like what we saw with autonomous vehicles. He argues that this hype is driven by a lack of understanding of how generative AI actually works.

“People think it's some sort of a magical thing that understands and reasons and all of that,” Fady says. “And there is no reasoning. It just predicts what's the next word. This is what it does.”

Fady believes that this hype will eventually die down as people come to understand the limitations of generative AI. However, he also believes that generative AI has the potential to be a disruptive technology that will change many things in the world.

“I think we're looking at something that kind of massive,” Fady says. “It's going to change the way we work, the way we communicate, the way we consume information. It's going to change everything.”

Key Takeaways:

Generative AI is a powerful technology with the potential to disrupt many industries.

However, it is important to manage expectations and understand the limitations of the technology.

Generative AI is still in its early stages of development, and it is likely that we will see significant advances in the years to come.

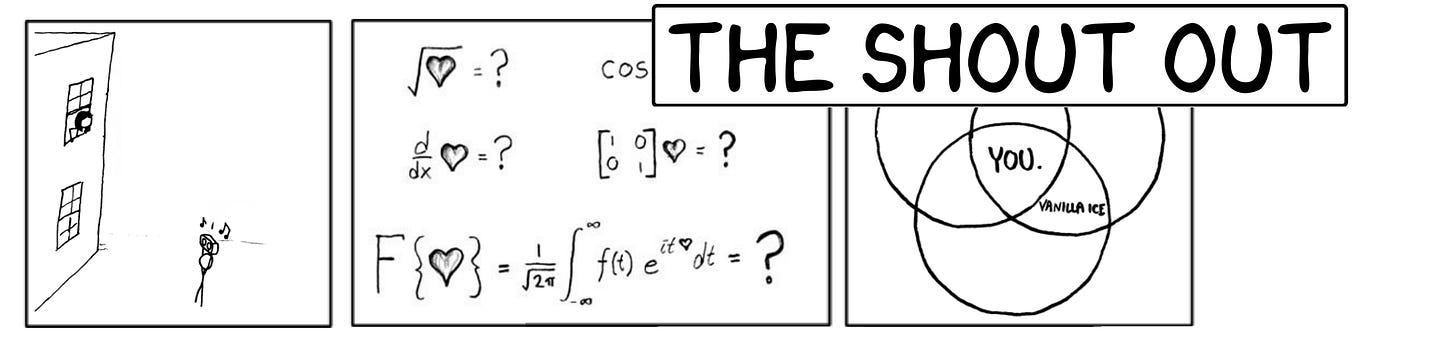

Fady gives his shoutout to his good friend Oliver Mitchell, from FFVC, for being an early and pioneering investor in robotics.

Fady also shared with us that he was recently introduced to one of Mitchell's portfolio companies, but that he was initially skeptical of the company because it was in a crowded space. However, when he looked closer at the company, he found that it had a huge differentiation in that it had built a technology that could do something that no one else out there could do. Consequently, they syndicated an investment together with a large family office in Germany that owns a multi-billion dollar automation company 🚀 None of this would have been possible without Mitchell's introduction and for that and so much more, Fady is grateful for Mitchell's friendship and support.

Q: What advice would you give your 10 year younger self?

Chill out.

Q: What are your top tips for emerging VCs across Europe who are fundraising ?

It's crucial to be prepared for rejection and skepticism. It's a marathon, not a sprint, so you need to pace yourself and maintain resilience. Surround yourself with a competent team that exudes confidence and expertise, making it effortless for potential investors to place their trust in you.

In my case, I was fortunate to collaborate with an exceptional partner, Mark Martin, who possessed over 30 years of experience at Analog Devices Industrial Automation, Sensors and IoT division, a multi-billion dollar business unit. With his leadership, we assembled a world-class advisory board comprising industry leaders, effectively addressing any gaps in our team's skillset.

By building a strong team and establishing a supportive network, you can instill confidence in potential investors, assuring them that their investment is in safe hands.

Q: What’s the most counterintuitive thing you’ve learned in venture?

Being nice and kind pays off.

Help Ensure Europe A Defined Category in Stanford Study on Startup Resilience.

Help ensure Europe a dedicated section in Stanford University's groundbreaking study into startup resilience. This research offers VCs and entrepreneurs the chance to learn from the comeback stories of startups that survived and thrived after significant setbacks.

As a supporter, your firm will gain recognition, exclusive webinar access, the opportunity to do joint articles with Stanford University as well as educational resources to guide investments and nurture portfolio companies through tough times.

Upcoming events

📺 Virtual events we’re hosting

Data Driven Portfolio Modeling | Jan 17, 2024, 12:00 PM - 1:30 PM

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg

Odense Investor Summit | 📆 13 - 15 March | 🌍 Denmark

GITEX Europe 2025 | 📆 23 - 25 May | 🌍 Berlin

Super Venture | 📆 4 - 6 June | 🌍 Berlin

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen