EUVC Lowdown | 13.11.22

Read on for more on the war in Ukraine's effect on tech, 500 EE's investment in Kalder, LPs actually worth your time, the rise of secondaries in EU & the move of VC investments beyond Silicon Valley

Welcome to this week’s edition of The EUVC Lowdown 🗞️ The show that wraps up the week in European Venture with some of the key people making the headlines. Today, we cover:

Listen & subscribe to the accompanying Lowdown podcast here 🎧 where we dived deep on the state and future of ESG in VC and the effect of the war in Ukraine on Tech with Oksana Stowe, Nicholas Nelson, Dan Bowyer, David Cruz e Silva, Andreas Munk Holm and at the helm the always maginificent Cathy White🎙️.

Do let us know if you have news, opinions or GIFs you want us to share on the Lowdown! We’re here to amplify you 📣

This week’s partner 💞

This newsletter is brought to you in partnership with Vauban, a Carta Company 💪 Vauban is the easiest way to launch & run your venture investing. An all-in-one integrated solution to form syndicates, VC funds, & co-investment SPV programs built for scale and has facilitated over $1bn of capital invested in companies such as Revolut, Bolt and AirBnB.

If you haven’t yet checked it out yet, Vauban is now making it even easier to launch your angel syndicate with their new product called Atom.

With Atom, angels can band together to launch an SPV for just $2K + 2% of the raised capital (up to US$200K). To learn more, go to Vauban.io/euvc/ and mention EUVC for a loving treatment!

⚠️ At EUVC we run a community of European syndicate leads, so if you’re looking for some sparring, don’t hesitate to reach out!

with 💖 David

This week’s events 🥳

Watch the Replay 🎥: “From Bubble to what? Making sense of the current market”

This month’s virtual event was quite the success with 591 attendees from the EUVC community and some rather deep discussions on the back of the US vs EU unicorn report. We’re happy campers here ⛺ from our heart, thx for all the support 💞.

You can download the report here 👇 and the slide deck used here.

This week’s podcasts 🎧

The European VC #127 René Savelsberg & Julia Padberg, SET Ventures

In this episode, we’re happy to welcome Julia Padberg and René Savelsberg, partner and managing partner at SET Ventures. Julia's mission is to reduce the climate impact of the energy sector through digital innovation, together with industry-leading entrepreneurs. René co-founded SET Ventures in 2007. He has 25+ years of experience in technology investing in both deeptech and in energy transition with a background in corporate venturing and venture capital.

In this episode you’ll learn:

The origin story of SET Ventures, where they got their name from

How the climate VC landscape has evolved over time and where we are headed

What allowed SET to survive - even thrive - through the big CleanTech wipeout in the early days

Culture & firm building and its importance to building and retaining talent

The European VC, #126 Rémy and Ulric, Vauban

In this episode, we welcome you to a very special interview where we've brought the founders of Vauban, Rémy and Ulric on for a deep dive on the story behind the acquisition of Vauban by Carta. You'll hear all about the founding story of Vauban, how they continue hustling to create the infrastructure for European venture and what's to come

In this episode you’ll learn:

The love story of Rémy and Ulric and what the future has in store for them as founders, investors and people

The big reveal of the story behind the sale to Carta - and where Vauban will go to next

How Ulric and Rémy see the future of private markets in Europe and beyond

The UrbanTech VC #05 Built environment in cities of the future – an architect’s view - Caspar Schmitz-Morkramer, Caspar.

In this episode, we're happy to welcome Caspar Schmitz-Morkramer, Founder and CEO of the internationally active, multiple award-winning architecture studio from Germany that is named after himself. The company “Caspar” takes into account the hybrid, dialogical thinking, which sees all designs as strategies for the future and the construction industry transformation.

In this episode you’ll learn:

About major paradigm shifts in what and how to build in urban environments

What a "no-aliens policy" means in the urban context

Why the "classic European city" serves as a model for modern developments

The importance of balancing all three sides of the sustainability triangle

This week’s GIFs & Memes 🙊

Elon Musk has had his team working on a Twitter facelift

Placement agent presenting results to hiring VC

VC board member walking into Port Co’s office for an "onsite visit" after the CEO only cut the burn by 30% and not by 90% as was originally "suggested"

Masa-san ripping in to the SoftBank Investment Advisers team after yet another portfolio company, FTX, implodes into oblivion:

This week’s LP syndicate news 💸

Acrobator’s update on the war in Ukraine’s effect on tech

Despite the persisting war in Ukraine, the tech sector continues to thrive. Our thesis on Ukrainian founders is reinforced by recent announcements in the portfolio as well as the increasing focus of large asset allocators to CIS-founders. During our visit to Lviv and Kyiv in early October, Ramon and Joachim met with the vice-minister of digital transformation, the machine learning faculty lead at the Ukrainian Catholic University, the leads of all major tech hubs in both cities and scores of founders and other stakeholders in the eco-system. Three things became very clear:

Where once the Ukrainian diaspora was a very loose group of people, they are now more united and supportive than ever (now more akin to the powerful Armenian diaspora.

The tech community in its broadest sense is instrumental in keeping the country running, local economies resilient, and facilitating the grass-roots resistance to Putin’s aggression through innovation and grit.

A high level of ingenuity and competence is being developed in areas such as drones and non-satellite-based/indoor navigation systems and related sensors.

500 Emerging Europe invests in Kalder

💥We've been waiting to announce this for a while! Soooo excited to be investing in Gökçe and cheer for Kalder for years to come🎨

Read the full article here or the TL:DR below:

🔮GOKCE IS GREAT.

🪀Kalder is a web3 brand loyalty and engagement platform

🔦Arın writes boring investment posts - but read it to learn more

💎Kalder will build the ultimate Brand 3.0 toolkit - stay tuned!

🧿1 investment a month! Always.📯 500 Emerging Europe

👏Credit where credit is due. Ekin found Gökçe during talent mapping

🙌 Baris Human Capital, "Lotti" Emergence Capital, Isabela 8VC, Arda, Soma Capital

This week’s stories 🗞️

The LPs actually worth your time

Borys put out a great post that we couldn’t but reshare here. Check it out 👇

While raising my second fund for SMOK Ventures to invest in top pre-seed founders in Central & Eastern Europe I wasted a lot of time on calls with irrelevant (to me) institutional LPs who never invest in emerging managers or don't care about my region. If only I had this list...So, here's the list of specially curated institutional LPs actually investing in emerging managers in Europe:

Isomer Capital (UK)

Multiple Capital (Germany)

Molten Ventures (UK)

AlphaQ Venture Capital (Germany)

equation (Germany)

Cendana Capital (US)

Aldea Ventures (Spain)

All Iron Ventures (Spain)

Blue Future Partners (Germany)

Presight Capital (UK)

KfW Capital (Germany)

RSJ Investments (Czechia)

EUVC | The European VC (Thx Borys 💞)

PFR Ventures (Poland)

European Investment Fund (EIF) (Luxembourg)

EBRD (UK)

I only listed the funds of funds that have invested in multiple emerging VCs (as in funds 1-3) in Europe.

Borys ended his post with a call for people to add other relevant LPs in the comments and I’ll do the same here 💓 Do put it in the comments or reply to this email with some worthwhile names to add to the list! 💞

Here’s a couple from my end:

Anthemis Group (UK)

Blue Wire Capital (UK)

Vækstfonden (DK)

Goldman Sachs Launch (UK)

Industry Ventures (US/UK)

And three other cool resources along these vibes 👇

Vincent Jacob’s list of European LPs

Muieen Cader’s list of resources for emerging managers

Ali Rohdes’ list of Funds that lead seed rounds

The rise of secondaries in Europe

This week our good friend and founder of Siena Secondary Fund, Rando announced that Isomer had joined as their first institutional investor 🥳

Isomer is joining a group of 80+ investors across Europe, further solidifying the rise of secondaries in Europe. And it’s about time we got more of these investors:

In developed markets secondary transactions account for 2-5% of the total market cap of startups. In Europe we are still far behind this figure, but with Isomer`s support, we can work to improve liquidity options for VC-backed companies.

A statement complemented by Chris Wade from Isomer:

“We like to support emerging European VCs as they develop new verticals and niche strategies which are additive to the ecosystem. The secondary market in Europe lags behind the US, and we believe that there is a great opportunity to address this. As companies stay private for longer, the need for liquidity increases over time. Siena`s team has the will and vision to fill the gap in the market”

Chris Wade, partner at Isomer.

At EUVC we’ve been talking to more and more VCs pursuing this strategy (maybe also because we’ve been quite vocal about our love for the strategy 😍) and if you’re interested in this space like us, I thought it might be worthwile just sharing the episodes we’ve launched so far with these managers. Putting on top our bro Rando who just shared this great piece of news 👊

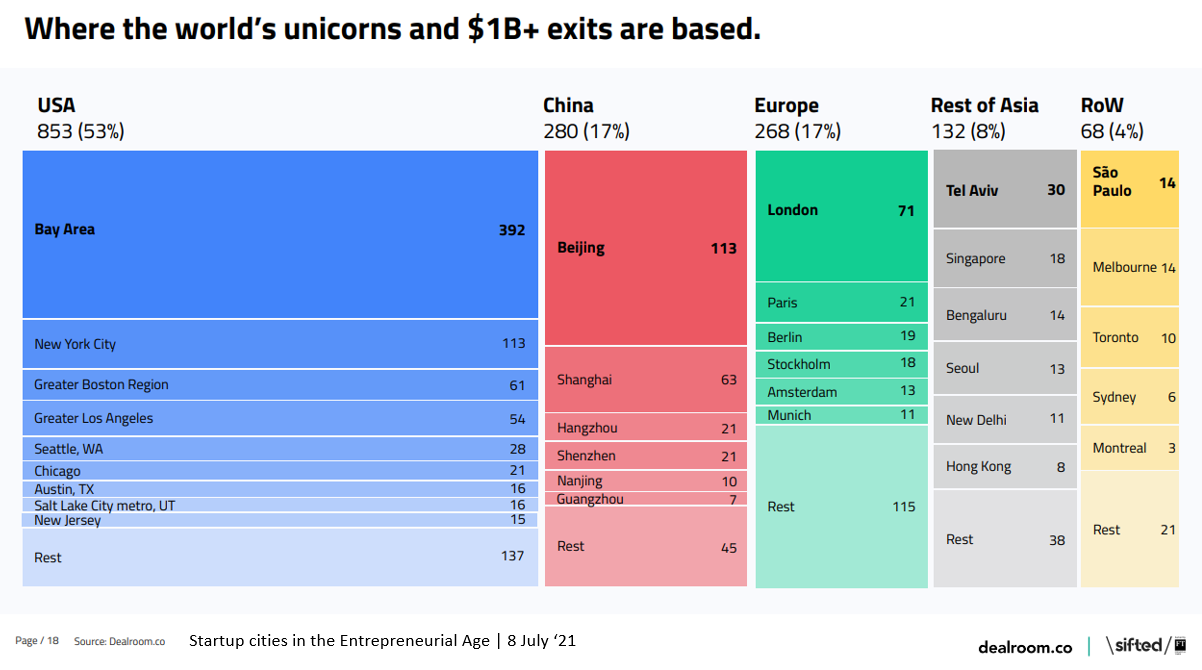

VC Investment: moving beyond Silicon Valley

Joseph Mariathasan put out a pretty solid article for Investment & Pensions Europe (IPE) on the trend of VC moving beyond Silicon Valley.

- “We’re in a sustained golden age of innovation all around the world led by transformational technological advances that are impacting every industry,” says Todd Ruppert.

Fundamentally, this driving enormous growth in value created in VC 🚀 together with the fact that companies are staying private much longer,, making value creation accrue to private investors rather than those in the public markets.

A shift in dominance

But within VC, we’re also seeing a shift in dominance. As Joseph observes in the article: Within the US, Silicon Valley's dominant position is shrinking as other ecosystems catch up. Outside the US entrepreneurs are enabled with transformational tech, VCs have raised record capital, and valuations are better.

“A lot of the smart investors are seeking opportunities which are purposefully not in the highly valued hubs”

Joe Schorge

And as we also discussed in the webinar discussed in the top of this newsletter: In 2014 there were 52 cities around the world with at least one unicorn and the US represented 38% of them. By the end of 2021 that number had exploded to 170 cities with the US representing only 25%.

A geographic spread which is many times more substantial in Europe than anywhere else:

In the article, Taimur Hyat says that

“Forward-thinking CIOs can leverage the vision and market intel of VC management and portfolio companies to identify potential targets of disruption in other parts of their portfolios,”

… something which I have started growing a pet peeve for: the shift from Corporate VCs to Corporate LPs 🎠 in other words: smart corporates should consider partnering with matching VCs over trying to create their own shop inside their own. At least, I know quite a few who’d be amazing partners for universities and corporates 🤔

This week’s funds 💵

🇪🇸 Klima Energy Transition Fund by Alantra & Enagás - €210m, fund 1, energy startups - Madrid

🇫🇮 Inventures. - €150m, fund 4, second close - Helsinki

🇩🇪 Kapital 1852 - $120m target, fund-of-fund - Düsseldorf

🇪🇸 GoHub Ventures - €60M, fund 1, series A - Valencia

🇺🇸 Mozilla Ventures - $35m, fund 1, early-stage - San Francisco

🇨🇭 Privilège Ventures - CHF 20m, fund 4, diversity - Lugano

Section powered by the InnovatorsRoom.

This week’s hires 👩💼

🇬🇧 Frontline Ventures - Principal Seed Team - London

Apply here: innvtrs.com/3Lx6zXa

🇬🇧 Mubadala Capital - VC Internship - London

Apply here: innvtrs.com/3NxqKFt

🇬🇧 Doxa Partners LLP - Investment Analyst - London

Apply here: innvtrs.com/3hcvkNv

🇬🇧 Fin Capital - Investment Associate - London

Apply here: innvtrs.com/3h38qYy

🇩🇪 SevenVentures - VC Associate - Munich

Apply here: innvtrs.com/3frxGr2

🇫🇷 Runa Capital - VC Associate France - Paris

Apply here: innvtrs.com/3gXIr4N

🇩🇪 AVIV Group - Ventures & Incubation Associate - Berlin

Apply here: innvtrs.com/3SPmJxa

🇩🇪 Atlantic Labs - Growth & Venture Dev Associate - Berlin

Apply here: innvtrs.com/3NEGO8C

🇸🇪 Norrsken VC - VC Internship - Stockholm

Apply here: innvtrs.com/3UkeMRP

🇺🇸 Andreessen Horowitz - Partner Fintech - Menlo Park

Apply here: innvtrs.com/3Nsy9Ga

🇺🇸💻 eBay Ventures - Principal - San Francisco, Online

Apply here: innvtrs.com/3NRYpd5

🇪🇸🇵🇹 Antler - VC Associate Iberia - Barcelona, Lisbon, Madrid

Apply here: innvtrs.com/3t9wAnc

💻 6MV - VC Associate Technical - Online

Apply here: innvtrs.com/3TjjTRk

Section powered by the InnovatorsRoom.

Thx for reading and being awesome 💗 we love you for it.