EUVC Lowdown | 27.11.22

Read on for Slushgate, Founder salaries, whether 10 min groceries are a necessary thing, the LP take on micro VCs & Solo GPs, the might angel long tail & VC portfolio modelling. And Seedcamp on EUVC😍

Welcome to this week’s edition of The EUVC Lowdown 🗞️ The newsletter that dives into the headlines in European Venture with some of the key people of the industry. Today, we cover:

The EUVC Lowdown podcast

Listen & subscribe to the accompanying Lowdown podcast here 🎧 where we covered Slushgate, the current state & future of meat and finally the feisty topic of founder salaries with Tilen Travnik, Borys Musielak, Dan Bowyer, David Cruz e Silva, Andreas Munk Holm and the always magnificent Cathy White at the helm 🎙️.

Do let us know if you have news, opinions or GIFs you want us to share on the Lowdown! We’re here to amplify the EUVC community 📣

This week’s partner 💞

This newsletter is brought to you in partnership with Vauban, a Carta Company 💪 Vauban is the easiest way to launch & run your venture investing. An all-in-one integrated solution to form syndicates, VC funds, & co-investment SPV programs built for scale and has facilitated over $1bn of capital invested in companies such as Revolut, Bolt and AirBnB.

If you haven’t yet checked it out, Vauban is now making it even easier to launch your angel syndicate with their new product called Atom.

With Atom, angels can band together to launch an SPV for just $2K + 2% of the raised capital (up to US$200K). To learn more, go to Vauban.io/euvc/ and mention EUVC for a loving treatment!

We run a sub-community of European syndicate leads, so if you’re looking for some sparring, don’t hesitate to reach out! We’d love to get to know you.

with 💖 David Cruz e Silva

This week’s events 🥳

How do you land a cover story?

“I get dozens if not hundreds of pictures and press releases every single day. And it's rare that I even bother opening them. Unless I know or trust the person who's sending them to me or, unless they have a really, really, great subject line.”

Join us as our PR-guru Cathy White takes us through how to build relationships with the media that will get you past the junk-mail button of even the best tech reporters.

This week’s podcasts 🎧

The European VC, #131 Reshma Sohoni, Seedcamp

Today we are happy to welcome a real legend to the show; Reshma Sohoni, Co-Founder and Managing Partner of Seedcamp. With Seedcamp, Reshma has not only pioneered seed stage investing in Europe, but also built what’s become one of Europe’s consistently highest performing funds. Consequently, we thought we had no choice but to dive deep with Reshma on firm building to tease out some learnings from one of the greats.

In this episode you’ll learn

Origin story & where the now famed name SeedCamp came from

The importance of staying true to your north star and building an ever stronger flywheel around your firm

How to think about brand building, recruiting & onboarding new talent and keeping the brand lived by all team members

How Reshma thinks about their LP base, why they’ve doubled down on small ticket LPs and requiring value-add and not just money

How Reshma thinks about follow-on investments and raising opportunity funds vs single-opportunity vehicles

The European VC #130 Romain Diaz, Satgana

Today we are happy to welcome Romain Diaz, Founder and CEO of Satgana, a Climate Tech Venture Capital firm, investing in early-stage pre-seed with follow-on reserves for the seed round up to €500k. Romain is a passionate entrepreneur, a pragmatic idealist, and genuinely a nice guy

In this episode you’ll learn

How Romain’s journey into VC took him from Rocket Internet in Germany, to a venture studio in South Africa and finally now to finally land in Lisbon

How Romain thinks about the venture studio model for an emerging VC and how his own path has made him smarter

How Romain thinks about their value add to founders and ability to pick and win the best in a time with increasing competition in Climate Tech

How Romain has thought about building Satgana from scratch to now announcing it to the world

The UrbanTech VC #06 Lessons Learned - Katharina Junglass and Mark Harré, 2bX

Today’s episode is a special one, as we welcome you to the hosts themselves as guests. Listen to 2bX‘s two GPs reflect on the launch of their podcast, including learnings about being a podcast host but more importantly including an essence of learnings about the first five episodes, urban challenges and possible solutions. Enjoy being part of a very honest conversation between two co-founders and get to know their pure dynamic.

In this episode you’ll learn:

There is a shared understanding of urban challenges of various stakeholder

Collaboration and interaction between stakeholder is needed to solve all problems

But there’s no best practice yet how to tackle that to make it work

Recording and producing a podcast is so very valuable for hosts themselves

Having no guest creates a quite intimate environment leading to very open conversations (or how self-absorbed, sarcastic and brutally honest the hosts talk without having a guest)

Churn FM Ep 187: Steve Hazelton (Sturdy)

Predicting vs preventing churn

Today Andrew Michael had Steve Hazelton, Founder and CEO of Sturdy.In on the show.

In this episode you’ll learn:

All about Steve’s experience with the varying levels of acceptable churn as companies grow and how to decrease it over time.

How pricing can be leveraged to increase retention

How onboarding fall-off rates can be reduced in enterprise deals by charging customers upfront

A discussion of the pros and cons of predicting vs preventing churn.

This week’s GIFs & Memes 🙊

An illustration of why I love VC 🌊

Alexandria Ocasio-Cortez & Elon Musk duet

originally shared by Derek Watson.

40 under 40 behind bars

Originally shared by Matt Turk

Investors changing focus every two weeks

Originally shared by Trace Cohen.

Two VCs on a panel discussion on a topic they can’t even pronounce

This week’s LP syndicate news 💸

500 EE’s Gender equality & Economic Impact

🌱500 EE have been reporting their ESG metrics to their investors for the past few years. Recently, They decided to make them public and share their evolution

building their ESG reporting in public 👀.

💐Below is Enis’ selection of a few of them, more details in the pics 👇

Women-led portfolio companies at 500 Emerging Europe:

🦋14/40 (35%) in Fund I

🐛6/14 (43%) in Fund II

🌳Carbon Emissions Prevented (Whole Surplus, Evreka, BiSU): 113 tons/year

🍆Food Recycled & Upcycled (Whole Surplus) 28 tons/year

💉Healthcare Accessibility (Carbon Health, Massive Bio, BillionToOne, Vivoo) ~1M people/year

👩🏫Daycare facilities led by women (The Village Network): 44

👩🎓Students Enrolled (The Village Network): 80

💰Money Saved (Plum) £1.2B/year

This week’s stories 🗞️

#Slushgate by Cathy White

It’s been over a week now since Slush ended and came under fire for awarding a €1M prize to Immigram - a Russian founded British company that helps talent relocate to the UK.

After winning the pitch competition, new information was quickly shared revealing a lot more ties to Russia than just the founders’ passports.

Within a few days Slush pulled the prize fund - and asked the five leading investors to stop any progression with their investments. Accel, General Catalyst, Lightspeed Venture Partners, Northzone, and NEA. You know, just some casual small names…

The “total PR fuck up” - according to Borys Musielak from SMOK Ventures - could have been avoided.

While there are a bunch of lessons on the comms side of this - the bigger failing is in the DD done before the competition. You can see why the company slipped through the net and looked appealing.

✅ British founded

✅ Diverse founding team

✅ Fixing talent shortages in the west

But unless I’m mistaken it’s VERY clear that there is a war and the Ukraine is under attack, so surely being a lot more sensitive to everything AHEAD of time, would have saved a lot of trouble, a lot of criticism, and not tarnished the Slush name quite as badly.

Crisis comms can be avoided by running scenarios in advance and then figuring out logistics that help you avoid them.

This year the Helsinki conference unfortunately ended with a shit snow (pun intended).

Late-night convos with Chris Wade

In the last edition of the Lowdown, I teased that I felt the late-night convos with Chris Wade, co-founder of Isomer Capital, might be able to carry their own segment. Let’s see if it does 😁 So this week, I hit Chris up and asking him what he was thinking about these days. The reply was imminent:

There’s a lot of market talk on the subject of 10 minute grocery deliveries. And no question, the sums invested and the continuing route to un-profitability will continue to keep many GP’s and LP’s awake into the late night.

Which it rightly should, if I may interject 😶🌫️

But this has also made me think: do markets, customers and/or consumers actually know what they do not have? I mean, pre mobile phones nobody was jumping up and down saying: “I MUST have a device that I can spend my life on ….”

Back then, we all used telephones in offices and homes and felt that was quite satisfactory. But then one day Skype arrived and changed the landscape entirely. But imagine if Skype had required Gorillas-like-funding. Would we, in the venture ecosystem, been ready to fund them? And in turn do what was needed to kickstart the revolution of work and global communication? Would consumers have shook their head and said “who needs this?”

Thinking back to simpler times, Chris added:

We must remember that our ability to predict the future can be quite limited. My first experience as a child of grocery delivery was my mother calling a store (with a black telephone hidden in special place) with her list and magically the good stuff arrived ….. perhaps not in 10mins though…"

So, is Chris saying that 10 minute groceries are a great idea and investment case? I don’t know exactly and neither do I think he is decided. But I do believe that he’s saying that we, as financiers of the future, should be wary of thinking we’re capable of foreseeing the future, even when a good tweet like “who the f*** ever thought we needed 10 minute groceries” lends itself so easily to us.

Interestingly, in the wake of the FTX scandal, the founder of The Information Jessica Lessin put out a similar piece this week.

Reporters and editors (myself and The Information included) were so busy waxing on about all the things crypto companies were not doing that we failed to focus on the risks with what they were actually creating.

Sadly, it is a mistake caused by laziness and ignorance. It is far easier to push a narrative of what a new technology is not than to understand what it is. And crypto is particularly complicated. So we focused on parallels to the world that we knew. And we missed the big story: the deeply risky and deeply codependent financial engineering that is now roiling even some of the biggest firms.

Finally concluding:

We must learn to think differently now. There are many new technologies that are easy to dismiss, like the metaverse and artificial intelligence. Instead of leading with what these technologies are not, reporters and editors should try to see them from the perspective of their biggest adherents—and find the holes.

But for the press to do its job, we must learn this lesson and learn it fast: The most disruptive technology doesn’t work by disrupting things we already understand. It builds new systems right under our noses. To serve readers amid this massive period of technological change, we must be open enough to see that—and then skeptical enough to find the flaws before it is too late.

What can I say? 🤷♂️ … I think I’ll keep dreaming of a better future and help back the managers trying to fund it. With money and a bit of memes.

The LP take on solo GPs & micro VCs

We’re seeing more Solo GPs and Micro VCs come up and everyone seems to be writing on them (TechCrunch thrice in the last few days (#1, #2 & #3) and Sifted twice (#1 & #2).

A caveat to what many seem to think though: to the experienced, solo GPs are not a new wave in Europe and there has not been a particular lack of LP appetite for them - so when someone claims to be pioneering anything in this space, watch out for marketing speech. Nonetheless, I’m running the media-hamster-wheel as much as everyone else, so thought I’d pitch in 🙈 with the perspective of some of Europe’s leading LPs on these. So I reached out to some good friends 💞

Lets kick it off with the solo LP and verified lover of micro VCs, Ertan Can:

We think that micro VCs outperform the VC asset class. As solo GPs are very often at the same time micro VCs, we are also a strong believer in solo GPs. Ca. 1/3 of our last fund are solo GPs.

So, we all know the math behind this rationale: It’s a whole lot easier to return a 20 M€ fund than a 200 M€ fund. But what else is driving the trend? Mark Schmitz from the recently out of stealth fund of funds equation pitches in:

We observe the atomization of early stage finance. Solo GPs and Micro VCs are best positioned to detect technology trends and partner with entrepreneurs at the most attractive investment stage in a company's life cycle prior to Series A. That's why equation has built dedicated technology to systematically find and fund these emerging managers.

Echoing this view, Stephan Heller from AQVC adds:

While a solo GP setup has its risks, we think it also has a lot of advantages in the way of speed and agility around investments as well as the option of keeping the fund size relatively small.

And diving a bit deeper on the risks,

Bertie Highmore of Blue Wire Capital adds:

Small funds with solo GPs have a higher risk profile in that there is a single point of failure (think: what if the manager decides they don't fancy this any more, or worse something material changes in their ability to do the job) ... but they benefit massively from having agile strategies, and the fact that stand-out talents aren't diluted.

For BWC as a direct-first investor, we also have to think about the social aspect of the few LP tickets we do; with solo GPs it's sometimes easier to form those close relationships and find synergies.

Bertie Highmore, Blue Wire Capital

At EUVC, we can only say that we’ve got a bit of a crush on these famed solo GPs & micro VCs as well. But there’s something to be said about AUM to headcount. In last week's newsletter, I praised a fund for being 4 partners to a 20 M€ fund. That’s hustle ✊ But oftentimes, a solo GP will also raise a 20 M€ fund. What’s that? Well, at least, less hustle. Do I think it’s a problem? Not at all (per se). But it does put it into perspective when the you’re evaluating two funds against each other and the one has 4 super senior, highly coveted FTEs to deploy 20 M€ and the other has just 1. So yes. There is something to that… that said, I know a few solo GPs with 20+ I’m super hyped about.

These days, we’re dancing with a sub-10M Solo GP and I’m super excited. In love, even. (Luckily, David doesn’t fall in love as easily as I do 😂).

Then there’s the speed argument. Just six months ago, everyone would praise the speed of a solo GP. Now, maybe a little less. If tier-1 US funds can realize on the back of the FTX scandal that “maybe they should stop relying on other people’s DD” speed definitely seems to be a liability just as much as a strength.

Batman without Robin

In Zosia Wanat’s article for Sifted, they had Bogdan’s picture put under the headline of Batman without Robin. So obviously, I couldn’t help but do this 🦇 as we love Bogdan at EUVC. We recently had him on the podcast and promise you’ll be hearing more about him and his firm underline ventures in the coming time. DM if you want an intro to this superstar ♥

One thing I really loved in the Sifted article was the emphasis on the micro- and solo-GP community in Europe:

[Declan] Kelly says that he gets a lot of support from other European microfunds and solo GPs — they exchange WhatsApp messages every day and share information about investment opportunities.

“It seems like we all work together even though we all work for our own companies,” he says.

Ajami adds that she has benefited hugely from her network of LPs and other people from the ecosystem. As she used to train boxing competitively, she now compares running her business to fighting in a ring.

“That’s also a sport that you do alone, at least it looks like you’re doing it alone. But in the back, you have all the support. And that’s the same as being a solo GP,” she says. “When I was boxing, it’s you in the ring, and people think that you’re doing it alone: you are fighting. You’re out there alone also as a solo GP, but it shouldn’t be underestimated how many people are also in support of that.”

As you know, we’re all about community at EUVC, so couldn’t let that one slip 💘.

In another article, Sifted recently made a list with some of the more well-known solo-GPs in Europe, should you wanna acquaint yourself with them:

Harry Stebbings

Declan Kelly

Nathan Benaich

Arthur Bernard

Max Claussen

Manuel Grossman

Bogdan Iordache

Mike Chalfen

Alexander Lange

Annelie Ajami

Neil Murray

Stefano Bernardi

Siim Teller

Marc McCabe

Rodrigo Martinez

Wanna hear more from these Solo GPs & Micro VCs? Here’s a couple of our episodes with them:

Solo GPs

Micro VCs

Let’s talk about Founder Salaries

Dan Bowyer from SuperSeed poked the bear this week and got hell for it. We talked about this in the accompanying Lowdown episode, but to put it simply: Dan relayed a situation where he had decided against an otherwise incredibly exciting startup on the grounds that the founder required a very high salary and wouldn’t budge even though different structures to meet him were offered.

LinkedIn’s editorial team then picked it up and amplified it and thus: Europe’s tech echo chamber went crazy. Primarily with people saying VCs are power hungry, sadists.

Dan finally decided to delete his original post in an attempt to reset the conversation. Let’s see what he said:

As a founder how much should you pay yourself?

The follow up.

I deleted yesterday’s post.

Founder salaries is an emotive topic.

I don’t mind being punched in the face, well I do, it spikes anxiety, but I totally accept it and welcome it.

As a VC I expect to get punched. We’re an easy ivory tower target and personally, I sometimes say punchworthy things.

But sharing difficult topics is important to me. Not for their own sake, but to raise important subjects; to learn, grow, share.

For me it’s progress, and anything that lives in the space between VCs and founders is why I get out of bed.

So I’ll continue to share, relay, lift lids. And I’ll learn how to do it in more helpful ways to support our community.

But yesterday I was frustrated by the acid.

Not just thrown at me (most didn’t agree with my position btw).

But when a thread become toxic for others too, that’s not cool.

However, as a more positive follow up.

The founder is re-engaged (incidentally, and not via the post), and I will do everything to support him and the business to develop their next steps. With us, the VCs who chimed in, others - or in other ways. He possibly shouldn’t raise VC.

Thank you to those who posted thoughtful responses. They got me thinking. Love it.

And for those who didn’t fully read the post before slinging, I love you too.

I'll share where everything lands, and generally continue to poke the bear.

Just remember, it’s only a teddy bear, really.

The post got 165 comments, so guess it didn’t silence the debate. WDYT about this subject?

Modeling VC Investment Strategies

Wael Nafee of Raed Ventures is sharing the open-source version of their VC fund simulator 😍 The simulator allows funds to model and compare different strategies based on various parameters. Hopefully, this should help VC fund managers make more informed decisions about capital formation and deployment approaches.

They’ve developed many internal tools that augment their internal decision-making process, both in the fund and portfolio management aspects. This helps them iterate towards better quality decision-making and provides a framework for their continuous improvement

We also interviewed the Founding Partner Omar A. Almajdouie on the EUVC pod for one of my very highly coveted episodes that dives into how the founding story of Raed and how they charted their path from being a family office to a CVC to finally become a strictly financial and independent VC ✊ as well as a true insider’s view on VC in MENA.

SPV For the price of a big mac

As some of you are probably aware Assure, one of the larger SPV providers in the US blew up this week. Arik, being the COO of Assure’s primary competitors, of course put out a piece on this.

And as he said:

That is pretty big news - going by their numbers we are talking over 8,800 investments and 50,000 investors affected. Assuming the Average SPV size ($1.49M as quoted in their State of SPV report), that is $13.2Bn of assets that are at risk of being liquidated.

Read Arik’s full article to understand why it happened.

But more importantly, if you or someone you know ran SPVs on Assure’s platform, they’re in a mess right now. But Vauban are helping migrate Assure SPVs to the Vauban platform. Of which we’re happy users, so warm recommendations from us ♥ happy to share experiences should you be considering this, just DM me.

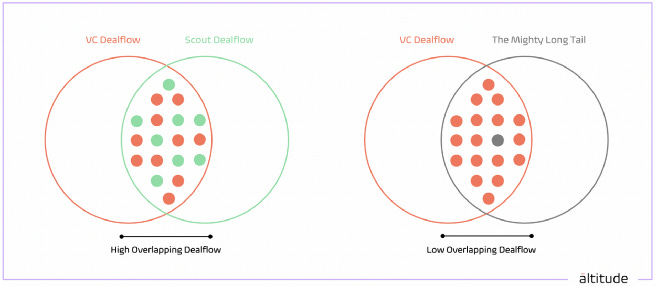

The Mighty Angel Long Tail

Marc has finally launched āltitude, a firm which I’m personally extremely hyped about - for many reasons, but in particular because of their Open Angel program. I’ve tried to pull together some of the core passages in their launch article. But as always, I urge you to go read the whole thing and connect with the author ♥

“Open Angel is a new way to leverage informal networks, by aligning economic interest in order to access high quality deals, earlier.”

Open Angel is built on the premise that great deals can come from anyone and anywhere:

We aim to harness the mighty angel long tail or professional angel, enabling any angel and/or syndicate out there. Regardless of their background, or where the deal has been sourced.

But why do Marc, Videesha & Ingo do this?

The Informal VC Market is a major part of the early stage funding curve, which comes way before most VCs even consider to invest. It mainly refers to the investments made by angel investors. So how many angel investors do we actually have in Europe? There are around 340.000 active angels.

Angel investors are a powerhouse of early stage investing. They provide over 50% of all early stage funding volume. They also don’t just participate in first cheque or Pre-Seed rounds, more than 60% of the funding goes into Seed and Series A rounds.

95% of the overall angel landscape are long tail angel investors with a fairly small portfolio and limited experience. Though, the sheer volume is impressive.

Given that the VC market follows a power law — timing, tracking and access to deals earlier is becoming the key to success. Angels play a big part in this, often being the first to see deals before anyone else. Naturally more VCs will want to work with them.

Traditionally, VCs work with angel investors in a number of ways and many of them are trying to follow the quality over quantity approach, aimed at rather professional angels:

(i) Scout Programs: The most popular are scouting programs, where VCs handpick a small number of individuals (often operators and branded angels) into an annual cohort and give them money to invest into deals that they wouldn’t otherwise see (which we are not sure about).

(ii) Angel Communities: often attached to their funds,x angels and operators, which are not in any formal programs, but they’re invited to special VC events, share dealflow with the VC and have potentially co-invested with the angels and operators before, or even have them as LPs.

So, VCs are likely to be biased in picking angels and operators from their tech ecosystem for their scouting programs — but why? They would probably have seen most of the deals anyway. They are not unlocking informal networks with new deals outside of their own closed tech ecosystem. That’s why we love the mighty angel long tail.

There are three core consequences:

(i) VCs neglect the power of the long tail.

(ii) These angel groups may be biased or less diverse.

(iii) There is a potential overlap to deals they would see anyway.

To solve for this, Marc, Videesha & Ingo have created Open Angel

Our prediction is that we are going to see many more angel syndication platforms, specialist angel groups and formal / informal angel programs from emerging and established VC funds, which can only be a good thing for founders and VC ecosystem. However, we also believe:

(i) Great deals can come from anywhere.

(ii) Outstanding companies can be built anywhere.

(iii) We need more diversity and inclusion in angel investing.

(iv) The power of informal networks and long tail angels is immense.

(v) The ability to see great outliers doesn’t duly depend on backgrounds.

This week’s funds 💵

We are so freaking excited to see Pact VC announced in TechCrunch today 😍 Monik Pham is an absolute rockstar and their mission is unbeatable: Back mission driven startups in the "ABC”-categories: Access (economic inclusion), Betterment (personal and professional well-being), and Climate. And backed by Anne Hathaway as reported by Mike Butcher. What can I say #respect.

🇫🇷 SE Ventures - $520m, CVC-topup - Paris

🇩🇪 Vsquared Ventures - €165m, fund 3, deep-tech - Munich

🇬🇧 Index Ventures - $300m, fund 2, 🌍 Global, seed - London

🇬🇧 Simplyhealth Ventures - €68m, fund 1, health-tech - Andover

🇨🇭 EquityPitcher Ventures - CHF45m, fund 2, final close - Zurich

🇺🇦🇩🇪 GR Capital - €30m; €100m target, first close - Kyiv, Berlin

🇮🇹 Unruly Capital - €18m; 25m target, fund 1, first close - Rome

🇫🇮 Wave Ventures - €2m, fund 2, 🌍 Nordics, student-vc - Helsinki

Section powered by the InnovatorsRoom.

This week’s hires 👩💼

🇬🇧 Quantum Light - VC Associate - London - innvtrs.com/3USu691

🇩🇪💻 Planet A Ventures - VC Analyst - Berlin, Online - innvtrs.com/3VcYEC9

🇩🇰 Dreamcraft Ventures - Investment Manager - Copenhagen - innvtrs.com/3g8L04d

🇩🇪 Rivus Capital - VC Associate - Berlin - innvtrs.com/3Vq2VlT

🇬🇧 Cleever - Chief of Staff - London - innvtrs.com/3gm4l1G

🇨🇭 Partners Group - PE Associate - Zug - innvtrs.com/3ER3Tlw

🇪🇸 Seaya - Senior VC Principal - Madrid - innvtrs.com/3AsNmBO

🇩🇪 Project A Ventures Portfolio - Founder Associate - Berlin - innvtrs.com/3EgWz0Y

🇨🇭 Lightly - Founder Associate - Zurich - innvtrs.com/3V4LSWA

🇩🇪 TastyUrban - Venture Development Associate - Berlin - innvtrs.com/3gmlVTp

🇩🇪 Superchat - Founder Associate - Berlin - innvtrs.com/3U0aezt

🇬🇧 Emerge Education - Associate / Senior Associate - London -innvtrs.com/3EFkQPH

🇫🇷 321founded - Corporate Startup Studio - Partner - Paris - innvtrs.com/3tBiqLW

🇫🇷 Paris Business Angels - VC Analyst - Paris -innvtrs.com/3GsOWHJ

🇩🇪 Brose Group - Investment Manager - Berlin -innvtrs.com/3TZmy2M

🇩🇪 Fidelium Partners - PE Analyst - Munich -innvtrs.com/3UXqpie

Section powered by the InnovatorsRoom.

Thx for reading and being awesome 💗 we love you for it.