EUVC Newsletter | 12.06.23

SuperVenture = SuperConfused? And when to measure what Fund KPI as well as reflections on Apple's big launch, The Journey from founder, to VC, to Angel, and a bunch of new opportunies 👀

Welcome to the GP/LP newsletter of Europe🙏

Firstly a heartfelt welcome to the 58 newly subscribed venturers who have joined since our last post! If you haven’t yet, join the 9,656 LPs, VCs & Angels that do or share it with your besties🤗

Table of Contents

Open in browser for clickable ToC 👆

Upcoming events:

Expand Northstar - the ultimate startup and investor connector event

TechBBQ - where hygge and tech meets

How to construct a risk-balanced portfolio?

SuperVenture = SuperConfused?

Yannick Oswald, Partner at Mangrove: Death of the keyboard

SuperAngel #12: Bjarke Klinge Staun’s Journey from Founder to Creandum-VC to SuperAngel

Intel Ignite’s Deep Tech Accelerator Program Launches in the UK

When to measure which Fund KPI?

Upcoming Events

Expand North Star in Dubai - the ultimate startup and investor connector event.

15 - 18 October, Dubai

Discover the tech and investment opportunities fuelling growth across UAE, MENA, and APMEA regions at Expand North Star and GITEX GLOBAL, now the world’s largest tech and startup event

Join 1,400 exhibiting startups, 1,000 investors, at Dubai Harbour to scout for your next big deal, connect with other investors, meet public and private stakeholders to elevate your fund goals. Co-located with Fintech Surge and Future Blockchain Summit, and in association with GITEX GLOBAL; Expand North Star you’ll be serviced with an agenda over 4 action-packed days with a curated Meetings Programme, the invite-only Investor Forum, the Venture Studio and Accelerator Summit, and additional exclusive satellite events for fund managers in town.

TechBBQ - where hygge meets tech

September 13- 14, Copenhagen

7500+ attendees, 2600 startup reps, 340+ speakers, 620+ Scaleup reps , 880 investors and 150+ media reps. Clearly, TechBBQ has become the heartbeat of the startup and innovation ecosystem in Scandinavia. It began as a humble BBQ gathering for tech enthusiasts and entrepreneurs in 2013, but has since evolved into a large-scale summit that draws attendees from around the world for two days of inspiration, networking, and growth.

How to construct a risk-balanced portfolio? AngeI investment strategy deepdive

Virtual | Mon, Jul 3, 2023, 12:00 PM - 1:00 PM CET

Do you have a well-considered thesis and strategy in place for your angel investments? And are you properly diversified on stage, geo, vertical and sheer number of investments? And what´s even right for you?

Join a panel of Europe’s leading Super Angels to discuss how to construct a risk-balanced angel portfolio, what to consider when devising your strategy and why there’s no right strategy for everyone.

We promise a candid discussion and plenty opportunities for you to ask questions during the discussion.

SuperVenture = SuperConfused? Don’t worry, so are we.

By Chris Wade, Founding partner of Isomer Capital

If you feel confused about today's Venture capital market, attending SuperVenture 2023 probably wouldn’t help too much.

The panels, the fireside chats, the keynotes were writhed with a mix of optimistic and less positive predictions, but before diving into the 2-minute headlines, it is worth noting that Superventure 2023 broke a few records:

For the first time, the conference was 3 days vs 2. Remember, in 2017, Superventure was a 1-day event in 2017 and before that a couple of hours in the basement of the SuperReturn PE conference!

On day one, 100 people were on the waiting list, unable to get in!

Only good to see and can’t wait to seeing Superventure 2024 in a bigger location in Berlin to accommodate the growing interest in our industry 🚀.

My 5 headlines from SuperVenture 2023

1) ESG is mainstream

I counted no less than five panel sessions on ESG, and it’s with great pleasure that I conclude that we’re now shifting the focus of the discussion from why/if/should we to best practices and how to standardize reporting. It’s clear that Europeans lead this initiative, and I believe this is because entrepreneurs in Europe are building naturally sustainable companies.

2) Chapeau European Venture

I think I am right in saying this was the first year that the annoyingly frequent reference to the performance of European Venture to US Venture was absent.

Perhaps this was due to the excellent Adam Street keynote at the top of the conference presenting the data that European Venture returns equal and, in some cases, exceed US venture returns.

Atomico presented a 1st look at the state of European Venture, which will be their 9th annual report which, in summary, highlights that the trend for continuing strong growth in European Venture is positive.

3) The long-term is positive (unclear when, though)

One way to think about the health of the future is to consider exit market considerations:

Companies preparing for IPO when the market re-opens are financially in much better shape than the cohort that went out in 2020-2022; almost all are growing profitably, which should imply healthy IPOs and, more importantly, remain so!

The top 20 largest publicly traded companies have, on average, $40bn cash on the balance sheets, and when the macroeconomic sentiment improves, this will be a source for renewed M&A activity,

4) Seed round pricing under pressure (or feels like they will be)

Most of the VCs presenting suggested that seed valuations in Europe had not declined since the change in direction in venture capital. US VCs report some decline but still a modest one in comparison to the drop in growth stage pricing. Market commentators on both sides of the Atlantic expect seed valuations to decline further in the next 6-12 months; however, it was suggested that "hot" companies may buck this trend. Throughout the conference, we had repeated reminders that VC funds are well-capitalised on a historical basis which will surely underpin this trend.

5) Some portfolio companies are doing well, but new rounds will remain challenging for some time

We heard many stories of portfolio companies defining market declines in revenue growth and ability to raise; however, there was a consensus that funding conditions would remain negative for the next 12 months.

So, what will we say at the next Superventure in June, 2024?

"Well, maybe a glimmer of an upturn."

Confused? Well, I think it's the word that best describes the current market. On ending the 2nd day of this exceptionally well-attended VC/LP conference, I had the following thought:

Only time will tell how the next 12 months will evolve, but one thing is for sure; the quality of the VCs on stage at Superventure 2023 makes me believe we are in good hands.

Finally, the famous/infamous VC party was very well attended with the usual entry antics for those without a ticket, and it continues to be a wonderful networking event for all in (and a few others!) in our industry. Can’t wait to meet you all out there and if not before, next year!

Yannick Oswald, Mangrove: Death of the keyboard

LP Hypeman’s note: It’s rare that saying openly that a platform launch by Apple would be considered a bold bet. But the list of naysayers denouncing VR-glasses is considerable. So seeing Yannick from Mangrove make a case for the Apple Vision Pro was uplifting. Personally, I am skeptically excited.

Let’s look at some excerpts from Yannick’s article (read it in full here):

The keyboard is finally dead… and your voice, eyes, and hands are replacing it. 4 years ago, we predicted: ‘The keyboard will be gone in five years.’ And this is exactly what is happening here. Just a year earlier. The product has a real shot at replacing laptops and keyboards for many use cases. Finally, I don’t have to sit awkwardly with my laptop on my lap anymore on flights or in the evening when writing this blog post on my couch...

This is really the first user experience (UX) where you interact with software just by looking at it (can’t wait to try the eye-tracking!), talking to it, or moving your fingers and/or body.

For Apple, it is all about its services business (powered by its app store platform) and, secondly, its wearables. Launching another killer product like the Vision Pro will only boost the depth and extent of its app platform. The effortless utilization and transition between devices increase the use cases and reach with every new product launched. If it becomes a massive product hit à la iPhone, even better for them and startups. The way the product was introduced this week, it certainly looks like Apple is betting on both.

It will be interesting to see how the product will be received by consumers. And how the competition will react to this. Until then, instead of trying to downplay these incredible tech innovations, let’s enjoy the good news (we need more of those these days) and think about what kind of new businesses could be built in the future. Because they will be…

Read it in full here.

SuperAngel #12 Bjarke Klinge Staun’s Journey from Founder to Creandum-VC to Angel

When it comes to the world of deals and investments, surprises often lurk in the shadows, waiting to pounce on our expectations. Bjarke Klinge Staun, a name that may not yet be familiar to all, has a tale that embodies this spirit of unforeseen triumph.

Picture this: a time when Trade Republic, that very same Trade Republic that now commands attention and admiration, wasn't exactly setting German hearts ablaze. Yes, hard to believe, but true. But oh, how the tides would turn, and how they did!

In the latest episode of The Super Angel podcast, we dive deep into the world of Bjarke Klinge Staun, a man whose journey is nothing short of remarkable. Long before startups became the chic playgrounds of the entrepreneurial elite, Bjarke co-founded an algorithmic trading company, defying convention and paving his own path. And then, the fateful chapter at CREANDUM unfolded, where he fearlessly ventured into the realm of investments, backing the likes of Pleo, Bolt, and, of course, Trade Republic.

With a twinkle in his eye and a portfolio that now boasts over 30 companies, Bjarke's journey leaves one in awe. A true maverick, he has made a name for himself through a web of angel investments, skillfully weaving his way through the intricate tapestry of the startup landscape. The Super Angel podcast awaits, inviting you to immerse yourself in Bjarke's tale of tenacity and triumph, an auditory feast for those hungry for inspiration.

Prepare to be enthralled, for in this realm of deals and dreams, the unexpected often holds the key to unlocking extraordinary success. Bjarke Klinge Staun's tale is a testament to that, a testament that reminds us to embrace the unpredictable and embrace the uncharted, for within those untrodden paths lie the stories that shape our world.

Intel Ignite’s Deep Tech Accelerator Program Launches in the UK

Got UK-based Deep Tech Startups in your portfolio? Our friends at Intel Ignite have officially launched their Deep Tech accelerator program for early-stage deep tech startups and are now accepting applications for its first cohort in London, opening September 2023 🤖

Intel Ignite’s 12-week acceleration program helps transform startups into industry-disrupting companies by focusing on critical aspects of startup growth, including finding the ideal product-market fit, conquering tech challenges, and developing a successful go-to-market strategy. In addition to the UK, the program has offices in Israel, Europe, and the US.

UK-based early-stage deep tech startups are invited to apply to the program by 23 June.

When to measure which Fund KPI?

Hypeman’s note: In salutation of Fund KPIs and in preparation for the sage advice imparted by Marc’s post below, let me share a quote from an upcoming eu.vc episode with Fred Destin from Stride:

You have no excuse not to be sophisticated when discussing portfolio construction and reserves. All the knowledge is readily available. Learn. This holds significance for LPs.

Fred Destin, Stride

Allow this powerful statement to ignite your curiosity, propelling you into the world of Fund Key Performance Indicators (KPIs) as explored by Marc's —a true gem of insights.

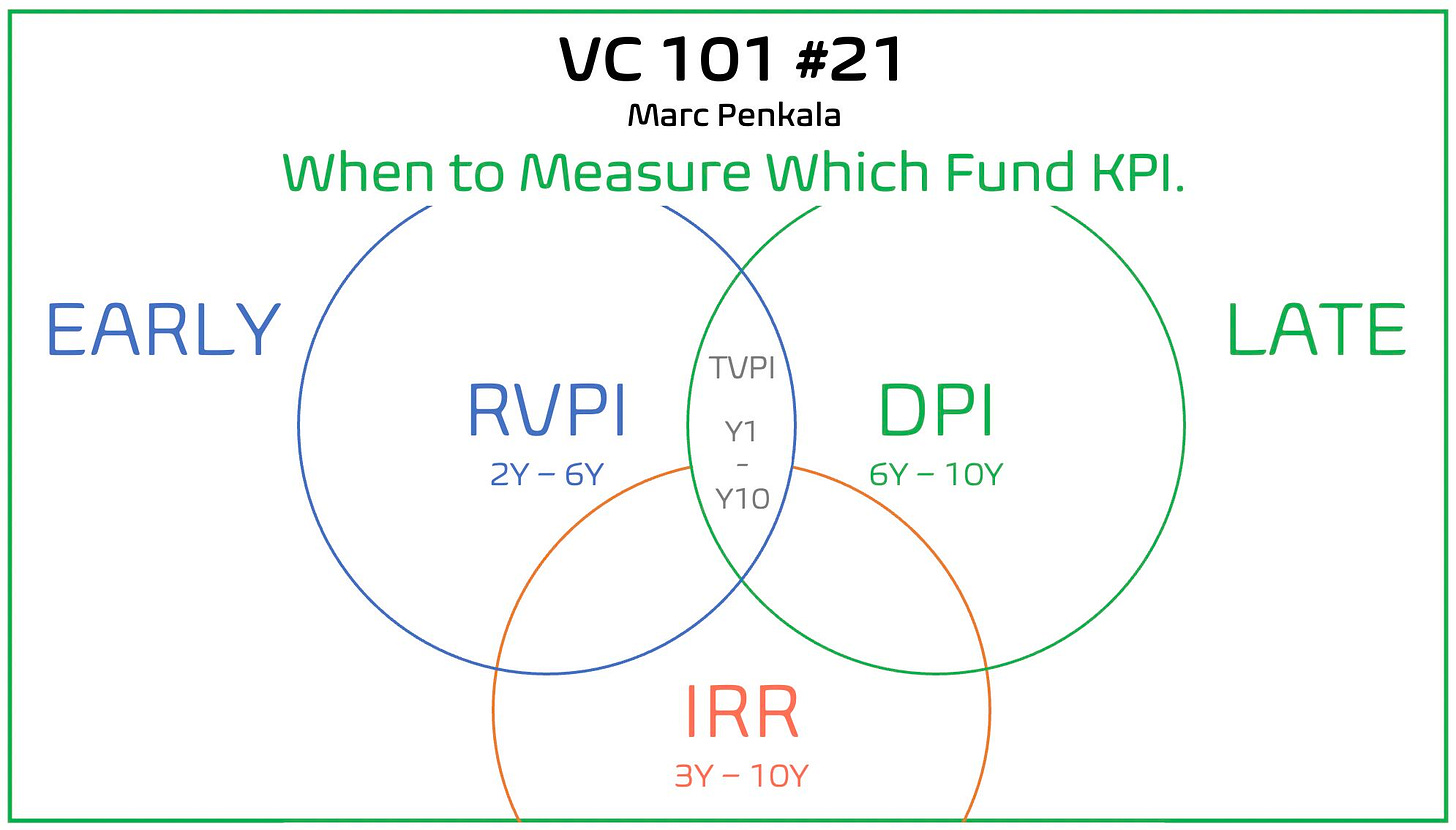

The 𝗿𝗲𝗹𝗮𝘁𝗶𝗼𝗻𝘀𝗵𝗶𝗽 𝗮𝗻𝗱 𝗱𝗲𝗽𝗲𝗻𝗱𝗲𝗻𝗰𝘆 of TVPI, RVPI, DPI, and IRR in venture capital funds are 𝗰𝗿𝘂𝗰𝗶𝗮𝗹 𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝗶𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀 that provide insights into fund performance. These metrics play different roles over the lifetime of a VC fund.

1. #𝗧𝗩𝗣𝗜

During the whole lifecycle of a fund, the 𝗧𝗩𝗣𝗜 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗿𝗶𝗺𝗮𝗿𝘆 𝗺𝗲𝘁𝗿𝗶𝗰 𝗼𝗳 𝗶𝗻𝘁𝗲𝗿𝗲𝘀𝘁. TVPI measures the total value of the fund's investments relative to the capital invested by LPs. It includes both the RVPI and DPI. A TVPI of less than 1.0x indicates that the fund has not yet returned the capital to its investors (common in the first two years, J-Curve), while a TVPI greater than 1.0x signifies positive returns.

2. #𝗥𝗩𝗣𝗜

As the fund progresses and matures, 𝘁𝗵𝗲 𝗥𝗩𝗣𝗜 𝗯𝗲𝗰𝗼𝗺𝗲𝘀 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴𝗹𝘆 𝗿𝗲𝗹𝗲𝘃𝗮𝗻𝘁. RVPI measures the remaining value of the fund's investments relative to the capital invested. It reflects the potential

upside and represents the future returns that are yet to be realized. A higher RVPI indicates greater unrealized value.

3. #𝗗𝗣𝗜

Once the fund starts generating distributions to investors, 𝘁𝗵𝗲 𝗗𝗣𝗜 𝗯𝗲𝗰𝗼𝗺𝗲𝘀 𝗮 𝗸𝗲𝘆 𝗺𝗲𝘁𝗿𝗶𝗰. DPI represents the proportion of capital

returned to LPs through distributions. It indicates the liquidity and cash flows generated by the fund. A higher DPI suggests that investors are receiving cash returns and potentially achieving liquidity, especially meaningful if they come in early (Recycling and Net Contribution).

4. #𝗜𝗥𝗥

Lastly, 𝘁𝗵𝗲 𝗜𝗥𝗥 𝗺𝗲𝗮𝘀𝘂𝗿𝗲𝘀 𝘁𝗵𝗲 𝗮𝗻𝗻𝘂𝗮𝗹𝗶𝘇𝗲𝗱 𝗿𝗮𝘁𝗲 𝗼𝗳 𝗿𝗲𝘁𝘂𝗿𝗻 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗲𝗱 𝗯𝘆 𝘁𝗵𝗲 𝗳𝘂𝗻𝗱. It considers both the timing and magnitude of cash flows, providing a measure of the fund's overall performance. The IRR is

particularly relevant when comparing the fund's performance against other investment opportunities or assessing the GPs ability to generate attractive returns.

𝗦𝗨𝗠𝗠𝗔𝗥𝗬

In summary, over the lifetime of a venture capital fund, the 𝗧𝗩𝗣𝗜 𝗶𝘀 𝗰𝗿𝘂𝗰𝗶𝗮𝗹 𝗮𝗰𝗿𝗼𝘀𝘀 𝘁𝗵𝗲 𝘄𝗵𝗼𝗹𝗲 𝗹𝗶𝗳𝗲𝗰𝘆𝗰𝗹𝗲 𝗼𝗳 𝗮 𝗳𝘂𝗻𝗱, 𝗥𝗩𝗣𝗜 𝗴𝗮𝗶𝗻𝘀 𝗶𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝗰𝗲 𝗮𝘀 𝘁𝗵𝗲 𝗳𝘂𝗻𝗱 𝗺𝗮𝘁𝘂𝗿𝗲𝘀, 𝗗𝗣𝗜 𝗯𝗲𝗰𝗼𝗺𝗲𝘀 𝗿𝗲𝗹𝗲𝘃𝗮𝗻𝘁 𝘄𝗵𝗲𝗻 𝗱𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻𝘀 𝗮𝗿𝗲 𝗯𝗲𝗶𝗻𝗴 𝗺𝗮𝗱𝗲, 𝗮𝗻𝗱 𝗜𝗥𝗥 𝗽𝗿𝗼𝘃𝗶𝗱𝗲𝘀 𝗮 𝗰𝗼𝗺𝗽𝗿𝗲𝗵𝗲𝗻𝘀𝗶𝘃𝗲 𝗺𝗲𝗮𝘀𝘂𝗿𝗲 𝗼𝗳 𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝘁𝗵𝗿𝗼𝘂𝗴𝗵𝗼𝘂𝘁 𝘁𝗵𝗲 𝗳𝘂𝗻𝗱'𝘀 𝗹𝗶𝗳𝗲𝘀𝗽𝗮𝗻.

Understanding the interplay and significance of these performance KPIs enables investors and fund managers to evaluate the fund's progress, potential, and overall success.