EUVC Newsletter 13.1.24 | Energy, Tech, and Market Shifts in the European VC Landscape

Join us as we digest the week's news in European Tech 📰

This week, the European VC landscape was marked by significant shifts in energy investments and technological innovation. France’s €1 billion investment in nuclear technology underlines a strategic move towards sustainable energy solutions, while the US's position as the top LNG exporter opens new doors for European investors in alternative energy. Concurrently, the rise of AI and machine learning across sectors signifies a growing trend towards tech-centric investments.

Economically, a blend of optimism and caution was evident. The increase in US bankruptcy filings and the European banking sector's performance highlighted a volatile yet resilient financial environment. Regulatory changes and the SEC's approval of bitcoin ETFs introduced new complexities, particularly in the cryptocurrency market. Against the backdrop of the World Bank's forecast of a slow global economic growth, European investors are navigating a landscape where strategic recalibration and focus on stable sectors are key.

Highlights

🌍 European Nuclear Revival: France's €1bn investment in nuclear startups signals a renewed European focus on nuclear energy, with opportunities in innovative tech like micro-reactors.

💰 Seed Funding Dynamics: Europe’s seed funding dipped to €403 million in December, with the UK, France, and Germany leading. Energy, Health Tech, and Fintech attract the most funding.

📈 US Bankruptcy Trends: An 18% rise in US bankruptcy filings in 2023, mainly due to increased interest rates and the end of pandemic support, reflects tighter global credit markets.

🚀 SpaceX's IPO Horizon: SpaceX's potential 2025 IPO, valued at $175 billion, could significantly impact global space and investment sectors.

📊 Stable US Job Market: The US labor market remains resilient despite global uncertainties, indicating potential investor confidence.

🛢️ Commodity Market Shifts: Geopolitical events affecting Russia's Arctic LNG project, Red Sea oil transportation, and Brazil's maize exports reshape commodity investment risks and opportunities.

🌱 Sustainability and Tech Focus: AI advancements and the US's rise as a leading LNG exporter highlight growing sectors for investment.

💹 VC Market Outlook: The global VC market faced a downturn in 2023, yet optimism for recovery in 2024 persists, especially in public tech valuations.

📉 Economic Shifts and AI Impact: The expected impact of AI on elections, space regulation, and the pharmaceutical industry illustrates emerging investment areas.

💳 Financial System Reforms: G20's initiative to optimize international payments by 2027 may increase financial crime risks, affecting global investment flows.

🏦 European Banking Evolution: Improved profitability in European banks, despite lower-than-expected valuations, presents new investment opportunities.

🌐 Global Economic Forecast: World Bank predicts slow global growth, emphasizing the need for strategic investment in transformative areas.

🪙 Crypto Market Developments: SEC's approval of spot bitcoin ETFs and subsequent false social media claims highlight both opportunities and volatility in the cryptocurrency market.

🔒 SEC's Cybersecurity Breach: The false announcement on SEC’s hacked social media account about bitcoin ETFs underscores market sensitivity to regulatory news.

🌍 World Bank’s Economic Outlook: A predicted slow global economic growth rate in 2024 emphasizes the importance of cautious and strategic investment planning.

🤖 AI’s Role in Business Transformation: Duolingo’s reduction in its contractor workforce due to AI adoption exemplifies AI’s growing impact on business models.

🌏 EU Scrutinizes Microsoft-OpenAI Deal: The European Commission’s investigation into Microsoft's OpenAI investment under EU merger regulations indicates the increasing regulatory focus on tech investments.

Want more insights like this directly into your inbox every week?

As a member you get:

🌟 Curated investment opportunities, including access-constrained deals.

🤝 Privileged connections with inspiring people in the industry, building strong networks and relationships across Europe.

🔍 Proprietary insights into cutting-edge tech and emerging markets.

📖 Access to best practices, skill development, and valuable insights to enhance your investment expertise.

💸 Exposure and access to the asset class we all love - Venture Capital.

And the best part? You get all of this for FREE, as long as you remain an active and engaged member.

Deep Dive

Energy Investments & Technological Innovations

France's commitment of €1 billion to nuclear startups under the France 2030 plan signals a significant shift in the European energy paradigm. This move not only reflects a renewed interest in nuclear technology, particularly in micro-reactors and modular reactors, but also underscores the growing demand for innovative energy solutions. Such governmental backing opens new avenues for VC investments in energy tech startups, which could potentially revolutionize the industry.

Simultaneously, the US’s ascent as the world’s largest exporter of liquefied natural gas (LNG) marks a pivotal moment in global energy dynamics. This development has the potential to reshape energy dependency and market trends, offering European investors opportunities in alternative energy sources and technologies. The diversification of energy investments is crucial, considering the urgent need for sustainable and reliable energy solutions, a theme echoed by the growing interest in AI and machine learning within private equity firms.

Furthermore, the advancements in AI, as observed in Duolingo's increased reliance on AI models and Microsoft's significant investment in OpenAI, are indicative of a broader shift towards technology-driven solutions across sectors. The integration of AI into various business models is not only transforming operational efficiencies but also opening new investment channels in the tech sector. The European VC market, therefore, stands at a crossroads where traditional energy investments are increasingly interwoven with technological innovations, presenting both challenges and opportunities.

Market Dynamics

The recent global market dynamics, characterized by the US bankruptcy filings and the European banking sector's performance, paint a picture of cautious optimism mixed with underlying risks. The 18% increase in US bankruptcy filings in 2023, primarily driven by heightened interest rates and stringent lending standards, serves as a cautionary tale for European investors about the potential volatility in the global financial market. It underscores the importance of due diligence and risk assessment in investment decisions.

In contrast, the improvement in the return on equity for European banks, despite the disconnect between profitability and share prices, suggests an undercurrent of resilience in the European financial sector. This resilience, however, is tempered by the potential implications of regulatory shifts, such as the European Commission's investigation into Microsoft's investment in OpenAI under EU merger regulations. This scrutiny reflects a growing emphasis on maintaining competitive fairness in the tech sector, which could have far-reaching implications for investment strategies and market dynamics.

Additionally, the approval of the first spot bitcoin ETFs by the SEC, despite the initial misinformation incident, highlights the increasing relevance and volatility of the cryptocurrency market. This development is likely to attract new retail and institutional investors, adding a layer of complexity to the European VC market. Investors need to navigate these evolving financial landscapes with a strategic approach, balancing traditional investment models with emerging trends in digital currencies and blockchain technology.

Global Economic Outlook

The World Bank's forecast of a slow global economic growth rate in 2024, coupled with the mixed performance of the Eurozone economy, presents a nuanced backdrop for the European VC market. The predicted worst half-decade of global economic growth in 30 years, due to factors like higher borrowing costs and geopolitical tensions, necessitates a recalibration of investment strategies. European investors need to be cognizant of the global economic headwinds and their potential impact on investment returns and market stability.

Moreover, the Eurozone’s record-low unemployment juxtaposed with challenges in economic growth points towards an underlying robustness in the labor market, yet flags concerns about sustainability in high employment. This scenario demands a more meticulous and forward-thinking investment approach, where opportunities in resilient sectors like technology, healthcare, and renewable energy are prioritized.

Altitude introduces their SME Tech Market Map

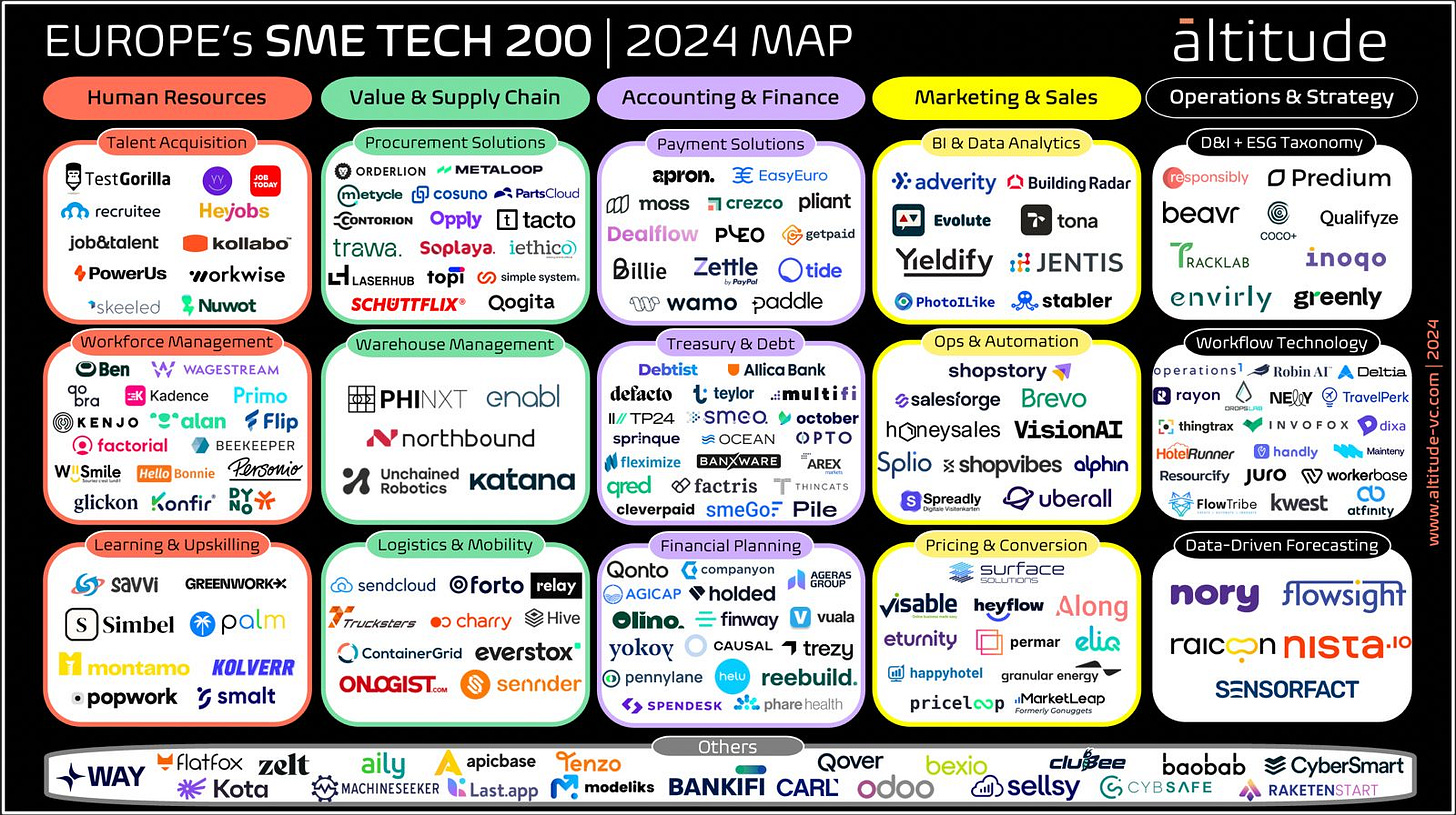

During months of research, we have identified hundreds of tech companies that are accelerating the digitisation of SMEs in Europe.

SMEs are the backbone of our economy. Driven by the post-pandemic trend towards digital transformation, 23 million small and medium-sized businesses in Europe spent over EUR 400 billion on software solutions in 2023.

At āltitude, we are investing in this massive trend. Last year, we reviewed more than 2,500 deals and identified hundreds of outstanding European tech companies that are accelerating the digitisation of SMEs.

Yesterday, we launched our first "SME Tech Market Map", featuring an extract of our research. In this first version, we showcase 200 start-ups that are shaping the SME tech landscape. The result of our research is a collaborative effort, involving industry experts, angel investors, and founders. You can explore the map further on our website.

What's next? This is just the beginning. We're committed to continuously updating and expanding our findings, ensuring the map remains a valuable resource for investors, entrepreneurs, and anyone interested in the SME tech ecosystem. We will also launch additional vertical-specific SME tech maps in the coming months.

Not on our map? Let us know about additional SME Tech startups from Europe: Submission for SME Tech Map

Reach out to us if you want to know more about the map and exchange thoughts on SME Tech: hello@altitude-vc.com

Ps. If you love SMEs, don’t forget to listen to this week’s conversation with Lucile Cornet from Eight Roads 👇

Frontline’s hiring two new Associates 🔥

There’s few that we love more than our good friends at Frontline. And now you have the chance to join them (or recommend a dear friend to join them) as they’re hiring two new Associates to join their Seed investment team in Europe 🪴

Both positions will working directly with the wonderful Zoe, William, Will and George, with one based in London and the other in Dublin.

View the full job description and application here.

Links & Resources

Sifted: Overview of seed funding deals in December 2022, highlighting investment trends in various sectors and notable seed rounds.

US News: Insights into the rise in US bankruptcy filings in 2023 and predictions for 2024.

Investing.com: Article discussing SpaceX's potential IPO plans and its market valuation.

Reuters: Analysis of the U.S. labor market and its impact on economic trends.

Not Boring: A newsletter covering various topics, including tech investments and market predictions.

The Economist: Discussion on geopolitical events and their implications for global trade and resource distribution.

PitchBook: A report on the state of the venture capital market in 2023 and its global impact.

The Information: Insights into the impact of AI on the 2024 U.S. election and other related tech trends.

BBC: A report on Microsoft and PNNL's discovery of a new substance that could lower lithium usage in batteries.

TechCrunch: News about Duolingo reducing its contractor workforce due to increased reliance on AI.

MSPowerUser: Article on the European Commission's investigation into Microsoft's investment in OpenAI.

PitchBook - US PE Breakdown: A comprehensive breakdown of the US Private Equity market trends and predictions.

PitchBook - Continuation Funds: Analysis of the rising use of continuation funds in the VC market for liquidity solutions.

Financial Times: Insights into the fragility of government bond and funding markets and the related reforms.