EUVC Newsletter | 14.08.23

VC vs PE, Cavalry's Cards Against VCs, The Investor Productivity Tool Stack, A16Z Games Fund' deck, and a perspective on regular check-in's.

Welcome to the EUVC Newsletter 🗞️

Join us in welcoming 634 LPs, VCs & Angels who have subscribed since our last post! If you haven’t yet, join the 12,176 insiders that do & share it with your besties🤗

Table of Contents

VC vs PE performance and a caveat against betting based on benchmarks by Samir Kaji

The Cavalry Cards Against VC by Alessandra Mazzilli

Investor Productivity Tool Stack by Andre Retterath

A16Z Games Fund One Pitch Deck, a walkthrough by Andrew Chen, GP of A16Z

An Investor's Perspective on the Value of Regular Check-Ins by Charles Hudson, GP of Precursor Ventures

Upcoming events

We’ve got some good ones coming up…

Contribute to INSEAD’s VC research on startup success, founder traits, & investment choices. Share insights in a 30-min interview – your convenience matters. Receive exclusive findings report, empowering future investments. Confidentiality assured. Enrich startup success insights!

VC vs PE performance and a caveat against betting based on benchmarks, by Samir Kaji

LP Hypeman’s note: If you’re investing in venture and aren’t already following Samir Kaji, go do so now. He’s writing and pod is succinct and important. Below I highlight two posts by Samir. The first stacks VC against PE performance on benchmarks and the second gives a word of caution to anyone diligencing VCs and paying to much attention to benchmarks in this analysis.

This year, I saw the same company held at $600MM with one firm, and nearly $1.5B at another firm. Of course, the one that held at $1.5B benchmarked better.

- Samir Kaji

Part 1: VC vs Private Equity data by the numbers:

Alternatives have become a staple of HNW portfolios. It makes sense given the size of the private markets (87% of companies w/$100MM+ in revenues are reportedly still private).

PE and VC are two of the largest areas of investment, with PE generally serving mature CF+ companies while VC serving the growing innovation economy. Although these two are not mutually exclusive when building a portfolio, wanted to do a comparative analysis (using Pitchbook data) to see the relative risk/return differences.

Caveat 1: Benchmarks often have survivorship bias, and limited sample sizes.

Caveat 2: We are just using the publicly available PB benchmarks here, although our analysis shows similar data using other benchmarks.

Takeaways:

- A VC fund portfolio needs 10-20% of the portfolio to be top decile (with 10 funds, 1-2x) to fully justify risk/return. From a DPI standpoint, this is likely through smaller funds, but not necessarily on Net IRR (later reserve checks have shorter time to liquidity vs. small funds that incline toward Seed/A)

- Top Decile VC is the holy grail of alts at 3x+ Net TVPI and 40%+ Net IRR.

- PE on average has a 3-4 year headstart on liquidity (4 years on average vs. 7 years)

- Top Quartile VC vs. PE is essentially very similar when taking into account timing of cash flows (only 2% delta in Net IRR, TVPI multiple difference of .3x). Slight outperformance in VC.

- Bottom Quartile: This is the death zone for VC, and PE is definitely far safer as PE still returns 1x capital (vs. .77x for VC).

Manager selection and access in VC is so substantially critical, and why adverse selection in VC (funds, but also directs) is such an issue for investors looking to invest in the asset class.

1996-2021: 26 years

Top Decile:

Net IRR: VC: 41.14%, PE: 32.23% - Average delta of 8.9%, VC outperformed PE on a net IRR basis 62% of the time of (16/26)

TVPI: VC: 3.06x PE: 2.51x - Delta of 0.5x; VC outperformed PE 65% of the time (17/26)

DPI (1996-2018 to adjust for time to liquidity): VC: 2.11x, PE: 2.16x

PE provided better DPI 60% of the time (13/22): Note that in years post 2013, both VC and PE still have significant unrealized residual portfolio value (particularly VC).

Top Quartile:

Net IRR: VC: 25%, PE 23%, - Avg delta of 2%, VC outperformed PE about half of the time (14/26)

TVPI: VC: 2.38x PE: 2.07x, delta of .3x, VC outperformed PE 73% of the time (19/26)

DPI (96-2018): VC: 1.66x PE: 1.76x, PE provided better DPI 60% of the time (13/22).

Bottom Quartile:

Net IRR: VC: -4.9%, PE 8% - Average delta of 13%, PE outperformed every year (26/26)

TVPI: VC: 0.77x, PE 1.05x - PE outperforms 73% of the time

DPI: VC: .31x, PE .67x: PE outperforms 91% of the time 21/23 years

Part 2: Picking managers based solely on historical performance - A word of warning

Earlier this week, I wrote a post looking at the historical returns of Private Equity versus Venture Capital (Top decile/top quartile/bottom quartile).

For LPs, I'd heavily advise against choosing venture managers based simply where they place in benchmarks, especially in first 5-7 years. Why?

1) Persistence of returns is present, but fairly weak these days relative to the past. VC has shifted so much with fund sizes, management team transitions, competition, etc. Very hard to predict performance simply based on the past.

2) Over the last few years, particularly in seed, fast deployers were rewarded given the quick mark-up culture. I.e. if you deployed in 14 months vs. 36 months, there were more companies that were marked up. It's been shown that a fund doesn't settle in it's final quartile until about year 7.

3) Funds sometimes hold the same companies at wildy different marks. When diligencing a fund, should always the manager about valuation methodology, and what they are holding their breakouts at. This year, I saw the same company held at $600MM with one firm, and nearly $1.5B at another firm. Of course, the one that held at $1.5B benchmarked better.

4) Benchmarks treat VC as a monolith, and typically include funds of all types in a sample set. I.e. The fact that a $3B VC fund may be included in the same sample set as a $40MM pre-seed fund reduces the effectiveness of a benchmark (particularly when looking at multiples). The two offer wildly different risk / return / time to liquidity profiles.

5) Survivorship bias: Sample sizes are often limited, and often include only self-reported numbers. This often skews benchmarks and results in survivorship biases being present

At the end of the day, LP investing is a long term ex-ante exercise. Instead of over-indexing on past results and benchmarks, it's critical to evaluate the go-forward position of a manager, and determine what is the appropriate absolute return and risk level to make the investment viable for you.

The Cavalry Cards Against VC

by Alessandra Mazzilli

LP Hypeman’s note: There’s nothing better than self-deprecating humor. Alessandra and the Cavalry aced this one. Don’t forget to pick up the full PDF file for the game here 🤠

🌞🚨PERFECT CARD GAME FOR YOUR SUMMER🌞🚨

One of our key missions at Cavalry is to make sure our Visiting Analysts focus on mission-critical activities only. Hence why I would like to present to you today (drum rolls🥁): ‘Cards Against VC – Cavalry Edition’, courtesy of our amazing Laura Zecca and Nicola Andreottola (miss you and your creations deeply) & finishing impeccable touches by the one and only Lena Ostrovskih (best comms professional in town if you ask me).

Why did we do this? Well, among the myriad of cringe-worthy subsets within humanity, Venture Capitalists clearly stand as a prime example (highly recommend following @ VCBrags on Twitter)

We are also generous enough to share the fun. We are in fact giving away 10 card decks👀 All you have to do is:

Comment below by completing the sentence “Since I work at a VC firm, I'm no stranger to _______.”

The ten comments with the most reactions will receive one of our decks. Needless to say, politically correct or banal does not resonate well with this game.

And if you want to trouble your printer yourself (however, bear in mind that this is not the private equity version yet…), you can download our ‘Cards Against VC’ as a PDF by visiting this Notion Page

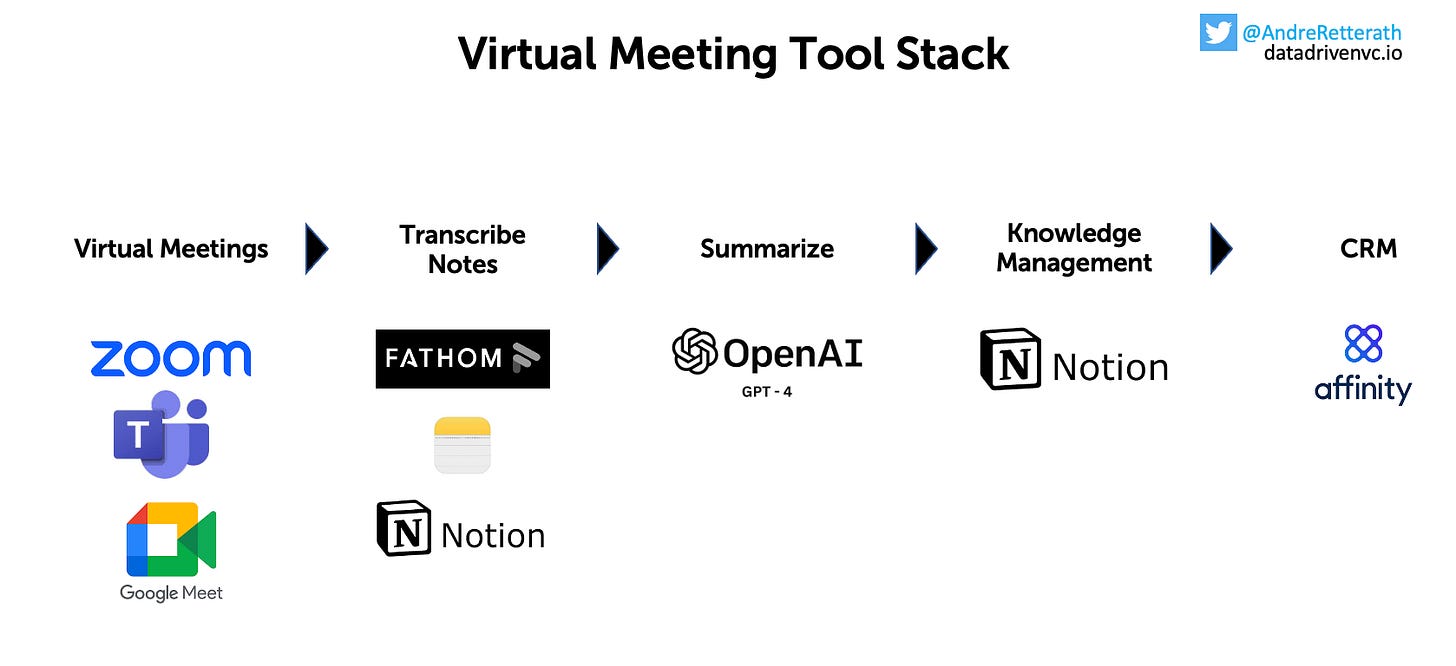

Investor Productivity Tool Stack

by Andre Retterath

LP Hypeman’s note: This week, Andre put out a great collection of visualizations of his tech stack. It’s clear that AI and the automated integrations of different tools is changing how the best investors operate and it feels that if you’re not automatically capturing transcription notes from all meetings, having AI analyze them and constantly add new tools to your stack you’ll soon be obsolete … but hey, let’s not forget where “feels” got us to the last time.

Either way, this should provide food for thought for most:

In ended up with around 80-100 individual tools, depending on what we classify as a “tool”. I use approximately half of them (see visual above) on a daily basis and while this sounds still a lot, my biggest insight is that the greatest efficiency gains come from combining different “best-of-breed” solutions via APIs and automation tools.

Hereby, the majority of these solutions become rather a passive component of my stack as they get automatically triggered via APIs and other automation tools without me noticing it in the day-to-day. In the remainder of this article, I dissect some frequently occurring workflows into their individual stages and depict the tools that I use to execute them. All of these flows are connected via automation tools that I highlight at the end of the article.

Exemplary workflows and preferred tools to execute them

These are some exemplary tasks in my daily job and I use the highlighted tools to achieve high-quality output with maximum efficiency. In addition to the depicted tools, I use a range of Plugins (check out “Top 13 Chrome Plugins Every VC Should Use”) and - of course - our internally developed data-driven software platform EagleEye.

Automation is the core of my tool stack

As mentioned in the introduction, the core of my tool stack is the glue that connects it all together, i.e. the automation stack. Without going into too much detail, I can clearly say that Zapier is among the most critical tools in my stack. It connects different software applications via thousands of readily available integrations, serves a great spectrum of logical conditions, and provides high reliability and uptime.

If you’d like to learn more about how I use Zapier in my daily work, you might want to check out this “10x Your Productivity With ChatGPT” post and download the free step-by-step PDF guide at the bottom. It shows how I use the OpenAI API and Zapier to create my own Slack bots and execute a number of tasks.

I personally advance my tool stack on a continuous basis, so it’ll likely be outdated soon. Of course, every stack is highly individual, just like your personal time allocation and goals.

A16Z Games Fund One Pitch Deck, a walkthrough

by Andrew Chen, GP of A16Z

LP Hypeman’s note: One of the most exhilarating aspects of hosting The European VC podcast and actively participating as an LP is the opportunity to engage with and delve into the intricate minds and visionary outlooks of Europe's trailblazing VCs. The futures they see, the technologies they back, the theses they invest by.

And the pinnacle of this experience is unveiled when these elements harmonize in a well-thought-out deck—wherein they narrate the story of their thesis which encapsulates not just months of research, but also years of experience and visionary foresight development.

Reading Andrew’s Games Fund One Deck gave me a much-improved understanding of games and was a welcome departure from the all-too-many decks that do little to widen anyone’s horizon bar the manager’s own glories.

Below, a mere glimpse of it’s full story 👀

In the meantime, I wanted to share a fundraising deck for a16z’s GAMES FUND ONE that we put together a little over a year ago. Of course a lot of fundraising decks have been published for our favorite companies — in fact, I have a folder full of the v1 pitch decks for Dropbox, Coinbase, Uber, etc — but rarely do you see decks for venture capital funds. I wanted to share this deck with some voiceover so you have a sense for what’s involved. Obviously there are lots of redacted slides, but you’ll at least get a flavor.

Thanks, Andrew. (Venice, CA)

A16Z GAMES FUND ONE PITCH DECK

We’ve hit the 1 year mark!!!!

A year ago, we raised GAMES FUND ONE, our first $660M fund focused on games. 25 investments and 10 new hires later, we’ve learned so much.

To celebrate, I’m going to share some slides we used to raise the fund. Yes, even VCs have to pitch :)

We structured our pitch deck into a discussion and overview about the games industry – many folks outside the industry needed some context to catch up. And then our investment areas, and then how we approached the team. (I’ve redacted notes about returns/companies/etc, of course)

For the overview – Games are driving the GenAI Revolution and this games are having their “Marvel Moment” showcasing their cultural power as some of the top shows – The Last of Us, Movies – Super Mario Movie, and Games are expanding entertainment IP like Hogwarts Legacy.

And by the way, the industry has changed substantially from when people were buying cartridges one at a time to decade-plus long-running games where friends come together as a next gen social network.

Games are often the killer app for new technologies. 3D, GPUs, and virtual items all came from games, though we might re-label them as metaverse, or NFTs. Before freemium, there was shareware. Games helped bring computing to the home, with Atari and Nintendo.

Here’s the “why now” slide – and today we’d update this slide with AI AI AI AI AI AI :) – but there are some amazing tailwinds that the industy has seen over the past decade

Last year we were very focused on studios, web3, and infrastructure. This year we’ve continued to maintain that focus, but have really started to lean into AI. In Q1 alone, we met over 100 AI x Games companies. And in 2023, 80% of the Games Fund’s investments have had a major AI component – either reinventing core gameplay or creating tools

We need to balance our approach to include all key areas of games, but also adapt to new trends.

As we invest across the ecosystem – both game studios but also infra, next gen consumer, and other areas – we need to also help the companies succeed. We do that by building a team that’s “games native”

A major part of a16z’s differentiation has been our Operating Team that helps companies. In fact the vast majority a16z’s staff focuses on that, and it’s a small minority that focuses on investing Gaming startups want help here: – hiring – creators – launching – publishers

Last year, we hired operators like Doug McCracken from Supercell to lead Marketing, Lester Chen from Youtube to lead Creators, and Jordan Mazer from Riot to lead Talent. Everyone has a startup mindset we all act like owners and work without clear directives. (Many more folks to come!)

Given the economic downturn, we’ve spent innumerable hours working with our portfolio to maximize their probability of long term success. This is when the operating team is so powerful. But the games market is resilient!

As we round out the year, we’re continuing to build and innovate. Builders are needed to help builders. We’ve been building the team in year one and hired from Blizzard, Supercell, Youtube, Riot, Twitch, and Unity. Join us!

Thanks to everyone who’s supported us in Year One!

Kudos to the new team, our founders/co-investors, and our friends across the ecosystem

And of course, my close colleagues Jon Lai, Marc, Ben, and the entire team who have been building this initiative from the start!

PS. Finally, our lawyers made me add this at the end :)

An Investor's Perspective on the Value of Regular Check-Ins

by Charles Hudson, GP of Precursor Ventures

LP Hypeman’s note: Ask ChatGPT to give you a tl:dr for this article and you’ll realize that it’s core insights are painfully obvious. Yet, I want to include it nonetheless. Why? Because there are details that I think are worth noting and reflecting on for any venture investor. I’ve marked these in bold and will leave you with one particularly astute quote.

As an investor, I don’t know, ex-ante, which of the 10-12 meetings per year with a given company will be impactful. My experience is that neither I nor the company can evaluate the value of any of those meetings in real time; the value is often only known after the fact with the benefit of hindsight. Usually, 2 or 3 meetings each year will address decisions material to the company's outcome. The other meetings allow us to get to know each other and (hopefully) build mutual trust and a shared understanding of the problem the founders are tackling.

We have tons of posts about why founders should write updates, this is a post about the investor perspective on the value of real-time check-ins.

This post is not about why founders should write and send investor updates. We have enough of those posts already, and if you do a simple search, you’ll find tons of VCs opining on why founders should keep their investors updated regularly. I want to address a different but related topic. We have a very large portfolio, and many of my investors (Limited Partners, or LPs) ask me why I spend so much time meeting with existing portfolio companies and what I get out of those meetings. In a typical week, I talk to 30-40 of our existing portfolio companies; those meetings are a significant chunk of my time and are very important to me. I find these meetings extremely valuable, and I wanted to lay out why I find them so useful and what I, as an investor, get out of them. Before getting into specifics, here’s some essential info on where companies are when I meet them:

I don’t have a previous relationship with the majority of the companies that we invest in at Precursor. I get to know most of the founders we back through the investment we make in their companies. I value getting to know them as people.

My experience is that product velocity, or the ability to turn investor dollars into a product with strong product-market fit, is the most significant predictor of future success. We invest in pre-launch companies, so I am betting that the people we back will be able to build what they outlined when we met. Spending time 1:1 allows me to gauge how quickly founders are figuring out the core problems they’re facing and how they talk about and think about the challenges they face.

I generally don’t take Board seats, so I use my monthly check-ins with companies to understand their progress over time. I don’t believe that most pre-seed companies need boards, as there are relatively few governance issues to address at that stage.

As an investor, I don’t know, ex-ante, which of the 10-12 meetings per year with a given company will be impactful. My experience is that neither I nor the company can evaluate the value of any of those meetings in real time; the value is often only known after the fact with the benefit of hindsight. Usually, 2 or 3 meetings each year will address decisions material to the company's outcome. The other meetings allow us to get to know each other and (hopefully) build mutual trust and a shared understanding of the problem the founders are tackling.

The more frequent the touch points, the less pressure there is on any conversation or check-in.

Regular check-ins allow me to get to know the founders better and for them to get to know me better. I want to be a good advisor to the founders we back, and I learn a lot from regular touchpoints with them. Most of what I hope to learn about them is how they solve problems, and I tend to focus on a few key areas:

I learn a lot about how the teams we back process new information that confirms or challenges their view on the problem they are tackling. Given that we invest in companies looking for product-market fit, this is precious insight to gain.

I learn a lot about where their energy naturally flows with respect to product, people, and market opportunity. Every founder we back has a natural focus based on his or her background and interest, and knowing where his or her energy naturally flows helps me understand a given founder’s strengths and weaknesses.

With trust, I hopefully earn the right to share candid feedback, positive or negative, on my view on where the business is headed. Sometimes an engaged observer or investor can see things the team can’t see due to their proximity to the problem.

Founders don’t owe me, or any investor, their time. Keeping investors up-to-date and informed comes at the expense of other activities that can create value for the business. The founder's job is to build a big business, with or without help from their investors. Hopefully, this post sheds some light on why I value regular check-ins with portfolio companies.