EUVC Newsletter | 16.05

Q1 '23 valuation report digest, Minimum Viable Reporting by Gil Dibner, LPs helping VCs, Fundraising best practices & rewriting how private markets are run w/ Floww & LSEG on the eu.vc-pod 🎧

Welcome to the GP/LP newsletter of Europe🙏

Firstly a heartfelt welcome to the 138 newly subscribed venturers who have joined since our last post! If you haven’t yet, join the 9,177 LPs, VCs & Angels that do or share it with your besties🤗

Table of Contents

Open in browser for clickable ToC 👆

EUVC #176: Rewriting how private markets are run w/ Umerah & Martijn from LSEG & Floww 🎧

LPs helping fund managers like VCs help founders by Michael Sidgmore

Pitchbook's Q1 2023 EUVC Valuations Report - 8 key Takeaways

Fundraising best practices for managers, strategic LP management, and LPACs by Samir Kaji & Meghan Reynolds

Upcoming Events

Building Private Markets by Leveraging Public Markets

Thu, Jun 15, 2023, 3:30 PM - 4:30 PM

Many companies are working on making the private markets more accessible to investors. Only one company however is doing this with the backing of a central and established player such as LSEG (London Stock Exchange Group). This truly is one of the big swings taken at democratising access to startup and venture fund investing 💣

Latitude59 - Last chance! 🎟️

May 24-26, 2023, Talinn

With 1.3M people, Estonia barely beats Prague with the size of its population. But when it comes to startups, they know what they’re doing! Their tight-knit IT-savvy community just unleashed its tenth unicorn into the world.

In other words, don’t miss out 👊

First up a Meme-injection to get you in the mood for today’s newsletter:

EUVC #176: Rewriting how private markets are run w/ Umerah & Martijn from LSEG & Floww 🎧

Brought to you in partnership with Floww & LSEG.

This week we were joined by Umerah Akram, Head of Private Markets at the London Stock Exchange Group (LSEG) and Martijn de Wever, Founder of Floww to dive deep on how they’re changing how private markets are run.

I must say, we’ve seen quite a few firms come up in Europe lately trying to disrupt exactly this. And some have looked quite similar, if not indistinguishable. So when I first heard about Floww, I was suspicious.

But I do actually think there’s something to pay attention to here.

‘Cos Floww has partnered with LSEG, yes - that LSEG. The London Stock Exchange Group. And they’re not playing the game of building a centralized platform for private markets, but rather the game of empowering the decentralized nature of private markets.

“It's in nobody's interest to have a centralized market. It is more in everybody's interest to take away the pain problems of running liquidity events. I belive you either disrupt the current market players or you empower them. Hey, I'm much more a believer of empowering players.

Martijn de Wever, Founder of Floww

But what’s that Floww x LSEG partnership about? What’s the stock exchange getting into this for? We asked Umerah, Head of Private Markets, to take us through their motivations:

We are looking at creating a new type of wholesale market in the UK, which the government is committed to and is referred to as the Intermission Trading Venue by the UK Treasury, which is really about giving private companies opportunity to access periodic liquidity and we will be leveraging some of our public market assets to deliver that.

Umerah Akram, Head of Private Markets at LSEG

Now that’s exciting! … At least it is to me! 🤓 Join us in experiencing the vision that LSEG and Floww are pioneering for the private markets by listening to the full episode below or sign-up for our joint event on the 15th of June 3:30 CET.

Gil Dibner on Minimum Viable Reporting

Hypeman’s note: For some reason, there are few topics that catch my attention as consistently as board dynamics. Though my exposure be limited, especially compared to that of you giants reading this newsletter, there’s one thing that’s abundantly clear: too many boards function terribly. Luckily, we have people like Gil who write candidly.

The last thing I want is to water down his message, so I’ve plugged it in below in full, but highly recommend that you subscribe to Angular’s important newsletter.

In today’s climate, reporting to investors and other stakeholders is more important for CEOs than ever. It’s critical to avoid surprises, CEOs should make sure people are on board for upcoming financial rounds, and — generally — that there is support for their approach. While it may not always be fun to hear warnings, CEOs are relying on their stakeholders to sound the alarm as early as possible when they feel a course correction is needed. Additionally, preparing stakeholder reporting should benefit CEOs by forcing them to step outside the day-to-day and reflect on the business. Finally, this can be a big time-saver. The clearer your reporting and the more current it is, the less time you need to waste bringing people up to speed in board meetings or 1:1 meetings.

Two key tools. Over time, I’ve come to a set of conclusions on what is generally the most effective set of tactics for reporting for any company with revenue (if you are pre-revenue, reporting can be lighter and slightly less frequent). In my mind, a company’s reporting package should consist of board decks and weekly reports.

Board decks. The goal here is to provide more detail on critical issues so that the board conversations can be effective. These should be distributed one week before your board meeting, ideally as Google Slides so that people can both download them and comment or ask questions online. The main point of these decks should be to facilitate great board conversations about issues that matter to management, so they should contain whatever metrics, information, analysis, customer data/quotes, or whatever else would be helpful to achieve that goal. The board meeting is designed to serve the CEO. The board deck serves that meeting — so make sure it does. Don’t turn it into a blind metrics dump that will take hours to go through.

Weekly reports. Yes, weekly. I used to avoid asking CEOs to prepare weekly reports — and I still believe that it’s up to the CEO’s discretion how frequently they want to report. But my experience has been remarkably consistent: CEOs that report weekly perform better. Period. We can debate the mechanism behind this linkage, but the correlation is too strong for me to ignore. My view is that any CEO with revenues should be reporting to key stakeholders on a weekly basis. What does that look like?

Light. This weekly report must be lightweight. Make it too heavy and (1) people won’t read it, (2) the CEO will stop writing it, and (3) the key points will be too hard to identify. Putting the weekly email together shouldn’t take more than 30 minutes tops, probably less. Over a month, that is less than two hours. Much easier than updating multiple stakeholders in hour-long calls.

Shared in google drive. It’s fine to email the weekly update out, but the best format seems to be a shared google doc, so that everyone can comment and ask questions. This way, your communication with stakeholders is one conversation, you don’t need to answer any questions twice, and everyone gets the benefit of all the clarifications and commentary that everyone needs. It keeps it as one stakeholder conversation between board meetings. Some companies even invite key direct reports to read and access the same google doc so that they can answer questions. At the early stages, that seems to have more benefits than downsides.

Oriented around quarterly numbers. Early-stage startups are unpredictable things, so weekly or monthly numbers rarely tell the story. Monthly numbers move around too much to matter — and the sale you close this week doesn’t mean much in isolation. These things only matter in relation to quarterly targets. What seems to be most useful in understanding a business is, therefore, weekly shifts on quarterly numbers. You have a quarter target for a KPI (usually revenue or ARR, sometimes something else) and the numbers that capture your progress towards those targets move around slightly on a weekly basis. Did a deal close? Did a deal slip to next quarter? Did a deal get smaller than you were expecting? Those changes capture a lot of information. Share that with your stakeholders, and they will understand what is happening. So will you.

KPIs. Most of the companies we work with are oriented around ARR as the KPI. For an ARR business, I have found the following quarterly KPIs to be most useful — especially when reported on a weekly basis. At a minimum, report on the current quarter. But as visibility improves, you may want to include next quarter as well. The report should include the number and how that number changed from the previous week. Here are the four KPIs I care most about:

New ARR Target. This number should not change during the quarter. This is the target for the increase in ARR during the quarter. It’s important because you want to see how real ARR is tracking above or below target.

New ARR Closed (through the door). New ARR actually signed so far in the quarter. This number only changes when new ARR is signed. Often broken down into new logos and upsell. Churn can also be reported.

New ARR Forecast. What you actually believe you will close during the quarter. This number should move around quite a bit and should always represent your true best guess. You should try to never miss this number.

Upside New ARR. This represents all the new ARR that could potentially close during the quarter if all goes perfectly. This number can often be much larger than the forecast. A deal that could happen but not in the current quarter should not be included.

As things change, these numbers will move around — and your weekly report should include key changes to these numbers and the reasons behind them. For example: “New ARR Forecast: $100K. Up $10K in the week because ACME Inc. which we thought would be $25K next quarter will buy $10K this quarter. We still expect $15K upsell next quarter.” Another example: “Upside New ARR: $550K. Down $100K because Beta Inc. and Charlie Inc. are pushed to next quarter.”

Cash burn and runway. With each week’s report, include the key cash flow and runway data. Monthly gross cash burn, monthly net cash burn, cash balance at the end of the last month, months of runway assuming no further sales, and months of runway in your actual on-target plan.

Other updates and asks. It’s helpful to put in updates from marketing, product, engineering, and HR when significant — but don’t spend too much time doing this. Just what is critical. Also make sure to put in your asks — as well as a link to your updated intro text (so people can easily make customer intros) or other sales collateral.

That’s it. The sort of weekly update described above is a sign of a well-run company — one that is turning into a machine. More importantly, it provides confidence that everyone (the CEO and all the stakeholders) know exactly what is happening, if we are above or below plan, and what is happening in the field. These are challenging times — and the 15–30 minutes a week it will take you to put this together will pay for themselves.

If you have a different format for weekly reporting that you think is useful, I’d love to see it.

Good luck out there.

Gil

🙉 MEME-break

The US is gearing up for the primaries and it promises to be entertaining. Never a dull day. Watch the full town hall where Trumo owns the show (and the CNN anchor) and make up your own opinion and enjoy the besties from the All-in pod giving their take here.

LPs helping fund managers like VCs help founders by Michael Sidgmore

Hypeman’s note: With the risk of talking our own book too much, I wanted to reshare a great friend’s post this week and hope to convince you to both join us for event and subscribe to Michael’s newsletter and podcast Alt Goes Mainstream.

Fund managers are founders too. As LPs in a number of VC funds at Broadhaven Ventures (particularly first-time funds and emerging managers), we think it’s important to help GPs build their asset management businesses just as we do as a VC helping founders build their companies.

I’m excited to join a LinkedIn Live conversation next Thursday May 18 with Andreas and David, who are building and running operator LP syndicates for VCs in Europe at EUVC, and Marc Penkala, GP at altitude and Joachim Laqueur, GP at Acrobator Ventures, where we’ll discuss how funds can leverage their LP community to build a strong VC/LP relationship and help their portfolio companies.

I’ve long been a believer in bringing a community approach to asset management to provide funds and companies with a broader network of potentially active and engaged participants — from helping to build iCapital to enable the high-net-worth investor community to access top funds to investing into the likes of Republic, Allocate, bunch, Capital (fka Party Round), Syndicate, Seed Club Ventures, Brassica at Broadhaven Ventures.

The innovation in infrastructure has now been built to enable broader participation into funds and companies — and many asset management businesses and investors are the beneficiaries of this evolution in market structure as the mainstreaming of alts continues.

Subscribe to Michael’s Alt Goes Mainstream and join thought leaders from private markets firms like Blackstone, Goldman Sachs, Apollo, Fidelity, iCapital, Franklin Templeton, and more.

Pitchbook's Q1 2023 EUVC Valuations Report

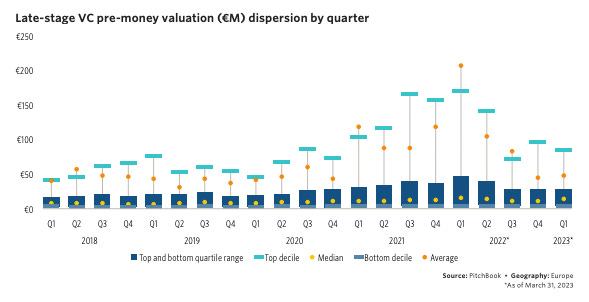

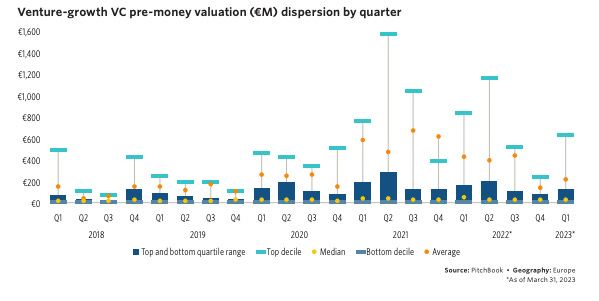

Hypeman’s note: Firstly: Hello secondaries👋 Secondly, what a whopper to see median deal value at Venture Growth go from 22.7m to 11.3m. Rarely have stories been as vividly told by just one number. To look at ‘23 from the bright side for late-stage investors, at least the more moderated pace in the early stages is giving them less noise to deal with. Could’ve used that a while ago 🫤 Makes me happy to see that the pitchbook team expects late-stage valuations to flatten soon though! But then again, the IPO-market was also supposed to open at the end of ‘22 according to many fortune-tellers…

Finally, seems number of unicorns in Europe remains flat, so maybe we don’t have as many Zombie-corns as I had feared after all? One can hope.

With that awful picture imprinted on your cornea, let’s get to our good friend Patricia’s 8 key take-aways from the report:

8 Key Takeaways for Investors by Patricia

The first quarter of 2023 was a tough period for startups and VCs in Europe, according to the Q1 2023 European VC Valuations Report by Pitchbook.

While some indicators, such as flatter valuations and tougher funding conditions, suggested a cooler market, other trends, such as resilient acquisition activity and improving exit valuations, indicated some resilience.

Here are the key takeaways from the report and what they mean for angels, VCs, LPs, and GPs in Europe.

LPs:

Non-traditional investors have been investing less in Q1 2023, dropping by 65.3% YoY, the lowest point since Q4 2021.

Due to economic uncertainty and macroeconomic pressures, the trend is expected to continue in private markets.

The denominator effect limits investment activity, prioritizing liquid assets more than ever.

GPs:

Valuations have now stabilized compared to the past years when these skyrocketed, especially in the later stages of financing. Companies are now prioritizing profitability over just growing quickly at any cost.

Europe-based unicorn valuations have stopped increasing in 2023.

Venture-growth stages are experiencing a significant decrease in deal value. The median deal value is now €11.3 million, compared to €22.7 million in 2022.

Founding teams should improve capital efficiency due to inflation, interest rate hikes, and low growth affecting businesses that require financing.

As the European VC market navigates through the economic uncertainties and inflationary pressures of 2023, the outlook is still uncertain. Let’s dive deep to discover an in-depth perspective on European VC valuations and what to expect next!

1. Robust angel valuations in Q1 2023.

Angel valuations median: €3.7M vs. €3.7M in 2022.

Angel investors with sufficient capital could benefit from investing in brand-new ideas during VC valuation downturns. Examples of previously VC-backed companies launching successfully during market downturns count the likes of famed Uber and Airbnb.

2. Early stage — a more stable option?

Seed valuations remain stable at €5.5 million in Q1 2023, with median deal values increasing slightly to €1.7 million, likely driven by startups at the seed stage tending to be lean and less vulnerable to economic turbulence.

Investors may concentrate capital and resources on the best ideas that could be long-term successes. This creates more streamlined investment opportunities for later-stage investors.

Current market conditions could increase competition among startups, intensifying selection processes and streamlining investment opportunities.

3. Third quarterly drop in early-stage VC Valuations.

Median early-stage valuations in Q1 2023 fell to €5.5 million, marking a 15.4% QoQ drop and the third consecutive quarterly decline.

Lower valuations reflect market expectations, comparable revenue multiples, and achievable growth rates, and indicate a shift in capital availability and growth prospects for early-stage businesses.

VC-backed companies previously commanded a premium, but the valuation step-up is now pacing at 1.4x in Q1 2023, significantly down from its 2.0x reading in 2022, pointing to a tricky valuation market.

4. Uncertainty slows investment in late-stage VC.

In Q1 2023, the median late-stage valuation rose 26.9% QoQ to €13.4 million. Enpal, a Germany-based solar panel provider, raised €215.0 million at a €2.2 billion pre-money valuation influencing the quarter significantly.

Near-term uncertainty affects investment levels, but long-term investment opportunities are still present.

Late-stage valuations are expected to flatten soon.

5. Venture growth valuation fell, but deal value increased.

Median venture-growth valuation dropped by 40.9% to €25.3 million in Q1 2023 compared to Q1 2022.

The median venture-growth deal value increased by 19.9% to €9.9 million in Q1 2023 compared to Q1 2022.

Record-breaking valuation figures are unlikely in 2023, but robust deals are still a thing.

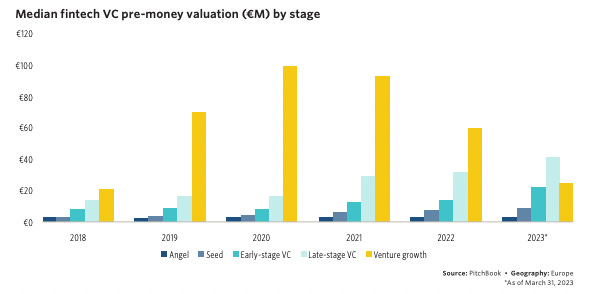

6. Fintech continues to be where it’s happening

Fintech valuations and deal sizes grew in Q1 2023, but challenges remain ahead.

Late-stage companies will likely suffer the most, with median venture-growth pre-money valuations for Fintech companies down 59.7% in Q1.

Fintech valuations will continue under pressure for the rest of the year.

7. Energy remains strong

Q1 started with mixed feelings in the Energy sector, and valuations saw a correction in Q1 2023 from the peak in 2022.

The Russian invasion of Ukraine highly influenced the sector, which highlighted critical supply chain issues.

Deal activity for technologies that need multi-year implementation is expected to stay resilient through the year.

8. Unicorn count & VC deal activity

Europe-based unicorn valuations flattened at €471.2B, indicating a cooler market with downward pressure on valuations expected.

Deal value and count for unicorns fell significantly in Q1 2023, with less cash available for growth.

VC-backed companies face challenges, with reports of internal valuation discounts, layoffs, and reduced spending.

Similar situations with stress on valuations at companies like Klarna, Checkout.com, and Revolut could spread deeper into the VC ecosystem.

A continuous period of fewer exits could prevent LPs and GPs from getting capital into new funds to finance startups.

Unicorn dealmaking is expected to remain quiet in 2023, with consumer and business spending stalling due to inflation.

Fundraising best practices for managers, strategic LP management, and LPACs by Samir Kaji & Meghan Reynolds

Hypeman's note: One of the pods that's always on my list of must-checks is Samir Kaji's Venture Unlocked. In case it's not on yours (yet) I wanted to introduce you to the latest episode as it touches on one of the core topics we cover in this newsletter. Find the spot below that gets you most excited and give it a listen 🎧 .

In this episode, Samir & Meghan discuss:

(02:42) Meghan’s career path that led her to Altimeter

(05:40) How Meghan defines capital formation

(10:33) Making decisions that allow the investment team to thrive while balancing LP interests

(14:03) Building the right frameworks with LPs who may ultimately become long-term partners

(17:03) Ways managers can differentiate outside of returns

(19:44) Other factors that go into LP relationship management

(23:16) The importance of transparency with your LPs

(26:01) How LPs are reacting to current market trends

(29:17) Using an LP Advisory Committee strategically

(35:00) International sources of institutional capital

(40:14) Fundraising advice for solo GPs

(43:32) What to look for when hiring for a capital formation role

(47:16) Predicting the market over the next 5 to 10 years