EUVC Newsletter 18.04.23

The VC Tech stack with Seedcamp's Miguel Pinho, How to think about Venture Debt and what's up with Family Office Venture Capital!? Cash drying up for VC newcomers, opportunity funds & personal safety

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective.

Firstly a heartfelt welcome to the 334 newly subscribed venturers who have joined since our last post! If you haven’t yet, join the 8,803 LPs, VCs & Angels that do or share it with your besties🤗

Table of Contents

Open in browser for clickable ToC 👆

Venture debt in Europe - status quo, who it’s for, and how to leverage it.

Family Office Venture Capital - getting stuck in the middle?

Upcoming Events

Latitude59 - don’t miss out!

With 1.3M people, Estonia barely beats Prague with the size of its population. But when it comes to startups, they know what they’re doing! Their tight-knit IT-savvy community just unleashed its tenth unicorn into the world.

In other words, don’t miss out 👊

Supercharging Angels on pangalactic gargle blasters tomorrow night in London!

Join us for a mesmerizing evening with leading angels, VCs and LPs where every sip, bite and convo will take you on a journey of unparalleled sensory pleasure and intellectual stimulation only rivaled by a trip in the heart of gold.

In other words, let the gargle blasters and outlandish canapés transport you to a world of infinite possibilities while experiencing the power of the community being built around EUVC and Altitude.

And for those who need an agenda despite the amazing copy above:

7:00 Welcome

7:15 Words from SVB UK & Vauban

7:30 Invitation to journey with eu.vc and āltitude 🚀

Latest pods 🎧

The story behind Planet A and Science Based Investing

Today we are happy to welcome Nick de la Forge, Co-Founder and General Partner of Planet A, a leading European GreenTech Fund looking to invest into scalable, sustainable innovation. Before following the calling of building Planet A, Nick worked in different roles at leading firms at European deep-tech startups and funds, his own company Scalewonder, and he has a long-ranging track record as an angel investor in the WEB2.0 and WEB3.0.

In this episode you’ll learn:

Nick’s surprising journey from his university studies to Web 3 to finally launching Planet A

Nick's views on ReFi as investment vertical and solution to our climate issues

How to build from a theory of change when building your fund and why causing systemic change is a success criteria for Planet A

The importance of ensuring that prospective LPs understand and accept the core assumptions of your fund

How Planet A employ Life Cycle Assessments to measure impact and use science in your investment decision making

Designing the VC Techstack with Seedcamp’s Miguel Pinho.

In our two-part episode with Miguel Pinho, we dived into the design of the VC Tech Stack at Seedcamp and explored the common misconceptions that Miguel see in our industry. And of course: teased out learnings and tips for VCs building their techstack!

Miguel is the head of technology at Seedcamp, the European seed fund launched in 2007 that helps European entrepreneurs to compete on a global scale. He works on internal and public-facing projects ensuring they leverage the right tool suite to continue to identify, invest and support the most exciting companies out there.

In this episode you’ll learn:

Miguel’s journey to becoming one of Europe’s leading voices on the VC Tech stack & the path to being a truly data-driven VC

How Seedcamp’s journey with tech took Miguel from a Fireman-phase, through a Gandalf-phase, then McGiver-phase to finally arrive at the Architect-phase

Why simple and unsexy things like Password managers are things VC managers need to think about when building their tech stack and why

Why, how and when VCs should think about hiring a head of tech

Why FOMO might be a good thing in venture, but a terrible thing in building the VC tech stack - and pervasive in the industry nonetheless!

Why Airtable is an absolute power tool for VCs and Miguel’s perspectives on leveraging it’s power

Why Miguel believes there’s too little deep thinking about the VC tech stack and too many looking for a magic bullet rather than making the effort to build their own path

How to think about the organizational development to leverage the power of data and tech as a VC - when to hire a Miguel!? Should you even?

How Miguel thinks about the trend of data driven VC and if it’s more than just big words

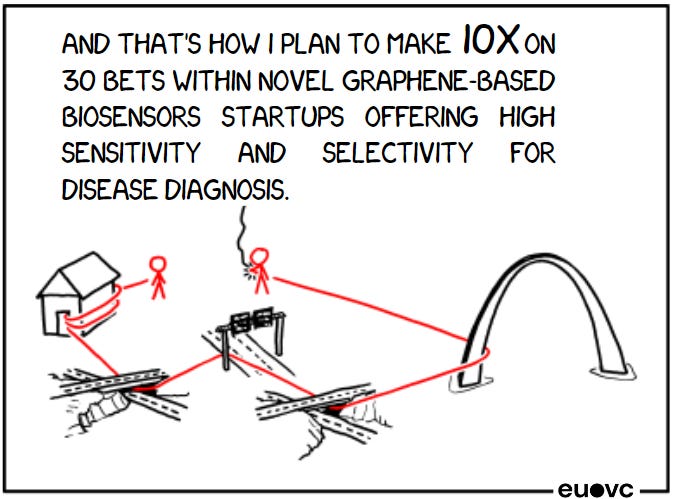

Comic of the week

GIFs & Memes 🙊

When a bank acquires a fintech company, and the CTO needs to comply with the new dress code:

Venture debt in Europe - status quo, who it’s for, and how to leverage it.

For this week’s episode, we jumped into Venture debt with Kim Lundberg from Denmark’s Export and Investment Fund (EIFO) - formerly Vækstfonden/The Danish Growth Fund.

Read on for the key take-aways and listen to the full episode to go deep 🤿.

Venture debt - where we’re at in Europe

Revenue-based financing is a newer financing product that's becoming popular in Europe and the US. It is a short-term and quicker-to-apply-for option than venture debt, but can be more expensive overall, especially if you don’t master its intricacies.

While venture debt has been around since the '70s, it's only been in the past decade or so that we've seen it take off in Europe. According to data from Dealroom, the amount of venture debt raised by European startups increased from €1.2 billion in 2015 to €2.9 billion in 2019. In the first half of 2020 alone, European startups raised over €1.3 billion in venture debt.

When it comes to the European landscape of tech lending, there are around 20 active players in Europe and more US venture funds targeting European startups. Larger banks have not entered the space significantly, but there is increasing venture debt activity in Europe, with costs for equity rounds fluctuating more than loans.

If you’re trying to educate yourself on venture debt, there’s a pretty simple solution to go deep: reach out to the biggest suppliers of venture debt and ask for a walkthrough. They’re selling a product and educating you so you can be customer is part of their business.

Speaking of debt investors, it should be stressed that knowing your lender is important just as important as knowing your investor. Before picking the lender, you definitely want to do the usual diligence of taking references. Picking a lender is much more than just the interest rate, three things you definitely want to to solve for are flexibility, long term orientation and good morals as foundation. You don’t want to be stuck unable to pivot because of a rigid debt supplier.

Common misconceptions

There are some common misconceptions associated with venture debt. One of the critiques raised is the overhang created by debt facilities for future rounds. Future investors coming into the company would have to pay for the debt facility, which could make it harder to raise the next round. For sure, this can be true, but it doesn’t have to be. As with any funding, it's a balancing act and the debt structure and timeline must be designed in a way that fits the future equity funding (& growth) plan.

Another common misconception is that venture debt is a good tool for financing CapEx intensive businesses. Typically, venture debt is a more appropriate option for financing future organic growth or acquisitions. Today, future cash flows are more critical than assets when it comes to loan financing. That said, having collateral is still necessary to de-risk the deal in most cases.

Thinking about venture debt?

It’s important to remember that venture debt financing is more complex than typical business management, and founders should understand their role in the process. Startups often have fewer business-savvy or financial executives, making it challenging to avoid situations where they may make the wrong decisions alone. To navigate the complexities of venture debt financing, founders should seek guidance from investors, peers, and lawyers. Having a lawyer review the documentation involved in venture debt financing is crucial.

As with any financing option, there’s a reason why venture debt exists and dismissing outright seems rash. And as the European tech ecosystem continues to mature, we can expect to see even more startups turning to venture debt as a financing option and more competitive structures from the providers.

Listen to the full episode to learn:

Everything about tech lending in Europe, it’s history, role and who it’s for (and not!)

The core terms you need to know and how to think about them

The intricacies and nuances of Venture debt and Revenue-based financing and how to employ these services as a VC for your founders

Kim’s take on the effect of tech lenders not having an equity reward as part of their deal structure

Where to seek more knowledge and key resources about venture debt

“Family Office Venture Capital” - getting stuck in the middle?

Jan Voss, head of Family Office at BLN Capital coined an important term this week: “Family Office Venture Capital”. In short, a concept referring to a "mix and match" Private Equity and Venture Capital - as captured by the below table.

It’s important to note: This does not work! To compensate for the risk profile of startups, lack of diversification and hands-on involvement, you need to go for the moonshots. Just as the good ol’ Michael Porter taught us all about strategy: Don’t get stuck in the middle.

Or as Jan puts it:

Deals that offer 1x return in a downside scenario cannot offer the upside that an "outlier" company should return in a VC portfolio. To get it right, family offices need to commit to either private equity or venture capital, meaning they should either write larger checks and get involved or understand VC portfolio construction and invest in a large number of "moonshots" where defaults are likely.

Or, though of course speaking my own book, I’ll reshare Jean-Bernard’s take:

Though, scouring the market for the best VCs, accessing and assessing them isn’t a small task either 👇

Which is why I tend to say: you don’t have to do the hard work of diligencing every VC in Europe. Just hit me up to join our LP community 🤗

The Information: Cash dries up for VC newcomers

“I did not raise a dollar between May 1 and October,” Wischoff said. “It was horrible.”

After $329 billion flooded venture capital between 2021 and 2022, the wealthy backers of VC funds are pulling back. “You’ve got to kiss a lot of frogs in this environment” to raise money, says one VC manager.

Early last year, Wischoff set out to raise $50 million for her second fund. The goal seemed achievable given that it took her only one month to raise $5 million for her first fund in 2021. But the war in Ukraine, which sent shockwaves through the global economy, and the upheaval in tech stocks made fundraising far more difficult than she expected. After months of struggling, she decided to close the fund with just $20 million raised.

Kate Clark and Becky Peterson

While the article also states that anyone with a bit of a network could raise a fund in '21, which I believe would (after all) be a stretch to say for Europe, there's no doubt that raising in '23 in Europe definitely shows the same dynamics as described by the Information in the US. #VC #euvc #venturecapital

Raising for an opportunity fund these days? Think twice.

Ten startups, including Y Combinator (YC) graduates Deel and Brex, have written a letter to YC expressing their disappointment in the startup accelerator’s recent decision to end its late-stage Continuity fund and lay off 17 employees, including fund leaders Anu Hariharan and Ali Rowghani.

The founders request that Hariharan and Rowghani keep their board seats despite the shutdown of the fund. The decision to end the fund has been controversial, with some YC founders taking to the startup’s internal messaging platform, Bookface, to voice their concerns.

Dealing with the outcry, Garry Tan has responded by acknowledging the difficulty of changing strategies and promising to address the specific issue of board seats with each affected company.

Great article by The Information sharing some of the pitfalls to consider when changing strategies in VC 👀

Fear the Birdie.

Denmark was riled by a kidnapping case this weekend. Waking up the day after to see this article on The Information made me happy:

"Already my relationship with my Birdie is a complicated one. I’m glad it exists. I wish it didn’t need to. I’m comforted by it. I hope to never use it. I question whether it would actually help if I were attacked on the street. I acknowledge that it’s better than nothing. Each time I look at my Birdie dangling innocently from a brass keychain off my handbag, I’m both reassured and resentful. It’s an elegant piece of technology that I hate even potentially needing to use."

A friend asked if I got one. Yes, I did. Whatever keeps my family safe 💞

2hearts hiring an intern 💞 know someone cool?

Share this!

2hearts is a diverse community of people with immigration backgrounds in Europe’s tech industry. We provide mentorship for young talent and support each other to overcome cultural challenges and succeed in our professions.

Why we love it

👉 It’s a paid internship position, for a minimum 3-6 months, remote with the possibility to work at the Berlin office

👉A perfect position to actively shape, learn from and closely work with Europe’s largest platform and community for culturally diverse talent in tech alongside an extended team of more than 30 tech entrepreneurs, investors and managers.

👉 We know so many members of the 2hearts community and truly want to support the important work they’re doing.

Tell your friend, niece, sister or uncle to apply by reaching out to Elnura with their CV.