EUVC newsletter - 22.05.2025

This week, we’re going big. The first Summit drop and three true specialist deep dives each marking a line in the sand for European venture

This week, we’re going big. The first Summit drop and three true specialist deep dives each marking a line in the sand for European venture:

🇪🇺 Oliver Holle kicks off our EUVC Summit Talks with a bang—laying out the US counter-offensive in Europe, why founders and VCs must engage politically, and what’s really at stake for the continent’s tech sovereignty. This is the first official release from our Summit stage—and it sets the tone.

🥽 Dave Haynes—ex-Seedcamp, now deep tech GP at FOV Ventures—delivers a true masterclass on immersive tech. Think AR, VR, multimodal interfaces and what comes after the smartphone. No hype, just edge insight from one of Europe’s best specialist investors in consumer frontier.

🚀 And then there's Visionaries Tomorrow. We sat down with Sebastian Pollok for one of the first deep dives on the new dedicated Frontier Tech fund from the Visionaries Club family. Operator insights, generational LP strategy, and what it really means to build with—not for—your customers.

🚗 And if mobility is your beat, Marcus Behrendt of BMW iVentures brings one of the most strategic deep dives we’ve had on the future of automotive. From natural fiber composites to autonomy at port scale, it’s a look under the hood of how Europe’s industrial giants are betting on startups to reinvent themselves—and why CVC done right might just be the lever Europe needs.

Each one of these episodes brings a different lens—but all of them tell the same story: Europe is leveling up.

Dig in, share with your smartest VC friend, and let us know what you think.

with 💖 David & Andreas

Table of Contents

🎧 Podcasts of The Week

VC: Dave Haynes on How AR Glasses, Multimodal AI, and Teleoperated Robots Will Reshape How We Work

Founder: Sebastian Pollok on Building Visionaries Tomorrow & Europe’s Deep Tech Renaissance

Sales & Scaling with Ryan Lieber, Snowflake’s First SDR [Path to Market - Seedcamp Podcast]

CVC: BMW iVentures: Hedging the Future of Mobility, One Strategic Bet at a Time

✍️ Insights Article of The Week

🎧 Podcasts of The Week

In this episode, Andreas Munk Holm sits down with Oliver Holle, Founding Partner at Speedinvest, to unpack Europe’s current position in the global venture landscape. Fresh off the EUVC Summit and gearing up for GITEX, Oliver brings the heat, calling out flawed narratives, making the case for political engagement by founders and VCs, and breaking down the strategic implications of geopolitical capital shifts.

Oliver shares how Europe is better positioned than its reputation suggests, why AI represents a public narrative opportunity for tech, and how learning from private equity could help European VCs build durable winners. From silent fund shutdowns to the rise of solo GPs, this episode is a crash course in navigating the new European venture normal.

Here’s what’s covered:

03:46 Key Relationships in the Founder-VC Dynamic

09:56 Navigating Power Dynamics in Founder-VC Relationships

22:03 The Importance of Team Dynamics in Startups

26:05 Building Effective Communication and Culture in Growing Teams

28:44 The Challenge of Team Dynamics in VC Firms

32:36 Addressing Ego Issues in Leadership

38:32 The Evolving Role of Founders

47:12 Self-Reflection and Personal Growth

55:12 The Importance of Energy Management

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation on the Spotify/Apple episode🎧

Brought to you by Affinity – Exclusive dealmaking benchmarks

What can Affinity data on almost 3,000 VCs from 68 countries reveal about how VCs performed last year and how dealmaking will continue to evolve?

Dave Haynes on How AR Glasses, Multimodal AI, and Teleoperated Robots Will Reshape How We Work

This week, we’re joined by Dave Haynes—former Seedcamp and now early-stage investor at FOV Ventures—to dive deep into the edge of consumer tech: AR glasses, multimodal UX, and what comes after the smartphone.

With roots in Seedcamp, SoundCloud, and the VR boom, Dave brings unique insight into what makes future-focused consumer products work—and why VCs have so often gotten this wrong.

Here’s what’s covered:

06:32 Betting on the Next Platform: What Comes After Mobile?

09:20 AR Glasses: What's Real vs. Hype

14:11 Lessons from the Early Days of SoundCloud

18:33 Spatial UX: Why Multimodal Interfaces Matter

22:48 Why VCs Get Consumer Tech Wrong So Often

26:15 Europe’s Edge in Privacy-First Consumer Interfaces

30:29 FOV’s Thesis on Spatial, Identity & Ambient Interfaces

34:50 Why the Real Opportunity Lies in Infrastructure

37:42 How to Evaluate Founders in Emerging Tech

42:06 Dave’s Playbook: Staying Curious in Weird Markets

Berlin is the place. GITEX is the moment.

Europe’s largest inaugural tech, startup, and digital investment event lands in Berlin. GITEX EUROPE unites global innovators, investors, and policymakers to shape the continent’s future across AI, quantum, cybersecurity, and beyond.

Get a ticket with the EUVC Discount Code - GE25EUVCTKT

Sebastian Pollok on Building Visionaries Tomorrow & Europe’s Deep Tech Renaissance

In this episode, we sit down with Sebastian Pollok, co-founder of Visionaries Club and a rare breed of operator-turned-investor, for a wide-ranging conversation on what it takes to back the next generation of European B2B founders.

From backing the earliest stages of trailblazing B2B ventures to bridging generational gaps in LPs and talent, Sebastian breaks down his formula for fostering durable companies—and the common traits among those with breakout potential.

He also shares how his experience at The Hut Group and as founder of Amorelie shaped his views on brand, distribution, and why conviction beats consensus when building the future of enterprise.

Here’s what’s covered:

04:42 Why the Best Founders Build “With” Customers, Not “For” Them

10:56 Visionaries Club's Thesis: Europe’s B2B Moment

14:30 The Difference Between Operator-Led and Finance-Led VC

19:10 What Sebastian Learned Scaling Amorelie

23:15 Bridging Generational Capital: Visionaries' LP Strategy

27:42 Are European Founders Still Underselling Themselves?

32:00 What Makes a “Category King” in B2B SaaS

36:45 Inside the Visionaries Club Deal Flow Engine

41:02 The Rise of “Content-Led” B2B Startups

45:39 Why Gen Z Talent Will Reshape European VC

Make an impact with the bank made for the innovation economy

We know building relationships and building businesses go hand-in-hand. With our sector expertise and tailored solutions, we’ll connect you with what’s next.

BMW iVentures: Hedging the Future of Mobility, One Strategic Bet at a Time

In this episode, Marcus Behrendt, Managing Partner at BMW iVentures, joins Andreas and Jeppe for a deep dive into how corporate venture capital is reshaping Europe’s industrial DNA—from the inside out.

With iconic legacy sectors under pressure and tech waves crashing at their gates, Marcus unpacks how BMW’s venture arm scouts for tomorrow’s breakthroughs—from natural-fiber composites to scalable autonomy—while staying anchored in strategic intent and sustainability.

From balancing big company goals with startup freedom to the roadblocks slowing Europe down, this is an honest look at what it takes to drive change.

Here’s what’s covered:

04:11 Investment Focus: From Smart Supply Chains to Sustainability

09:56 The Auto Industry in Flux: Disruption, Legacy & Tesla’s Vertical Model

14:31 Integration vs. Modularity: What Will Define the Next Automotive Leaders

17:01 Avoiding the Kodak Trap: Why Culture Eats Strategy in Corporate Innovation

25:56 Leveraging the Core: Staying Close to BMW’s Strategic Heartbeat

28:04 Natural Fibers & Rare Earths: Investing for CO2 Impact and Supply Chain Resilience

34:42 Scaling Autonomy in the Real World: From Car Plants to Ports

37:33 Europe's Structural Weakness: Legal Complexity and Inconsistent ESOPs

44:11 Pensions, Politics & the Case for Venture Policy Engagement

47:04 Why BMW iVentures Remains a Single-LP Fund—and Proud of It

Watch it here or add it to your episodes on Apple or Spotify 🎧. Chapters for easy navigation are available on the Spotify/Apple episode.

Want to learn how a top LP navigates the industry? Join us on May 27th at 1:30 pm WEST for an exclusive AMA session with Hervé Cuviliez, co-founder of Id4 ventures.

Hervé is the co-founder of ID4 Ventures and a seasoned entrepreneur and investor with 20 years of experience in operations, scaling, and monetisation. He has invested in some of Europe’s biggest names and emerging fund managers in the U.S. market. After building and selling his first interactive agency to DDB Worldwide, he co-founded Diwanee and Leap Ventures, a growth-stage VC firm. Through ID4 Ventures, he leads a data-driven investment strategy, backing top-tier early-stage VCs across Europe and emerging players in the U.S., with fund-of-funds partnerships including Bolderton, Notion, Hoxton, and Seedcamp.

This is a unique chance to ask your questions directly and gain insights that aren’t available elsewhere. Spots are limited, and they’re exclusive to our community members.

↓ Register below to attend ↓

Climate Investment Reframed: Christian Hernandez on the Real ROI of Adaptation (ImpactVC spotlight series)

In this episode, Andreas Munk Holm sits down with Christian Hernandez, co-founder and Partner at 2150, to challenge a common VC misconception—adaptation isn’t plan B, it’s a billion-dollar frontier. From heat-proofing megacities in the Global South to tackling the carbon cost of concrete, Christian breaks down why the climate crisis needs more than mitigation—and why adaptation is just as investable.

Christian shares how 2150 is building its strategy around deployment readiness—bridging the chasm between early tech and infrastructure-scale solutions. This conversation lays out the economics, urgency, and capital flows reshaping climate tech today—and why adaptation is core to building a livable 2150.

Here’s what’s covered:

01:35 Scaling for the Switch: When Venture Hands Off to Infra

03:01 Cooling the Planet: Human Limits, Economic Drivers & Air Conditioning

05:06 De-risking for Deployment: The Role of IFC, World Bank & Public Finance

07:42 Software for Adaptation Risk: Interdependencies & Insurability

11:42 Concrete, Meat & Flying: Where Real Emissions Come From

16:50 Why 2150? Long-Termism and Climate Deployment Urgency

18:15 Lessons for Climate VCs: Investing with Impact and ROI in Mind

24:38 Case Study: Vammo's Electric Scooters & Battery Swapping in Brazil

26:15 Open Source Thinking: Sharing Climate Research Across the Ecosystem

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation on the Spotify/Apple episode🎧

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

Sales & Scaling with Ryan Lieber, Snowflake’s First SDR [Path to Market - Seedcamp Podcast]

In a new episode of Path to Market, our Director Natasha Lytton and her co-host Micah Smurthwaite, Partner at Pipeline Ventures are joined by Ryan Lieber, an experienced Go-to-Market Leader and one of Snowflake’s earliest employees and its first SDR. Together, they discuss Snowflake’s impressive growth trajectory, the challenges and strategies of category creation, key sales methodologies like MEDDPICC, the best approaches for scaling internationally, and cross-functional sales efforts.

Ryan shares his experiences from joining Snowflake as an unknown startup in 2014 to its current status as a data giant with over 7,000 employees and a market capitalization of over $50 billion.

He also delves into when and how founders should hire their first SDRs and sales leaders, the metrics for measuring their success, and the role of marketing alignment in scaling sales. Moreover, he emphasizes the importance of understanding regional cultural and communication nuances and how to leverage partnerships in new markets. Lastly, Ryan discusses his current role leading Snowflake’s startup program in Europe, aiming to help next-generation data-intensive startups succeed using Snowflake’s data cloud.

Here’s what’s covered:

05:01 Building the EMEA Team

08:19 Finding the Ideal Customer Profile

13:57 Sales Methodology: MEDDPICC

21:48 The Daily Grind of an SDR

22:01 Key Traits for Sales Success

23:30 Red Flags in Sales Hiring

27:07 Effective SDR Metrics

34:54 The Power of Marketing in Sales

36:49 Scaling Internationally

42:26 Snowflake’s Startup Program

You can watch it here or add it to your episodes on Apple or Spotify chapters for easy navigation are available on the Spotify/Apple episode.

Want to learn how a top LP navigates the industry? Join us on June 12th at 12 PM WEST for an exclusive AMA session with Daniel Keiper-Knorr.

Daniel is a founding partner at Speedinvest, where he leads limited partner relations and fundraising at both the fund and portfolio levels. With a career spanning investment banking, entrepreneurship, and venture capital, he started as a stockbroker and private banker at Erste Bank in Vienna and Credit Suisse in Zurich before transitioning into the startup world.

As a co-founder of 3united, he played a key role in its growth and eventual acquisition by VeriSign.

Since 2007, Daniel has been an active angel investor, bringing hands-on expertise in sales and business development to early-stage ventures. In 2011, he co-founded Speedinvest, leveraging his extensive experience to support founders and drive investment success.

↓ Register below to attend ↓

Fund Modelling in VC: Essential Building Blocks

Most fund modelling advice is generic.

But your model isn’t just a spreadsheet—it’s your entire pitch strategy in numbers.

Our recent article breaks down the 6 essential blocks of a solid VC fund model.

💡 Whether you’re first-time or Fund III, this session will help you:

Build a credible, LP-friendly model

Avoid assumptions that sink returns

Translate vision into real fund mechanics

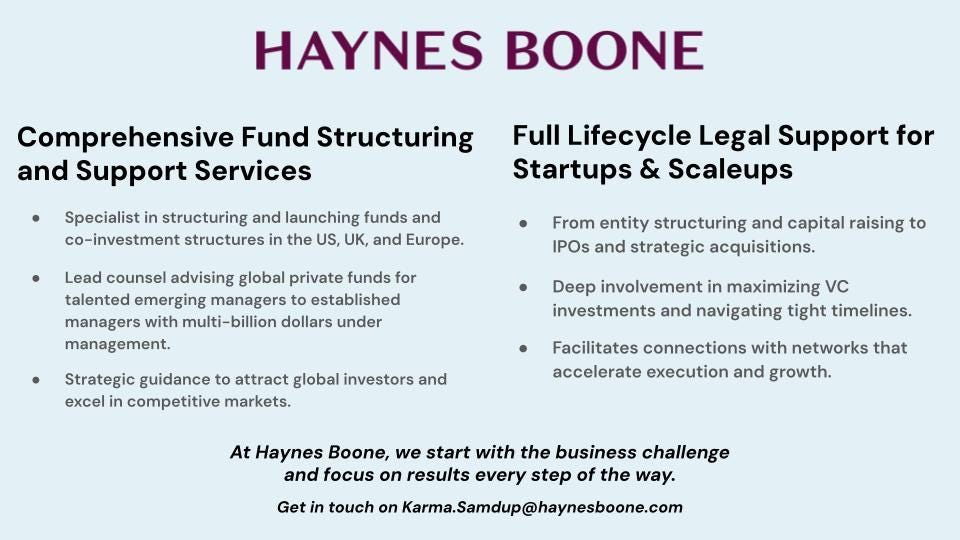

We’re proud to welcome back Haynes Boone as the official sponsor of the Firm of the Year category at the EUVC Awards.

Haynes Boone brings deep expertise in fund structuring and full lifecycle legal support for VCs, GPs, LPs, and startups across the US, UK, and Europe. As trusted advisors to emerging and established fund managers alike, they know what it takes to build and scale in competitive markets, making them the perfect backers of this high-caliber award.

Whether you're launching Fund I or navigating late-stage growth, Karma, Vicki, and the team at Haynes Boone are ready to help you.

🧠 Startup Incorporation for Global Founders

Choosing where and how to incorporate a startup isn’t admin - it’s strategy.

And yet, countless founders (and the VCs who back them) still treat it as a checklist item, only to get stuck flipping jurisdictions mid-round or getting hit with dry tax at exit.

We broke it down in a full post a few weeks back - stories, frameworks and why it matters more than ever if you’re backing global teams you can read the post bellow.

And on May 28, we’re going deeper in a 2-hour masterclass for GPs:

✅ Founder horror stories

✅ Incorporation decision-making frameworks

✅ Jurisdiction trade-offs: US vs UK, NL, and Estonia

✅ Live demo of the Matchmaker tool

👥 Not yet a member? Join here.

We’re heading to EBAN Congress in Copenhagen – and you should too.

Join us June 3–5 as the EBAN Annual Congress lands in one of Europe’s most vibrant startup hubs. Co-hosted by EBAN and DanBAN, this is the go-to gathering for Europe’s angel investing scene—bringing together 400+ angels, LPs, and ecosystem leaders for high-quality networking, insights, and deals.

Whether you're looking to sharpen your view on where the market is heading, meet fresh syndication partners, or just catch up with old friends over a Copenhagen cocktail—this is where you want to be.

What to expect:

🗓️ June 2 – Welcome Reception @ Copenhagen City Hall

🎤 June 3–4 – Keynotes, panels & networking @ POOLEN (9:30–17:00)

🍽️ June 3 – Gala Dinner @ POOLEN (19:00)

🌆 June 5 – Copenhagen Explore Day

EUVC perk: As our community partner, you get 15% off tickets. Use code EUVCxEBAN2025 at checkout.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

🗓️ The VC Party at SuperVenture — don’t miss it.

This is your last chance to save on your SuperVenture booking, but be quick, we’re already 90% sold out!

Don’t be the one missing out on attending the world’s largest LP/VC connection point. Buy your ticket here.