EUVC Newsletter 26.10.23

Europe’s leading LPs on Getting the Terms Right For Funds, Navigating Cornerstone LP conversations, The "Made with Biology"-Funding Napkin 2023, AI Companion & VC Investor rankings.

Welcome to the EUVC Newsletter 🗞️

Join us in welcoming 309 LPs, VCs & Angels who have subscribed since our last post (yes, it’s been a month since our last ‘real’ newsletter)! If you haven’t yet, join the 17,450 insiders that do & share it with your besties🤗

Table of Contents

Europe’s leading LPs on Getting the Terms Right For Funds

Navigating cornerstone LP engagements

Made with Biology Funding Napkin 2023

AI tip: If you’re not using AI companion, get moving!

Founder Compensation Survey by CREANDUM & Slush

Dealroom’s VC Investor Ranking

Upcoming events

Three days left to help uncover the State of European Tech!

This edition is brought to you in partnership with …. Moonbit

Moonbit's Protective Asset Allocation (PAA) Portfolios

Harness the dual-momentum of Bitcoin & Ethereum with Moonbit's PAA strategy. Benefit from the "price persistence" principle and crash protection up to 100% in USDT. Secure upside potential while guarding against downturns.

Europe’s leading LPs on Getting the Terms Right For Funds

In our recent roundtable with Europe’s leading LPs we explored how managers best navigate getting their terms right in the current market - obviously, the days where any aspiring VC could float super carry without compensation are gone. With a panel of LPs that are all well-versed cornerstoning LPs, these are the guys that have most of these conversations in Europe.

So let’s get into it 🤓

When Possible, Go Plain Vanilla

Helped by the fact that venture in Europe is largely influenced by major stakeholders like the EIF, standardized terms reign supreme. But this is not to be shun. It helps expedite the investment process with all LPs and curtails excessive back-and-forth and uphold clarity in proceedings. In our panel, it’s a clear recommendation that managers steer clear of minor, often unnecessary customizations and instead focus unerringly on the fund’s primary goals, getting to a solid fund that appeals to LPs.

New funds, in particular, should prioritize simplicity in their investment structures. Introducing convoluted terms or pioneering untested financial innovations could introduce hesitation among potential investors. Straight-forward terms facilitate smoother transactions, quicken decision-making, and provide a clear vision that investors can rally behind. Don’t create friction where there doesn’t have to be any.

A note on Super Carry

Before the reset, we saw more GPs asking for super carry but while possible for some swing in that market, the current times demand a balanced approach. Not surprisingly, our LP panel underlined that, in their view, a super carry structure implies an expectation of superior returns and thus logically should accommodate the converse scenario in return.

In other words, the panel underscored the importance of proportionate compensation, where a willingness to accept reduced gains during less successful periods should be as present as the quest for higher rewards in prosperous times. Such variable carry structures, contingent on performance, establishes a more equitable partnership between managers and LPs. This model not only incentivizes outstanding performance but also fosters a culture of accountability for underachievement. By embracing lower carry for underperformance parallel to super carry, fund managers demonstrate commitment to shared success, enhancing trust with LPs.

That said, fund managers considering this route must provide substantial evidence of past successes to justify such premiums. Opting for aggressive financial structures without a solid performance history risks alienating potential investors who may view this as overconfidence or an attempt to bake in what’s considered a clear misalignment of financial interests.

Navigating cornerstone LP engagements

Skillfully navigating cornerstone LP engagements is absolutely integral given their influential role in setting the tone for subsequent fundraising. Our panel gave some advice on how fund managers can optimize these pivotal interactions:

Commence Dialogues Pre-emptively It’s prudent for fund managers to initiate conversations with prospective cornerstone investors ahead of formal commitment requests. Early interactions facilitate a mutual understanding, paving the way for smoother negotiations. In doing so, focus on informing yourself as to the LP’s specific processes and investment criteria. This allows you to anticipate their needs and preferences so you can develop a more tailored and compelling proposal and process.

Forge Consensus on Key Terms Swiftly: Once you’re ready to talk terms, ensuring that you achieve early consensus on fundamental investment terms is crucial. Discerning their deal-breakers early prevents future stalemates but it also avoids that unaddressed discrepancies can snowball into substantial impediments, potentially derailing not just the involvement of cornerstone LPs but also deterring subsequent investors. This is particularly important if the potential LP requests unconventional conditions or requirements.

Adopt a Flexible, Investor-Centric Approach: Recognize that each investor interaction is distinct with its own dynamics. While overarching industry norms guide term acceptability, there’s often negotiation room, especially for cornerstoning investors. That said, be careful about terms that aren’t confined to the current fund generation as the long term effects can be substantial - it’s hard to know which position you’ll raise the next fund from.

All in all, while it’s wise to exercise adaptability in negotiations, it’s equally important to remain anchored to standard practices to preserve the fund’s broader appeal. Plain vanilla baby. This is particularly true if you’re creating your initial momentum with commitments from personal networks or smaller investors. Managers truly need to be circumspect about the conditions they consent to, ensuring they don’t alienate future institutional investors.

Upholding Transparency and Operational Autonomy: To little surprise, our panel argued vehemently that fund managers be forthright about any unique relationships or agreements between the GP and LPs. As an example seen more often one might think, situations like an LP possessing an option to acquire a stake in the GP or third-party entitlements to carried interest will necessitate upfront communication to avert trust issues. By being transparent, managers uphold integrity and mitigate potential conflicts of interest that can arise at a later time.

Independent Governance Mechanisms: Our panel emphasizes the importance of having governance structures that affirm the fund’s autonomy to solidify investor confidence in the fund’s self-governing operations and reassures investors of the fund’s focus on core objectives and investment strategies, without the distraction of operational ambiguities.

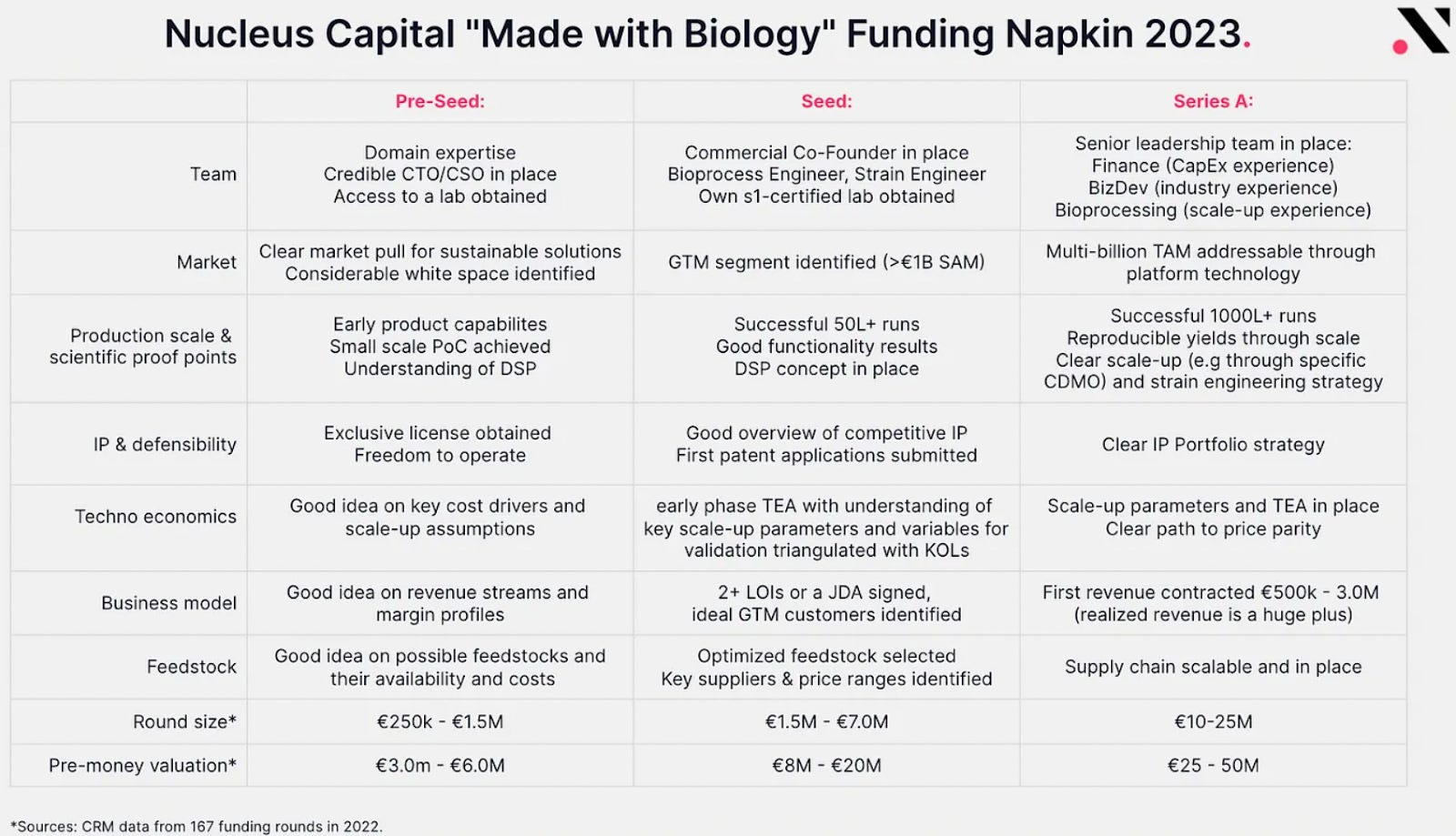

Made with Biology Funding Napkin 2023

LP Hypeman’s note: Wanted to share something I found super cool in a recent LP update from Nucleus. Definitely provided me with a good framework for how to think about a sector I know far too little about compared to the strides that are being made and the winners we see emerging. Here it is, shared unfiltered with the team’s kind permission 👇

At the beginning of 2023 we asked ourselves the question: What does it take to raise capital for Synthetic Biology companies in 2023?

Since we couldn’t find a satisfactory answer, we leaned on Christoph Janz’s “SaaS Funding Napkin” and subsequently developed our own point of view.

With the aim of providing guidance to entrepreneurs and fellow investors, we’ve compiled a set of key milestones to hit from Pre-Seed to Series A and launched the inaugural “Made with Biology Funding Napkin 2023”:

AI tip: If you’re not using AI companion, get moving!

You might think this is a paid promotion, but it’s actually not. Just wanted to share to make sure that all of you out there using Zoom are aware of the AI companion tool. We’re using it in our meetings and it’s nothing short of amazing. Never again do fiddle around the desk to find a pen and paper to do notes on, never again do we have to fill each other in on an important meeting the other person couldn’t make it to. What a blessing.

Learn more here → https://blog.zoom.us/zoom-ai-companion/

Founder Compensation Survey by CREANDUM & Slush

This is a really important topic and there's still a taboo particularly at the early stage around founders not feeling like they should give themselves a salary.

Help make founder compensation a lot more transparent by forwarding the below survey to your founders.

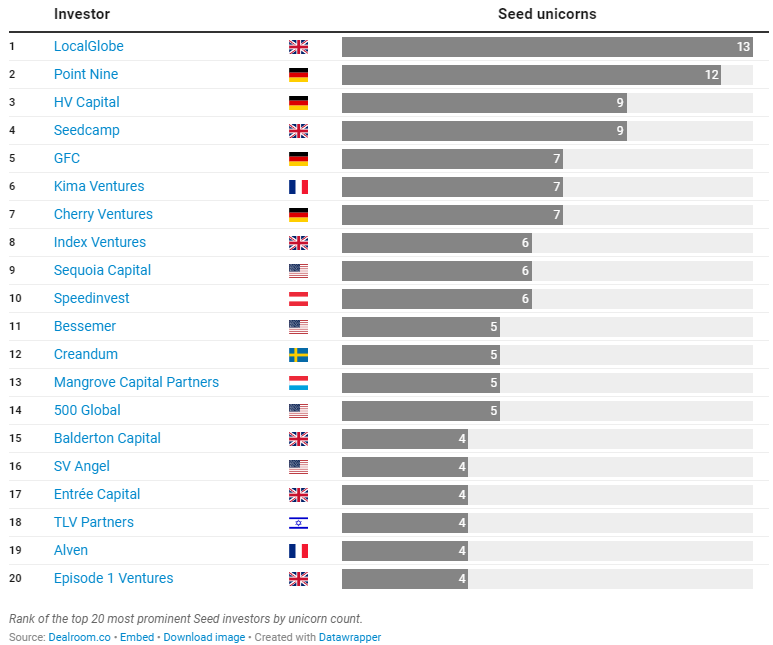

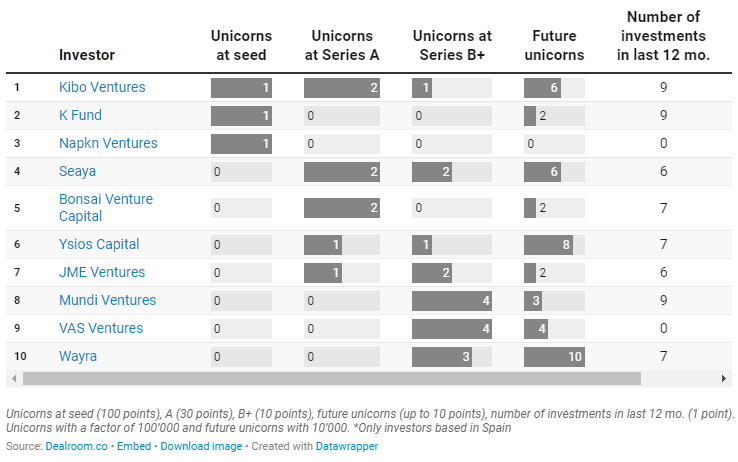

Dealroom’s VC Investor Ranking

In case you haven’t yet seen it - the VC Investor Ranking is out 🥇. You can always debate how to score these things. Dealroom writes that it’s “a practical tool for all startup ecosystem decision makers” which might be taking it a step too far, but it’s certainly interesting and entertaining 😁 At least, as an LP, this is not what I’ll be placing my chips on the basis of, but it’s a good guide to figure to guide anyone in figuring out whose side event to prioritize at tech events 😏

Play with the interactive rankings here and for a quick overview of the top winners in the EMEA, some quick snaps below.

EMEA Combined Ranking 2023

EMEA Seed Ranking 2023

EMEA Series A Ranking 2023

Rank by number of unicorns (at Seed)

UK ranking

DACH Ranking

France Ranking

Spain Ranking

Israel Ranking

Nordics Ranking

CEE Ranking

Italy Ranking

Upcoming events

📺 Virtual events we’re hosting

Winning in The Secondaries Boom | 📆 Oct 31, 2023, 3:00 PM - 4:00 PM CEST

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg

Super Venture | 📆 4 - 6 June | 🌍 Berlin

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai

GITEX Europe 2025 | 📆 23 - 25 May | 🌍 Berlin