EUVC Newsletter | 28.03.23

LP views on first close incentives and LP perks, How nextgens think about VC, Investing in Web3 in '23, VCs adjusting fund sizes and why Europe will play a central role in the sequel to The Power Law

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective.

Firstly a heartfelt welcome to the 112 newly subscribed venturers who have joined since our last post! If you haven’t yet, join the 8,469 LPs, VCs & Angels that do or share it with your besties🤗

Table of Contents

Open in browser for clickable ToC 👆

Super Angel, #08: Charlie Delingpole, ComplyAdvantage

EUVC, #161 Thomas Otter, Acadian Ventures

LP Musings w. Chris Wade: The Power Law-sequel cannot disregard Europe

One of Europe’s First Female Solo GP firms launched: Beyond Capital

Latest pods 🎧

Super Angel, #08: Charlie Delingpole, ComplyAdvantage

Today, we're happy to welcome you to Charlie Delingpole, founder of ComplyAdvantage, an AI-driven financial crime risk and detection technology powered by Complydata. They have raised $100m from Index Ventures, Balderton Capital, OTPP and Goldman Sachs with global hubs in London, New York, and Singapore.

In this episode you’ll learn

The importance of being part of a strong angel community with peers you trust and whose opinion you value

How Charlie thinks about activating his network as part of his diligence process

Why Charlie is going from a more international strategy to a more nationally focused one

Why Charlie believes it’s important to impose systematic professional processes on himself when angel investing

EUVC, #161 Thomas Otter, Acadian Ventures

Today we are happy to welcome Thomas Otter, General Partner at Acadian Ventures, an early-stage venture capital firm that helps founders around the world build enduring companies. Recent European investments include Techwolf, Fifty, and Figures. Thomas has an operator background in HR Tech and the Future of Work, having been a Research VP at Gartner, and led Product at SuccessFactors.

In this episode you’ll learn:

The Future of Work vertical and why it’ deserves a vertical special to its own

Why there’s a need for a specialised VC like Acadian for Future of Work

How their niche focus allows Acadian wins as a global investor

GIFs & Memes 🙊

Founders building on top of ChatGPT these days 👇

A rare video of the SVB Bank Run 👇(credits to Matt Turck)

LP musings w. Chris Wade 🧠: The Power Law-sequel cannot disregard Europe

By Chris Wade, founding partner of Isomer Capital (and European Venture’s #1 LP OG). Get to know Chris in our two-part episode on his journey & thinking 🎧.

From 2017 - 2020, year Sebastian Mallaby wrote the book “The Power Law” and my 10c to everybody practicing the art of venture capital: this is a must-read history on VC. And for some of the stories that were deemed too juicy for Penguin Random House, tune in to the EUVC episode with Sebastian 👇

But why do I recommend this book as a reference piece on VC?

In it’s essence, “The Power Law“ is the history of Venture Capital. While unashamedly US-centric, but (after all) several chapters on the rise of VC in China, only minor nods are given to Europe. Honestly, to my mind that is OK because the majority of the last 60 years of venture activity has been in those geographies.

Mr Mallaby of coursed starts at the beginning with Arthur Rock backing the traitorous 8 to form Fairchild to escape their awful boss William Shockley. Among the 8 were of course Robert Noyce and Gordon Moore.

The book continues to describe in detail how Venture Capital was at the heart of the telecoms technology revolution, Cisco for example and then Internet 1.0, then on to Yahoo, Apple, Google and so on.

Being an OG these names have a part in my early years and the reference to Ampex Corporation (Redwood City) where I was a student intern in 1979 made it a particularly fascinating read for me personally.

All in all, the narrative over +40 years charts the different approaches to Venture Capital and the attentive reader will tease out learnings on how to pick the right approach for the different technologies, capital requirements, and entrepreneurs as well has how to navigate macro-economic cycles.

Some key trends I want to highlight:

Amount of seed capital: early VC deals were in the neighborhood of $1-2m - and this was into companies like Intel. But then Google came along and demanded much more - request VC’s initially struggled with.

Adapting the model to fit the likes of Google was soon followed by the criticism that VC’s ploughed too much capital into startups (see my musing on the unified theory of VC suckage for more on that!)

The early days of VC investing had 3-6 months of detailed analysis with the entrepreneur to determine what could wrong and finding a CEO or marketeer to help start the company was often needed.

The endless debate on how much the VC should be involved in the company’s decisions and outcomes has followed the industry since inception. Mr Mallaby provides multiple clear examples how, in some very well known home-run cases of Venture Capital, the VC-partner involved in the company was fundamental.

The book also does a brilliant job relaying stories of how entrepreneurs challenged the grandees of Sand Hill road (e.g. Zuckerberg arriving at Sequoia in his pyjamas pitching a completely different business than Facebook).

So Europe isn’t part of the book at all!?

For those (and I include myself) who cannot cope with idea of a book on venture capital that does not include Europe here are a few therapeutically soothing words:

During the period of writing the book (2017 – 2022 ) here is what you in Europe have achieved:

Unicorns: 92 to 327

Capital deployed: 25 to 91 €Bn

Company investments: 8,284 to 12,382

And from FT’s The resilient boom in entrepreneurship: “in 2022 France registered more new startups than ever before […] “March 2012 to march 2022 750,000 new companies were started in the UK

Clearly, Mr Mallaby’s sequel to “The Power Law” will no doubt include Europe.

WEF & Uplink: Spotlight on Una Terra on EUVC

We’re proud supporters of the WEF’s Uplink, the open innovation platform for people and the planet 🌍. Learn more here.

This week we published another episode with one of the top innovators from the Uplink Innovative Funds for our Future challenge, featuring Luca Zerbini, Managing Partner and co-founder of Una Terra, a €200M Venture Capital fund to accelerate European scale-ups fostering solutions to climate change and biodiversity loss. Aside from outstanding returns, the fund targets the removal of 2 gigatons of CO2 and 1M tons of plastic waste per year. I truly hope they succeed 🙏

In this episode you’ll learn:

The value that the WEF network and Una Terra’s involvement in the Uplink challenge for Innovative Funds For Our Future

Why Una Terra have tied their carry to impact metrics, how they’ve thought about it and implemented it

Why Luca has dedicated himself not only to VC but also to advising the world’s leading PE funds

The importance of governance in the Climate Tech sector and how Luca and Una Terra have built their setup to protect against greenwashing

Access the best VCs in Europe

We’re building the leading community to access & back Europe’s best VC funds. If you’re committed to venture, don’t hesitate to reach out or apply to join us 🤗.

LP views on first close incentives

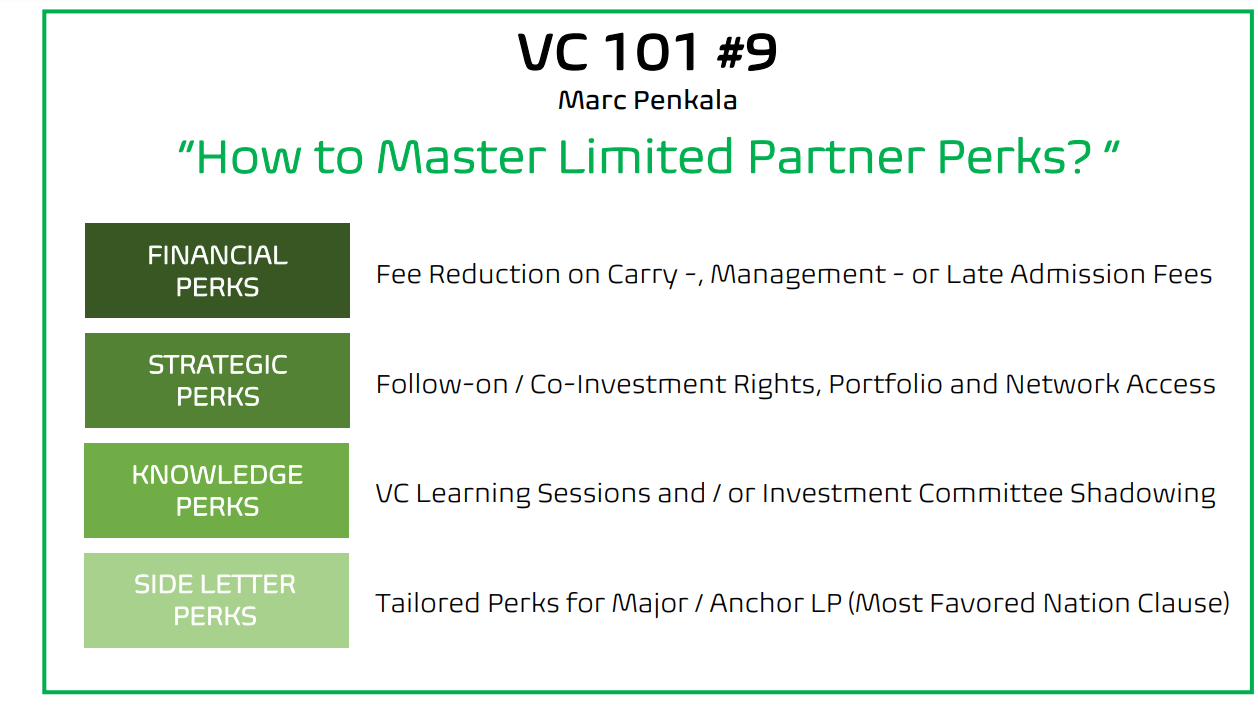

Our good friend Marc Penkala recently put out a post on Mastering LP Perks. As always, stellar content (fully reproduced below).

#LP perks should be an integral part of every #Fundraising playbook, for both emerging and established #VC funds.

Though, not every LP has the same needs and not all perks are equally relevant. That is why it is crucial to cluster LPs in groups and understand their investment rationale and their respective needs.

𝐆𝐏𝐬 𝐦𝐚𝐲 𝐜𝐨𝐧𝐬𝐢𝐝𝐞𝐫 𝐠𝐫𝐚𝐧𝐭𝐢𝐧𝐠 𝐋𝐏 𝐩𝐞𝐫𝐤𝐬 𝐟𝐨𝐫 𝐯𝐚𝐫𝐢𝐨𝐮𝐬 𝐫𝐞𝐚𝐬𝐨𝐧𝐬, 𝐬𝐮𝐜𝐡 𝐚𝐬:

1. Accelerating the pre-market or first closing (mainly financial & strategic perks).2. Attracting a particular category or set of LPs (mainly strategic & knowledge perks).

3. Convincing anchor LPs to come on board (individual MFN side letter perks).

Financial perks are obviously the most meaningful and impactful ones, mostly granted to pre-market or first closing LPs and of course the big shots - anchor LPs, which negotiate tailored terms via side letters #MostFavoredNation.

Though, there is a broad set of soft perks, such as strategic and knowledge perks. They might seem less relevant but may convince a certain set of LPs to invest into a fund. 𝐏𝐞𝐫𝐤𝐬 𝐚𝐫𝐞 𝐚 𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐲 - 𝐮𝐬𝐞 𝐭𝐡𝐞𝐦 𝐰𝐢𝐬𝐞𝐥𝐲 🚀

But there’s a specific issue that I keep hearing VCs struggling with lately:

How to entice LPs to come in for first close?

I asked some of Europe’s leading limited partners to find out.

Let’s hear it first from Nicky Sugarman, Partner at Stanhope Capital, one of Europe’s leading investors with 30B$ AUM:

Traditionally the main way to entice an investor to be part of a first close is to offer a reduced management fee, and in some instances even a reduction in carry.

On the fee side the most common variations we have seen are usually a window of time where no fee is charged (such as until the final close), or a discount for the investment period / life of the fund. For some GP’s this can be challenging, especially those with smaller fund sizes, but it is a good way to appeal to fee-sensitive investors.

Reducing carry is less prevalent, but for a great fund this can materially reduce the gross-net spread, making it really attractive to LPs. The flip side to this is that it does impact the alignment of interests, and may incentive a GP to hold a position for slightly longer to maximise return, rather than take some liquidity earlier in order to manage risk in the portfolio.

What has become more popular over recent years is giving first close investors preferential access to co-investments, or discounted fee/carry on such deals. As more LPs look to add direct investments to their portfolios, this might end up being the ‘everyone’s a winner’ option as GPs don’t need to give up their fund economics, and LPs get a boost to their direct deal flow.

Lastly, offering up an LPAC seat to a first closer may help, but the number of cases where this is likely to be the deciding factor would be limited.

That said, the biggest determinant of why an LP would be part of a first close is their confidence in the GP to generate returns and their relationship with the team.

Meeting with prospective LPs when you are not fundraising means not only do you get a chance to build the personal relationship, but the LP gets to see how you operate over a much longer period of time. Trying to bring an investor into a first close is a lot easier when they have essentially been doing their due diligence for 1-3 years.

Now let’s hear what René Andres, one of my absolute favs at EIF (💖), has to say:

In cases where a GP has gathered a sense of interest from several LPs, there are some effective mechanisms, but also some no-go’s that not all steer clear of.

Effective incentives:

Very clear communication around closing timelines (i.e. “we are closing on the XXth of June, in order for you to participate in the closing, we need your firm interest by XXth of May, after that we can not take you in the closing” etc.)

Active communication on “signaling vectors”, i.e. what LP is also investing, what founders are investing and recent news in the pre-fund portfolio

Gathering subdocs in a rolling fashion, rather than fixing them to one date

No-Gos:

Aggressive tone

Inflatable (and sudden) use of discounts (fees, carry etc.) and economic incentives coming all out of a sudden

And finally, while not really a no-go as such, it can be very difficult for a large LP to manage if a GP keeps changing timelines every 2 weeks.

And finally, aptly underpinning the importance of building traction and relationships, Stephan from AQVC’s perspectives:

While reduced fees and co-investment rights are typical incentives offered to investors, ultimately, the relationship and trust between the investor and the VC fund are most important for long-term success.

In addition to these "incentives", it's also essential for both parties to be strategically aligned. By being aligned on goals and priorities, a first close is usually easier. However, all of this is hard to artificially create, if you don't have it already.

What tactics are you employing? Participate to see the results on my LinkedIn poll here 👀

One of Europe’s First Female Solo GP firms launched: Beyond Capital 🍾

So I’ve only had the pleasure of meeting Gloria once. But what a rockstar. I leave the floor to her with only one word: respect 👊

📣📣📣 Introducing Beyond Capital 🎉🎉🎉

I am excited to launch Beyond Capital, a €21.5M angel-operator fund dedicated to partnering with exceptional European pre-seed and seed founders who aspire to build transformational B2B companies.

When I embarked on this journey less than a year ago, I didn’t know where it would take me. All I knew was that the European tech ecosystem was at an inflection point, that capital alone was no longer sufficient to support transformational companies and that I loved teaming up with operators and fellow VCs to partner with the most ambitious entrepreneurs.

That’s why I decided to start Beyond and bring together 50+ tech operators and founders from successful tech companies such as Personio, Stripe, WhatsApp, Sumup, KRY, and Deliveroo to jointly support the next generation of founders.

What is the value proposition to our founders?

😎 We aim to support you like a founding team member, not like another investor, even if it means negotiating against ourselves.

💪 We work tirelessly to support you on your journey, connecting you with early customers, world-class talent, and global investors. We strive to be the highest value per euro invested on your cap table.

👷♀️ We collaborate with other investors and will help you build an exceptional support group, optimising for your success and without our own agenda.

Today, this crazy idea has become a reality, and I am incredibly grateful for all the support I received from

- the 70+ founders I have had the privilege to partner with as a VC and angel investor,

- my ex-colleagues at Index Ventures and TCV as well as co-investors who I had the chance to learn from since I stumbled into VC in 2015, and

- the 100+ limited partners who believe in me.

James Heath: How NextGen’s think about Venture

James recently put out a great post drawing out learnings from one the getaways that any VC would pay big dollars to be the fly on the wall of. It really stuck with me, some years back, I co-authored a book with my mentor on succession in family businesses (do reach out if you’re interested!). The change that a new generation heralds was apparent. And when it comes to investing, equally so.

Whether you’re an LP or VC, make sure to follow James for insights, his addition to your feed will prove a real gem.

🎢 Here are some POSITIVE insights for the #VC ecosystem following the rollercoaster past few days surrounding SVB

✈️ I spent three days in Portugal with 40+ next-generation family offices talking all things VC. My key takeaways:

🚀 VC is an asset class that the next-gen FOs take seriously. Regardless of the background of the family, exposure to VC is almost fundamental instead of a nice to have

👫 The co-investment journey is essential. FOs want to work collaboratively with VCs through co-investments. This step is often taken before a FO decides its mandate and invests directly

🤝 Next-gen FOs are very receptive to investing in VC funds. Many positives were discussed, such as helping with deal flow, due diligence, spreading VC risk over a portfolio, and reducing the administration associated with a high volume of direct deals

🫶 Smaller funds win. There was a preference for smaller (sub $300m) funds over larger VC funds. FOs want to feel involved its portfolios - the data also shows smaller funds generally perform better

🔥 Having a focus matters. Whether it was by geography or sector, FOs want to back VC funds where GPs have an obsession, where brand reputation and expertise can be leaned on

♻️ Impact is necessary. Next-gen FOs are increasing the number of investments made in impact start-ups/funds, across multiple verticals. Longevity, healthcare and education were sectors of focus

✍️ Next-gens will only invest directly in start-ups in higher volumes. If an FO is not committing itself or an individual to focus on VC entirely, it is unlikely to invest directly. Next-gen FOs seem to be more open to having this as an option - direct investing may see an upward trend as a result

🤓 Investing in start-ups or VC funds associated with the family business sector was seen as both a preference and something to avoid. It's essential to understand the FO business sector and find collaborative commercial aspects.

Investing in Web3 in ‘23

The Information just put out a piece on the hotness around investing in Blockchain’s Building Blocks. Akash Pasricha fittingly starts his article saying:

Mention the term “blockchain infrastructure” at a party and you’re likely to meet blank looks. Unless, that is, you’re hanging out with a group of crypto venture capitalists.

While I’m in no way a crypto VC, I couldn’t be more excited for the picks and shovels of the vertical. And for that reason, I’m incredibly excited by what the very early team is building in this space and invite you to join us at our upcoming event on Web3 in '23 - where are we headed & how to capture it? It’s going down on Tuesday, Apr 4th, 12:30 PM - 1:30 PM CET

We'll dive into topics like:

🎯 How to think about investing in the space

⚖ How to think about private vs public market exposure

🚀 Why some of the biggest opportunities will be in Decentralized infrastructure, Real world impact and Public markets/tokens.

📈 Why the current bear market will give rise to the next generation of giants

And as always, if you’re an LP, Angel or VC interested in getting to know the team, hit me up.

VCs adjusting fund sizes

Axios recently reported that Founders Fund has quietly cut the size of its eighth venture capital fund in half, from around $1.8 billion to around $900 million. As they say:

This is a shot across the VC industry's bow by firm founder Peter Thiel, and will force peers to explain why they're not doing the same. It also puts added pressure on firms that currently are in market.

So what are we seeing in Europe?

Definitely, these last weeks, I’ve been receiving emails in my inbox with varying versions of the below:

We’re putting our fundraise on hold for a while…

I’m considering lowering the target size of the fund…

These are tough days and having launched a raise in the ‘21/’22 obviously means you’ve launched in a market where more things were possible than are today. So what do you do?

Well, whether we like it or not, everything comes down to narrative. And it’s no one’s favorite task to devise a story that explains why you won’t hit your initial target. But I think there’s plenty good reasons to do it:

Objectively, you likely needed a bigger fund size to execute on your strategy in the market of yesteryear than this year.

Running towards a target you no longer believe in can be highly demoralizing - consider how long you (and your team!) can endure!

Even the big guys have had to recognize that things have changed (#reference-Thiel’s-move, one of the best in the game)

Is there some hubris to this? In most cases, yes of course. But it’s not a coincidence hubris originates from Ancient Greek. It couldn’t be more human, we all suffer from it. Don’t hold it against yourself.

So why am I saying all this? Because I’m sure that for every manager who has written me saying they’re considering to pause their raise or lower their target there’s another hundreds more.

🚨 Listen up: It’s likely the LP market that has changed, more than it’s you miscalculating your capability to raise. Being a self-reliant, successful individual, you’re most likely feeling this is more on you than it really is.

Sit down, talk it over, consult your true believers, execute. There’s nothing else to do.

How leading VCs navigate the ‘23 investment landscape

As we all delve into the unknown territory of the VC going forward, ‘23 promises to be an interesting year filled with uncertainties and unpredictabilities. To some, ‘23 is a whole new ball game, to others, it’s back to basics.

So how do we navigate through this? Well, data seems to be top of mind.

We gather, we analyze, and we benchmark.

Payback periods have become more important than ever.

But the name of the game is not just preserving capital, but building efficient growth.

Raising money ain't easy, so we gotta prove that we can grow without burning too much cash. But VC is still a game of growth.

Across the board, and for the better, we've witnessed a shift in the way companies are being evaluated, where unit economics and underlying profitability are key factors.

See the teaser of the panel talk below or watch the full session here.

This week’s hires 👩💼

Section powered by the InnovatorsRoom.

🇷🇴🇦🇪🇬🇧💻 Siemens Energy Ventures - Venture Analyst - Bucharest, Dubai, London, Onlineinnvtrs.com/3JDglq7

🇬🇧 Cherry Ventures - Head of Finance & Strategy - London innvtrs.com/406a0uk

🇪🇸 Secways - VC Analyst - Barcelona, Madrid innvtrs.com/3JCgOJr

🇩🇪 Comet Rocks - Venture Associate - Berlin innvtrs.com/40sONul

🇨🇭Sparrow Ventures - Head of Growth - Zurich innvtrs.com/3z3t8NC

🇨🇭eevolve - PE Analyst - Zurich innvtrs.com/3TAjpb7

🇩🇪 twinwin - Founder Associate - Berlin innvtrs.com/3lvSrVI

🇬🇧💻 Antler - Capital Director UK - London, Online innvtrs.com/3FHJbVc

🇩🇪💻 Global Entrepreneurship Centre - Principal / Partner - Düsseldorf, Online

innvtrs.com/3TA94vS

🇩🇪 blueworld.group - Investment Manager - Frankfurt innvtrs.com/3JTckOL

🇩🇪💻 Aquin- Mergers & Acquisitions Associate - Munich, Online innvtrs.com/3JIiwc8

🇩🇰 Novo Holdings - Junior Analyst Internship - Copenhagen innvtrs.com/3nbPtGl

🇫🇷 Pinterest - Insights Strategy Analyst - Paris innvtrs.com/3zvAHgF

🇬🇧💻 Quine - Head of Product - London, Online innvtrs.com/3yUPzEN

💻 Polygon Technology - Ecosystem Partnerships Director - Online

innvtrs.com/3KdQGWD

Thx for reading and being awesome 💗 we love you for it.