EUVC Newsletter | 28.8.23

The correlation between top tier funding and startup success, LLMs are becoming Enterprise-ready and reflections on whether it's time to turn in my wings? 🤔 + memes are back! 🙈

Welcome to the EUVC Newsletter 🗞️

Join us in welcoming 488 LPs, VCs & Angels who have subscribed since our last post! If you haven’t yet, join the 13,328 insiders that do & share it with your besties🤗

Table of Contents

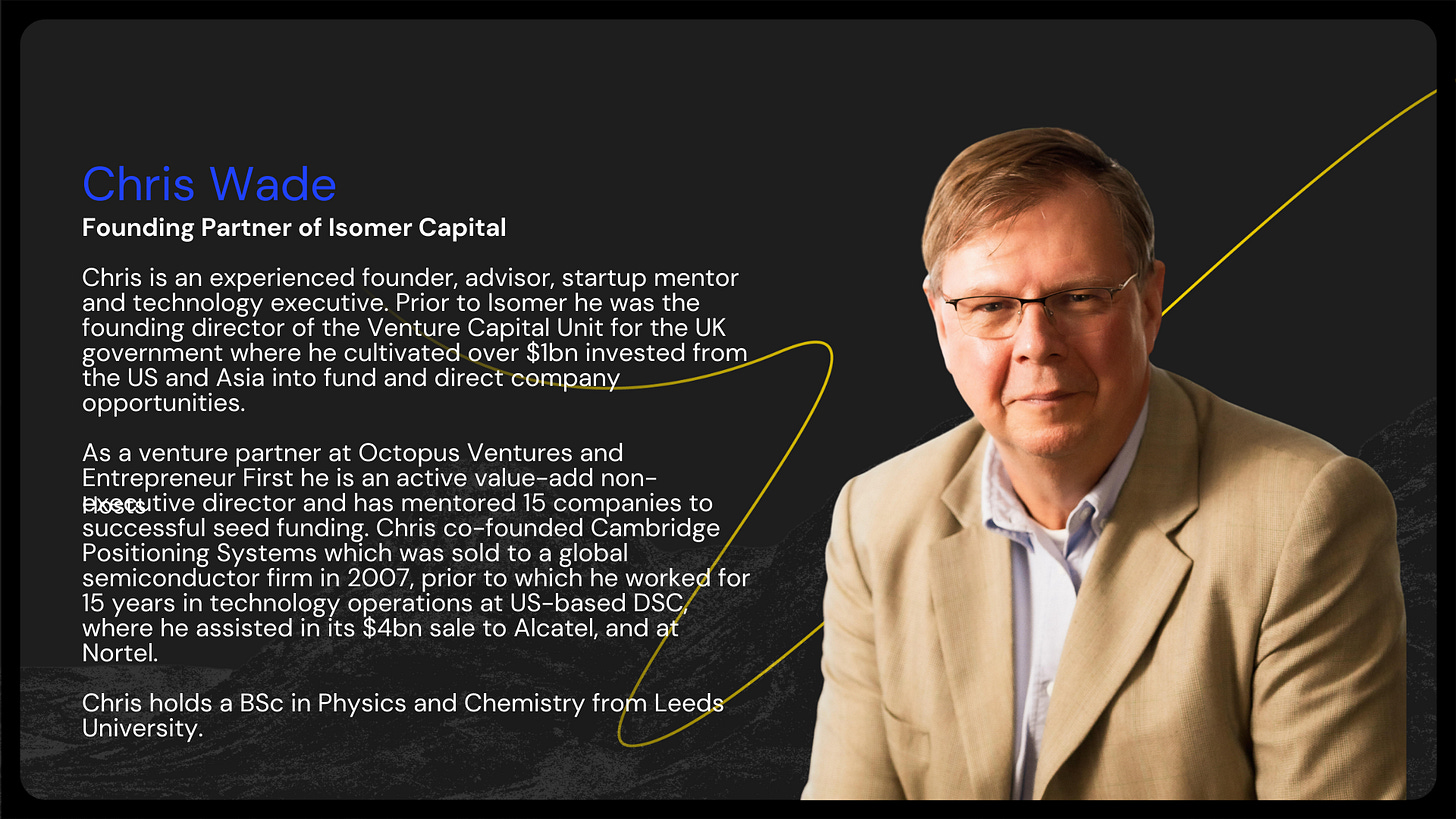

Does Significant Funding by the World's Best V.C.'s Guarantee a Successful Investment Outcome? by Chris Wade

Time to turn in my wings? by Andreas Munk Holm

LLMs Are About to Become Enterprise-Ready 🤖 by Lunar Ventures

Upcoming events

Does Significant Funding by the World's Best V.C.'s Guarantee a Successful Investment Outcome?

By Chris Wade

I recently read about VanMoof's fall from European e-bike leader to bankruptcy, leaving many unfulfilled customer promises, double-clicking on this sad story.

In 2020, the company secured $40 million in funding from world-class investors, propelling it into the limelight. The media hailed this as a breakthrough, predicting a bright future. However, customer complaints about shipping delays and quality issues began to mount. Despite its financial prowess, VanMoof faced operational challenges that marred its image, ultimately leading to its demise.

It made me think that funding alone cannot resolve underlying business complexities or guarantee a successful trajectory. Was this a rare example, or is it a fact of life in venture capital?

Simply put, I want to explore whether there are other examples of significant funding by the great and good that have failed to build great companies or positive investor returns.

WeWork: Softbank's Vision fund invested over $18Bn., WeWork's valuation skyrocketed, seemingly invincible. However, a lack of profitability and an overambitious expansion strategy led to its downfall. Ultimately, the company's excessive funding acted as a smokescreen for its inherent flaws, resulting in a spectacular fall from grace.

Improbable SoftBank's investment in Improbable, a UK-based virtual simulation startup, showcased the allure of substantial funding. 2017 SoftBank invested $502 million in the pre-revenue A round, catapulting the company into the unicorn club. The future seemed promising, but as time was unveiled, the company faced struggles translating its groundbreaking technology into viable products. The investment masked deeper issues in product-market fit and strategy execution. The undeniable truth remains that funding doesn't replace the need for sound business strategies and tangible results. While the journey for Improbable is not over, most observers question if it can be a Unicorn again.

Other examples:

Quibi: (Quick bites) a short-form mobile video platform launched in 2020 with $1.75 billion in funding and high-profile content partnerships. Despite the substantial investment (Disney and Alibaba Group) and media attention, the platform failed to gain user traction. Its downfall was attributed to a combination of factors, including a crowded market, content that didn't resonate with audiences, and a misunderstanding of user preferences. The company closed in Nov 2020.

Jawbone: Jawbone, a company known for its wearable fitness trackers and Bluetooth speakers, raised over $900 million in funding. Despite the substantial financial backing, the company struggled with production delays, legal disputes, and fierce competition from rivals like Fitbit and Apple. In 2017, Jawbone eventually shut down its consumer wearables business. Jawbone investors Included KPCB, Sequoia, Andreessen Horowitz, and Khosla Ventures.

Fair: Fair, a car leasing startup that aimed to disrupt the traditional car ownership model, raised over $1.5 billion in funding. SoftBank's Vision Fund was a significant investor in Fair. The company faced difficulties in managing inventory and financial stability, going through multiple rounds of layoffs and restructuring. In 2020, Fair filed for bankruptcy.

And this is not a recent phenomenon:

Solyndra: Solyndra was a solar panel manufacturer that raised over $1.6 billion in funding, including a substantial loan guarantee from the U.S. government. The company's unique cylindrical solar panel design failed to compete with the falling prices of traditional flat solar panels. Solyndra filed for bankruptcy in 2011, leading to scrutiny of government-backed investments in clean energy startups

Fab.com: Fab.com started as a design-focused e-commerce platform and gained attention for its unique products and curated shopping experience. The company raised over $330 million in funding but faced challenges maintaining consistent revenue growth and profitability. Business strategy and leadership changes didn't prevent Fab.com from ultimately shutting down its consumer-facing operations. Investors included Menlo Ventures, Atomico and Andreessen Horowitz.

Webvan: Webvan was an early online grocery delivery service that raised over $800 million in funding during the dot-com boom. However, the company struggled with high operational costs, including building large fulfilment centres, and faced challenges in achieving profitability. Webvan filed for bankruptcy in 2001, becoming one of the most infamous failures of the era. Investors included Sequoia, Benchmark.

Conclusion: The narratives of startups securing monumental funding rounds can obscure the fact that capital is just one piece of the puzzle. As the above examples show, funding doesn't guarantee success. Real success is rooted in visionary leadership, a clear value proposition, market understanding, adaptability, and disciplined execution, i.e. Hard Work and JFDI.

Around 2010, I was in a meeting in Cambridge (U.K.) talking about the value of Venture Capital in the startup ecosystem. I will never forget Hermann Hauser, a leading European technology investor and co-founder of ARM Holdings, saying:

"ARM achieved global dominance without relying on signifiant venture capital. Its business model focused on licensing intellectual property rather than manufacturing physical products, enabling it to scale with agility. ARM's trajectory highlights that innovation, strategic partnerships, and solid execution can lead to industry leadership without the need for astronomical funding rounds."

Which I thought was topical given this week's announcement that another great European tech company, ARM, will return to the public market with a Nasdaq listing in Q4 23…

Time to turn in my wings?

By Andreas Munk Holm

I’ve been having some interesting conversations lately. Seems many angels are ready to turn in their wings and go for a prolonged holiday. Before we get to whether that's a good idea or not, let's try and understand why.

First of all, Venture investing is all about the power law. While you can invest successfully without the top top top returners (Cf. Seedcamp's Fund VI deck, publicly available on their website, >3x returns can be attainable even without hitting the home-runs), truth be told: this is very very very rare performance. Even by VCs who invest for a living.)

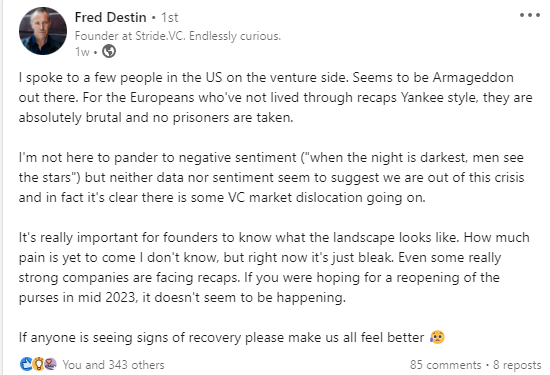

Now, let's crunch some numbers 📉 VC-backed companies are bleeding, with US investments plummeting 58% from Q4 2021 to Q4 2022 (Pitchbook's word, not mine) and the bloodbath isn't over. Note Fred Destin's post from last week stating poignantly “Seems to be Armageddon out there”

Now let's take a history lesson for a bit 📊

Historically, 63% of ventures flopped between 1995-2011.

1999 was a dumpster fire with 75% losses.

But from 2012-2020, a mere 31% stumbled 😲

As David Clark from VenCap International plc said: Does this mean that founders suddenly became twice as good at growing their companies? or have VCs improved their selection capabilities by 100% ?

Of course not. Truth is. It was just longer death throes. Smart (and long-time) LPs, VCs and Angels know this. But the boom in new angels we've seen in the same period (now up to 500,000 angels across Europe according to EBAN - European Business Angel Network data) means that most angels have not experienced the pre-2012 times, so seeing 60-70% loss rates is obviously a bucket of cold water 🪣

So, is it time to turn in the wings? 👼

I'd give a resounding no ⛔, but I would say: it's time to learn from the best and try to replicate their strategies. That's why I've dedicated my time to talking to all the best on the eu.vc pod and angel investing in and with them.

I'm no oracle, but I'm a good copy-paster.

LLMs Are About to Become Enterprise-Ready 🤖

LP Hypeman’s note: It doesn’t seem too long ago that firms like Lunar were doing weird quant and algorithm stuff… But as is often the case with the meticulous choreography of a master chef, seemingly inconspicuous beginnings have the potential to evolve into something of monumental significance. Enter deepset – a quintessential embodiment of this transformative journey. Initially composed of mere ingredients: two tablespoons of language models, a sprinkle of vector databases, and a layer of text embedding models for good measure. The alchemical result? A model-agnostic developer platform, meticulously engineered to empower AI teams in sculpting pliable and resilient systems, propelled by the cutting-edge prowess of contemporary language models. Now that sounds like something I’d like to sink my teeth into 🧑🍳

As interest in large language models and vector search grows, we are thrilled to announce that Balderton Capital is leading the latest $30 million funding round for deepset, which will be used to develop further their AI platform called deepset Cloud.

deepset develops the industry standard open-source framework Haystack, which allows developers to build LLM applications using various components for NLP projects, including language models, vector databases, and text embedding models.

Haystack serves as the foundation for deepset’s commercial offering: deepset Cloud, a model-agnostic developer platform designed for AI teams to create flexible and robust systems powered by the latest language models. Boasting SOC2 certification, deepset Cloud is regarded as the most production-ready LLM framework, allowing enterprises such as Airbus, Siemens, and many others to leverage large language models to gain a competitive edge in their respective industries.

Deepset Cloud covers the entire lifecycle of NLP applications, from experimentation to production, with an emphasis on fast prototyping, frequent feedback cycles, and easy customization. Clients from diverse sectors like media, legal, finance, and insurance have used deepset Cloud due to its usability and convenience.

It was our privilege to back deepset from the very start, and we’re incredibly proud to continue supporting Milos, Malte, and their exceptional team as they reshape the world of enterprise AI.

It’s no secret that we at eu.vc are happy and heavy users of the Vauban platform as it allows us to punch out more content for you guys without bogging us down in back-office hassle.

For a very special treatment, use this form to let the Vauban team know you’re coming from the eu.vc community 🤗