EUVC Newsletter 31.03.24 | Upcoming benchmarking session and easter spirit shoutouts

Join us as we digest the week's news in European VC 📰

Let’s welcome 175 LPs, VCs & Angels who have subscribed since our last newsletter. Join the 22,889 that do & share it with your besties

We recognize the imperative need for a deeper understanding of benchmarking practices within our community. To this end, we're planning a focused session on benchmarking.

This will include interpreting benchmark reports, understanding LPs' performance metrics, and integrating benchmarks into fundraising strategies. The aim is to equip our community with the insights needed to effectively compare their funds with peers and market standards. We invite you to pre-register!

Highlights

📜 Regulatory Shifts: The EU's stringent stance on Big Tech's election integrity measures underlines a growing regulatory environment, potentially reshaping digital platform operations.

🛠️ Nordic Entrepreneurial Exodus: Norway's controversial exit tax policy could stifle its startup ecosystem, serving as a cautionary tale for European countries balancing innovation with fiscal policies.

🏦 Baguettes Beat Brexit: France's resilient economy, outperforming its European counterparts, offers a stable backdrop for investment, despite the private market's slower pace.

🔄 Liquidity Labyrinth: Analyzing private fund cash flows reveals critical insights into LP strategies and market liquidity, shaping investment approaches in a cautious market.

📊 Data Analytics Boom: The burgeoning data analytics sector, with significant spending and growth projections, is poised to redefine software investment priorities.

🤖 Trust & Safety Tech: Investments in Trust & Safety technologies reflect a growing market need for online security, marking it as an emerging field with high growth potential.

🌐 Digital Health Stabilization: The digital health sector's adaptation post-pandemic indicates a matured market, with AI integration opening new avenues for healthcare innovation.

🌱 Femtech Resilience: Despite its smaller scale, the femtech sector's steady dealmaking points to a growing recognition of women's health tech as a promising investment area.

🔋 Thermal Battery Potential: Investment in startups like Antora Energy signals the rising interest in thermal batteries, a critical component in the transition to renewable energy and industrial decarbonization.

🏥 Organ Transplant Innovation: AI's role in organ transplantation highlights a burgeoning sector with a $7 billion opportunity, fueled by technological advancements and increased governmental engagement.

🔒 Trust & Safety Tech Ascends: With significant investment in companies like Reality Defender and Logically, the Trust & Safety sector is poised for growth, addressing crucial online safety and trust challenges.

🕵️♂️ Safety Tech Spotlight: The Trust & Safety sector's rise reflects a broader trend towards securing digital spaces, balancing innovation with the imperative of online safety and privacy.

We're determined to create a community for investors tapping into the vast potential of Europe. LP investments underpin our approach, offering access to European tech at scale.

As a member you get:

🌟 Curated investment opportunities, including access-constrained deals.

🤝 Privileged connections with inspiring people in the industry, building strong networks and relationships across Europe.

🔍 Proprietary insights into cutting-edge tech and emerging markets.

📖 Access to best practices, skill development, and valuable insights to enhance your investment expertise.

💸 Exposure and access to the asset class we all love - Venture Capital.

And the best part? You get all of this for FREE, as long as you remain an active and engaged member.

Cracking into the Easter Spirit 🐣 with a few personal shoutouts

Shoutout 1: Giving Props to Pedals

Please Roll into Portugal Next!

The Cowboy Cruiser emerges as a compelling entrant in the urban e-bike segment, distinctively positioning itself through a blend of sophisticated design, smart features, and an emphasis on ride comfort. This e-bike differentiates itself from competitors by integrating a removable battery, which not only enhances user convenience but also addresses a critical pain point in the e-bike charging experience. The strategic decision to refine and build upon the successful aspects of previous models underscores Cowboy's commitment to iterative innovation, focusing on user comfort and practicality with the introduction of more relaxed handlebars and a comfortable riding posture.

Cowboy's approach to technology integration is noteworthy, as it enhances the riding experience without overwhelming the user.

The Cruiser's smart features, powered through an advanced companion app, offer a customizable riding experience, allowing it to cater to a broad spectrum of users, from tech enthusiasts to those seeking a simple and efficient mode of urban transportation. The QuadLock fitting point for phone attachment and wireless charging capability are standout features that highlight Cowboy's dedication to merging convenience with technology. The bike's performance is further accentified by its "AdaptivePower" system, which intelligently adjusts to various riding conditions, ensuring a seamless and efficient ride, critical for urban commuting.

While the Cowboy Cruiser sets a high standard in terms of quality and features, its increased price point and attractiveness as a theft target present notable market challenges. The pricing strategy may limit the bike's accessibility to a wider audience, potentially hindering its market penetration amidst a diverse competitive landscape. However, the bike's removable battery and robust software ecosystem present significant opportunities for Cowboy to lead in the high-end urban e-bike market, catering to a demographic that values quality, performance, and smart integration.

Here's my personal shout-out: Cowboy Cruiser, I’m eagerly awaiting your arrival in Portugal next!

Shoutout 2: Securing the Invisible Frontline

Binarly, a leading firm in the domain of firmware and software supply chain security, has successfully closed a significant seed funding round amounting to $10.5 million. This financial milestone was led by Two Bear Capital. The round also saw participation from a diverse group of investors, including Blu Ventures, Canaan Partners, Cisco Investments, and Liquid 2 Ventures, highlighting the broad interest and confidence in Binarly's approach and technology. Notably, pre-seed investors Westwave Capital and Acrobator Ventures increased their equity stakes, further underscoring the sustained support and optimism surrounding Binarly's trajectory and solutions.

At the heart of Binarly's value proposition is the Binarly Transparency Platform, an advanced, AI-powered solution designed to address critical security challenges within software and firmware supply chains.

This platform stands out for its ability to detect both known and unknown vulnerabilities, as well as evidence of malicious code injections, thereby offering a comprehensive defense mechanism against a wide array of cyber threats. Binarly's commitment to innovation is also reflected in its track record of identifying and mitigating numerous high-impact software flaws, including the significant LogoFAIL issue that affected billions of devices globally. The Binarly Transparency Platform's cloud-agnostic nature and provision of actionable remediation playbooks further enhance its appeal to enterprise security teams, enabling efficient and effective responses to security incidents.

Binarly's successful funding round and the development of its flagship platform are indicative of the company's strong position and strategic vision within the cybersecurity landscape. By focusing on the often-overlooked area of firmware security, Binarly addresses a critical gap in the broader cybersecurity ecosystem. The increasing prevalence of firmware-targeted cyber-attacks, due to historically inadequate security measures at this layer, underscores the importance and timeliness of Binarly's solutions. The company's ability to attract a diverse and reputable group of investors further validates its approach and potential to significantly impact how businesses and device manufacturers protect against and respond to cybersecurity threats.

With $10.5 million now in its war chest, Binarly is set to turn the firmware world on its head - because nothing says 'growth spurt' quite like turbocharging your team to tackle invisible cyber gremlins!

Shoutout 3: Where AI meets DNA 🧬

MiLaboratories' recent launch of Platforma.bio marks a significant advancement in the computational biology sector, utilizing artificial intelligence to enhance the efficiency and accessibility of biological analyses.

Platforma.bio distinguishes itself through a combination of user-centric design and advanced technological integration. The platform employs AI-driven large language models to simplify complex biological data analyses, transforming intricate processes into user-friendly, modular blocks.

This approach not only democratizes access to sophisticated computational tools for researchers across various disciplines but also optimizes the analysis workflow to reduce computational waste.

A notable innovation is the platform's patent-pending engine designed to identify and eliminate redundant calculations. This feature enhances the efficiency of iterative analyses, allowing researchers to focus on impactful scientific inquiries without the overhead of unnecessary computational tasks. The inclusion of initial analysis blocks for T-cell and antibody analysis, with plans to expand into other next-generation sequencing (NGS) data fields, underscores Platforma.bio's commitment to comprehensive research support.

Platforma.bio's launch is strategically positioned within the computational biology market through its collaboration with industry leaders like Illumina. These partnerships not only validate the platform's technological prowess but also strengthen MiLaboratories' market presence, potentially broadening the platform's user base and application scope.

The decision to offer Platforma.bio for free to academic and non-profit organizations aligns with a broader trend of making advanced scientific tools more accessible, thereby accelerating research and innovation. This approach could foster a loyal user community and establish Platforma.bio as a go-to platform within the scientific community, further solidifying MiLaboratories' reputation as a key player in the field.

Raise your pipettes to Platforma.bio, the silent partner in the lab!

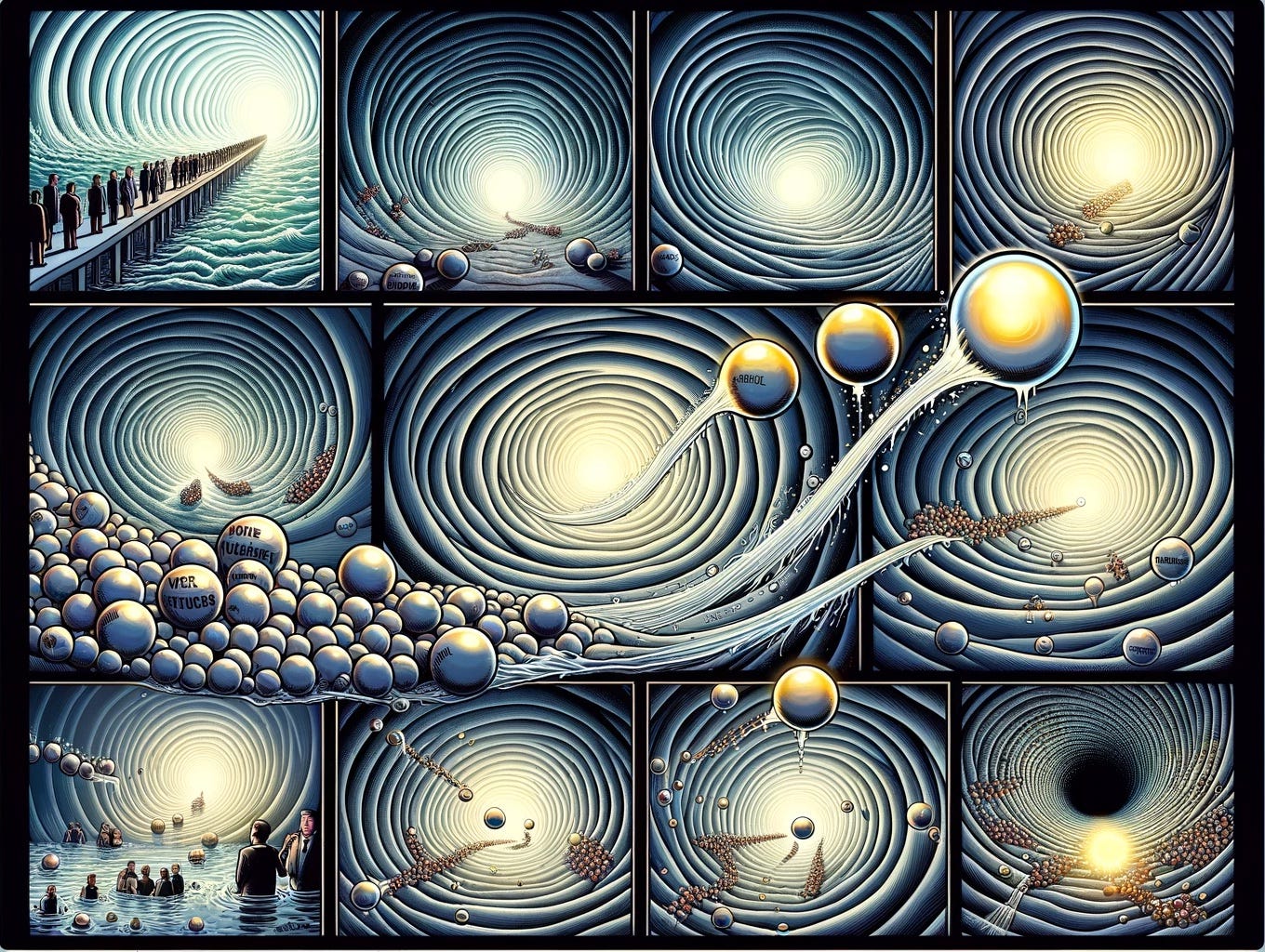

Surfing Turbulent Cash Flow Waves

by PitchBook

A pivotal revelation from the analysis is the disparity between the industry's focus on low distribution rates and the underemphasized yet ongoing capital call activities. In 2023, the distribution rates across most asset classes plummeted well below their historical averages, signaling a widespread challenge in liquidity realization. However, the steadfast capital call rates, especially in PE, private debt, and real assets, paint a picture of a resilient investment activity landscape, albeit amidst market adversities.

The sector-specific insights further enrich the narrative by highlighting the distinct liquidity experiences across different asset classes. PE, for instance, has witnessed a significant reduction in distribution rates relative to NAVs, marking a liquidity squeeze. Yet, the consistency in capital call rates underscores a sustained, albeit cautious, deal-making vigor.

VC's investment pace has notably decelerated, primarily due to pronounced dealmaking challenges, impacting both distributions and capital calls.

👉 This dual contraction reflects a broader slowdown in the VC deal-making environment, exacerbated by prevailing market headwinds. The stark drop in distribution rates to historical lows highlights the challenges faced by LPs in realizing liquidity from their VC investments. Concurrently, the moderation in capital call rates suggests a cautious approach by VC firms amidst an uncertain investment climate. This nuanced understanding of the VC cash flow dynamics offers critical insights into the liquidity pressures and investment strategies within the venture capital ecosystem, underlining the importance of adaptive fund management practices in navigating the evolving market landscape.

Real estate's liquidity landscape has been marred by a dual challenge: the cooling of both capital calls and distributions. This is largely attributed to the adverse effects of rising interest rates and the sluggish repricing of commercial real estate assets, which have collectively hampered deal-making activities within the sector.

Contrastingly, real assets emerge with distribution rates hovering close to historical benchmarks. The sector has experienced a surge in capital call activities, signaling robust investment opportunities, particularly in infrastructure and digital assets sectors that have shown immunity to broader market downturns.

Private debt stands out for its relative stability, maintaining near-neutral net cash flow levels amidst the turmoil. The alignment of capital call rates with historical averages, coupled with reasonably healthy distribution rates, reflects the inherent robustness of private debt as an asset class, offering a semblance of liquidity predictability to LPs.

TVPI Under the 🔬

Adapted from Benchmark’s newsletter

The European VC landscape has undergone significant transformation due to the interplay between global economic shifts, including historically low interest rates and the impact of the COVID-19 pandemic, which ushered in an era of increased liquidity and accelerated growth for technology-driven sectors. This period witnessed a surge in valuations, driven by a confluence of factors such as an abundance of dry powder, heightened competition, and a speculative investment climate fueled by the SPAC boom. This environment led to a decrease in the average startup failure rate, as many companies remained afloat through VC support, contrary to traditional market correction mechanisms.

The unfolding scenario in 2024, however, suggests a stark contrast.

Preliminary data indicates a significant uptick in startup failures, particularly in sectors that previously thrived, such as Fintech and Healthtech.

This trend raises crucial questions about the reliability of TVPI as a metric for assessing VC performance and guiding LPs. The apparent disconnect between past valuation practices and the current market reality necessitates a deeper examination of TVPI's efficacy in reflecting genuine investment value amidst such volatility.

Discussions with GPs reveal a looming wave of valuation adjustments. Factors contributing to this include a higher threshold for securing follow-on capital and a significant portion of companies poised to seek funding in a tightened capital environment. The combination of these elements, along with a discernible slowdown in capital deployment and an increase in startup shutdowns, underpins the anticipation of a major TVPI reset in 2024.

Despite these challenges, there are emerging positive signals, such as an influx of called capital in early 2024 and a potential revival in the IPO market, buoyed by successes like the Reddit IPO. These developments, coupled with a lagged correlation between public market rallies and VC market rebounds, hint at a gradual recovery phase that could reshape investment strategies and valuation paradigms, ultimately affecting TVPI calculations.

For LPs (and arguably GPs as well), the evolving market dynamics underscore the need for a nuanced understanding of TVPI's limitations and potential as an evaluative tool. The anticipated reset in TVPI underscores its sensitivity to broader market fluctuations and the importance of contextual analysis when interpreting its indications. LPs must therefore consider a range of factors, including market trends, sector-specific dynamics, and individual fund strategies, to assess the relevance and reliability of TVPI in the current climate.

We recognize the imperative need for a deeper understanding of benchmarking practices within our community. To this end, we're planning a focused session on benchmarking.

This will include interpreting benchmark reports, understanding LPs' performance metrics, and integrating benchmarks into fundraising strategies. The aim is to equip our community with the insights needed to effectively compare their funds with peers and market standards. We invite you to pre-register!

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

0100 Conference Europe | 📆 16 - 18 April | 🌍 Amsterdam, Netherlands

TechChill Riga 2024 | 📆 17 - 19 April | Riga, Latvia

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany