Everyone’s building fund models. Few trust them.

12 weeks to turn your fund model from a guessing game into a decision-making tool.

We asked a group of GPs and emerging managers a simple question:

What keeps you up at night when building your fund model?

The answers came fast — and familiar.

Assumptions. “Unrealistic,” “biased,” “too clean.” Turns out the art of modelling isn’t math — it’s judgment.

Pacing & reserves. Where intuition meets discipline — and optimism dies.

Exits. Everyone knows it’s a black box, yet we still try to model it.

Sensitivity. Most models are static snapshots when they should be living systems.

Cashflow dynamics. Circular references, multiple closes, timing chaos.

Everyone’s building fund models — few trust them.

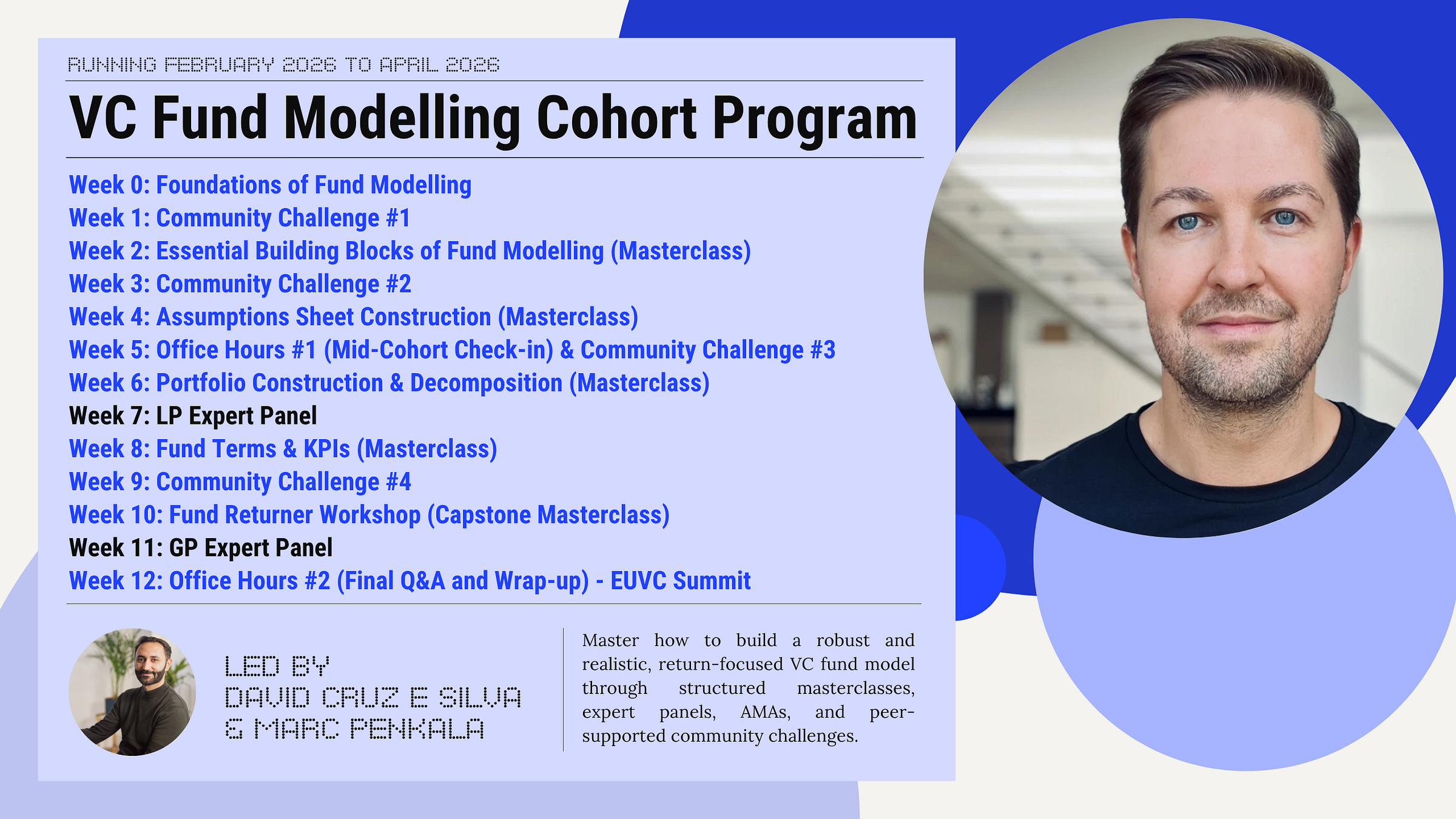

That’s the tension behind the Fund Modelling Cohort — 12 weeks of fund modelling, four sessions led by Marc Penkala (āltitude) and David Cruz e Silva (EUVC). Four Community Challenges to ensure theory becomes practice. Two Expert Panels with LPs and GPs.

Designed for GPs who actually want to trust their model again.

Together, we’ll unpack the truth filters of a solid fund model:

Clarity of assumptions — the storyline behind the numbers.

Realism of pacing & reserves.

Exit logic that doesn’t rely on fairy tales.

Fund modelling isn’t about formulas — it’s about judgment, calibration, and feedback loops.

P.S. You can also start small (just email david@eu.vc):

Get the Essential Building Blocks presentation.

Watch the first 30 minutes free.

Then decide if you want to go all the way.