Four of Europe’s leading VCs: AI Is Leading Us To A Seemingly Inescapable Dystopia

With the potential of AI being both utopian and dystopian, the choices made by VCs, Founders and Policy Makers today will undeniably shape our collective future.

In our recent roundtable discussion on the Impact of AI, the Partners of four of Europe’s leading Venture Capital firms Fred Destin, Founding GP of Stride.VC, Claude Ritter, Founding GP of Cavalry Ventures, Ekaterina Almasque, GP of OpenOcean and Dr. Andre Retterath, Partner of Earlybird Venture Capital discussed the societal implications of the rapid advancement of artificial intelligence and our role as venture investors.

Watch the full recording here, this section starting at 52:30 or listen to the audio version on Spotify/Apple 🎧

While we’re inherently optimistic and this conversation likely emphasized the dystopian aspects more than all the good things AI may herald, it’s worth to pause for a second and ponder what we can and should do. Let’s get into it.

A Seemingly Inescapable Dystopia and VC’s Responsibility

Fred Destin, known for his candid observations, commenced with a balanced view, recognizing the vast potential of AI as evident from DeepMind’s application in Google, resulting in a 40% reduction of data center costs. However, he swiftly pivoted to a bleaker assessment of AI’s implications.

Destin painted a dystopian future, drawing parallels between the tech community’s "move fast and break things" mantra and the current approach to AI. By likening the inadvertent and severe repercussions seen in platforms like Facebook on democracy, media, and public information access, he forecasted a similarly turbulent path with AI, especially concerning the job market.

Highlighting the historical shifts from agrarian societies to industrial ones and the current transition from white-collar jobs to an undefined 'X', Destin opined that the tech industry, particularly VCs, might be grossly underestimating the speed and scale of AI-induced job losses. These losses, he fears, might spur societal disruptions on an unprecedented scale, leading to potential unrest and even riots. Or as Fred put it:

So I don't think robots will kill the planet, but I do think that a very large number of people will be displaced out of a job very quickly, and I think that the tech community is a little bit in denial of its impact, and it puzzles me, Because … Look back at Facebook and you move fast and break things. They fucking broke everything. It was like, whatever we learned from the past 20 years in terms of what we did to democracy, media, citizen participation in information, apply that to jobs going forward. And so I think there is a looming issue that is absolutely enormous. And I think that whatever explanation I've heard around driving knowledge work and creating new jobs, I don't think it will be able to absorb the shift that we're talking about. The problem is the speed and the magnitude. So in the long term, we'll all be dead. In the short term, we might have riots. In other words, the long term doesn't matter. I'm worried about the next 25 years.

Destin’s most poignant remark, however, targeted VCs directly. He drew attention to the prevailing trend where VCs continually drive companies to maximize value, often at the expense of societal interests.

This, he emphasized, may lead to a future where the relentless pursuit of value might amplify societal fractures.

"VCs will tend to drive companies to maximum value. That is not very often aligned with maximum societal interest."

Fred Destin

The Value Divide and the Coming Disruption

Echoing Destin’s sentiments, Andre Retterath provided insights into the ever-widening gulf between the rich and the poor, exacerbated by the power law distribution inherent in the venture capital world. He warned of a scenario where giants like Microsoft could harness AI to further cement their dominance, thereby displacing a vast segment of the workforce.

"We will see even more value creation by very few players. And many people will be displaced in their jobs … The gap between the rich and the poor will continue to increase."

Andre Retterath

His concerns extended to societal fabrics, especially in countries like Germany. With older employees in traditional sectors potentially resisting change, he stressed the imperative need for venture capitalists and tech founders to adopt a more inclusive vision when steering AI's trajectory.

The Dual Edged Sword of AI

Claude Ritter's provided a more optimistic outlook but still concluded:

"It really bugs me that, that we're, you know, running into something that we clearly have no answers for yet."

Claude Ritter

Ekaterina Almasque's globally-informed perspective provided nuanced arguments. While Ritter sees challenges as opportunities, hoping to counterbalance AI’s exponential trajectory with proactive solutions, Almasque fears the centralization of knowledge underscoring the potential loss of cultural diversity, with AI models primarily focusing on English.

"There is a real threat of languages disappearing in the future because everything is in English."

Ekaterina Almasque

A Final Word: The Crucial Role of Venture Capitalists

Wrapping up the discussions, Fred Destin emphasized the critical role of VCs in this narrative. He introduced the compelling concept of "intentional venture," urging VCs to be more conscious and purpose-driven in their investments. It is incumbent upon VCs to ensure that the relentless drive for profitability does not lead to a dystopian society devoid of jobs and replete with unrest.

“We've toyed with this idea of intentional venture. So in other words, can we filter the companies by intentionality? Intentionality of the founder, intentionality of the product, and most importantly, intentionality of the reward, of the incentives, because the world works on incentives. So how can you change incentives and to what extent can we bake that into how we think and invest?”

Fred Destin

This roundtable discussion serves as a clarion call to the venture community to introspect and recalibrate. With the potential of AI being both utopian and dystopian, the choices made by venture capitalists, founders and policy makers today will undeniably shape our collective future.

Feel you must be able to level up your LP game? 🤖 Read on to learn how Affinity can help you.

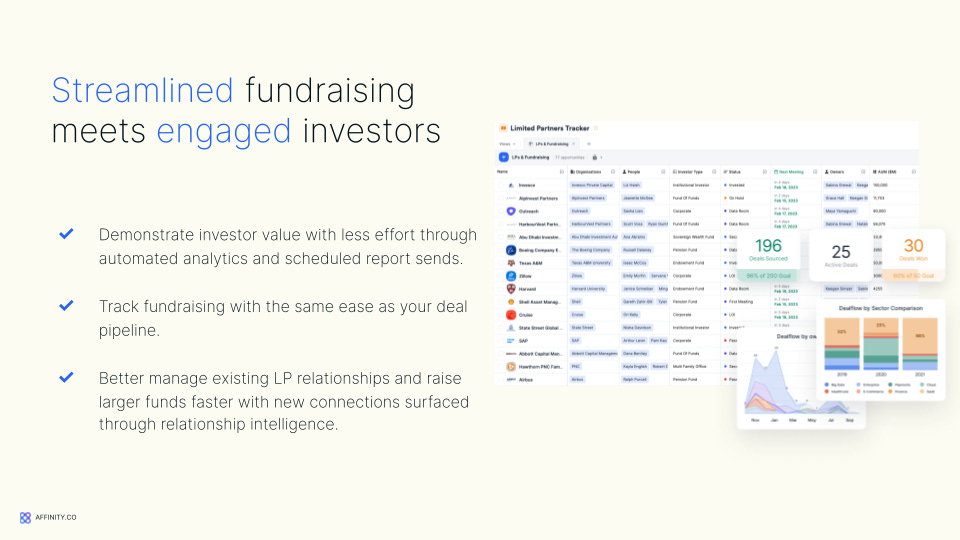

As a VC, you know that it is important to demonstrate value to your LPs. This means providing them with clear and consistent updates on the progress of your funds.

Affinity can help you do this by providing you with powerful reporting and analytics tools. With Affinity, you can quickly create reports on your activity, deal pipeline, and engagement with founders. You can also use Affinity's analytics tools to tell a clear story about your team's successes to current and prospective LPs.

Here are some specific ways Affinity can help you demonstrate value to LPs:

Create clear and concise reports: Affinity Analytics makes it easy to create reports that are tailored to your LPs' specific interests. You can easily filter and sort data, add custom charts and graphs, and customize the look of reports to keep everything engaging and on-brand.

Save time and resources: Affinity's automated reporting tools can save you a significant amount of time and resources. This means that you can focus on more important tasks, such as sourcing deals and managing your portfolio.

In addition to providing clear and consistent updates, it is also important to build strong relationships with your LPs. Affinity’s relationship intelligence platform is designed to help you build new connections and nurture your most important LP relationships. Affinity analyzes your firm’s collective network to identify paths to warm introductions and opportunities to connect with new LPs.

During fundraising, your engagement history and notes combine with Affinity’s enriched data to help you shortlist your most promising investors by criteria such as thesis relevancy, previous investments, or history of interest, and ensure that your outreach speaks directly to your audience. You can continue to track investment status and engagement by both organizations and individual investors throughout your raise, so you know where to best devote your time and resources.

With Affinity, you can demonstrate value to your LPs and build the strong relationships you need to quickly secure capital for future rounds.