In this episode of the EUVC podcast, Andreas discusses with Will Prendergast, Partner at Frontline Ventures.

With ~€435M in assets under management, Frontline Ventures is a venture investment firm that operates two distinct funds:

Frontline Seed: A €100M fund targeting pre-seed and seed-stage European companies with clear U.S. expansion intentions.

Frontline Growth: A €100M fund focusing on Series B up to D in U.S. companies planning to expand to Europe within 12-18 months.

Frontline Ventures, with offices in UK, USA and Ireland, specializes in B2B SaaS and Deeptech sectors. The firm's position allows it to bridge the gap between European and U.S. markets, providing valuable support for companies looking to expand across the Atlantic in either direction.

As a Partner at Frontline Ventures, Will Prendergast offers us a distinctive perspective on European and U.S. venture landscapes. His insights on early-stage investing in Europe and growth-stage opportunities for U.S. companies expanding to Europe are sure to be valuable for anyone interested in transatlantic venture capital's current state and future.

Notable investments: Workvivo (acquired by Zoom), SignalAI, Finbourne, Lattice, MosaicML (acquired by Databricks), Navan.

Watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation available on the Spotify/Apple episode.

How to Web Conference is the leading startup and technology conference in Eastern Europe. The 2024 edition takes place on October 2-3 in Bucharest and gathers over 3,000+ builders and visionaries from the industry, including world-leading venture funds, global speakers, and the most eager Eastern European founders.

The complete experience includes side events like Venture in Eastern Europe, with over 200 European investors, or Founders Summit, gathering founders and investors on October 1st.

As conference partners, we invite you to join us with a 10% ticket discount. Apply the following code when registering, and a 10% discount will be applied to your cart: EUVC10.

✍️ Show notes

We normally only give you notes by our guests, but this conversation spun out of control diving into Fronline instead of the planned topic. So for that reason, this time around, our core learnings are intermixed with Will’s notes.

Frontline Ventures: Investing on Both Sides of the Atlantic

Frontline Ventures has a unique dual strategy: a Seed fund focused on European companies expanding into the U.S. market and a Growth fund that backs U.S. companies entering Europe. This two-way approach gives Frontline deep insights into both markets, positioning them as experts in cross-continental growth.

A Contrarian Belief: You Can’t Be a Top European Investor Without U.S. Expertise

To be a top-tier European investor, you must also understand the U.S. market intimately. The U.S. accounts for 51% of global software spend and nearly 60% of global venture capital deployment, making it a critical battleground for any company or investor looking to lead in the B2B space.

Why Frontline Operates Differently

Unlike many firms that follow their seed investments with later-stage funding, Frontline’s growth fund exclusively invests in U.S.-based companies expanding into Europe. This creates a transatlantic flow of capital, where their seed fund helps European founders expand into the U.S., while their growth fund supports U.S. companies coming to Europe.

Investing in Europe with U.S. Insights

Frontline’s dual approach also allows them to continuously benchmark European companies against their U.S. counterparts. By constantly assessing both markets, Frontline can identify when European companies have the potential to outperform U.S. competitors or when they need to make strategic moves into the U.S. to stay competitive.

Fostering Two-Way Relationships with U.S. VCs

Prendergast highlights that Frontline’s growth fund helps them form meaningful, two-way relationships with U.S. VCs. By investing in the U.S. alongside top firms and helping those companies enter Europe, Frontline is no longer simply asking U.S. VCs to look at European deals—they’re collaborating on cross-border growth.

Creating a Seamless Market Bridge

This strategy gives Frontline what Prendergast calls “complete visibility” across both the U.S. and European venture ecosystems, allowing them to guide founders on both sides of the Atlantic in building global category leaders.

Why founders chasing unicorn status need to be successful in both European and U.S. markets.

B2B tech companies cannot become category leaders without cracking both markets: Europe and the U.S. combined make up 70% of global software spend and 70% of global venture capital dollars.

European founders need to think about the U.S. early as it is the largest single market for B2B tech and venture capital.

The U.S.’s domestic market accounts for 51% of global software spend.

$171bn of venture funding was deployed in the U.S. in 2023, which is close to three times the amount deployed in Europe.

U.S. expansion is fundamental for success, but attracting talent, securing investment and establishing a brand in the new territory is incredibly difficult and founders need a lot of support to break the market.

Patterns in U.S. launches among entrepreneurs who have successfully crossed the pond include the most popular locations and time zones to launch in and priorities for the first hires.

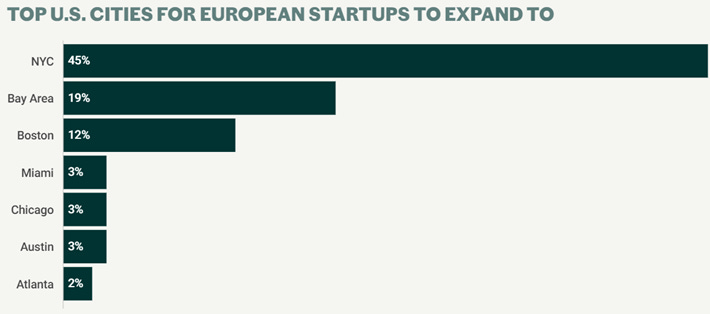

Time zone: Many European founders assume U.S. expansion means Silicon Valley, but just 19% land there. Analysis of over 200 B2B companies as part of Frontline’s U.S. Playbook found that New York City is the most popular destination for European startups, with 45% setting up in the city. The vast majority (70%) choose a location running on Eastern Time, so Boston is another popular destination (12%).

Strong sales teams: Analysis of 10 successful startups’ hiring strategies when launching in the U.S. found seven of these hired at least five sales roles in their first 10 hires. Understanding which positions will bring the most value at the time of launch is important given the rate at which teams scale.

Early junior hires: 60% of the companies analysed hired junior and mid-level employees for their first three hires. Only 30% hired an executive in their first hires. This focus on junior and mid-level hires indicates the difficulty of making successful senior or executive hires in a non-HQ location. Instead, many founders opt to transfer existing senior talent to the U.S., which not only ensures experienced leadership but also helps in establishing key company values and culture in the new office.

Biggest mistakes: underestimating the cost, you should expect that you need 18 months of runway for that market when doing it. Make sure you have real benchmarks. Many go in having allocated 50% of what they end up needing.

CEO has to commit to be in the market 50% and minimum 30% of the time. The success rate correlates highly with this.

How the pandemic has delayed startups’ physical launch into the U.S. by a year on average.

Pre-Covid, startups expanded to the U.S. after 4 years of operation, on average, but since 2020, that has increased to five years.

This is because some companies paused their expansion entirely or postponed taking physical premises in the U.S.

As the world became more receptive to working remotely, some founders decided to go down this route. The shift in attitudes towards more dispersed teams meant organisations could hire a U.S.-based team without having office space more easily and delay physical expansion until later in their growth.

The person behind.

Honesty is an advantage in life – it's not just a good thing to do.

Experience: Watching venture firms succeed and then fade out. This caused me to want to create a learning organization that existed beyond the founders

Kauffman Fellows Programme resulted in me doing a lot of personality tests. It really helped build self-awareness about what I enjoy, what motives me and how others perceive me.

Philosophy: Improve your weaknesses but perfect your strengths.…

Three biggest learnings in venture

Team is everything (natural bias is to forget) - have some examples to back this up

Exit/Ambition alignment is the difference between good and great outcomes

As a VC fund you need a great product for LPs not just for founders

Strongly held belief you’ve recently had to change your mind on.

As a seed investor, you can identify your winners early and double down on them in follow-on rounds. No longer believe to be true as you can’t tell so early what winners will be.

I believed that investing and operating in/from Europe alone you could win in VC. I no longer believe that. At least in the technology industry. You need to have proper visibility into what is happening in U.S. and possibly APAC.

There is no good test for ambition during a fundraising process as people tell you what you want to hear and ambition will change over time. I used to believe that. I now believe if you can understand people's motivations, it will tell you what you need to know about ambition.

Tips & tricks for emerging VCs fundraising.

Spend more time in the qualification phase of who you want to meet rather than trying to get meetings with LPs who are unlikely to invest

If a first time fund get in the game anyway you can. Moving from powerpoint to first investments will change how LPs look at you.

You are most likely to find new LPs through your existing LPs. Mine your existing LPs for all useful contacts.

The fundraising process is much more relationship driven than people think (and as result less performance driven). Figure out who you get on with and work closely with them.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

🧠 Upcoming EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

VC Portfolio Management: Capital Deployment and Reserve Planning

📅 Tue, September 24 | 4:00 PM - 6:00 PM CET | Lecturer: Anubhav Srivastava, Tactyc

Venture Debt: Structuring & Deal Terms

📅 Tue, October 8 | 11:00 AM - 1:00 PM CET | Lecturer: Hemal Fraser-Rawal

Benchmarking Session for GPs & LPs

📅 TBD - preregistration open now | Lecturer: To be announced 🤫

Got ideas or requests for future topics to cover? Let us know here.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

Bits & Pretzels Investor Summit | 📆 30 September | 🌍 Munich, Germany

How to Web | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 October | 🌍 Dubai, UAE

Invest in Bravery | 📆 21th of October | 🌍 Kyiv, Ukraine

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

culttech summit | 📆 5-6 November | Vienna, Austria

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany