In this episode, Andreas Munk Holm talks with Karma Samdup, Head of Private Funds and Venture in Europe in Haynes Boone's London office, and Vicki Odette, Partner in Dallas and New York, at Haynes Boone. They discuss the legal considerations in launching and managing venture capital funds. They also provide a detailed overview of key issues such as fund structuring, regulatory compliance, cornerstone LP dynamics, GP commitments, default provisions, and expense policies. They also discuss practical guidance on compensation models for key employees, using side letters, and negotiating with different types of investors.

Here’s what’s covered:

03:59 The Importance of Legal Expertise in Fund Management

10:58 Key Legal Considerations for Fund Managers

26:31 Navigating LP Negotiations

35:57 Effective Communication with LPs

40:48 Compensation Strategies for Key Employees

45:00 Hiring from Competitors: Best Practices

47:11 Protecting Your Firm from Departing Employees

Watch it here or add it to your episodes on Apple or Spotify 🎧, with chapters for easy navigation available on the Spotify/Apple episode.

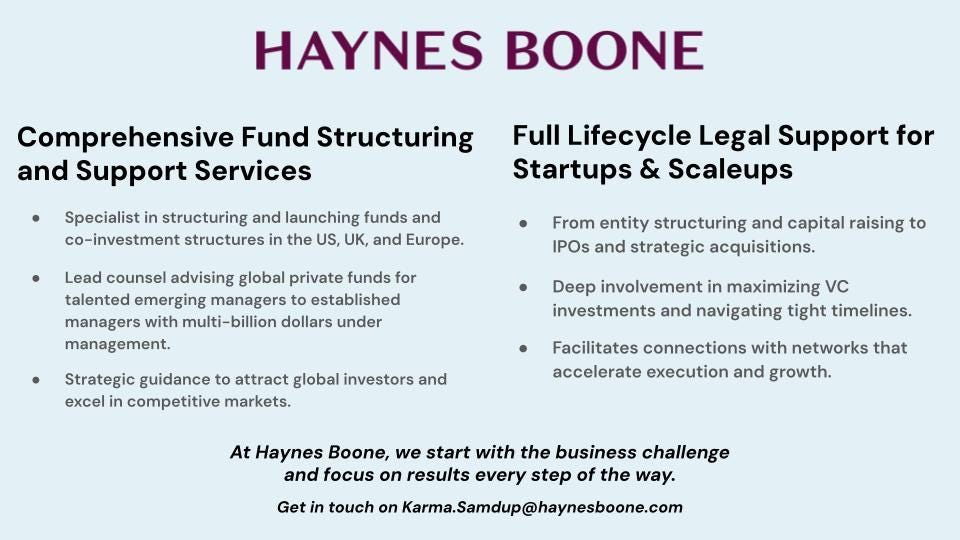

We’re proud to welcome back Haynes Boone as the official sponsor of the Firm of the Year category at the EUVC Awards.

Haynes Boone brings deep expertise in fund structuring and full lifecycle legal support for VCs, GPs, LPs, and startups across the US, UK, and Europe. As trusted advisors to emerging and established fund managers alike, they know what it takes to build and scale in competitive markets, making them the perfect backers of this high-caliber award.

Whether you're launching Fund I or navigating late-stage growth, Karma, Vicki, and the team at Haynes Boone are ready to help you.

✍️ Show notes

Legal Issues in a Fund Launch

Each jurisdiction has specific tax and regulatory implications that affect how the fund is marketed and structured. Transparent limited partnership structures are standard and expected.

Legal documentation, such as LPAs and regulatory compliance, needs to reflect jurisdictional requirements. Legal advisors recommend avoiding generic or platform-generated documents due to the risks associated with non-standard terms and reduced LP confidence.

GPs vs. LPs Dynamics

Haynes Boone highlights the importance of understanding the perspectives of the general partner (GP) and limited partner (LP). They work with both sides, allowing them to guide managers through negotiations with deep insight into what LPs typically require and what is considered market. This includes navigating side letters and special provisions and helping emerging managers prepare for questions LPs will ask.

Being aware of institutional LP expectations is critical, particularly regarding alignment and trust. The legal team often advises GPs on how to avoid creating obstacles in the documents that might deter LPs, such as unclear language or off-market terms. Their experience negotiating with LPs provides unique foresight into what provisions may become points of contention or red flags.

Platforms vs. Boutique Legal Advisory

While platforms like AngelList, Carta, and others offer low-cost fund setup solutions, the Haynes Boone team focuses on the irreplaceable value of expert legal advice in fund formation. Platforms are particularly useful for micro funds aiming to launch quickly, but they may fall short in more complex scenarios requiring deep legal and regulatory insight.

Experienced legal counsel is especially crucial when negotiating nuanced terms with LPs, structuring carry, or dealing with regulatory obligations. A boutique advisory firm can identify pitfalls, craft bespoke solutions, and ensure that fund terms align with both market expectations and the manager’s long-term goals—something templated tech platforms cannot reliably offer.

Key Legal Priorities for Fund Managers

Managers should prioritize creating a robust and market-aligned legal document set, including private placement memoranda (PPMs), partnership agreements, and side letters. While skipping a PPM might seem like a cost-saving measure, it undermines both LP protection and the manager’s legal defense in case of future disputes.

The legal documents should be protective and promotional, helping sell the fund by outlining strategy, background, and track record. Relying on standard documents or internet-based templates can backfire, especially with institutional LPs who expect sophisticated and customized documentation.

Fund Economics & Team Dynamics

A clearly defined strategy and team structure are fundamental legal and commercial considerations. Fund documents must specify the key persons and detail their roles and responsibilities. These designations directly influence provisions like 'key person events,' which can trigger fund pauses or renegotiations if a key individual leaves.

The team’s structure and experience are central to LP confidence. LPs often dictate who they consider irreplaceable; the legal documents must reflect this through tailored key person clauses. Ambiguity or lack of agreement on internal roles can result in conflict or funding complications later.

Side Letters & Special LP Provisions

Side letters are a standard tool for customizing terms for significant or cornerstone LPs, but they require careful drafting. Common requests include fee discounts, carry reductions, co-investment rights, and increased reporting transparency. To avoid operational or legal issues, these terms must be aligned with the fund’s economic model.

Seed investors may demand benefits that extend to future funds, which can inadvertently lock a manager into unfavorable terms over multiple vintages. Managers are advised to think long-term and avoid overcommitting in the excitement of securing a large initial check. Legal advisors play a key role in mitigating these risks.

Best Practices in LP Communication

Effective communication with LPs regarding capital calls is essential to prevent defaults and ensure smooth fund operations. Providing advance notice, beyond the minimum required in legal documents, can help individual or less institutional LPs prepare for capital deployment.

Managers can also consider facilities like subscription lines or NAV-based loans to manage liquidity and reduce reliance on unpredictable LP cash flows. Clear, predictable communication about expected call timelines builds trust and operational efficiency.

Employee Compensation

Fund managers must choose between granting direct carry participation or using phantom equity structures to compensate key employees. Each option has different implications for vesting, alignment, and tax treatment. Vesting schedules typically include a cliff followed by time-based vesting to encourage long-term retention.

Legal contracts should also include provisions for good vs bad leavers, performance criteria, and protections like non-compete and non-solicit clauses. A carefully designed compensation structure aligns employee incentives with fund success while preserving the GP’s long-term equity value.

Hiring From Competitors

Before hiring from a rival fund, managers must review any non-compete, non-solicit, or intellectual property clauses in the candidate's existing contract. Failure to do so could expose the hiring firm to legal action or reputational damage.

To mitigate risk, buyout arrangements can be structured as promissory notes that are forfeited if the employee breaches obligations. Understanding prior compensation and carry participation is also key to designing a competitive and legally sound package for new hires.

Some things are made for platforms - music, cabs & pizzas. But fund solutions aren’t one of them. Their individual client focus and regulation-first approach is your guarantee for flexible solutions accommodative to a broad range of deal and client specifics. The kicker? Prices that match any of the shelf-products in the market.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

💬 Community event | LP AMA with James Heath | ⏰ May 19, 1:00 PM - 2:00 PM GMT+2 | 💻 Online

Ever wonder how LPs actually think about fund strategies, especially in a world leaning toward specialisation? Join our next members-only LP AMA with James Heath, Investment Principal at dara5 and author of Why Specialists Will Win the Next Decade of Venture.

This is a small-group, interactive session where you’ll get the chance to ask candid questions and hear James’s unfiltered take on where LPs are placing their bets—and why.

Why attend?

Hear directly from a leading LP who’s investing in both specialist and generalist VC funds across Europe

Learn how LPs evaluate fund strategies—and why some are doubling down on focused, high-conviction theses

Get a behind-the-scenes look at what’s working in European VC, what’s not, and what LPs are watching next

Available for Members Only, become a member by upgrading to a paid subscription below

Join us at the EUVC Summit & Awards Show

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

0100 Emerging Europe 2025 | 📆 14-16 May 2025 | 🇭🇺 Budapest, Hungary

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🇩🇪 Berlin, Germany