How investors spot red flags in deep tech startups

Essential tactics for cap table structuring, reducing startup risks, and avoiding grant reliance, from our dear friends over from First Momentum Ventures

First Momentum Ventures (First Momentum), a VC fund in EUVC's portfolio, recently hosted the event "Clueless about VC Red Flags." It brought together First Momentum's Ana Koller, head of research, alongside David Meiborg, also from First Momentum, Steven Jacobs Venture Partner & CPO at Lakestar and Paul Klemm Partner at Earlybird.

The insights we extract from moment like this with our portfolio GPs aren't just informative; they're a playbook for smarter investing. As such, we thought we should share. After all, sharing is caring ❤️.

Hosted by First Momentum, content spiced up with love by eu.vc

TL;DR/V

Cap Table Management: It's vital for investors to guide founders, especially those from research backgrounds, in managing their cap table effectively. This involves balancing equity distribution to keep founders motivated while accommodating investors and partners.

De-risking Strategies: Investors should encourage the development of MVPs and early market fit validation. Aligning technology with market needs is crucial for reducing risks and attracting further investment.

Countering Grant Hypnosis: To combat the complacency often associated with grant funding, investors must instill a sense of urgency and business savvy in founders. This includes setting aggressive milestones, tying funding to these milestones, and fostering a culture of rapid iteration and market responsiveness. Encouraging commercial partnerships and exposure to entrepreneurial networks

can also help transition startups from a research to a business focus.

For Scientist-Founders: If you happen to be a scientist founder reading this investors focused newsletter, you might be interested in becoming a member of "Clueless No More." Learn more and join the network.

The crux of the discussion centered on identifying and understanding the 'red flags' in early-stage startups, especially those born within the walls of universities and research labs. These are not your run-of-the-mill startups; they are entities born from cutting-edge research and innovation, where the line between groundbreaking success and high-stakes failure is exceptionally thin.

Key among the topics was the importance of managing cap tables—a critical aspect often overlooked but vital for long-term success. The discussion illuminated the common pitfalls such as disproportionate equity for non-operative founders or university tech transfer offices, single-founder setups lacking diversified skill sets, and startups without a clear market-problem fit.

The conversation also touched on the lesser known topic of 'grant hypnosis' - a state where startups become overly reliant on grants, losing sight of the commercial viability and scalability of their ventures. This phenomenon is particularly prevalent in deep tech startups emerging from academic settings, where the transition from research to market can be fraught with challenges.

Investing in deep tech startups

Investing in deep tech startups is as much about understanding the future as it is about evaluating the present. It presents an interplay of risk assessment, visionary thinking, and strategic evaluation. For investors, it’s about identifying those rare gems that have the potential to not just succeed but redefine the landscape of technology and industry. To navigate deep tech innovation angels and VCs must possess a blend of analytical rigour and intuitive foresight.

Due to the high volume of potential investments, VCs often employ fast, heuristic methods in evaluating startups. Deep tech startups, often emerging from the realms of intense scientific research and cutting-edge technology, offer a unique challenge. They frequently operate in fields with long development timelines and high capital requirements. This necessitates an investment approach that's not just about funding but also about understanding the complex nature of technologies involved.

The primary lens through which these startups are evaluated is their potential to revolutionize industries or create entirely new markets. The assessment isn’t confined to the present capabilities but extends to envisaging the future impact. This forward-looking approach is crucial in deep tech investments due to the nascent stage of many technologies and markets involved.

The concept of founder-market fit is particularly crucial in deep tech. Investors seek founders who not only possess deep technical expertise but also a profound understanding of the market. The synergy between technological prowess and market insight can significantly enhance a startup’s prospects.

Emphasis is placed on the diversity and complementarity of the founding team’s skill sets. A team that collectively covers the spectrum of necessary skills – from technical expertise to business development and market understanding – is often seen as better equipped to navigate the challenges of growing a deep tech venture.

Successful deep tech startups often exhibit a balance between technological innovation and commercial acumen. The founding team should ideally encompass both technical and business expertise, ensuring a well-rounded approach to both product development and market penetration.

Finally, investors look for a clear, long-term vision and scalability in deep tech startups. The path to market for deep tech products can be long and winding, requiring a vision that encompasses not just immediate milestones but also long-term scalability and impact.

Read on for my take on why deep tech matters 👇

Red Flag 1: The cap table

Deep-tech startups, often originating from university or research spin-offs, present unique challenges in cap table management due to their inherent focus on groundbreaking technology and the often complex nature of their founding teams. Central to these challenges is striking a balance between founder equity and contributions from academic circles.

Founder Equity and University Contributions

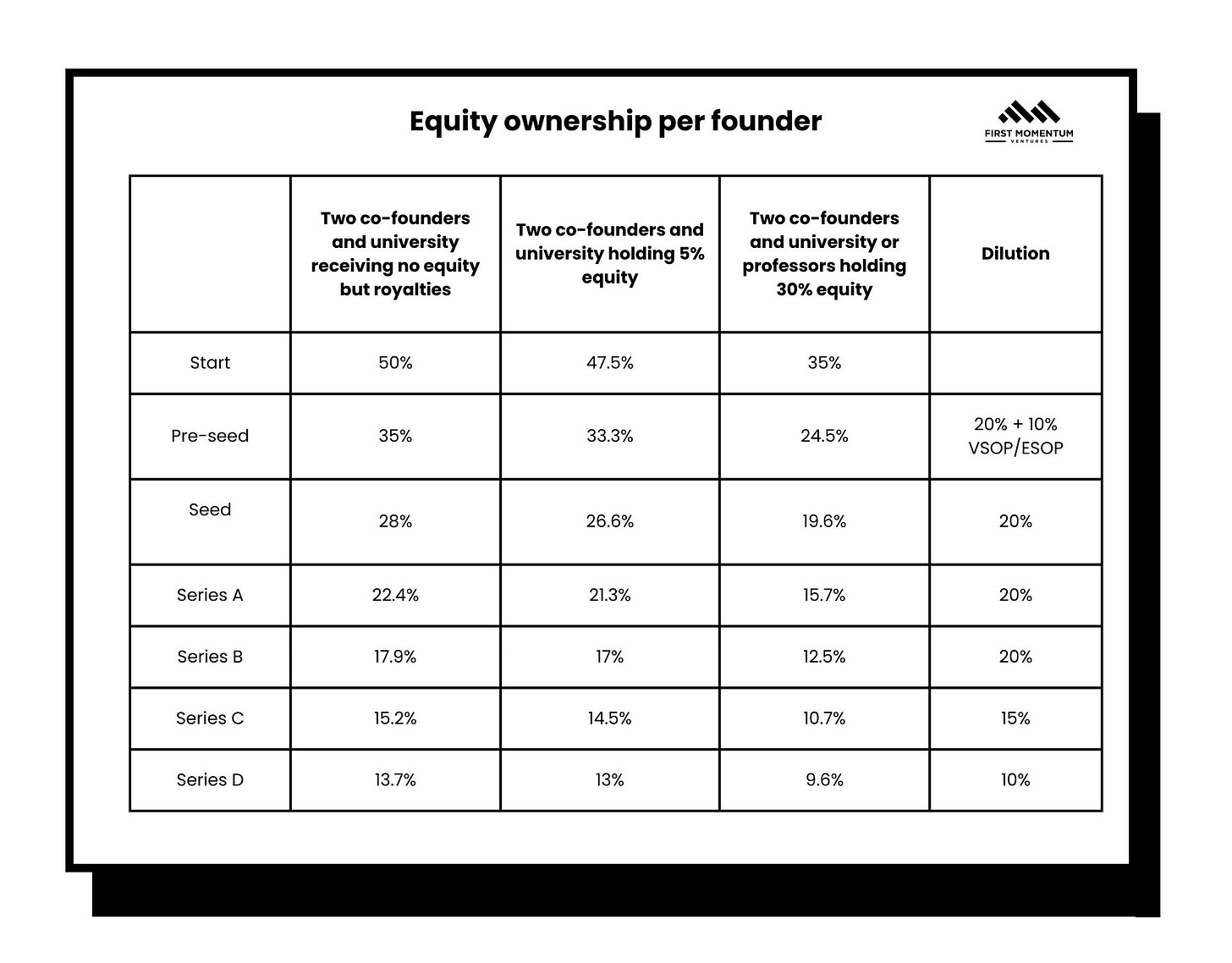

A common feature in the cap tables of deep-tech startups is the presence of equity allocated to professors, as well as academic founders, universities, or research institutes. This arrangement, while necessary, can be a double-edged sword. From an investor's perspective, maintaining an equitable and balanced cap table is imperative. The red flag arises when non-operational founders or academic entities hold excessive equity. Such imbalances often hint at potential conflicts of interest and misaligned incentives, which can be detrimental to the startup's growth trajectory.

It is essential for founders to engage in open dialogues with academic partners and investors, underscoring the long-term benefits of holding a smaller stake in a potentially thriving venture. Convincing professors and research institutions to accept lesser equity in exchange for the promise of future prosperity requires tactful negotiation. It’s a delicate dance, aligning the aspirations of academic brilliance with the practicalities of the business world. Drawing inspiration from models like Stanford University, which has set successful precedents in equity distribution, can guide these discussions.

Cap Table Reorganisation

Investors play a critical role in guiding deep-tech startups through the complex process of cap table restructuring when necessary. This often involves advising on buybacks of equity from non-core founders or renegotiating terms with universities or early-stage incubators. Specifically, it's important to manage university equity share, which investors typically prefer to see capped between 10-15%. The goal is to create a cap table that is attractive to future investors and sustainable for long-term growth. This support becomes crucial, especially when startups face intricate decisions about equity dilution and founder vesting in subsequent funding rounds.

[…] it's important to manage university equity share, which investors typically prefer to see capped between 10-15%.

A critical aspect often discussed in these processes is the potential dilution of founders' stakes. A skewed cap table can lead to disproportionate founder dilution, significantly reducing their long-term incentive to stay committed to the startup. This situation poses a serious concern, as founders, facing dwindling equity, might contemplate abandoning their entrepreneurial path for more lucrative roles in established corporations. Therefore, ensuring that founders retain a meaningful equity stake — while balancing the interests of academic partners and other early stakeholders — is pivotal in keeping them emotionally and financially invested in their venture's success.

Red Flag 2: De-risking the business

De-risking deep tech startups requires a multifaceted approach. It involves understanding the unique landscape of deep tech, emphasising value demonstration to customers, employing scientific methods in business development and embracing risk. And yes, cap table management again, which we’ve just expanded on ☝️ as well.

Deep Tech Dynamics

Deep tech startups typically experience a prolonged phase before generating revenue, primarily due to the complexity and innovation of the technology involved. This extended development period demands that investors adapt their strategies to accommodate longer gestation periods, focusing more on technological milestones and less on immediate revenue streams.

Customer Value

Demonstrating value to customers early on is crucial for de-risking deep tech ventures. While immediate revenue may not be feasible, indicators of customer interest, such as engagement and commitment to future collaborations, are vital. A team member with a commercial mindset can play a pivotal role in aligning the startup with market needs and customer expectations.

Scientific Methodology in Business

Deep tech founders, often rooted in scientific backgrounds, are well-equipped to apply a scientific approach to their business strategies. This method involves hypothesizing about market fit, experimenting with various applications, and iteratively solving problems based on feedback. This structured approach can significantly improve the startup's chances of success, offering a clear pathway through the complex landscape of deep tech innovation.

Embrace risk

Investors should actively encourage a culture that not only embraces rapid iteration and experimentation but also sees value in learning from failures. This paradigm shift is essential for startups coming from a more conservative, research-oriented background. It is about cultivating a mindset where swift action, adaptability, and resilience are at the core of the company's culture.

Cap Table Management (again)

Returning to the concept of cap table management, it's vital to recognize its role in the broader de-risking strategy. A balanced cap table prevents founder dilution and maintains long-term incentives for continued innovation and company growth. Proper cap table management is not just about equity distribution but also about ensuring the sustained motivation and engagement of key stakeholders in the company.

Red Flag 3: Grant Hypnosis 🧟

This term refers to a state where startups, having secured early public funding, continue on a business-as-usual path, not fully embracing the radical shift in pace and mindset required for startup success. Grant hypnosis often manifests in a lack of urgent progress in deep tech startups. While initial public funding provides essential support, it can inadvertently create a comfort zone that dampens the entrepreneurial spirit. The expectation in the startup world, however, is a departure from business-as-usual. Once a company is formed, it should operate under a new set of dynamics where product and company development occur at an accelerated pace. This shift is crucial for startups to stay competitive and innovative.

Expectations

It is crucial for investors to communicate the sense of urgency and rapid pace that is quintessential in the startup ecosystem. This can sometimes be a cultural shift for founders who are transitioning from a methodical, research-centric environment to a fast-paced, business-driven world. Investors should work closely with these founders, aiding them in reshaping their outlook and approach to align with the entrepreneurial landscape's demands.

Milestone-based funding

A strategic method to ensure consistent progress and focus in startups is through milestone-based funding. This model is designed to link the infusion of capital directly to the achievement of specific, pre-agreed milestones. Such a structure ensures that startups are continuously working towards clear objectives, moving beyond the safety net of grant funding. This method not only encourages startups to make tangible progress in product development but also instills a discipline of goal orientation and achievement within the team.

Commercial partnerships

Another pivotal role that investors can play is in fostering connections between the startup and established industry players. These connections are not merely for networking; they are avenues for startups to gain vital market insights and validation. By forming these partnerships, startups can quickly adapt and evolve their products or services to meet real market needs and demands. This real-world feedback loop is invaluable in steering the startup towards market relevance and commercial viability, thus de-risking the business for future investors.

Networking

Introducing startup founders, especially those from scientific backgrounds, to entrepreneurial networks can really impact their journey. These networks are rich ecosystems comprising mentors, industry experts, potential customers, and peers who have navigated similar paths. For scientific founders, this shift from the academia's landscape, often characterized by high egos and a culture of perfectionism, to the startup world is pivotal. In the early stages of a startup, the 80-20 rule prevails, where rapid progress and practical solutions take precedence over striving for perfection. The primary goal shifts from personal acclaim to advancing the product and company swiftly. Being part of such a network opens numerous doors for learning, collaboration, and customer acquisition. It exposes founders to diverse perspectives and experiences, crucial in guiding their strategic decisions and growth trajectories, and facilitates the transition from academic rigor to the dynamic pace of the startup ecosystem.

Progress Reviews

Maintaining a regime of regular progress reviews and accountability checks is crucial. These reviews are comprehensive evaluations that go beyond assessing technological advancements. They delve into various aspects of the business, including the validation of the business model, customer acquisition strategies, market positioning, and scaling plans. By conducting these regular check-ins, investors can keep the startups aligned with their objectives, ensuring a consistent focus on growth and development.

Enjoyed these insights? These are the types of insights we uncover from being an LP, as investors don’t usually line up at our doors to share their insights. By marrying our investing, talking and writing, hopefully these learnings will help you on your journey in venture 💡 Want to explore more?

Good piece !!!