As an angel investor, both new and experienced, strategic portfolio creation involves considering long-term goals, risk appetite, geos, verticals, vintages your own expertise, and the balance between direct investments and fund investments. Let’s dive in 🤿

TOC // Read the core insights from the webinar below the video 👀

The Core Diversification Parameters

Selecting stage and ticket size

Geographic diversification

Vintage Diversification

Building your network

Employing Investment Platforms to Diversify

Adapting to Market Changes

Venture Capital Funds in Angel Portfolios

Watch the discussion between Andreas and Marc from Altitude 📽️

Fun note: we actually had scam attempt during the webinar causing quite some interruption. Luckily, we managed to carry through successfully. Hope you enjoy it 👀

The Core Diversification Parameters

A risk-balanced portfolio involves diversification across various parameters like stage, geography, currency, and business models. Balancing risk in your portfolio serves the purpose of giving you downside protection (i.e. it reduces the likelihood of returning less than 1x your investment) and increases the number of shots on goal (i.e. the number of potential outliers you’re exposed to).

💡 Key insights:

A portfolio's risk mitigation relies on diversifying investments based on multiple layers, including stage, geography, currency, and industry.

Early-stage investments (pre-seed, seed) carry higher risk due to greater failure rates, demanding careful allocation and consideration.

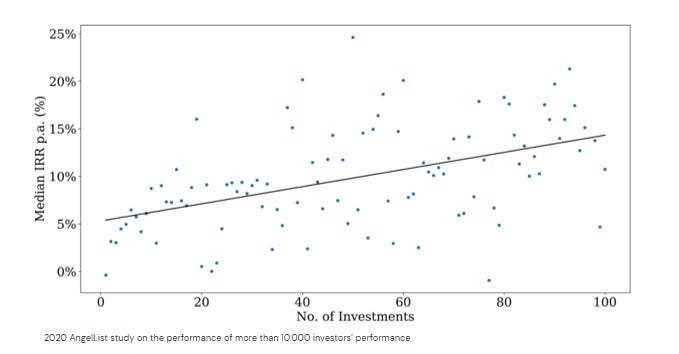

The data most people cite when it comes to arguing for a very diversified portfolio is the Angel List study from 2020:

On the eu.vc podcast, our Super Angel series explores the journeys and strategies of Europe’s super angels. To many people’s surprise, the majority of our guests do 5 - 15k€ checks and often have portfolios of 50+, some even numbering in the hundreds. You can listen to them all below 👇

Selecting stage and ticket size

As an angel investor, you’ll typically focus on early-stage investments (pre-seed, seed) as the early stages give you a sensible risk/return ratio without blowing up the ticket size required to be in the game. What is more, this is also where you’ll be able to have a meaningful impact beyond just capital and where your network and skillset can give you access to extra-ordinary opportunities (very rarely are late stage deals of high-flying startups offered to angels, unless you have a very special network optimized to grant you that - more on this later as we talk about the strategy of fund investing as an angel).

💡 Key insights:

Consider the size of your investments, the stage, geography, and business models that align with your expertise.

Some believe in ensuring that they cut meaningful checks for the startups as that allow them to influence decisions and maintain a meaningful stake even through later rounds.

The counter perspective to the above is that founders should be in the driver’s seat and if/when VCs come into later, you’re not in a position to do much as an angel should you have different incentives and goals from these. A note on this: don’t think you can engineer your way out of such situations together with a clever lawyer playing around with the term sheet. You just risk poisoning the startup altogether.

The strategy to protect against wipe-outs by later stage investors is to keep an eye on opportunities to sell early (more on this later) and, you guessed it, diversification. As an angel, you’ll have tons of externalities, it’s a matter of having exposure to the home runs that make up for all the ones where externalities wiped out meaningful returns.

Geographic diversification

As said, diversifying investments across different geographies reduces exposure to localized economic risks and fluctuations, however, executing on this without exposing yourself to the adverse selection problem can be tricky as you typically don’t have strong networks in these markets.

💡 Key insights:

Angel investors should not confine themselves to one region, considering macroeconomic factors, currency fluctuations, and localized challenges.

One thing to note; differences in investment practices, regulations, and even the use of investment structures like SAFEs should be carefully assessed when entering new markets. It’s also advisable to have some level of knowledge of local regulatory nuances, such as offshore entities and foreign exchange implications, contributes to informed investment decisions. I recall in the very first Super Angel episode we published, Roxanna Varza of Station F shared that she had overlooked the fact that a German investment would force her to travel to the German notary to finalize the deal, leading the deal to be held up for just a small check. Luckily, her money and value-add was worth it.

Geographical limitations are tied to available deal flow and network strength. An often applied approach to mitigate this is to start with familiar markets, be that familiar by geography, vertical or something else that’s idiosyncratic to you and allows you to access the hallowed halls of the top venture investors of a new geo.

When venturing into new markets, grasping the local market dynamics are essential. Active deal flow and an understanding of the market's ecosystem contribute to successful market entry. An example of this is the deep dive episodes we’ve done on the MENA region ahead of a 300+ delegation of European VCs and Angels going to Dubai for North Star in October (ping me if you’re interested in joining, I’d love to help you get a spot).

Vintage Diversification

Or in other words, how you avoid betting on the 🐂 when a 🐻 lurks on the horizon. We’ve just been through a reset in venture (and aren’t out yet) so vintage diversification is worth adding an extra note to. You probably know vintages from wine 🍷 and the concept is similar here: one year may be great, when another turns out to be less so. Though in whine it’s maybe a little more volatile as a rainy day can ruin a full year. In venture investing, it’s more about protecting against only being exposed to a set of vintages that end up getting caught up in a reset. In short; the implication for you angel portfolio creation is that you want to make sure that you’re not touristing into venture and devicing a strategy that will have you deploy all your investable capital in a short time span (e.g. within three or five years).

💡 Key insights:

Avoiding concentration in a single vintage prevents over-exposure to potentially unfavorable market conditions.

Spreading investments across different years mitigates the risk of being caught in a market bubble and encountering multiple flat or down rounds.

Balance the number of investments made each year to account for liquidity and risk tolerance.

Building your network

Essential to building a diversified portfolio successfully is that you can successfully access top tier deals across the factors that you diversify on. To do so, networks are essential. In fact, I like to put it like this:

💡 Key insights:

You’re gonna want to have a thoughtful approach to building out your network of founders and other investors as they’ll be crucial to access deals and supercharge your journey to gaining insights into new spaces and goes.

An oldie but goldie and a beautiful reference piece for anyone embarking on their angel journey is Jason Calacanis’ book “Angel”. In it, Jason provides a great set of tactics to build out your network methodically:

Step one, create a spreadsheet of all the co-investors in those ten startups you’ve invested in. There should be about fifty investors from the syndicate and a dozen other investors for each startup. That means you will have a pool of six hundred potential investors you can reach out to, minus duplicates

In your spreadsheet, put the person’s LinkedIn, AngelList, Twitter, and Facebook URLs. Connect with each of them on each of these four critical services. When you connect with them, send them a message that says, “Hey Jason, we’re co-investors in Evan Williams’s startup Twitter.” It will take you a couple of days to do this, but in the process you will learn how other investors present themselves to the world. Step two, make a private Twitter list called “co_investors,” and include all these investors in it. Bookmark that list on your browser and open it once or twice a day, favoriting, retweeting, and replying to your fellow investors’ tweets. Now you’ve started building basic “social currency” with a huge swath of Silicon Valley insiders by doing about a month of work— congratulations, you’re an insider! The next step is to start emailing the top, most interesting investors in this process. They might be the syndicate leads, or they might be people who co-invested with you in a syndicate.

When you meet with fellow investors, your goals are:

Figure out what they invest in and why.

Figure out what value they bring to startups.

Make sure they understand what value you bring to startups.

Ask them, “Have you seen anything interesting lately?”

Offer them, “I just invested in these two startups, which are exceptional. Would you like to get introduced to the founders?”

Determine if they prefer double opt-in introductions or blind introductions.

Keep the meeting short and be willing to travel to the angel. Let them know, “I’m happy to meet you at a time and place that works best for you. I know you’re busy.”

Employing Investment Platforms to Diversify

In the U.S., AngelList has democratized access to angel investing enormously by allowing almost anyone to tag along with the leading angels via their syndicates. Unfortunately, we don’t yet have a full-fledged platform like that in Europe, but we’ve got some players cracking away at trying to build it here. Odin, Uniborn, Vauban, Bunch, Leva, and Seedblink all come to mind. And there’s even more.

💡 Key insights:

Investment platforms provide an entry point for newcomers, enabling exposure to deal flow, investment theses, and investor strategies. This comes at the cost of fees of course, but exposure to tier 1 deals make up for that.. as long as you get the tier 1 deals 👇

Beware of adverse selection risks - often the best deals never make it to these platforms and also that not all claims of high returns can be accurately verified, and past performance is not always indicative of future success.

Due diligence remains crucial even on platforms, as claims of track records should be validated through careful analysis of individual contributions and deal sourcing.

Being on these platforms can be super valuable, if not for cutting checks, then to build up an understanding how experienced investors assess deals and their reasoning behind investment choices helps new investors learn the fundamentals of the asset class. This is one of the core reasons why my co-founder David and I invest in venture funds myself - look over our shoulder here 👀.

Adapting to Market Changes

Venture investing is inherently cyclical and the goal of diversification is of course that you build a strategy, tactics, and mindset that can withstand these cycles as much as possible. In this conversation, Mark shared that he had found guidance in Gartner’s Hype Cycle in considering technology verticals 👇 but you can learn much more about how to think about investing in the current market in https://www.eu.vc/p/angel-investing-in-the-current-environmentour webinar dedicated here.

💡 Key insights:

All too often, angels pull back during bear markets when that’s often the very best time to invest in startups. However, when doing so, it’s paramount that you swiftly asses how the rules of the game have changed.

In the current downturn we’ve seen dramatic shifts in the financing risk of startups as follow-on funding has become scarce(r), a changed focus on pure revenue growth to profitability (or at the early stages, at least a path to profitability), and entry valuations (particularly in some sectors/geos). Every market reset comes with some rewriting of the rules.

For the investor that doesn’t want to ride hype cycles, evaluating a company's unit economics, sustainability, and potential for real-world adoption is paramount, transcending the hype-driven market narrative. That said, riding and jumping off the hype train at the right time can be incredibly lucrative when done well:

Johnny Bourfarhat, who founded online events software firm Hopin in 2019, sold nearly 17% of his shares for more than $120 million, but that was over the course of multiple years.

MoonPay raised $405 million by selling shares to investors, and the remaining $150 million represented shares cashed out by insiders in a secondary transaction.

We’ve also seen a shift in what verticals and technologies are hot this last year, making an AI interested investor have to accept that the price of these deals has suddenly spiked and crypto investors (suddenly?) show price discipline.

Venture Capital Funds in Angel Portfolios

Including venture capital (VC) fund investments in an angel portfolio can provide diversification, access to a broader network, and exposure to larger numbers of startups. VC funds that engage with LPs actively can offer valuable insights and connections.

💡 Key insights:

VC fund investments are now more accessible with platforms allowing for a streamlined, easy-to-navigate SPV-formation process making it easier for angels to band together to back VCs without having to flesh out hundreds of thousands per investment. Again, this is what David and I do with our syndicate on the side of eu.vc.

If you pick the right VC funds, you’ll find that they engage their LPs in a way that resembles a grade-A active angel club, offering networking opportunities, deal access, and insights into the verticals and market that they excel in. We like to think of becoming an LP of such funds as a club with a high entry fee but big downstream pay-off. You just need to find the club that’s right for you 👇

Fund investments can be particularly valuable for angels without extensive networks (or gaps in specific spaces they care about!), helping them gain insights, learn from the best about startup investing, and build relationships for the long-term (as a VC fund investment is a 10 year+ endeavor).

Dive deeper: