Impact investing at the buyout stage, interview with Christian Melby (Summa Equity) 🏆

by August Soliv, Author of Impact Supporters | Originally published on Impact Supporters.

Guest post by August Soliv, Author of Impact Supporters | Originally published on Impact Supporters.

Key insights:

Interview with Christian Melby, Partner, Chief Investment Officer, and part of founding team of Summa Equity (“Summa”)

Impact investing at the buyout stage for Summa is about strengthening topline growth of companies that generate positive societal impact through their products or services and thereby scaling positive impact

The impact buyout market is growing but it is still far from saturated as many players specialize in geographies or some verticals – and also the size of the impact buyout market is expected to grow driven by climate change and other challenges facing the planet

Summa invests in SMEs with both social and environmental impact - but not all industries are mature. Summa will most likely be investing in different industries 5 years from now and again different ones 15 years from now

Summa does both buyout and growth investments (the split is 70%-30% respectively in the latest fund)

Meet Christian Melby 👋

On the professional side, Christian is Partner and Chief Investment Officer at Summa. He was part of the founding team back in 2016. He leads the investment committee at Summa and one of Summa’s three investment themes: Tech-Enabled Transformation. At Summa, he is responsible for TBAuctions and has been involved with Logpoint as well as most of Summa’s other big software deals. One of the software deals was Pagero that was sold to Thomson Reuters and provided Summa with a 6x return on their investment. He joined Summa to have a real impact through his work and the private equity (PE) model 🌟

Christian has spent most of his career in PE. He was previously a partner at both Norvestor and Reiten & Co. Before that he worked at Arthur Andersen in Business Consulting and Corporate Finance 📚

On the personal side, Christian is turning 50 years old this year 🎂 and lives in Oslo with his wife and two kids.

Meet Summa 💼

Summa is one of the leading global impact PE buyout firms. Summa was the world’s first buyout fund to commit to the UN SDGs and raised what was the largest European Article 9 Buyout Fund in 2022. Summa’s first fund was €450m, the second fund was €650m, and the third and most recent is €2.3bn.In total, Summa today has approx. €5bn AUM from leading international investors such as pension funds, insurance companies, endowments, and funds of funds 💶

Summa’s goal is to invest to solve global challenges. They wanted to prove that they could use the PE model for impact while making superior returns. Christian says that, so far, they have been able to prove it with market leading returns on their 30 investments and 10 exits 💼📈

Summa’s three investment themes are Resource Efficiency (sub-themes are e.g. Recycling, Circular Economy, Sustainable Food Production), Changing Demographics (sub-themes are e.g. healthtech and life science), and Tech-Enabled Transformation (sub-themes are e.g. Governance, Risk, Compliance, and Cybersecurity) 🌿

Summa’s investment criteria 🔍

On the formal side, Summa has a Northern-European investment focus so their key markets are the Nordics, DACH, Benelux, and the UK, but they have some flexibility in the mandate for other geographies. Summa’s investment cheques are usually in the range of €50-200m but they also go higher. Summa’s core is majority buyouts, but in their Third Fund, they can also make growth investments with controlling minority stakes 🌍

The companies that Summa invests in have to solve one of the major global challenges, that they have identified (i.e. the 3 investment themes). Usually, they make the simple test in their DD of asking start-ups “What global challenge are you solving?“.

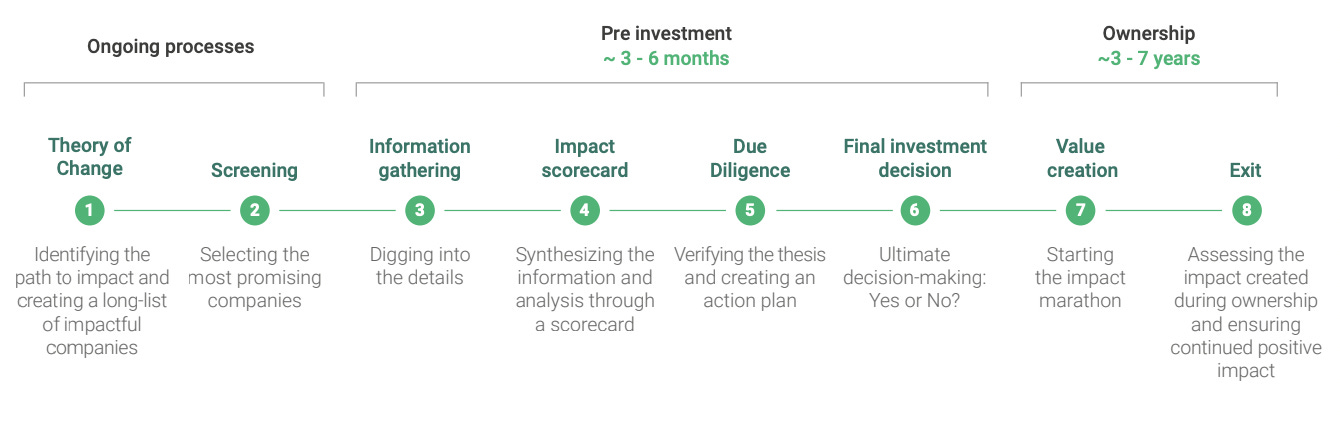

Summa’s overall impact investment approach looks like the below:

Source: Summa Equity’s 2023 portfolio report

Impact at buyout stage 🌱

Christian says that the difference between impact and sustainability is that sustainable investing is defined by EU regulation. Impact investing is a more general term that has no direct legal definition, but the focus is to have a positive societal impact through investments.

Christian believes that it is possible to do impact investing at the buyout stage. To create impact in established “impact companies”, you need to scale the positive effects they are already creating. Therefore, Summa focuses on achieving high growth in all their deals - and don’t focus on value creation through financial engineering like other buyout investors might do. Moreover, Summa focuses on ensuring that all businesses have clear positive contribution in their industries before investing in them (which is a key criterion for proving impact) 🌟

Impact buyout market outlook 📈

Christian believes that the market is not saturated yet - rather, it is Summa’s mission to inspire others to start investing in impact and get more funds into impact. As Christian sees it, the existing impact buyout funds in the market are distributed well geographically and thematically, and supply and demand fit quite well, but supply will grow and so should demand. Christian believes that for Summa to stay relevant in the market, they have to build strong vertical sustainability competencies 🌐

Social vs environmental impact ♻️

Summa invests in companies generating positive social and/or environmental impacts and expects similar returns in both. Resource Efficiency is an environmental theme, whereas Changing Demographics and Tech-Enabled Transformation are tilted more toward being social themes. The impact of the last two themes is that Summa is part of creating a more precise, efficient, and accessible healthcare system and a more transparent society 👩⚕️💡

There is a difference in maturity per industry. Some industries are not investable today as the companies in the industry are too immature for Summa, but they will hopefully mature in the future. Summa will, therefore, invest in different industries 5 years from now, and new different industries 15 years from now. As an example Summa has been looking at sustainability reporting but haven’t found a company that is ready for investment yet. Conversely, Summa has invested a lot in agritech 🌾 recently where investments are arriving at a stage where the industry makes sense for buyout investors. Some examples are Oda and STIM.

Ideal asset types for Summa 🏢

Summa does both buyout and growth equity investments. With their latest fund, they will do 70% buyout investments and 30% growth investments. As explained, growth equity was an addition to the latest fund as Summa has been adding capabilities in that space to their team in recent years. Christian says that Summa was interested in doing growth investments from the beginning, but they needed to prove the success of the buyout fund before expanding. They do a combination of buyout and growth as it allows them to both support impactful SMEs that are fairly mature and are more the target of their buyout business as well as more innovative start-ups that are the target of their growth business. Summa believes that this also optimizes risk-returns for investors - and in both segments, they focus on revenue growth to scale the impact of their investments so they have spill-over learnings 💼

Impact-weighted accounts 📊

Impact-Weighted Accounts – or IWAs – are a way for organisations to quantitatively assess their impact: how they create value to all stakeholders. The uptake of compiling and publishing IWAs is a key step in the transformation of our economy into an impact economy: a sustainable economy that creates value for everyone - Impact Economy Foundation

Christian sees IWA as a way to ensure that companies are not only judged based on their financial accounts, but also on the positive and negative impacts they have on society. Summa has been implementing IWA over the last years with their portfolio. Christian believes that initiatives like this are key for the industry to create transparency on impact, but comes with a lot of trial and error. Moreover, there are many reporting standards out there, but a core difference with the IWA model is that it will, once it gets mature enough and covers products and services more accurately, enable comparisons between companies across industries. Today, that is very difficult to do based on general sustainability reporting. However, Christian thinks that IWAs will reach a level of maturity soon where it will be possible to take it into account when pricing companies - but it requires a lot of data and requires deep cooperation and good data management from the investment targets as well 📊

Christian concludes that it is hard to have one model with credibility, that can fit all industries, and all types of business models but IWAs is one of the closest of achieving it so far.

Summa Foundation - more layers of impact 💖

Summa Equity has the Summa Foundation, a non-profit that owns 10% of the firm. It takes the profits from the investment firm and deploys that as donations along the same investment themes as the firm invests but with more flexibility. For example, the foundation has been working for equal opportunities in sports and homelessness in Europe, and education and nutrition in Africa - and curiously enough been a key contributor in the work to save the migration of wildebeest in Masai Mara. These are some of the problems that the Summa investment firm wouldn’t be able to solve directly and where Summa needs the additional layer of impact and purpose of donations that it gets through the foundation.