Impact through spacetech VC, interview w. Mark Boggett (Seraphim Space) 🪐

by August Soliv, Author of Impact Supporters. | Originally published on Impact Supporters.

Guest post by August Soliv, Author of Impact Supporters | Originally published on Impact Supporters.

Key insights:

Interview with Mark Boggett, CEO and Co-Founder at Seraphim Space

The revolution in spacetech in recent years has been the commercialization of spacetech and the cost reductions in both the launch and satellite markets 🤩

Some facts showing the importance of the space economy today: 1. 18% of the UK GDP is dependent upon satellites, and 2. if you turn off the satellites in the UK for seven days, the cost to the UK economy would be $7 billion 💸

Some of the impact areas in spacetech are: climate monitoring, resource management, carbon footprint management, health, education, connectivity to remote areas 🌍

We are currently in Space 2.0: commercial spacetech with terrestrial applications. Space 3.0 is the in-space economy. Space 4.0 is about ensuring human habitation in space on the Moon and Mars. Seraphim focuses investments on Space 2.0 tech today, but has started making some investments in Space 3.0 🛰️

There was not a single start-up in Seraphim’s Fund I where the start-up failed because of the technology. It was always about the management teams 👥

It’s August Solliv 👋 Let’s dive into why spacetech is a key vertical in the impact VC space (≈11 min reading time):

Spacetech is overlooked 🌌

Spacetech is an impact topic 🌱

How Seraphim thinks about spacetech 🧠

Learnings from Fund I 📚

Tech is not the largest risk in spacetech ⚙️

Good spacetech management team 👩💼

Seraphim Space’s LPs 🏢

Global South vs Global North 🌐

Tips for a generalist VC looking at spacetech 💡

Meet Mark Boggett 👋

Mark is a space fanatic and the Co-Founder and CEO of Seraphim Space. He describes himself as a career technology investor. He started his career as a technology analyst and then moved into venture before starting Seraphim Space about 10 years ago. In the last 10 years, Mark has been a space specialist investor 🚀

Meet Seraphim Space 💼

Seraphim Space is the most prolific spacetech investor globally. They operate through both a venture fund and an accelerator program, and combined, Seraphim has invested in 126 spacetech companies to date 🌍

Seraphim started as a venture fund. In 2016, they launched the world's first space-focused venture fund, a $90 million fund backed by a broad range of large space companies. The first fund secured a net 3x return, and Seraphim is currently fundraising fund II, which had its first close in April 2024 at $100m.

Seraphim launched Seraphim Space Accelerator in 2017, which today is the largest space accelerator globally. Seraphim is currently in their 13th accelerator cohort, and they run two accelerators a year, with about 10 companies in each one, including companies from around the world 🌍 The start-ups that they have accelerated have cumulatively raised $350m in Seed funding from 120+ different VCs. Mark believes that the accelerator is truly helping the global spacetech ecosystem grow as they have had nearly 30 countries represented, and they are backing what they believe are the entrepreneurs with the leading technology capabilities 🌟

Lastly, Seraphim also launched a spacetech growth fund in 2021, which is listed on the London Stock Exchange (Seraphim Space Investment Trust) and is Seraphim’s way of supporting spacetech entrepreneurs as they grow their businesses.

Spacetech is overlooked 🌌

Mark believes that there is still a misperception about space. He sees a general lack of understanding of just how broad space is - he likes to say that it is just as broad as AI 🧠

To give some figures on this, Mark highlights that 1. 18% of the UK GDP is dependent upon satellites (Know.space, 2023) and 2. if you turn off the satellites and in the UK for seven days, the cost of the UK would be $7 billion (London Economics, 2023). And as Mark sees it, these numbers will only increase in the future years as the segment grows.

Projections show that space will generate true trillion dollar market opportunities (xTech, 2024) - and Mark believes that will already be within the next decade.

Mark has experienced talking with many impact VCs that did not have spacetech as a vertical they invest in but then giving them examples of the companies that he invests in within wildfire insurance, GHG emissions measuring, tracking illegal fishing, and much more where they get truly excited about the opportunities. He hopes that more impact VCs will start investing in space 🌌

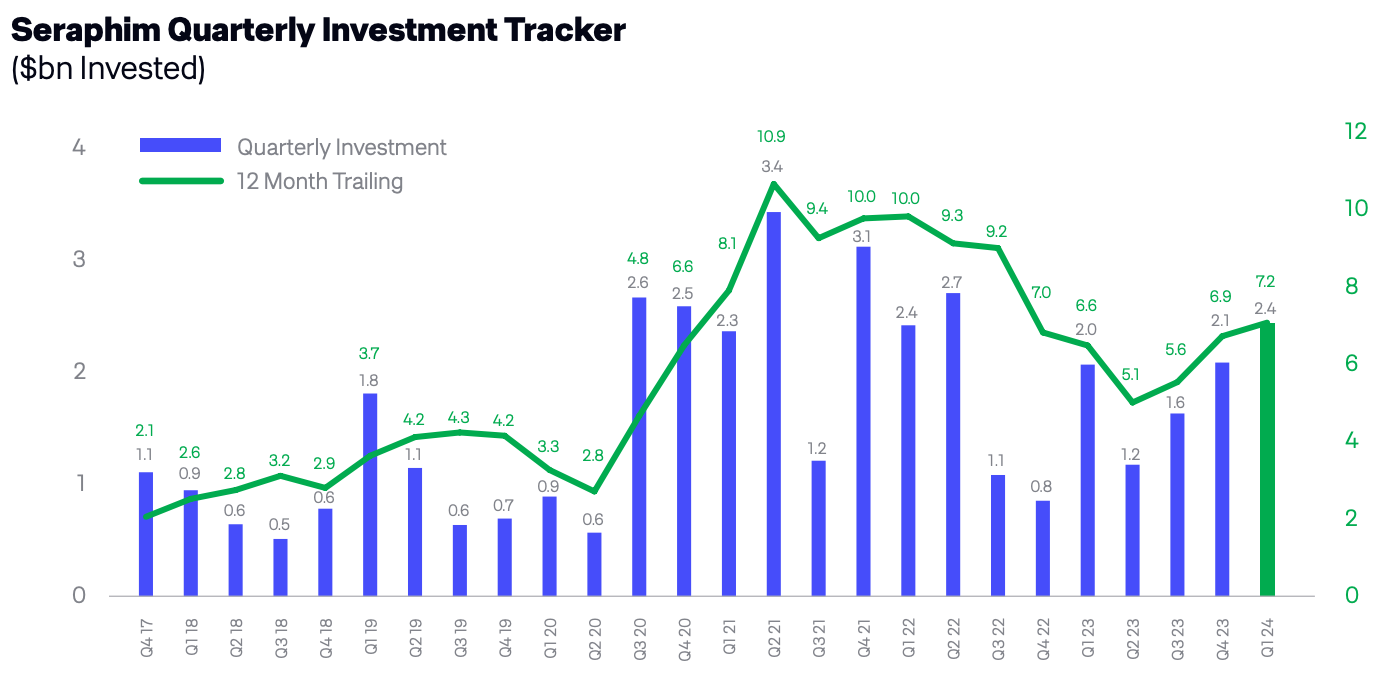

Source: Seraphim Space Index Q1 2024, 2024

Source: Seraphim Space Index Q1 2024, 2024

Spacetech is an impact topic 🌱

Mark says that spacetech in recent years has given us large satellite constellations that provide us with close-to-real-time data, of approx. every square inch of the planet, in high resolution, at a low cost. That has a ton of impact applications. Mark highlights some below.

Climate:

Earth observation and climate monitoring: Monitoring climate change, deforestation, natural disasters, etc. 🌎

Resource management: Ensuring efficient use of watering in fields, pesticide usage, waste reduction, etc. 🚜

Carbon footprint management: Monitoring carbon emissions, carbon sequestration, forests, and potentially moving our polluting industries to space 🏭

Sustainability in space: Managing space debris, renewable energy from space (e.g. in-space solar farms bringing energy to the earth), etc. 🛰️

Social:

Enabler of social mobility: Serving remote areas of the world with connectivity and communications 📡

Disaster response: Monitoring areas of natural and human disasters for emergency responses 🚑

Education: Using new data and connectivity to provide education, increase knowledge about the world, etc. 📚

Health: Using in-space zero gravity environment for drug development in biopharma, health monitoring systems from space, etc. 🏥

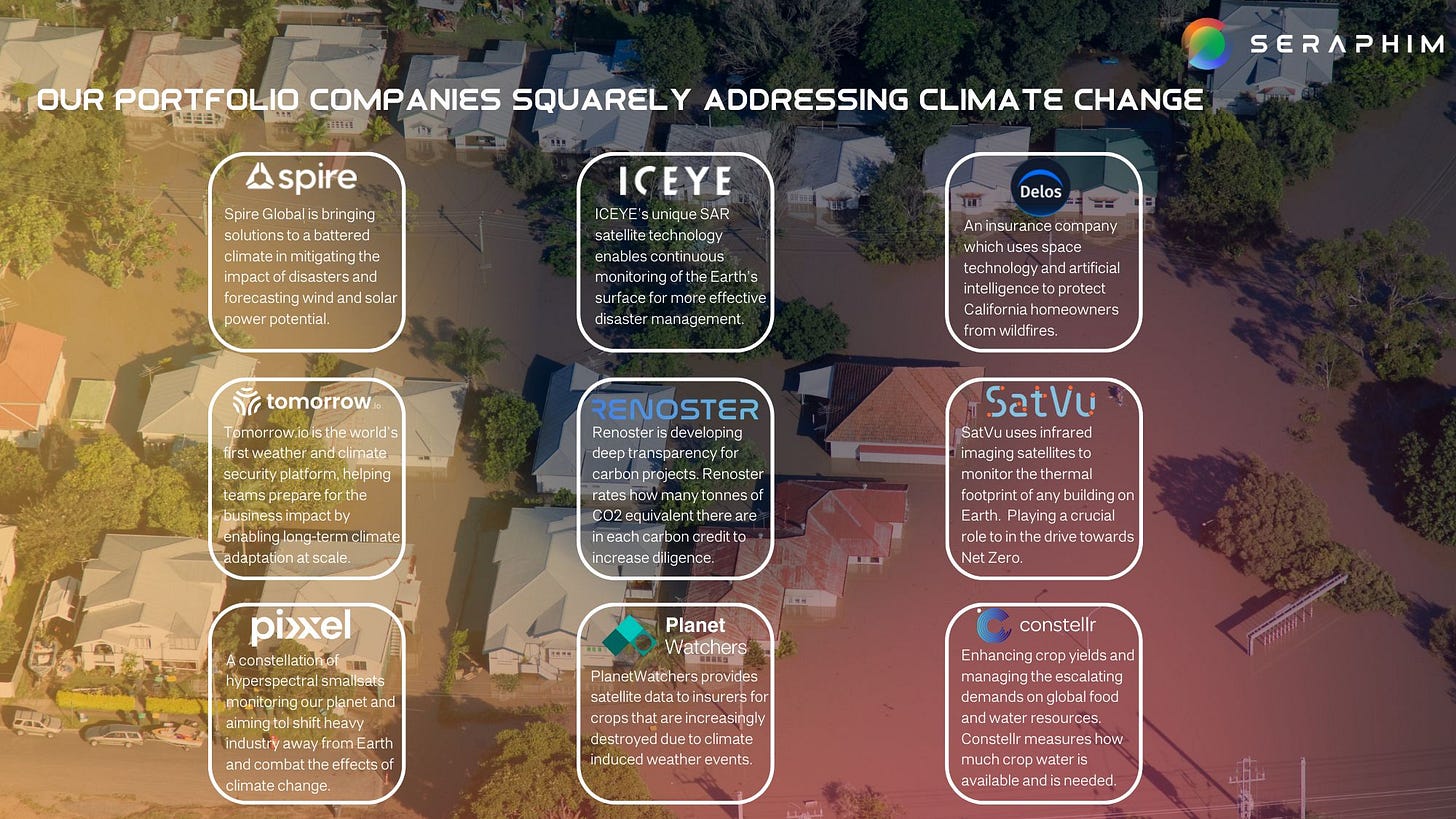

Here is an overview of some of Seraphim’s companies addressing climate change:

Source: Seraphim Space, 2024

How Seraphim thinks about spacetech 🧠

Seraphim’s way of breaking down the space market is in phases. Space 1.0 was about building governmental space programs. We are currently in Space 2.0, and in this phase, the focus is on developing constellations of satellites (digital infrastructure) around the Earth. Mark, therefore, currently invests heavily in the companies that enable the creation of those satellites, as well as companies that use the constellations to provide products and services to terrestrial customers 🌍 This includes launch of satellites, downlink, data analysis, communications, etc. Mark says this segment already has real-life customers, and this is the segment that most of the $1tn+ growth forecasts are built on in the short term. Space 2.0 is becoming a fairly mature segment and already has profitable businesses with $100m+ revenue 💸

Space 3.0 is focused on building infrastructure in space and is called the in-space economy. It includes building space stations, manufacturing capabilities, cell towers, or data centers in space. To really enter Space 3.0, we still need changes to the launch market. For example, SpaceX’s Startship (the world’s most powerful launch vehicle) needs to become fully operational, and a myriad of other large launch companies need to come to the market. Currently, Seraphim invests in some Space 3.0 businesses, but it is still at the periphery of their investment focus as growth of the market will take years.

Space 4.0 is about using the Moon as a stepping stone for Mars and ensuring human habitation in space 🌕 Space 4.0 is, therefore, solutions with no terrestrial market applications. An example could be in-space agriculture for in-space consumption. The size and timing of Space 4.0 is still uncertain, but there is an increased amount of technical development in that area. However, the area is still highly focused on being driven by grants from governments and space agencies. Seraphim focuses on Space 2.0 and 3.0 as they are a venture fund and they need to be able to make returns within a 10-year period, which is currently hard in Space 4.0. That means that they primarily look at start-ups using space to bring capabilities back to the Earth - and only if they see a moonshot project with a standout team and a standout technology, they might invest a small ticket in that 🚀

Moreover, Seraphim has defined 7 categories for spacetech start-ups. See below:

Source: CFA Institute, undated

Learnings from Fund I 📚

Mark has had many learnings from Fund I that he has taken with him to Fund II, which he currently is fundraising 📈 Here are the top ones:

When Seraphim has a strong conviction that a start-up has the right team, the right technology, the right market, the right position in the market, the right traction, and is, in general, a good bet, then Seraphim will double down on those companies 💪 They did not do that as much in Fund I but will do so more in the future funds - and it’s the only change they have truly made to their strategy. Because in hindsight, Mark can see that Seraphim knew very early on which start-ups from their portfolio were going to be breakout successes.

There was not a single start-up in Fund I that failed because of the technology. It was always about the management teams not being effective at executing against their own plans and scaling the business 📉 Similarly to the first point, Mark says that looking back, they also had a clear feeling for which management teams were excellent and which ones they had question marks over at the time of investment.

Tech is not the largest risk in spacetech ⚙️

I then asked Mark follow-up questions about how the management team could fail more than the technology. It seemed counter-intuitive in a deeptech sector such as spacetech. Mark said that the tech is often the easiest part to evaluate as he has access to many skilled experts from around the world from the world’s largest space companies (see section about LPs later in the article for more details), and he can compare start-ups to other spacetech companies that he has seen over the years.

Mark believes it is much harder to evaluate a management team, the size of the market, how the market will grow, and future competitive dynamics 📉

Good spacetech management team 👩💼

Mark says that what defines an excellent spacetech founder is whether they are prepared to listen and are coachable 👂 Mark sees it as possible to be successful without having that characteristic, but he believes that you lower your chances of success if you're backing an entrepreneur who doesn’t listen—and in VC, it’s all about increasing the odds of an entrepreneur being successful 📈

In the due diligence, Mark and his team ask questions about this to try and understand how they operate and whether they are prepared to take advice, listen to what other people say, change their minds, but also take advice selectively and not listen to everybody.

Seraphim Space’s LPs 🏢

Seraphim Space’s first venture fund was backed by large space companies such as Airbus, SES Space & Defence, Telespazio, Teledyne, Surrey Satellites, etc. 🚀 Mark says that these LPs backed the first Seraphim fund as they recognized that their industry was going through a period of disruption. They felt that backing Seraphim was a good way of understanding that disruption and potentially identifying the technologies and business models of the future 💡 Given the number of start-ups that have gone through the Seraphim ecosystem, he truly believes that he has been able to give the necessary insights to the space companies.

Mark, on his side, partnered with these large space companies, as in return, he could reach into their business units to get advice from the hundreds of thousands of space experts that they employed whenever he was evaluating new start-ups 📊 That access was key in building conviction around each investment he was making.

Global South vs Global North 🌐

The revolution in spacetech in recent years has been the commercialization of spacetech and the cost reductions in both the launch and satellite markets. Marks says that that has truly leveled the playing field. Previously, space was completely out of budget for many countries.

Mark is currently seeing developing countries invest in space and build up their own space capabilities 🚀 This is part of reducing the inequality between developed and developing countries. Today, almost every country worldwide can access the Internet in all rural areas, and with connectivity going directly from satellite to mobile phones in the future, access to connectivity will only increase 📶

Tips for a generalist VC looking at spacetech 💡

Mark sees that generalist VC or impact VC investors often make a first space investment, and then they make a 2nd, 3rd, and 4th right after as they get hooked on the opportunities. Here are his two main tips if you, as an impact VC, want to invest in spacetech:

Conduct thorough due diligence on the competitive landscape on a global scale 🌐 Spacetech is a global domain, and VCs can’t diligence just one region. Mark often sees generalist VCs that have invested in early-stage start-ups with huge competitors in the U.S. or elsewhere abroad that have raised $300m+ and have written IP on large parts of the tech they are using. That is a very high risk and can be a sign of a lack of due diligence of the competition.

Think about your return requirements. Mark says that if you have a traditional fund structure (10+1+1 years), you have to invest in companies that can return your money in that time range. To Mark, that is primarily Space 2.0 businesses as the ecosystem is today.

If you are looking for spacetech start-ups and scale-ups to invest in, take a look at Seraphim’s Spacetech Map 2024 🗺️

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned:

And some extra super cool resources: