We’re teaming up with EUVC to share our quarterly updates, which were previously only available to our investors! We, that’s very early Ventures, a Blockchain focused VC fund, run by computer science PhDs, investing in tech heavy infrastructure. Hope you enjoy!

1) DeFi Resurgence

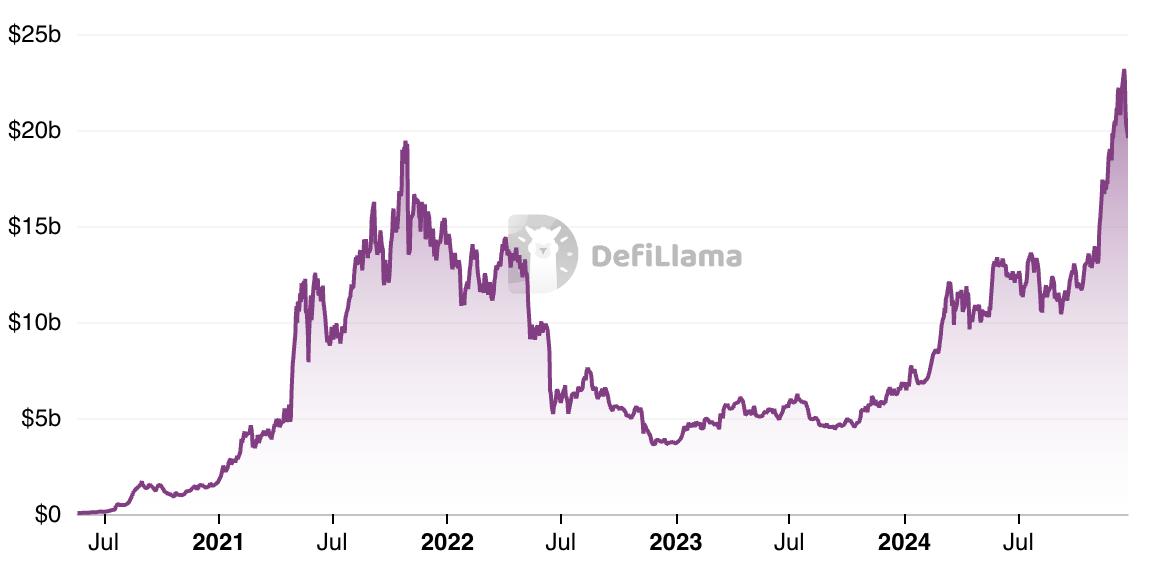

Decentralized Finance (DeFi), especially on Ethereum, has seen a strong boom across all relevant metrics in Q4 of 2024. This strength in one of Web3’s most proven use-cases could catalyze further growth across the board. It is partially driven by expectations for a clearer regulatory framework in the US over the next year, given the change of seat in government. The following metrics illustrate the growth in DeFi:

All-time-high in total trading volume on decentralized exchanges, achieving $340B+ monthly volume in November and December (source)

All-time high in total issued stablecions at $200B+ (source)

All-time high in funds deposited on the borrow/lending protocol Aave at almost $40B, overtaking previous highs in 2021 and reversing the year-long declining trend (see chart below)

2) New Investments

We’ve finalized 2 investments in Q4:

Valantis builds the next generation infrastructure for decentralized exchanges (DEX) with a modular, scalable approach. Key innovations are in the modularity as well as a unique request for quote model that delivers better execution prices. Thanks to their superior approach, they are currently fulfilling over 10% of all trades on CoW Swap for ETH-USDC. Operating in a market where DEX trading now represents around 10% of all spot crypto volume, Valantis is uniquely positioned to become the standard infrastructure layer for decentralized trading. We’ve invested alongside SevenX, Kraken Ventures and Figment in this round.

Olas builds infrastructure for autonomous AI agent economies, enabling the deployment and coordination of AI agents that can interact with blockchain networks and each other. The platform has shown significant traction with 1600+ agents deployed and 2.3M+ total transactions by agents. We were impressed by the long-term vision of the team of AI agents as the primary way of interaction with blockchains, and by their deep understanding of the use-case developed over years. This is the first VC round, led by 1kx, and executed as an OTC transaction where the public token was bought at a steep discount to current market price in exchange for vesting.

3) Strong Performance of Public Markets

Public markets have performed very positively in this quarter. Spurred by the Republican sweep and more expected regulatory clarity in the US, and even a potential strategic Bitcoin reserve, Bitcoin temporarily broke $100,000 before correcting back briefly. Ether and the broader token market, particularly the sector of DeFi (see headline 1) above), have also performed strongly. We are positioned well within DeFi, e.g., through private investments such as Valantis or Parabol. In public markets, we like CoW Swap and Spectra:

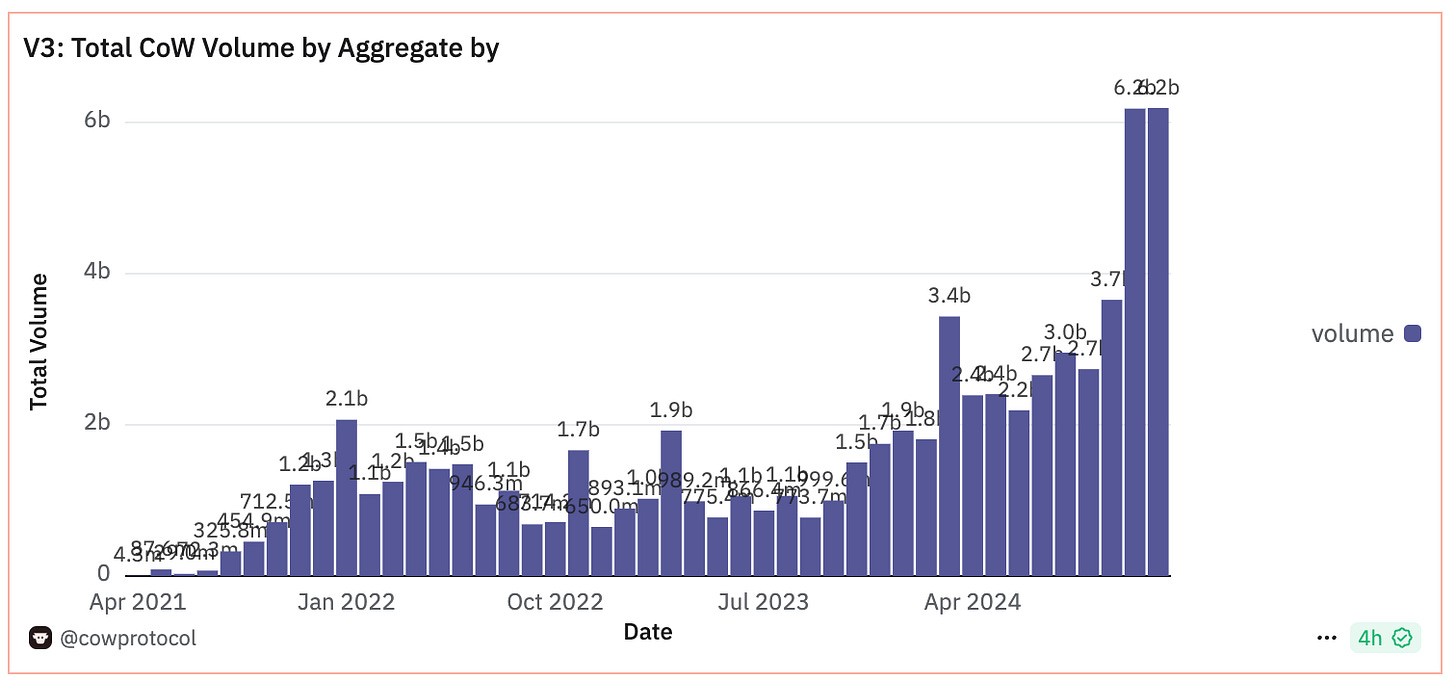

CoW Swap continues to show strong traction as a leading decentralized exchange, processing $6B+ in each November and December, and recently adding support for the fastest growing L2 Base (founded and operated by Coinbase).

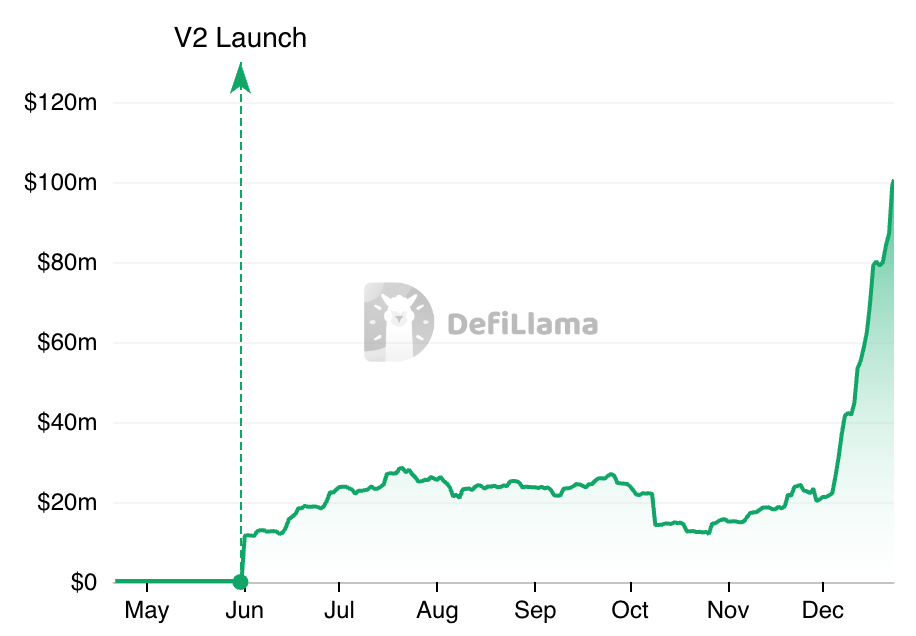

Spectra has amassed momentum, launching their v2 and aggregating over 100M total value locked in the protocol.

Best,

The very early team