Investing in the energy transition, interview w. Pablo Pedrejon (Seaya Andromeda) ⚡

by August Soliv, Author of Impact Supporters. | Originally published on Impact Supporters.

Guest post by August Soliv, Author of Impact Supporters | Originally published on Impact Supporters.

Key insights:

Interview with Pablo Pedrejon, Partner at Seaya Andromeda

Seaya Andromeda is a European Article 9 climatetech €300M Fund that invests €7m-€40m tickets across Series A-C

One of the main sectors Andromeda invests in is energytech, which is split into 4 categories: Energy Generation, Energy Distribution, Energy Consumption, and Mobility & Logistics ⚡

Andromeda splits project types between moonshots and shorter-term solutions and invests in the latter type - e.g. on topics like EV-charging software and providing ancillary services for the grid 🚗

Pablo’s main tip for investing in energytech: spend time understanding the intricacies of energy solutions and markets and build a 5-year perspective on a given solution 💡

Pablo believes that because of the global geopolitical landscape, some specific climate sectors are getting an additional tailwind through the quest for European sovereignty, e.g., energy, agriculture, and industry 🌍

It’s August Solliv 👋 Let’s dive into how to invest in energytech as an impact VC (≈8 min reading time):

Fundraising in a tough environment 💸

Choosing the growth positioning 🧩

Working with corporates 🤝

European sovereignty in climate industries 🇪🇺

Andromeda’s view on energytech 👀

Different maturities of energytech ⏳

Tips for investing in energytech 💡

Meet Pablo Pedrejon 👋

Pablo is a Partner at Seaya Andromeda. He is from Spain 🇪🇸 although he lived more than half of his life abroad 🌎 Pablo describes himself as being a passionate climatetech enthusiast who wants to play a big part in the green transition. Previously, Pablo was Co-Founder and CEO of Petsy.mx, a company in the petcare space, and a consultant at Oliver Wyman.

Meet Seaya Andromeda 💼

Seaya Andromeda is a €300 million climate tech fund. It is an Article 9 fund that invests across Europe in companies that either reduce CO2 or reduce waste ♻️ In practice, this is 6 sectors: energy, industrytech, real estate, circular economy, foodtech, and agritech.

Seaya Andromeda adds value to the start-ups they work with in three areas: 1. Deep sector experience as they have invested in over 17 climatetech start-ups to date. 2. They understand how to invest in both software and hardware. 3. They bring corporate connections to their start-ups.

Seaya Andromeda’s Investment Criteria 🔍

Seaya Andromeda invests €7-40 million in Series A to Series C across Europe. Ideally, the companies that Andromeda invests in are post-revenue.

Fundraising in a tough environment 💸

Seaya Andromeda held the final close of their €300m Fund I in July 2024 🗓️ Pablo identifies three reasons for their fundraising success:

Firstly, Andromeda is part of the wider Seaya VC platform. Seaya has been investing in Series A across Europe since 2013. They do traditional venture investments up to €7 million with a focus on AI and generalist topics. Before launching the new dedicated climatetech fund, Seaya Andromeda, Seaya had already invested in 10 climatetech start-ups in the last 11 years, even when climatetech was not a thing. Andromeda is an extension of that work and the credibility and experience of the Seaya team helped fundraise.

Secondly, Andromeda got corporate backing very early on in their fundraising, which helped create momentum in the fund and was further supercharged by support from the Spanish Government 🚀 Pablo believes that having such corporate and institutional investors early on helps raise the rest of the funding.

Thirdly, Pablo believes that being based out of Spain is a competitive advantage when investing across Europe. Spain is a leader in many climatetech industries and has a lot of local expertise in relevant sectors that Andromeda can tap into. Pablo mentions renewable energy as well as industrial sectors such as automotive, and agriculture.

Choosing the growth positioning 🧩

Andromeda has chosen to have quite a lot of flexibility in their mandate but focus on growth climatetech investments as they see that these are underfunded. Andromeda invests mainly in Europe and can both lead Series A and B rounds as well as co-lead and be followers on Series C rounds. Pablo says that it gives them the flexibility to help the best climate companies where they need the support the most. Likewise, they primarily invest in VC-backed start-ups but also have a mandate to invest in some bootstrapped companies.

In general, Pablo would argue that the analysis that you do to write a €7m check and a €40m check is quite similar, as Andromeda only invests post-revenue 💶 So Andromeda has streamlined their approach to all deals. However, some specific analyses such as cohort analyses might have more data to back them up for the bigger ticket size deals as the companies are more mature, and, therefore, require additional time for the analysis ⏱️

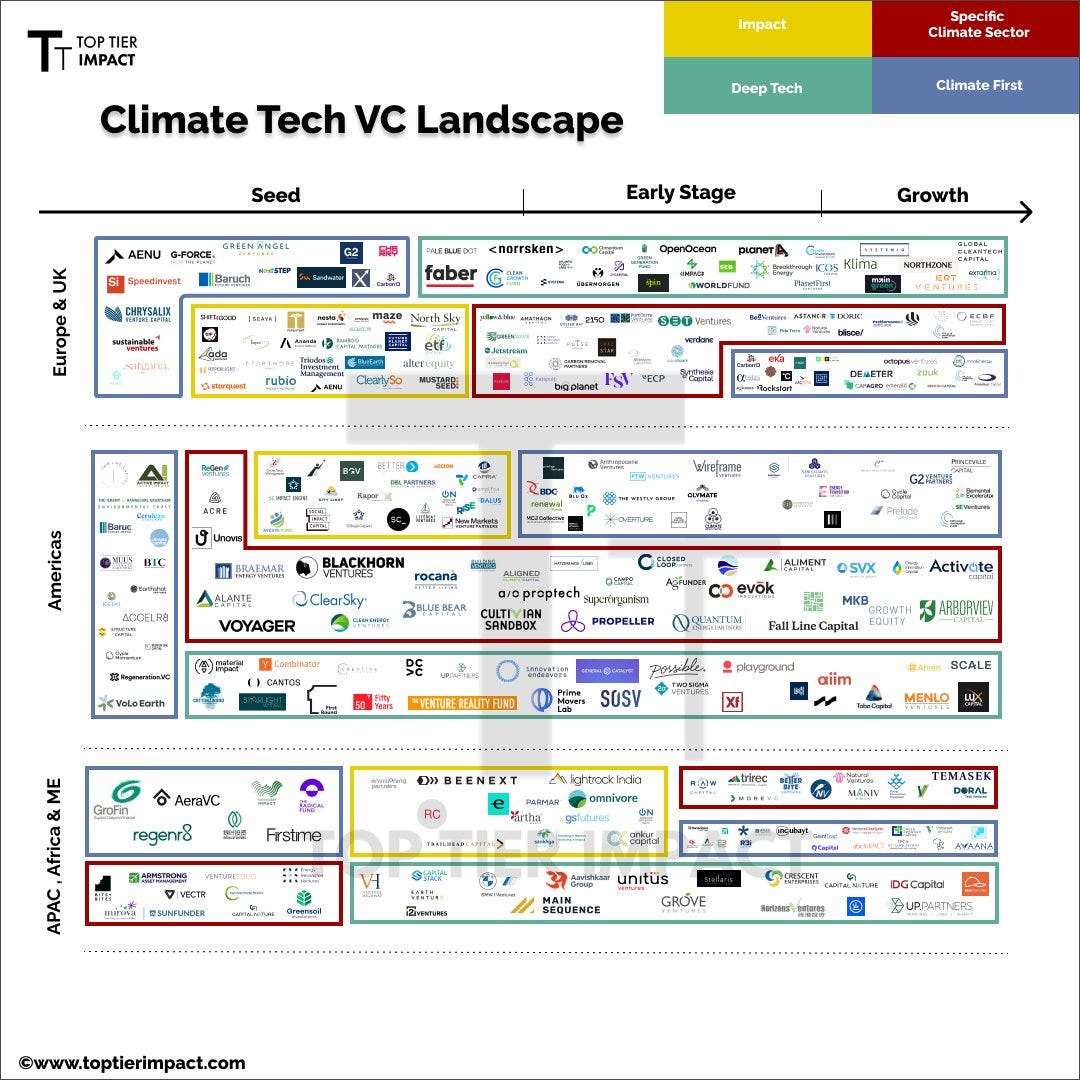

Seaya Andromeda joins the climatetech VC landscape below which is skewed towards a large amount of Seed and Early Stage funds and only has a few Growth funds.

Working with corporates 🤝

Andromeda is proud of working closely with corporates as part of their fund 🤝 Pablo gives some examples of the corporates that are LPs in Seaya Andromeda: Iberdrola (the #2 largest electricity player in the world; Atalayar, 2023), and BNP Paribas and Santander (the two largest banks in the EU; Statista, 2024) 🏦

These primarily add value to Seaya Andromeda’s start-ups in two ways:

1. Seaya uses them as sparring partners on specific topics within climatetech. For example, they work with Iberdrola on the major trends in energytech as well as in the due diligence process of energytech start-ups.

2. Seaya works with the banks to help provide alternative financing to their impact start-ups. The banks still perform their own analysis of the start-ups but Seaya can ensure that the start-ups get to talk to the right people at BNP Paribas and Santander.

European sovereignty in climate industries 🇪🇺

Pablo believes that because of the current global geopolitical landscape, some specific climate sectors are getting an additional tailwind, which Andromeda capitalizes on. Europe is trying to ensure sovereignty and self-sufficiency in key sectors such as energy, industrytech, and agriculture. Pablo believes that this quest for sovereignty will last for the next 10+ years in Europe.

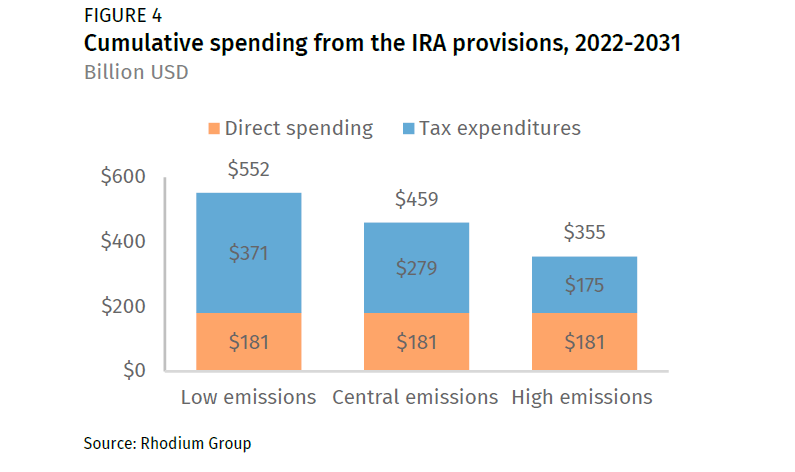

One of the forces pushing for European sovereign measures in key sectors is that the USA subsidizes its industries through the Inflation Reduction Act (IRA) and China subsidizes its industries untransparently 🌐 Below is a graph with the spending the USA is putting into climatetech nationally through the IRA until 2031.

Pablo mentions solar panels as an industry where Europe has previously been outcompeted due to subsidies ☀️ He says that a bit more than 10 years ago, solar panel manufacturing globally was nearly only done in Germany. And then fast forward to today, 85% is located in China after heavy Chinese government subsidies. If the EU doesn’t react to protectionist climate subsidies in other regions, then industries will be left behind (Climate Hardware Playbook, 2024; Reuters, 2023).

Andromeda’s view on energytech 👀

Pablo gives his perspective on why he believes in investing in energy as a climate VC besides the additional European tailwind:

If you look at the evolution of human society, it has always been very linked to access to energy sources. First, it started with cavemen and producing fire. And then it became more and more sophisticated and higher amounts of energy produced. Energy has been key to human development and will continue to be so - so mankind needs to find new ways to produce more energy in a greener way.

Andromeda breaks their view of the energy sector into four parts:

Energy generation - producing more energy more renewably

Energy distribution - ensuring that renewable energy reaches users with low levels of energy loss while ensuring compliance with regulation and working with an oligopoly of TSOs (grid congestion is one of the biggest and most under-the-radar topics in energy)

Energy consumption - providing end-consumers and C&I (commercial and industrial players) with access to energy

Mobility and logistics - ensuring that transportation is environmentally-friendly

Pablo states that Andromeda looks at sub-sectors across these 4 categories and operates by doing deep-dives within the verticals as there is such a breadth of opportunities that he sees it as necessary to go deep on a few topics 🔍

Two of the topics that Pablo’s team has done deep-dives on are:

The consumption of day-to-day buildings 🏢 - 10% of all GHG emissions are emitted through the day-to-day use of buildings. They have looked especially at building management systems and how to make commercial real estate much more efficient.

Energy storage 🔋 - there are large peaks in renewables during the day and current energy infrastructure can’t use it all, so we need to be able to store some of the renewables produced at peak hours in batteries to use it later.

[Note from the author, August Solliv]: CTVC has made a map of energytech and the solutions needed with a slightly different methodology that maps out the major categories of energytech solutions that is very useful for investors in the energy space:

Different maturities of energytech ⏳

Pablo sees that topics within energy are at different stages of maturity and need different types of funding. He reminds us that he is investing out of a €300m fund and has to pay back his investors in 10 years, so he can only invest in some types of businesses.

🌟 Moonshots: Moonshot ideas are projects pre-revenue that are trying to solve some of the largest problems in the energy sector, e.g. nuclear fusion. Pablo doesn’t invest in these businesses as they don’t fit his post-revenue criteria and are quite immature. He, however, thinks they are truly key to creating sustainable change in the energy sector. He would love for some governmental and potentially private forces to go together to launch a new Project Manhattan for nuclear fusion - putting all the best scientists together for 5 years with a one billion euro budget to find a solution to nuclear fusion.

🔧 Shorter-term solutions to existing problems: Pablo invests in solutions fixing existing issues within energy where there is clear product-market fit. He gives some further ideas of topics that he is looking at: ancillary services for the grid, software to manage energy usage in personal homes or industrial sites, and start-ups connecting solar panels with batteries and the grid. When investing in these, Pablo takes a 5-10 year perspective and only invests if he believes the sector will stay relevant in that time frame, e.g. Pablo believes that EV charging will grow going forward so they have invested in an EV-charging business 🚗 They build this perspective based on tech and general trends in regulation, but not based on specific subsidies.

Tips for investing in energytech 💡

Pablo has one major tip for anybody looking to invest in energy: Get into the intricacies of the energy space before investing ⚡ Pricing, regulation, and the energy market are different in each country (even within Europe) so you need to build a view of whether the specific energy solution and market you invest in will be 4-5x in 5 years ⏳

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned: