Isomer Capital brings the EUVC founders aboard as Venture Partners: anything but the status quo

Tech.eu just covered the announcement of Andreas & David as Venture Partners of Isomer Capital 🥳 Read on for the full story.

Read the full article here or below for some deeper context and core excerpts from Dan Taylor’s article on Tech.eu and other articles 🤓

The move isn’t quite a “traditional” Venture Partner addition to the roster, as the grand plan is for Andreas and David to help VCs build their funds via the EUVC content platform and its syndicates that allow them to build vested communities of founders, operators, angels, and VCs as "Operator LPs.”

Andreas and David have a completely different approach and toolbox to us through their content, events, and syndicate, which will bring immense value to our portfolio, partners, and more emerging managers […] We’ve known each other for quite some time now, and found that we were almost always discussing the same things, working toward the same goal. We simply didn’t get around to formalising the relationship until recently.

Joe Schorge, founding managing partner of Isomer Capital

A broad smile and laugh from Andreas confirmed this statement.

When David and I started looking around for a firm to partner with we did a lot of asking around and there’s one name kept coming up again and again. We’ve admired Isomer for a long time, and now, we’ll be able to bring our offering to even more of Europe’s amazing VCs while working with the best in the industry. By partnering with Isomer, we can go beyond that and support the LP side.

Andreas Munk Holm, co-founder of EUVC

By adding Andreas and David to the team, the firm aims to create a better LP environment in Europe and further support emerging VC fund managers.

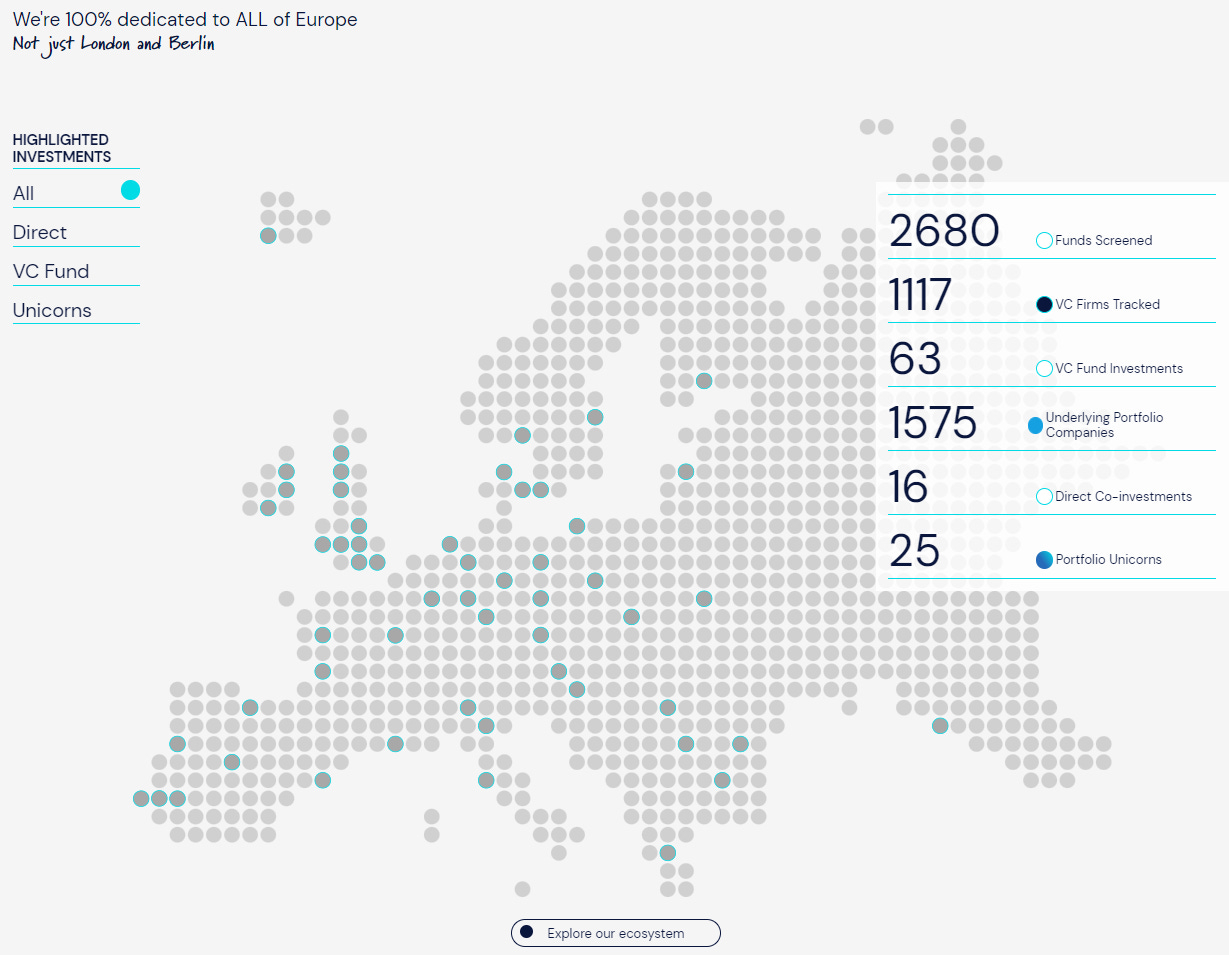

Isomer launched its £220M second fund of funds two years ago dedicated to backing early-stage VCs and their breakout companies in Europe. Isomer Capital has supported 1,575 companies across more than 40 countries and 63 funds.

Onwards and upwards 🚀

The firm is ready to embark on a new chapter, backing even more managers and expanding its co-investment and secondary activities to offer greater access to later-stage capital and liquidity solutions to the European ecosystem.

We were early believers in European tech and early to act on the thesis of finding and investing in the best VCs in every city and backing portfolio companies in later rounds. We aim to help founders from idea to exit, whether they created a company or a fund, and we continue to be thrilled that the performance of many early-stage VCs in Europe is top quartile on a global level. With exposure to roughly 1,500 companies across the continent, covering most industries and models, our portfolios are incredibly robust. But now we need to do more as an LP to provide further support to the VCs we work closely with.

Joe said and continued:

We're here to create the best European VC ecosystem possible. Andreas and David have a completely different approach and toolbox to us through their content, events and syndicate, which will bring immense value to our portfolio, partners and more emerging managers.

The past and future

EUVC was founded in 2020 by Andreas and David. It started as a podcast for GPs, but today, it includes five podcasts, a heavily subscribed newsletter, a WhatsApp group, live and virtual events, and crucially, the duo has created a vested community of founders, operators, angels, VCs, and LPs.

Andreas Munk Holm, Co-Founder of EUVC and newly appointed Venture Partner for Isomer, said:

We're democratising access to European venture capital. Our mission is to disseminate knowledge and build and nurture a community of real value add angels who want to invest as LPs. Whether they are founders, operators, or execs, if they can bring real value to the fund, we want them! By joining the team at Isomer - a team we have admired for a long time - we’ll be able to bring our offering to even more of Europe’s amazing VCs while working with the best in the industry. By partnering with Isomer, we can go beyond that and support the LP side.

Andreas continues:

We are now in a unique position to give something compelling for GPs and give access to VC to more people, attracting new types of LPs into venture through our LP syndicates and educating investors that should have exposure to European Venture through our collective knowledge and communities.

David Cruz e Silva, Co-Founder of EUVC and newly appointed Venture Partner for Isomer, added:

When Andreas and I embarked on the adventure of starting EUVC in 2020, it was because there wasn’t a podcast championing and connecting European VCs. Fast forward to today, and EUVC is the best platform to connect champions and give voice to European GPs. Isomer is a great supporter working hand in hand with GPs backing the early-stage tech successes of Europe. This is why this partnership makes so much sense. Isomer has the knowledge, expertise and experience, whilst EUVC can bring in the community, distribution and a disruptive approach to venture. All with the shared objective of driving more capital towards the future tech success stories in Europe.

Speaking on the next fund for Isomer, Joe Schorge added:

“It is an exciting time at Isomer as we launch the next edition of our flagship strategy, expand our co-investment and secondary activities, and consider how best to meet the evolving needs of our VC and company partners. We are considering other activities to formalise and expand; for example, our micro funds programme is very successful in both performance and strategic terms. Few strategies support new, big ideas in a clear and targeted way, which will continue to be an important focus for us in the coming years.”

Wanna come play with us? We’re pioneering operator LP syndicates for the best founders, angels and VCs in Europe. Join the fam 💞