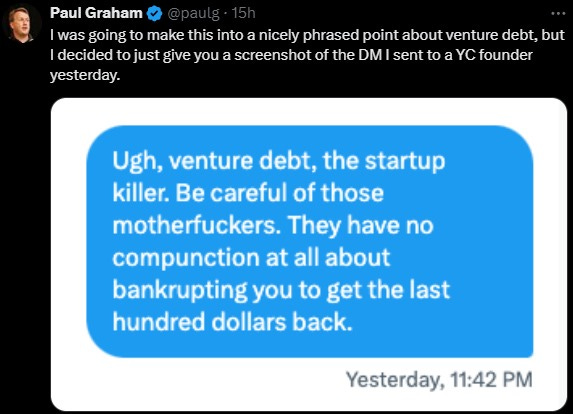

Masterclass on Venture Debt: Structuring & Deal Terms with Hemal Fraser-Rawal, GP at White Star Capital

In case you think there's more to venture debt than Paul Graham, join us October 8th for this masterclass

Special offer: Join the EUVC Community for 25€ per month and get 100€ off while enjoying access to on-demand masterclasses, tools & templates and monthly AMAs with leading GPs, LPs & experts.

In case you think there’s more to venture debt than Paul Graham…

…Join us for an in-depth session on Venture Debt specifically for senior VCs😁

We’ll cover all essential aspects of venture debt, from its origins and rationale to detailed discussions of deal terms and geographic variations important to be aware of. Designed with senior VCs in mind, this masterclass will offer practical insights and strategies that’ll improve your decision-making when it comes to leveraging venture debt in your portfolio.

Key Learning Points

Understanding Venture Debt: Grasp the fundamental principles and the strategic reasons behind using venture debt in investment portfolios.

Deal Structuring: Learn about the typical structures, pricing, and common features of venture debt term sheets.

Strategic Benefits and Drawbacks: Analyze the pros and cons of venture debt from an investor’s perspective.

Exploring Alternatives: Discover other credit-like financial products and understand their similarities and differences.

Geographic Considerations: Gain insights into the geographic nuances of raising venture debt and its implications.

Who should participate

This advanced workshop is ideal for General Partners, Emerging Fund Managers, Established VCs, and Family Office employees interested in enhancing their knowledge of venture debt and its strategic application in venture capital.

Time Commitment

This is a 2-hour online workshop consisting of:

Venture Debt Overview including what is venture debt, why and where it originated, and its importance and relevance in today’s ecosystem.

Deal Terms including structuring traditional venture debt, pricing, warrants, and common features.

Conditions, covenants, and security packages in term sheets, and the benefits and drawbacks of taking on debt from a GP's perspective.

Alternatives and Geographic Differences including an overview of other credit-like products in the market and their comparison to traditional venture debt.

Geographic variations in raising venture debt with a macro overview and specific considerations.

Your instructors

Hemal Fraser‑Rawal is a seasoned investor in private debt markets, with experience ranging from Leverage Finance to Growth Lending. At White Star, he brings innovative approaches to support entrepreneurs in achieving their ambitions. Prior to White Star, he was a Principal at Claret Capital Partners, deploying over €80 million annually into early-stage companies across Europe.

David Cruz e Silva is the founder of eu.vc, Europe’s Venture Community, and an angel LP supporting European early-stage funds and their breakout companies. His unique experience and positioning are invaluable for emerging VCs and LPs navigating European VC.

Already a member? Register here 👇

Keep reading with a 7-day free trial

Subscribe to EUVC | The European VC to keep reading this post and get 7 days of free access to the full post archives.