New Renaissance Ventures - Year 1 Update

by Severin Zugmayer, Founder of New Renaissance Ventures. | Originally published on New Renaissance Ventures Newsletter.

Guest post by Severin Zugmayer, Founder of New Renaissance Ventures. | Originally published on New Renaissance Ventures Newsletter.

One year ago, we introduced New Renaissance Ventures to the world as the first dedicated venture fund for the Cultural and Creative Industries. Now, 12 months into this journey, we’d like to take this opportunity to share a status update on our progress and provide an outlook on the industry.

Why New Renaissance Ventures? Why Now?

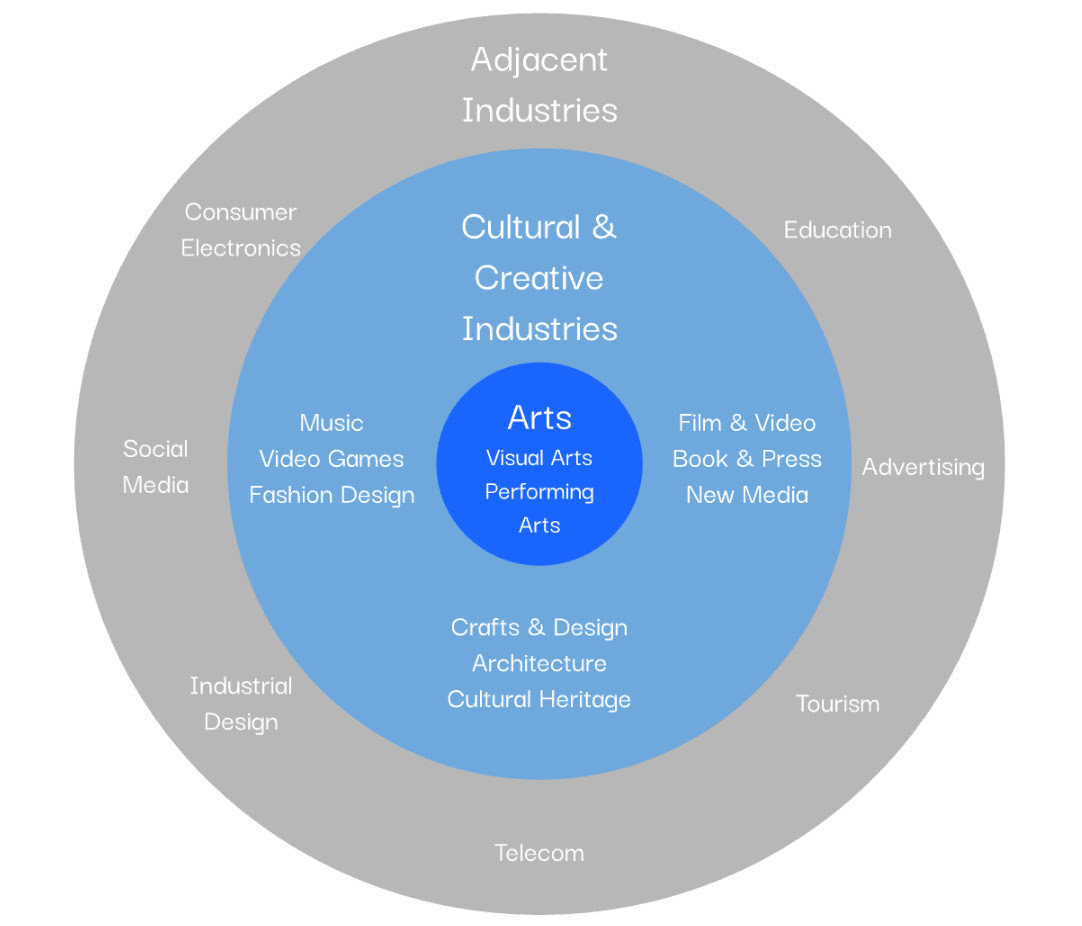

The Cultural and Creative Industries are the heart and soul of European society. However, they not only play a pivotal role in shaping our collective European identity but also represent 5.5% of the EU economy, making the sector larger than pharmaceuticals or telecommunications. Yet, in the world of tech and startups, this sector is often overlooked and underestimated. Great startups exist and are being built as we speak, yet this remains a largely untapped opportunity from a venture perspective.

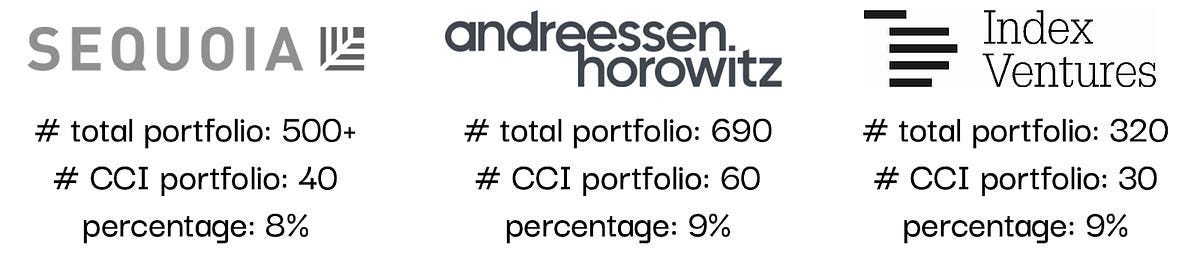

A deep dive into the portfolios of top-tier funds reveals that a significant percentage of companies (8-10%) fall within the Cultural and Creative Industries. Think of major successes like Netflix, Spotify, Shazam, Figma, Canva, Instagram, Twitch, and Unity, alongside more recent breakout companies like Patreon, BeReal, Eleven Labs, Black Forest Labs, Character.ai, and many others.

Despite the substantial share and impressive outcomes, most VCs tend to underestimate the potential of these sectors, often because they don’t follow the classic B2B SaaS playbook. Now, with the AI revolution gaining momentum and XR approaching an inflection point, we are witnessing a tectonic shift in the Cultural and Creative Industries, sparking a wave of innovation not seen since the shift to mobile.

While we're not following the herd by building the next climate tech fund and chasing opportunities that may not exist (that’s not my opinion), we’re pursuing a differentiated thesis, building a diversified portfolio within a niche. Even within a focused sector like Cultural and Creative Industries, there’s a range of highly relevant sub-sectors and adjacent categories. This balance enables us to develop a diversified portfolio while building domain expertise and fostering strong vertical brand awareness.

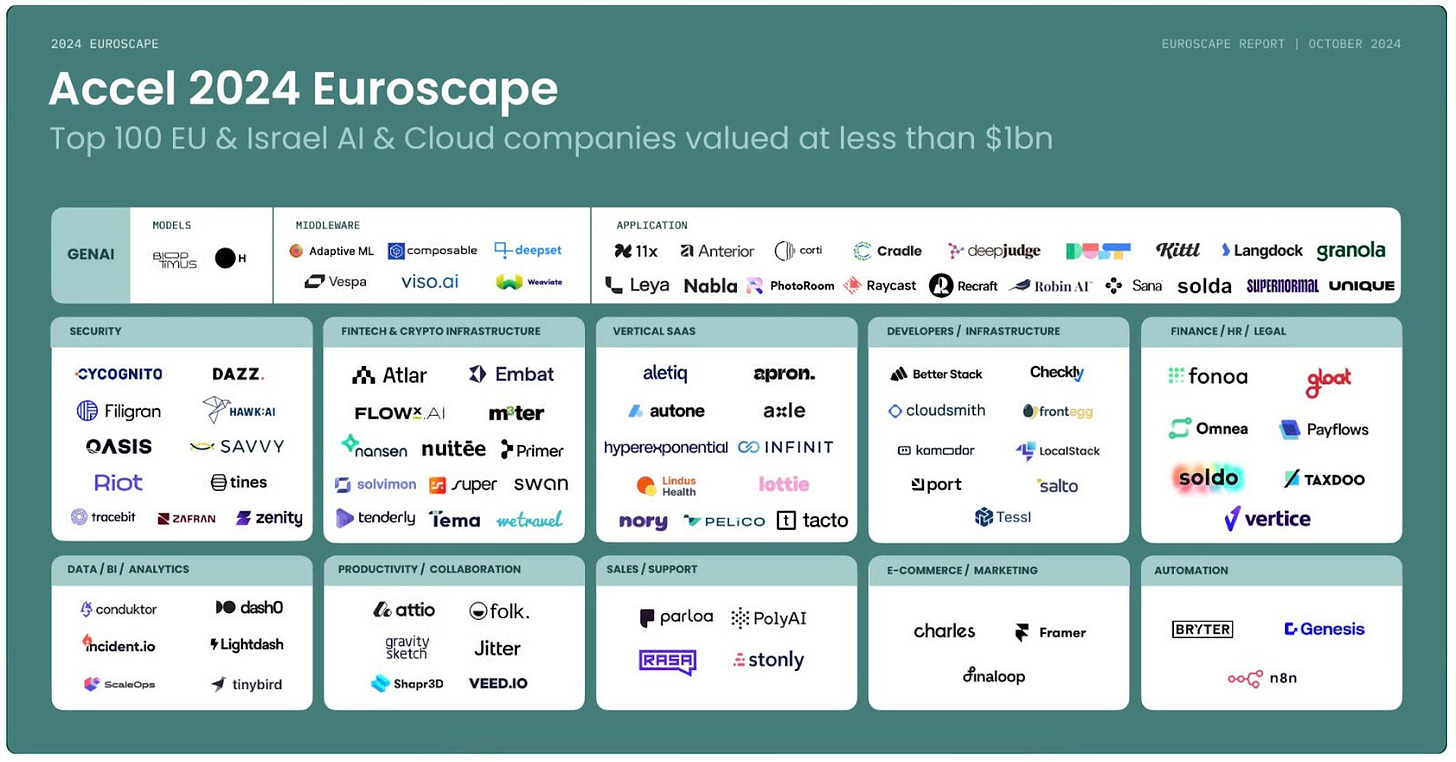

A recent example supporting this thesis is the Accel Top 100 AI & Cloud report. Although there is no specific category for culture or creative tech, eight companies in the report operate within the creative industries. This finding aligns with the portfolio analysis we conducted on top-tier funds. For reference, these companies are Kittl, Recraft AI, Photoroom, Gravity Sketch, Shapr3D, Veed.io, Autone, and Jitter.

It’s all about perspective. New Renaissance Ventures indeed has a different one.

To learn more about our perspective, listen to the recent roundtable discussion we held with EU VC and some incredible guests: Oliver Holle, Founding Managing Partner at Speedinvest; Hazel Savage, VP at SoundCloud; and Uli Schmitz, Managing Partner at Axel Springer Digital Ventures.

The New Renaissance Portfolio

The reason I love this job is simple: it’s the privilege of partnering with the brightest minds and visionaries of our generation. I’m thrilled to have invested in our first eight founding teams and their companies, you can find more details on each company here.

Our strategy has remained consistent since day one: we invest in early-stage tech, co-leading at pre-seed and following tier-one funds at seed. Initial ticket sizes range from €100-400k, with a geographic focus on Europe.

Here are some interesting stats about these eight companies:

Origination: 5 deals were sourced through founder or investor referrals, 1 through active deal sourcing, 1 through an existing relationship with the founders, and 1 via inbound from social media.

Geo: 3 companies are based in the UK, 1 in France, 1 in Germany, 1 in Ukraine, and 2 in Austria

Stage & Ticket: 5 deals were at pre-seed and 3 at seed stage, with an average ticket size of €250k.

Verticals: Music Social Network, New Media, Gaming, XR Content, Comics, Content Management, Music Education

Co-Investors: Notable co-investors include a16z, Firstminute, Speedinvest, JamJar, FJ Labs, Market One Capital, Shine Capital, Mercuri, 6th Man Ventures, The VR Fund, as well as several scouts from Sequoia, a16z, and Atomico.

Two companies are already in talks for their next round and we are closing investment #9 in the next few days. So no slowing down on our end.

The backbone of New Renaissance is our community

We’ve been fortunate to host events in spectacular locations across Europe, welcoming our community to the Palais de Tokyo in Paris, Manchester Square Garden in London, the Neue Nationalgalerie in Berlin, and the House of Music in Vienna. We are incredibly grateful to our partners who helped make these events possible on a very lean, solo-GP-friendly budget. :)

The feedback that resonates with me the most is that our events don’t feel like typical VC or networking events, yet they match the quality of content and people. That’s exactly what we’re aiming for.

As always, picture speak louder than words, so here’s a small gallery:

Lastly, we’re fortunate to build upon a strong and thriving CultTech community, allowing us to contribute to the ecosystem from a venture perspective. Against this backdrop, I’m thrilled to announce the first edition of the CultTech Summit, happening on November 5-6 in the heart of Vienna. This event breaks from traditional conference formats, offering not only debates and speeches but also creative and cultural performances, showcasing the breadth of culture and technology in all its forms. With New Renaissance Ventures as a close partner of the conference, I’m excited to moderate a panel on Investing in Culture and Creative Tech alongside an amazing lineup of panelists.

Final Thoughts

Year 1 has been successful. Despite this being one of the most challenging times to raise a fund in over a decade (with 2024 on track to be the weakest year for VC fundraising since 2015, see chart below), the timing for launching a venture firm has proven spot-on.

Remember, the time of maximum pessimism is often the best time to invest. The post-COVID reality has reset the venture landscape, bringing valuations back to more reasonable levels, unlocking talent from both over-funded startups and over-staffed Big Tech, and setting the stage for the next cycle.

These few years promise to be particularly attractive vintages for early stage venture, our portfolio companies are demonstrating strong growth, and our market positioning is resonating well with founders. I’m confident that there’s room in the European venture landscape to build a top-tier VC brand focused on the Cultural and Creative Industries. This is the foundation of New Renaissance Ventures, and it’s just the beginning. We couldn’t be more excited to execute on this vision.

I’m very grateful to have the support of so many of you on this journey. Your insights, encouragement, and trust have been invaluable as we build this platform.

Severin

New Renaissance Ventures