Newsletter 10.11.25 | The Structures Beneath the Story

From fund models to secondaries, purpose to policy — this week’s conversations reveal how Europe’s venture ecosystem is maturing beyond momentum into mastery.

This week, we’re going deeper into the real mechanics of venture, from the emotions that drive founders and investors to the structures that keep capital flowing.

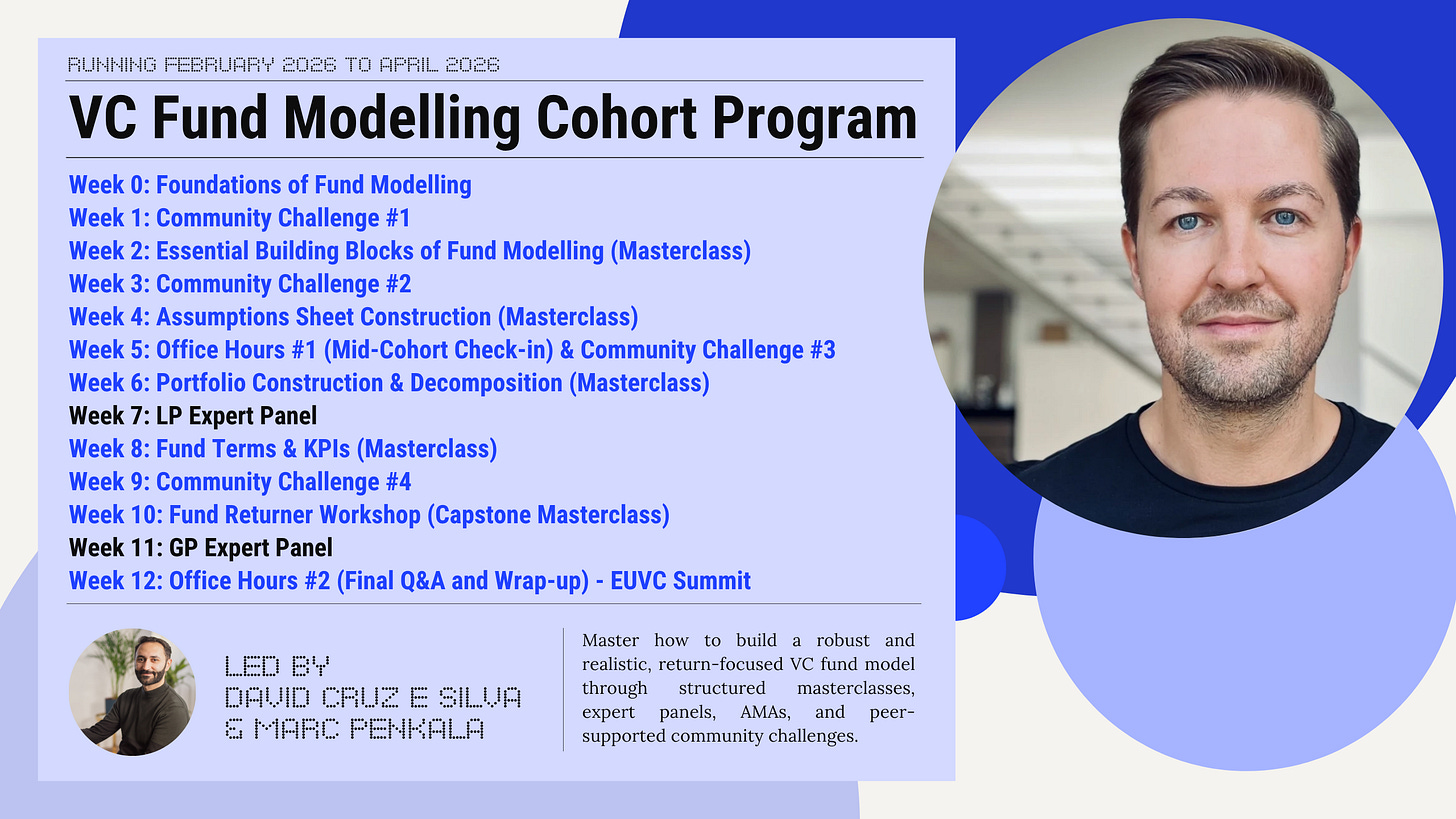

For anyone unsure whether our upcoming Fund Modelling Cohort is worth applying to, we’re reopening the Essential Building Blocks session — the one that kicked off our Fund Modelling series.

On the pod, Seb Agertoft and Mike Reiner unpack what happens when venture meets vulnerability — exploring purpose, trauma, and legacy inside the founder journey. Then, Alper Öner and Enis Hulli take us from Istanbul to global charts with Agave Games, a lesson in pivoting, scaling, and creative compounding. We also hear from Kristaps Ronis of ION Pacific on the rise of structured secondaries — liquidity without selling — and why 2025 is Europe’s year to reset the capital stack.

Rounding it out, This Week in European Tech tackles AI moratoriums, overregulation, and the quiet resilience still shaping Europe’s founders — plus insights on R&D tax credits and distributed engineering teams for those building through uncertainty.

The throughline? Venture isn’t just about returns — it’s about the structures, systems, and stories that make those returns repeatable.

With 💖 David & Andreas

Ready to build a fund model that impresses LPs?

Our 12-week Fund Modelling Cohort is designed for emerging fund managers, allocators, and professionals who want to learn how to build a robust, LP‑ready model from scratch. This isn’t just a series of lectures — it’s a hands-on, interactive experience where you’ll create and stress-test your own fund model with real-world feedback from experienced GPs and LPs.

This cohort isn’t just about learning theory. You’ll walk away with a real, tangible fund model that you can use to raise capital, structure deals, and make key financial decisions.

Seats are limited so don’t miss out on the opportunity to build the fund model that could take your venture to the next level.

Still unsure, watch the teaser to our renowned Essential Building Blocks masterclass.

Table of Contents

🎧 Podcasts of The Week

Seb Agertoft, Evolution & Mike Reiner, 432 Legacy: Venture beyond: Trauma vs Purpose

Alper, Agave Games & Enis Hulli, e2vc: Pivoting Models & Building Global Gaming Success from Turkey

Kristaps Ronis, ION Pacific: The Rise of Structured Secondaries in Venture

✍️ Insights of The Week

R&D tax credits: What startups miss, and how to make the most of a new regime

The ins and outs of leveraging distributed engineering teams

🎧 Podcasts of The Week

Seb Agertoft, Evolution & Mike Reiner, 432 Legacy: Venture beyond: Trauma vs Purpose

Welcome to a new episode of the EUVC Podcast, where we dive into the world of gaming with Alper Öner, Co-founder of Agave Games, and Enis Hulli, General Partner at e2vc — the VC who backed Agave before it even existed. Together, they unpack how Turkey became the epicenter of mobile gaming and how Agave’s breakout hit Find the Cat turned a niche mechanic into a global phenomenon. “Turkey has created two unicorns in gaming,” Enis says. “Out of Peak’s hundred people came eighty new studios. That multiplier effect is crazy.”

Alper shares how Agave began as a publishing startup before pivoting to build games in-house. “We wanted to get more skin in the game,” he recalls. That decision led to Find the Cat — a simple hidden-object game that skyrocketed up the charts with metrics investors called “once in a lifetime.” As Enis puts it, “The ROAS figures were super solid from day one. There was almost no risk — of course, scale it as much as you can.”

Now Agave is doubling down with What the Hex, a color-sorting puzzle that’s already testing off the charts. “When Alper sent me the test live, I asked my wife to try it,” Enis laughs. “A month later she’d played two thousand sessions.” For him, the lesson is clear: “Gaming is more Pixar than SaaS — it’s not about moats, it’s about the cornered creative resource.”

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Alper, Agave Games & Enis Hulli, e2vc: Pivoting Models & Building Global Gaming Success from Turkey

Welcome to a new episode of the EUVC Podcast, where we dive into the world of gaming with Alper Öner, Co-founder of Agave Games, and Enis Hulli, General Partner at e2vc — the VC who backed Agave before it even existed. Together, they explore how Turkey quietly became Europe’s mobile gaming powerhouse and how Agave’s breakout hit Find the Cat turned a quirky hidden-object idea into a global phenomenon.

“Out of Peak’s hundred people came eighty new studios,” Enis notes. “That multiplier effect is just insane.”

Alper shares how Agave began as a publishing startup before making the bold pivot to build games in-house. “We wanted to get more skin in the game,” he recalls. That shift set the stage for Find the Cat — a deceptively simple game that climbed the charts, generating hundreds of thousands of dollars in daily revenue and inspiring a wave of imitators. “The ROAS figures were super solid from day one,” Enis says. “There was almost no risk — of course, scale it as much as you can.”

Now Agave is doubling down with What the Hex, a color-sorting puzzle that’s already testing off the charts. “When Alper sent me the test live, I asked my wife to try it,” Enis laughs. “A month later she’d played two thousand sessions.”

For Enis, the takeaway is clear: “Gaming is more Pixar than SaaS — it’s not about moats, it’s about the cornered creative resource.”

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Kristaps Ronis, Ion Pacific: Structured Secondaries

Welcome to a new episode of the EUVC Podcast where we go deep with the people shaping European venture.

This week, David sits down with Kristaps Ronis, Partner at ION Pacific, to unpack one of the fastest-rising corners of venture: structured secondaries. Based between Europe and Asia, Kristaps has been with ION since its founding and now runs the firm’s European practice: helping GPs, LPs, and founders unlock liquidity without selling or signaling.

“DPI is king,” Kristaps says. As IPOs stall and LPs demand distributions, structured deals are stepping into the gap, offering partial upfront cash today and future upside tomorrow. He explains why 2025 is “the year of EU continuation vehicles,” what mistakes sellers make by waiting too long, and how even emerging managers can reopen information rights through relationships. In short: liquidity without selling is no longer a paradox, it’s becoming venture’s new normal.

🎧 Listen on Apple or Spotify or queue it for later with chapters ready to go.

This Week in European Tech with Dan, Mads, Lomax & Andrew

Welcome to a new episode of the EUVC Podcast, where our good friends Dan Bowyer, Mads Jensen, Lomax Ward, and Andrew J Scott dig into the headlines shaping Europe’s venture, policy, and tech future.

This week, the crew tackles the big questions facing European innovation — from the growing debate over AI moratoriums and overregulation to the funding freeze gripping LPs and founders alike. They explore whether Europe’s cautious politics are protecting society or quietly killing risk appetite, and how optimism has become the rarest currency in venture.

They also dive into deep tech’s quiet rise, founders stepping up as Europe’s new diplomats, and why the current downturn might just spark the ecosystem’s long-overdue reset.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

We’re mapping the biggest challenges in fund modelling. Add your perspective (3 min)

✍️ Insights of The Week

R&D tax credits: What startups miss, and how to make the most of a new regime

The UK now uses a single, unified RDEC scheme with a 20% headline credit (~15–16% net). Eligible loss-making SMEs (≥30% of operating spend on R&D) can access enhanced ERIS relief (~27% net). HMRC is tightening scrutiny—failures in documentation or vague descriptions can lead to rejection or clawbacks.

Clear, real-time record-keeping and collaboration between finance and engineering are vital. Spring 2024 ushered in a reimagined UK R&D tax regime: the merged RDEC scheme, offering a single 20% credit affecting all companies, large and small. While simpler, its net benefit—15–16% post-tax—is less generous than what previous schemes provided. To boost support, loss-making SMEs spending 30% or more of their operating expenses on R&D may qualify for ERIS (Enhanced R&D Intensive Scheme), delivering up to ~27% net returns.

Though more forgiving than its predecessor thresholds, ERIS is still intended for deeply R&D-focused businesses. Yet HMRC is also sharpening enforcement. They define qualifying R&D as an “appreciable advance” in science or tech; generic software or routine tasks do not count (a website, for instance, won’t qualify). Reclaimed credits—or subsequent HMRC assessments—are not uncommon without strong records. To stay ahead, founders are advised to embed R&D evaluation throughout engineering cycles—not kickstart everything at year-end.

For startups—and particularly founders in biotech, fintech, or deep tech—R&D tax credits offer essential, non-dilutive capital. But maximizing them today requires disciplined processes, cross-functional clarity, and documentation rigor. When done well, the financial upside and credibility boost are well worth the investment.

The ins and outs of leveraging distributed engineering teams

Building with distributed teams gives founders access to world-class skill at leaner costs — but also brings new challenges in alignment, culture, and management. As Kinfolk’s Jeet Mukerji shares, success with contractors hinges on long-term relationships, trust, and sometimes shared ownership: “We’re looking at granting equity options so they can feel like they have skin in the game.” Yet as Signal AI’s Alan Wright reminds us, letting knowledge “walk out the door” with contractors can limit learning and IP development — a trade-off every founder must weigh.

Remote’s Francesco Cardi adds that great distributed teams thrive on independence and clarity: “We design our hiring processes around people who are highly proactive and exceptionally clear writers.” Whether you’re outsourcing, hiring globally, or blending both models, distributed engineering demands intentional leadership and a strong cultural core. The right mix can turn geography from a constraint into a competitive advantage — if managed with purpose, trust, and structure.

Most of the stories in venture are about founders and VCs...

But behind every great fund, there’s women writing the checks behind the checks.

That’s why we’re proud to partner with FOV Ventures on the Female LP Pathways Survey 2025 — the first deep dive into what drives (and blocks) women from becoming LPs.

If you’re a female LP or an aspiring one, take 6-10 minutes to add your voice. Your answers will help us:

👉 Map the untold stories of women in venture capital.

👉 Build better data for new LP structures and syndicates.

👉 Open the door for more women to step into the LP role.

Every response helps write the Female LP Pathways Report — and yes, it’ll be fully open for everyone to learn from.

@fov-ventures @tesi @unlockvc @ada-ventures @kvanted

Where operational expertise and innovation work for you.

Where Europe’s venture capital LPs & GPs connect — curated, high-impact networking | Buy tickets now!

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.