TechBBQ & The Nordic LP Forum Did It Again🌟

We joined more than 800 LPs, VCs & Angels descending on Copenhagen for Nordic LP Forum and TechBBQ to see what the Nordics had to offer in 2023 - I doubt any one left disappointed 🔥

Copenhagen's canals have seen many a story unfold – tales of voyagers, of dreams, and of ambitions that stretched beyond the city's horizons. On this particular day, the gentle waves reflected a new tale: TechBBQ and the second edition of the Nordic LP Forum.

As so often, we joined up the day before the big event to connect some of our portfolio GPs with a group of angels. This time, Kenneth & Jan had invited us to drop by the Keystones Angel Network for a discussion on how angels and VCs can work together - and of course restate the adage we’ve come to live by: Venture investing is like high school and LP tickets are your backdoor to the best parties. Syndicates are the taxi that takes you there.

But let’s turn our eye to the big boys and shift our attention to the Nordic LP forum - this year exclusively for institutional LPs, but next year rumoured to be opened up for HNWIs as well 👀.

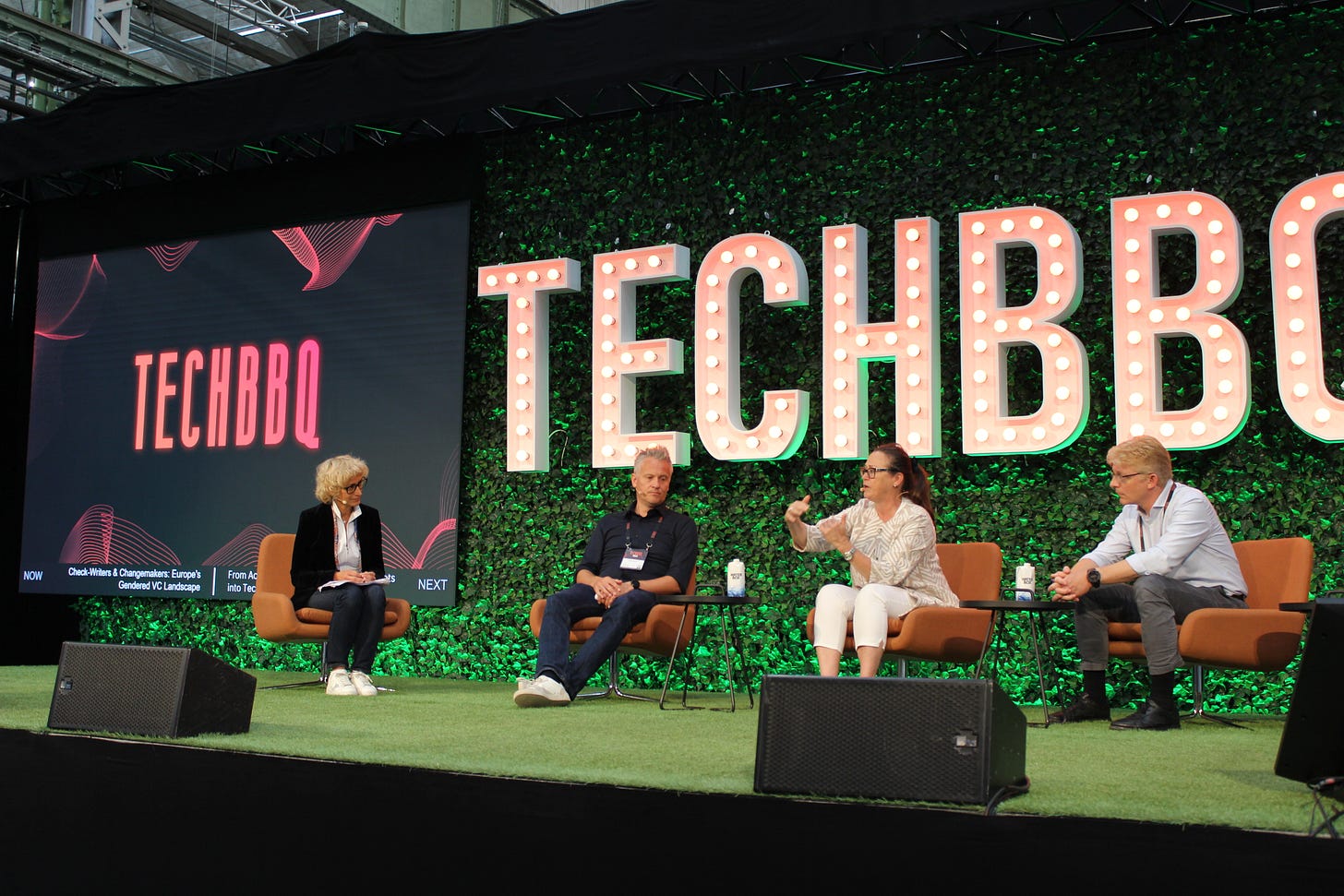

The Danish Foreign Ministry, had invited the TechBBQ team to host the forum at their spot right by the waterfront. While the pristine canal view was undeniably picturesque, it was rivaled by another view: the gathering of over a hundred Limited Partners (LPs) – both fresh-faced and seasoned – each bearing the spark of curiosity and the thirst to delve deeper into the intricacies of venture dynamics.

The air was thick with anticipation as the day's agenda unfurled. If there was one takeaway echoing in the hallowed halls, it was this: European venture, as any other region, has ridden a tumultuous wave. There’s been a time of sheer exuberance, a golden age where every VC seemed to have the touch of Midas. But, as is the story of so many golden eras, there had to come a precipitous fall.

However, like a phoenix, Europe is rising, rediscovering itself and the principles that have made venture the best performing asset class. Deputy Director at EIF, Uli Grubenwarter's session was a testament to this journey.

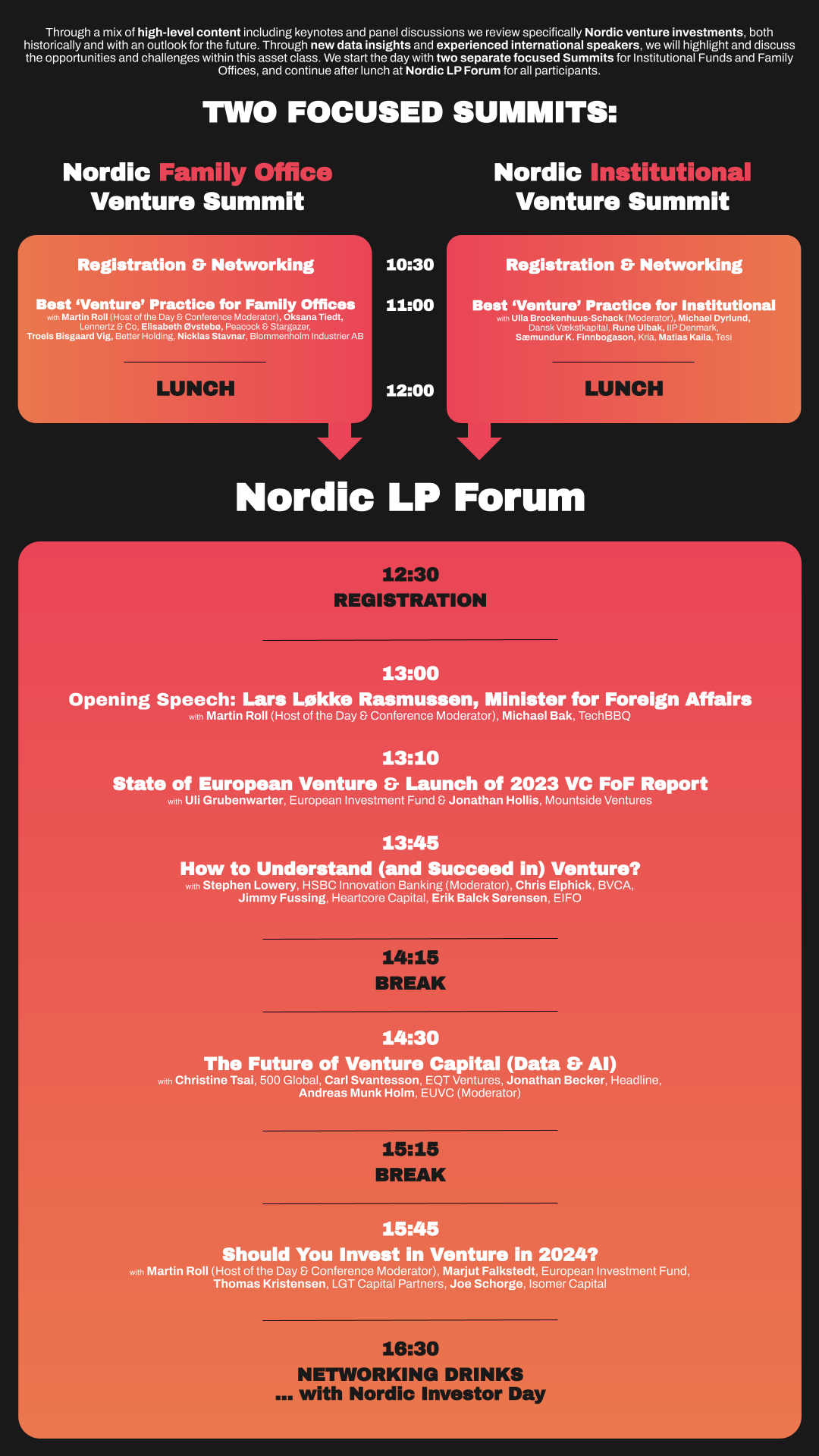

Offering a deep dive into the European Investment Fund's LP portfolio, Uli painted a picture of the past, the trials and tribulations, and most importantly, the trajectory we're on today. It was an analytical masterpiece, a narrative interspersed with data and insights. The conference was, as always, Chatham house rules, so you can imagine how my phone is burning in my pocket for sharing snaps of the presented deck. Instead, it’ll have to suffice to share the program and invite you to join us for the Forum next year.

For me, the most poignant moment arrived when Jimmy Fussing, Founding GP of Heartcore, took the stage. Debating the merits of backing emerging managers, Jimmy was thrown a curveball by a co-panelist suggesting that new LPs might be best served aligning with established managers. I found myself almost instinctively wanting to voice my disagreement. In my view, emerging managers are the lifeblood of innovation, the driving force behind ventures that dare to tread uncharted territories.

So, when Jimmy, instead of leveraging this moment to pitch Heartcore – undeniably one of Europe's finest consumer VCs with a storied legacy – chose to champion the cause of these new trailblazers, I felt a surge of admiration 💗 It wasn't just about acknowledging the prowess of the new entrants; it was about celebrating the spirit of venture as a whole 🚀.

The future of Venture Funds - the impact of Data & AI

Charged with anticipation, I took the stage to moderate a panel that promised insights into a future augmented by Data & AI: The Future of Venture Capital. Flanked by panelists from industry luminaries – Carl Svantesson of EQT, Jonathan Becker of Headline, and Christine Tsai from 500 Global – the conversation was geared towards understanding how Data and AI are redefining the very operations that power venture capital.

The most revelatory moment? A simple poll. A question posed to the sea of LP faces:

"How many of you are actively harnessing the power of AI in your day-to-day operations as LPs?"

Among the hundred or so faces, only three hands went up. It was a moment of stark realization, a testament to the untapped potential and the vast expanse of innovation yet to be explored. And yes, let’s just say, we took note. There's some intriguing content brewing in our pipeline, but more on that later!

As the sessions progressed, the room was treated to a closing panel that was nothing short of electric. Joe Schorge's presence was magnetic as ever (said by fanboy #1 and Isomer VP, all interests disclosed 🤞) and Marjut Falkstedt, CEO of the EIF and Thomas Kristensen from LGT gave us a panel to remember, while Martin Roll masterfully steered the ship safely, yet dynamically as the moderator. The energy was palpable, each panelist echoing a unanimous sentiment allowing us to close the day on the only note an LP day in Europe can end on: If you’re in a position to allocate today, there’s no better time to put down your chips.

As the day wound down, the night was still young. Our small contingent of friends and co-investors, found respite in the chic ambiance of a little place referred to me by my dear sister called Baka D’ Busk. Amidst the tantalizing flavors of vegan delicacies and under the soft glow of ambient lighting, conversations flowed as freely as the wine. As the clock neared midnight and the restaurant prepared to draw its curtains, there was a collective wish – if only we had a few more hours to revel in this exquisite company. Luckily, the wild days of TechBBQ with its busy conference floor and exclusive side events had us covered. One event stands out to me and we felt fortunate to be allowed to support it, The European Women in VC’s GP/LP meetup. Big shout out for pulling this off and doing the hard work needed. Read their fresh off-the-press report here.

Closing remarks

The journey through The Nordic LP Forum and TechBBQ was as enlightening as it was exhilarating. From poignant revelations about the future of VC to forging new alliances over delectable dinners, this journey was a reminder of the boundless potential and the sheer magic that the European venture ecosystem holds. Until next time, Copenhagen! 👊