Real-Time Tax Accounting: Transforming Fund Operations for VC and PE Managers

by Felix von der Planitz Co-CEO and Head of ACE TAX.

Guest post by Felix von der Planitz Co-CEO and Head of ACE TAX.

As someone who’s spent years navigating the labyrinth of venture capital (VC) and private equity (PE) fund taxation, I’ve learned one thing: complexity isn’t a bug; it’s the system. Yet, the speed of change in tax regulation is outpacing even the sharpest minds in the industry.

Enter real-time tax accounting—a revolution that’s disrupting the way we manage funds, optimize structures, and, most importantly, deliver returns.

If you’re managing VC or PE funds, Germany’s recent tax reforms are your wake-up call. Real-time tax accounting isn’t just a nice-to-have—it’s the competitive edge you need in today’s hyper-regulated market.

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

The Need for Real-Time Tax Accounting

Traditional tax reporting systems often leave fund managers playing catch-up, reacting to issues only after they arise. Real-time tax accounting flips the script: a proactive system providing ongoing insights into a fund’s tax position. It’s not just about staying afloat—it’s about steering the ship with purpose.

Currently, most fund managers are operating in a fragmented landscape where fund administration, accounting, and tax processes are siloed. Thousands of Excel sheets shuttle between departments and external service providers, creating inefficiencies and opportunities for human error. In this environment, reconciling discrepancies becomes a time-consuming chore, and vital insights are buried in disjointed workflows.

Errors in these systems aren’t just inconvenient—they’re costly. Misreporting, compliance breaches, and delayed decisions can erode investor confidence and create regulatory headaches. Real-time tax accounting eliminates these silos by integrating fund admin, accounting, and tax into a communicating ecosystem. This isn’t just automation; it’s a structural overhaul that transforms how funds operate.

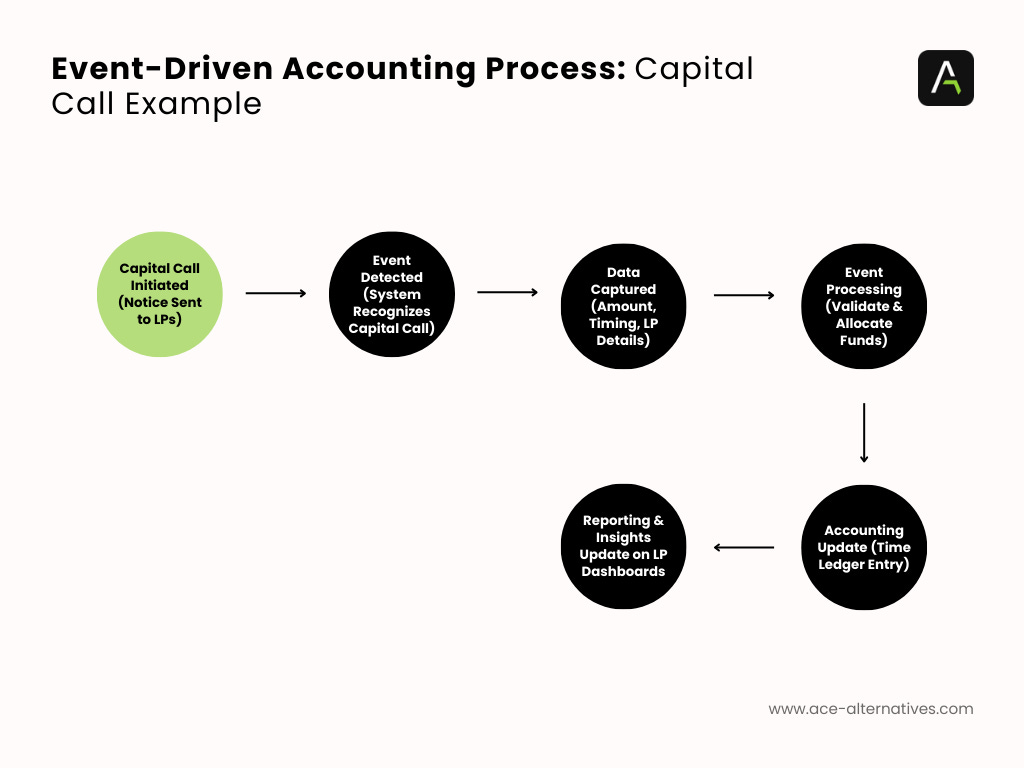

Let’s bring this to life with a practical example: managing capital calls for alternative asset vehicles. The process flows as follows:

Strategic Agility for VC and PE Funds

The unique tax complexities of VC and PE funds—such as partnerships’ tax transparency and trade tax rules—demand sophisticated solutions. Real-time tax accounting equips fund managers to address these challenges by enabling:

• Continuous monitoring of tax positions.

• Swift responses to regulatory changes.

• Strategic alignment with long-term investment goals.

• Enhanced liquidity and reserve planning to ensure capital is readily available for both anticipated and unexpected needs, reducing the risk of over- or under-allocating funds.

In this context, real-time systems aren’t just compliance tools—they’re your strategy compass

Benefits of Adopting Real-Time Tax Accounting

The advantages of implementing real-time accounting processes are crystal clear:

Efficiency: Significantly reduced reporting times and streamlined workflows.

Accuracy: Event-driven accounting systems minimize errors and enhance transparency.

Adaptability: Continuous updates enable fund managers to stay ahead in a fast-moving industry.

"With 6–8 weeks saved on manual reporting, 90% fewer time delays, and 24/7 real-time updates, the benefits of real-time tax accounting are staggering. It allows fund managers to shift their focus from fighting inefficiencies to driving returns."

— Felix von der Planitz, CEO of ACE TAX

Technology: The Key to Unifying Systems

The modern fund management ecosystem relies on a variety of SaaS-based accounting platforms and fund administration tools, each tailored to specific functions. However, operating these systems in isolation creates inefficiencies, redundancies, and potential for error. The key to overcoming these challenges lies in leveraging technology to unify accounting software with the entire fund administration lifecycle.

Integrated platforms enable seamless data flow across fund events, from capital calls to distributions, ensuring that all stakeholders have real-time access to accurate, consolidated information. By adopting tech-driven solutions, fund managers can reduce manual intervention, improve accuracy, and focus on strategic decision-making instead of navigating fragmented workflows.

However, creating such an integrated ecosystem is both expensive and complex, requiring significant investment and expert domain knowledge. The implementation demands a deep understanding of fund operations, tax compliance, and technology to ensure the system meets the unique needs of alternative asset management.

Why ACE Tax Is Your Trusted Partner

At ACE Tax, we’re not just adapting to the tax landscape—we’re transforming it. Our tech-driven solutions are designed specifically for fund managers and LPs, ensuring accuracy, compliance, and operational excellence.

Seamless Integration: Our tax services connect directly with your fund administration, creating a unified ecosystem that eliminates redundancies and enhances efficiency.

Event-Driven Accounting: By leveraging real-time, event-based accounting principles, we drastically reduce booking cycles, streamline processes, and provide unmatched transparency.

Tailored Solutions: From cutting reporting times by 90% to delivering actionable updates 24/7, we align our services with your business needs, ensuring you stay ahead in a fast-moving industry.

Conclusion

As tax laws evolve at an unprecedented pace, real-time tax accounting offers a path forward. By adopting proactive, technology-driven approaches, fund managers can enhance operational efficiency, maintain compliance, and position themselves strategically in a dynamic market.

Adaptation isn’t just a choice—it’s survival. Whether it’s managing the impact of carried interest reforms or streamlining complex tax workflows, the tools you choose today will shape your success tomorrow. Embrace clarity, embrace control, and chart a course for a more agile future.