Reflecting on Specialisation in Europe’s VC Landscape

Capped off by a members-only LP AMA

Despite the challenging economic winds of recent years, Europe’s venture ecosystem has proven remarkably adaptable. Many GPs are finding their voice - and their advantage - by focusing down. These emerging “specialist” managers pride themselves on going deep in a particular sector, region, or stage, hoping that laser focus will outperform a more generalist approach. In fact, we’ve seen a surge in specialised VC funds - those that go beyond basic sector labels and invest with deep conviction in fields like climate tech, health tech, deep tech, or region-specific innovation.

Yet does specialisation truly offer a better path to success, or are we overhyping a trend that works for some but not for all?

At EUVC, our aim is to shine a light on how European VC really works- showcasing the wins, the pitfalls and the inside track. Eager to delve deeper?

We’re hosting a members-only LP AMA with James Heath - Investment Principal @ dara5 and author of the article “Why Specialists Will Win the Next Decade of Venture”. For EUVC community members only.

Why Specialisation Is Gaining Ground

A Growing Interest in “Going Deep”

The appeal of specialisation is clear: a team dedicated to, say, renewable energy or AI in a single region can build extraordinary sector knowledge, forge highly relevant networks, and spot promising startups early - well before a more general fund might take notice. Throughout Europe, local ecosystems reinforce this dynamic: Paris now thrives on AI and semiconductor deep tech, Berlin boasts a creative surge in both consumer and B2B startups, and London retains its global clout in FinTech and cybersecurity. Specialised investors in each hub can embed themselves in the local scene, maintaining close ties with founders, academic institutions, and corporates. However, hyper-local approaches can also limit a fund’s ability to scale or syndicate deals across borders.

A Spectrum of Approaches

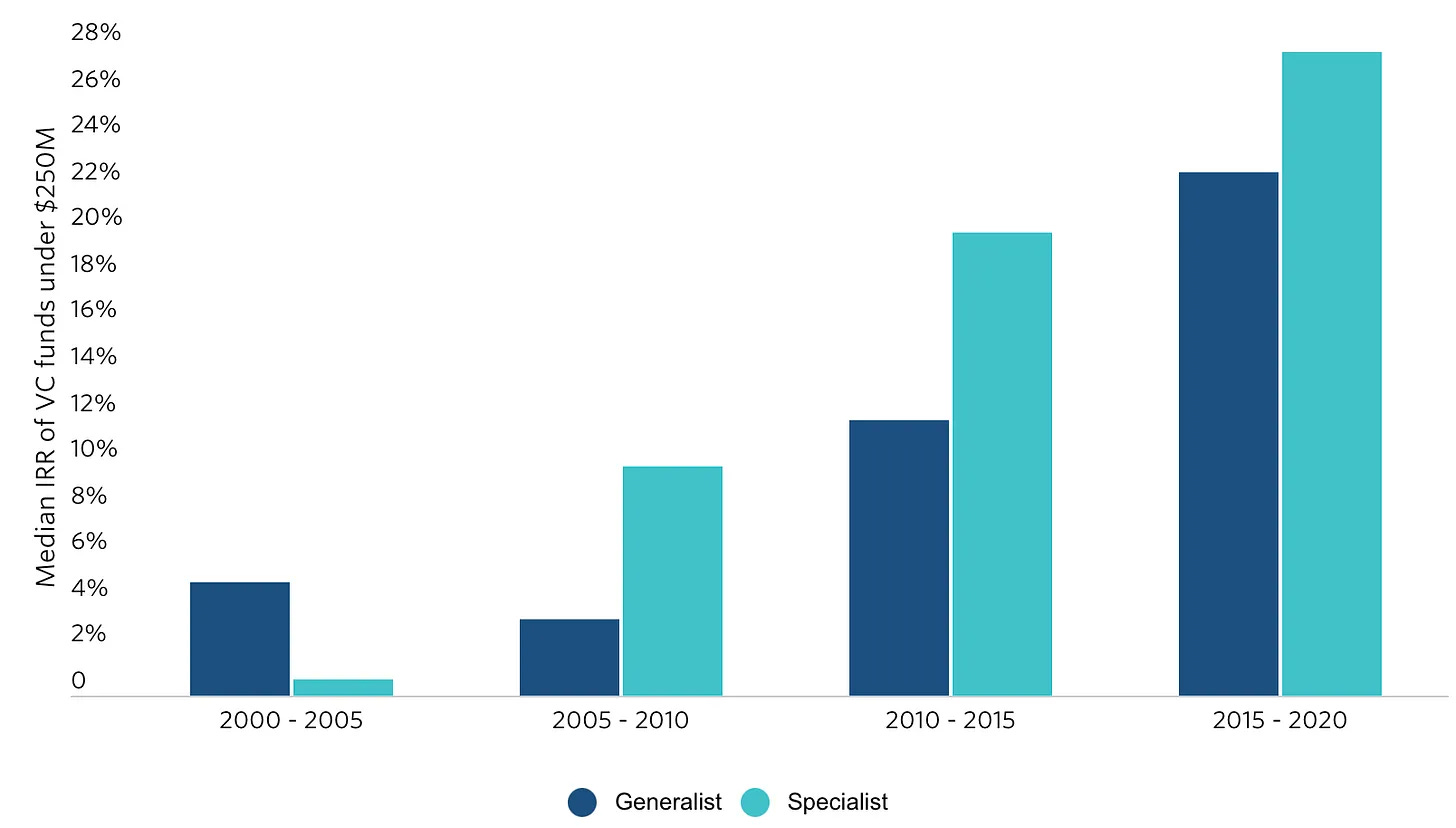

Some managers take a hybrid path: they pick a core domain (like AI) but diversify slightly within that space, targeting sectors such as AI for healthcare, enterprise, or climate solutions. This strategy retains domain-level expertise while hedging against single-sector headwinds. Data shows that specialisation often meets or surpasses diversified approaches in terms of returns, and in certain cases, it clearly outperforms. Multiple sources (including the European Investment Fund) point out that niche-focused funds hold their top-quartile status more consistently, thanks to competitive moats (like privileged relationships with labs or corporates).

In fact, according to an analysis shared by James (our guest for the upcoming LP AMA), specialist VCs can be nearly 50% more likely to reach top-quartile performance than generalists, based on a dataset of over 1,300 funds. Yet historical consistency isn’t a crystal ball - if a particular field stagnates or is overtaken by new technologies, hyper-focused funds can be left scrambling.

No One-Size-Fits-All

A well-run generalist fund can - and often does - perform just as impressively, especially when it has the flexibility and capital to pivot between surging sectors. Instead of framing it as “best vs. worst,” we see specialised and generalist models as two different ways to tackle Europe’s diverse venture landscape. While specialists can tap into local or domain-specific insights, they may miss broader cross-sector synergies. Conversely, generalists risk spreading themselves thin.

It’s also worth noting that median returns in venture can be deceptive. As James also recently emphasised, “if you’re not pushing for top-quartile performance, you might as well explore more liquid or less risky alternatives.”

Approach with Nuance

It’s tempting to attribute specialised funds’ outperformance solely to domain expertise, but the reality is more layered. Specialised GPs often benefit from richer networks: academic labs, policy circles, and industry partnerships, giving founders vital support beyond just capital. Still, there’s no guarantee of success. For every specialised fund that soared, another got blindsided by market changes, lacking the diversification to pivot in time. In short, the data suggests that focus can pay off—but it requires a clear-eyed understanding that specialisation is both an opportunity and a risk.

The LP Perspective: Growing Appetite, Lingering Scepticism

Institutional (Under)Allocation

European LPs, namely pension funds - representing huge untapped capital -, collectively control trillions in assets, yet historically, they’ve been cautious with early-stage VC - allocating roughly 0.01% of their capital to it. Over time, some have warmed to the idea that specialist strategies can deliver strong risk-adjusted returns, provided the managers have the track record and insider advantage to justify the narrower focus.

Hesitation often stems from worries that specialised strategies might rely too heavily on singular technologies or narrower market segments. In other words, the inherent volatility in a specialised approach can clash with institutional mandates for stable, predictable returns.

Many institutions prefer the relative safety of a diversified portfolio, especially during times of macro uncertainty. From that angle, a balanced blend of specialised and generalist funds might be the sweet spot in Europe’s vast and varied market.

Public Entities Leading the Charge

Government bodies account for as much as 68% of all European VC funding, a testament to Europe’s willingness to channel public capital into strategic areas like renewables or deep tech. The European Investment Fund alone has backed more than 650 VC funds since 2015, effectively mitigating risk for specialised managers working in policy-favoured sectors (such as those boosted by Horizon Europe or the Digital Markets Act).

Fundraising Hurdles

The reality is that specialised funds, however promising, can face steeper fundraising challenges. Our research indicates that 3 out of every 4 European GPs anticipate weaker fundraising in the near term. Even if specialisation outperforms in select niches, managers must convince institutions they can handle the sector’s ups and downs - and navigate to successful exits - before securing significant commitments.

Founders Weigh In

Why Specialisation (Sometimes) Matters

For many European founders, capital is only the beginning. They often seek hands-on support, well-connected networks, and practical know-how, especially when tackling niche fields like biotech, deep tech, or climate solutions. A specialised investor can offer deeply relevant guidance on everything from product development to regulatory hurdles and access to specialised talent pools. At the same time, specialisation has its risks: a hyper-focused fund might be too narrow in its strategic vision, limiting cross-industry collaborations or broader market pivots. That’s why some founders pair a specialised lead investor with a more generalist co-investor, blending focused expertise with a wider perspective.

Regional differences further complicate the mix. A specialised fund familiar with local language, hiring norms, or region-specific regulations can be a major asset, but if a founder aims for global expansion right away, a broader fund with international reach may open more doors. Ultimately, there’s no universal model - one startup may flourish with a niche investor who speaks its exact technical language, while another may prefer a more expansive approach. What’s clear is that specialisation can deliver extraordinary value beyond just writing a check, provided founders balance that focus with flexibility.

Embracing Complexity

At EUVC, our role isn’t to crown specialisation as king or wave a banner for generalists. Rather, we aim to spark the dialogues that help GPs, LPs and founders parse Europe’s evolving innovation landscape.

There’s more than one road to success in European venture- and that’s exactly what makes this ecosystem so exciting.

My stance is that focus can yield remarkable results, provided managers stay humble, data-driven, and ready to pivot when the market shifts. Let’s keep the conversation going - and hopefully see you at our AMA with James Heath, where we’ll dig deeper into these nuances. After all, real depth isn’t confined to one thesis: it thrives on honest questions, shared learnings, and the understanding that there’s more than one path to success in Europe’s ever-changing startup ecosystem.

If you’re intrigued - or even sceptical - about specialisation, we invite you to dig deeper at our upcoming members-only AMA with James Heath, author of the article “Why Specialists Will Win the Next Decade of Venture” and an LP who invests across both emerging and established managers in Europe. Expect candid insights, and an opportunity to ask all the questions on how specialists win (and sometimes lose), what LPs look for in hyper-focused strategies, how to balance conviction with risk and much more.

For EUVC community members only.

So, is specialisation “the future?” For many, it’s poised to be a driving force of the next decade, especially in Europe’s core strengths like AI, sustainability, or biotech. Yet not all specialised funds will thrive - factors like market timing, policy support, and the calibre of the management team matter as much as domain expertise. Meanwhile, generalist funds aren’t disappearing: many remain critical to the ecosystem, offering broader coverage and the financial muscle to lead larger rounds. Ultimately, there’s no single winner: Europe’s venture landscape is too diverse and dynamic for a one-size-fits-all model.

As James suggests, in frothier bull markets - where sheer access often trumps deeper insight - generalists can still thrive. However, I’d argue the dynamic isn’t entirely black-and-white. We’ve also seen specialists leverage their domain expertise to sustain (and even expand) their advantage, regardless of market conditions. Ultimately, outcomes tend to hinge on how well a fund can adapt, rather than whether it’s strictly specialised or generalist.

At first glance, the numbers for specialised funds can be compelling, but Europe’s mosaic of local policies, cultural nuances, and academic partnerships demands constant adaptation. The best specialised funds don’t just “pick a theme;” they build networks, insights, and infrastructure that help founders in ways broader than capital sometimes can. Whether that translates into enduring outperformance is an open question - one shaped by each manager who believes in the power of a focused thesis.