Research finds net zero not a priority for VCs tackling ESG

by Henry Philipson, Marketing & Comms Director at Beringea | President of ESG_VC

Guest post by Henry Philipson, Marketing & Comms Director at Beringea | President of ESG_VC | Originally published on ESG_VC.

ESG_VC and Marriott Harrison’s survey of more than 90 global VC firms reveals that whilst there is good intent amongst VCs to adopt ESG policies, challenging market conditions are impacting progress.

Data from ESG_VC, the industry initiative enabling start-ups and their investors to improve ESG performance, suggests VCs are pushing back on 'net zero'. In partnership with Marriott Harrison, a leading London-based high-growth market specialist law firm, found that more than half (54%) of 91 VC firms questioned see 'achieving net zero' as the least important motivation for their ESG initiatives.

Key findings: Value creation is the main driver of ESG in venture

The extensive survey, which provides unique insight into the attitudes of leading VC firms and how these are communicated, demonstrated rising industry inertia on net zero - with 48% of firms instead making 'value creation' the top driver of portfolio companies' ESG initiatives. This was followed by regulatory compliance (23%) and reporting to LPs (15%).

Lack of in-house ESG expertise, despite growing volume of work on sustainability

VCs reported a lack of in-house ESG expertise. Only a third (29%) of VCs have sustainability specialists leading their work on ESG, while 54% of respondents now publish an annual ESG report, suggesting market factors are shifting priorities.

Sustainability clauses have become market standard

ESG has, however, been factored into deals and is becoming a market standard, with 70% of VCs including a 'sustainability clause' in their term sheets and 45% including a 'diversity clause'.

Henry Philipson, Co-Founder and President of ESG_ VC, commented:

“This research shows the challenging position many VC firms find themselves in today. Investors are clear on the need to prioritise ESG and sustainability as significant drivers of value in their portfolio, but they often lack the resources or expertise to act on these objectives. ESG_VC and Marriott Harrison are, therefore, playing a key role in collaborating with the ecosystem to build a pragmatic roadmap for deploying ESG within start-ups.”

David Strong, Head of Venture Capital and a Partner at Marriott Harrison, commented:

“ESG frameworks have been brought to the forefront of many discussions within the private markets and this was clear from the initial ESG_VC report. Diving deeper into the investor survey has been enlightening. In particular it is interesting to see the findings on term sheets where diversity and sustainability clauses are becoming more prevalent in European term sheets (contrary to the direction we are seeing sentiment moving in the US).”

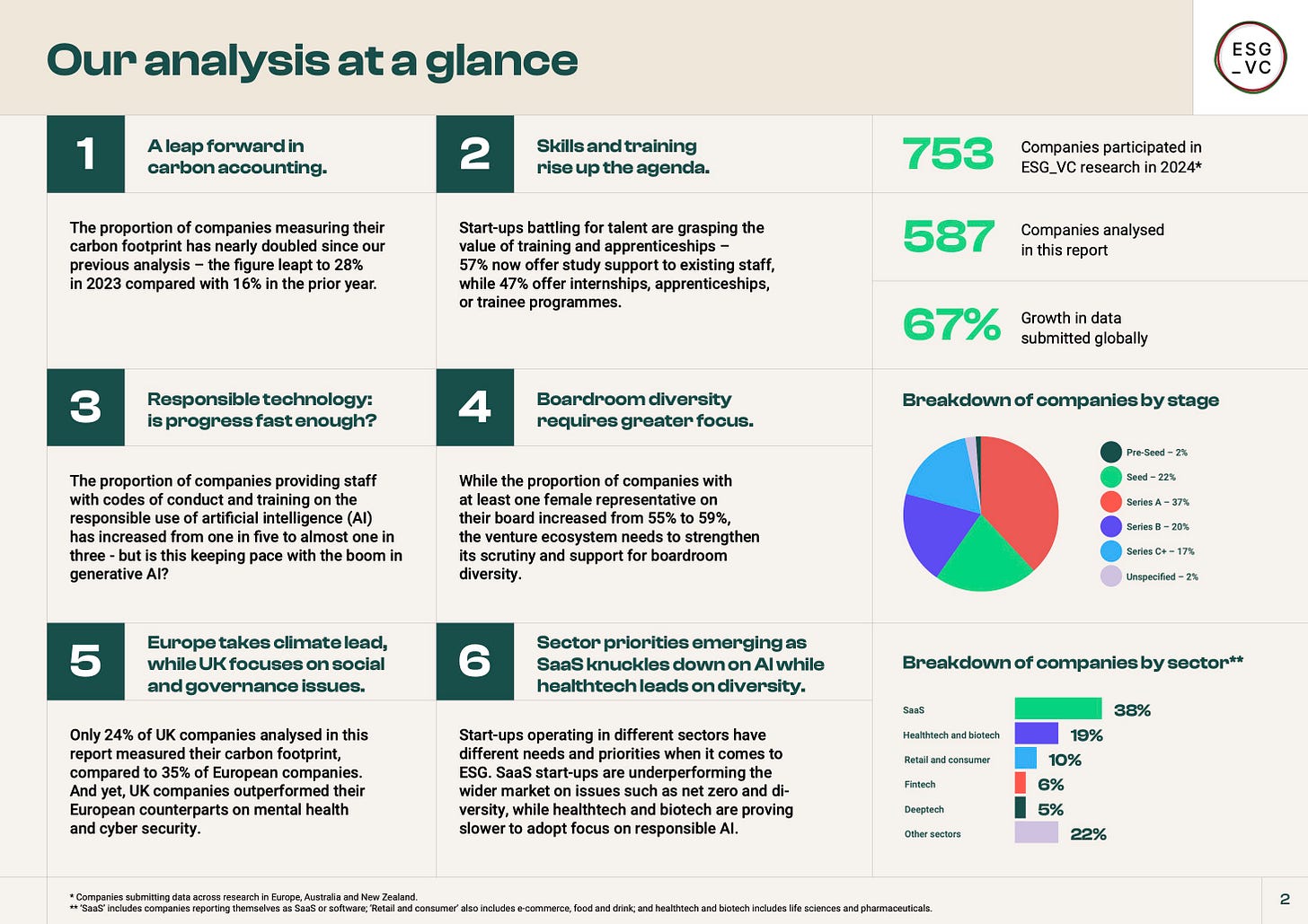

The investor survey comes following its analysis of ESG data collected from 587 start-ups backed by leading venture capital firms including Atomico, Molten, Beringea, Oxford Science Enterprises, and Astanor:

The findings highlight that Europe is outperforming the UK on net zero with 35% of European start-ups measuring their carbon footprint compared to 24% in the UK.

Europe also leads the UK on the adoption of responsible AI, with 34% of European start-ups offering staff training or codes of conduct versus 30% of UK start-ups.

However, these significant progress markers are balanced by the challenges still faced in leadership diversity with 41% of respondents answering that they do not have a woman on their board. The full report can be found here.