Scientific climate VC investing, interview w. Benedikt Buchspies (Planet A) 👨🔬

by August Soliv, Author of Impact Supporters. | Originally published on Impact Supporters.

Guest post by August Soliv, Author of Impact Supporters | Originally published on Impact Supporters.

Key insights:

Interview with Benedikt Buchspies, Senior LCA Analyst at Planet A

Planet A integrates science into their investment in 2 ways: 1. they build investment theses based on science and 2. they do a scientific climate DD on all start-ups at the same time as a financial DD

If the impact team says “no” to a deal then Planet A rejects it, even though the investment team said “yes“

Benedikt sees 3 different added values with scientific climate assessments for Planet A: 1. Planet A believes that the most sustainable will be the winners of their segments and the LCAs enable them to find the most sustainable start-ups, 2. LCAs are a brand value for Planet A towards start-ups, and 3. their portfolio start-ups can use the LCAs in their tenders and work ulteriorly

Greetings to 2k+ Impact Supporters! 🌍 It’s August Solliv 👋 Let’s dive into how Planet A approaches using science in their climate assessments of start-ups. (≈9 min reading time):

Role of science at Planet A 🔬

Speed of an LCA ⏱️

Complexity of an LCA 🤔

Added value from doing LCAs 🌱

Rejecting based on LCAs 🚫

Impact in early-stage start-ups is hard to measure 📊

Thresholds for impact 🌍

Outsourcing LCAs as an impact VC 🛠️

Hard-to-abate vs Easy-to-abate 🔄

Meet Benedikt Buchspies👋

Benedikt is a senior scientist at Planet A. He has an educational background in environmental engineering and did a PhD focused on sustainability assessment of renewable energy technologies. After the PhD, Benedikt took on a postdoc position at Technische Universität Hamburg. Both during his PhD and postdoc, Benedikt did a lot of lifecycle assessments (LCAs). Therethrough, he met a couple of the founders of Planet A and started doing LCAs with them as a freelancer. At some point, that side hustle became his main occupation and he decided to join Planet A full-time.

Benedikt has 2 main focus areas: 1. Build LCAs to due diligence climatetech start-ups and 2. Build investment theses based on science.

Meet Planet A 💼

Planet A is an early-stage climate venture fund. The fund raised €160m in their Fund I and typically invests tickets of €0.5m-4m in Pre-Seed to Series A rounds. Planet A only invests in businesses that support a transition to living within the planetary boundaries 🌍 Planet A invests in all sectors of the economy within Europe and Israel.

Role of science at Planet A 🔬

Planet A is one of the first climate VCs that has an internal science team that does environmental analyses 🌱 They go above and beyond carbon emissions - they also measure environmental metrics such as biodiversity loss and water pollution as part of the LCAs that they make. This is integrated with the investment team’s work in 2 ways:

Firstly, Planet A is thesis-driven. Their science team builds investment hypotheses based on what solutions the world needs the most to tackle the climate and biodiversity crises and the industry where solutions can have the highest impact. Through this proactive search, the science team assesses solutions in terms of their sustainability and potential systemic impact. They use this understanding to search for start-ups proactively.

Secondly, once Planet A gets in touch with a start-up for a potential investment and enters the due diligence phase, the science team also gets in touch with the start-up (right after the investment team to start their scientific assessment of the start-up). The science team asks questions such as: How does the start-ups potential supply chain look? What type of processes and services are involved in the start-ups’ activities? Both downstream and upstream? This work is done in close collaboration with the start-up. Equally as important, Planet A also assesses the systemic change that the start-up can bring if it scales.

Speed of an LCA ⏱️

I [August Solliv: the author] would feel quite uncertain about whether the LCAs would take too long to conduct and still stay competitive in terms of timing in the DD phase. Benedikt, however, assured me that the speed of the LCAs has never been a problem in the DD - they have never missed or rejected a deal because they were too slow in the DD 🕒 Benedikt also notes that he has done LCAs for the last 10 years so at some point you know what to look for in assessments.

Benedikt estimates that an LCA takes between 15 and 100 hours to conduct - it depends on the depth that Planet A chooses and the type of tech they analyze (some are easier than others and some are very similar to what they have done before).

Complexity of an LCA 🤔

An LCA is built around the whole product lifecycle (see below) and the systemic change created by a product.

Source: Planet A, 2021

Impact is measured by taking both the impact perspective into account and the business potential of the business. See below.

Source: Planet A, 2021

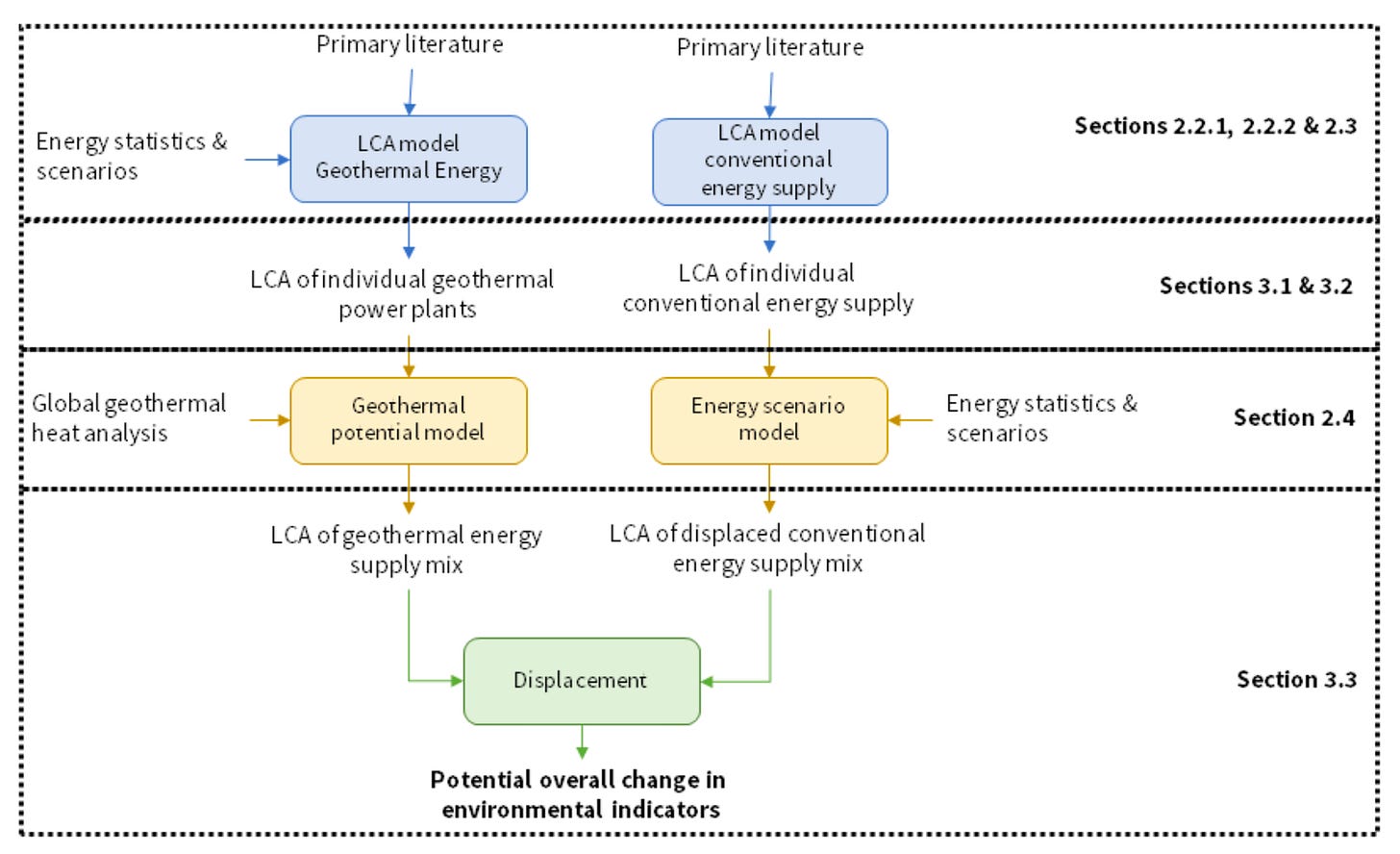

Benedikt gives an example of the high level of complexity that there can be in making LCAs. Planet A invested in GA Drilling. They develop a drilling head to enable deep geothermal energy production.

GA Drilling has a lot of uncertainties linked to their product: 1. The technology can be used everywhere in the world and Planet A doesn't know yet where it will be used. 2. Planet A doesn’t know yet what geothermal wells will look like in the future. 3. The drilling head could be used in wells that are 1,000 meters or 10,000 meters deep; nobody knows yet - but this changes the environmental impact heavily. Planet A, therefore, sets models up where they take that uncertainty into account. The example for GA Drilling is:

Source: Planet A, 2022

Added value from doing LCAs 🌱

Benedikt says that as he sees it there are both personal and professional added value to doing LCAs.

Personally, he appreciates the LCAs that Planet A does because it ensures that they only invest in truly sustainable impact start-ups.

Professionally, firstly, Benedikt and Planet A believe that the most sustainable companies will be the highest performers of the current decade(s) so the LCAs ensure that they bet correctly 📈

Secondly, Planet A invests in very mission-driven founders who want to understand their impact better. These founders recognize the engagement of Planet A and the LCAs are, therefore, a brand value for the VC towards the founders.

Lastly, Planet A’s portfolio of start-ups uses their LCAs when entering tenders in which sustainability is a criterion. The LCAs thereby become a competitive advantage for the start-ups to secure contracts 🌿 Planet A also offers their portfolio companies that they can get their LCAs recalculated if significant criteria change.

Planet A has published all the LCAs of their portfolio companies. Go and take a look if you want to be inspired: Link.

Rejecting based on LCAs 🚫

When I [August Solliv: the author] asked Benedikt if they ever reject opportunities because of the LCAs they conduct, Benedikt answered instantly:

Yes, definitely! There are quite a bit of direct rejections because of our impact criteria. We had cases where we believed a start-up would be economically successful but then discovered that the impact was not good enough. -Benedikt Buchspies

If we as an impact team say “no, that's not impactful enough”, then it's a “no”, no matter how economically successful this company might be. -Benedikt Buchspies

Planet A puts impact and investment decisions on the same level - and that’s because Planet A truly believes that you need to be highly impactful to make outsized returns.

Benedikt adds that something that he appreciates about their process is that whenever a start-up gets rejected based on impact criteria, then the whole organization learns from it as the investment team learns why it didn’t get an investment and they take it into their future investment analyses.

Impact in early-stage start-ups is hard to measure 📊

Planet A invests in early-stage impact start-ups. When they invest the start-ups are not at scale so their positive impact on society is most likely still not at scale and can be hard to measure and/or forecast. This can create uncertainty around the LCAs, but Planet A then together with the start-ups projects how the start-up will evolve and make assessments of the material and energy that they will require in the future 🌍 No start-ups knows who their supplier will be in 10 years, but you also don’t need that level of granularity for the LCAs. Instead, Benedikt and his team integrate estimates of how the energy mix and climate footprint of materials are estimated to evolve in the next 10-20 years in their calculations.

The systemic change that Benedikt also assesses can likewise change a lot over time. If you are DDing a company that has one very specific product and has one very specific substitute in the market, then it’s quite easy to assess the systemic change. But if you have a technology that scales and has multiple applications in different sectors and different economies, then it’s hard to predict the systemic change that will happen and it takes a long time, so you make a best estimate and note the uncertainty

Outsourcing LCAs as an impact VC 🛠️

Benedikt says that you could outsource LCAs - and some impact VCs already do it. He would, however, be reluctant to do so (even though he might be a bit biased coming from his position) 🤔 Here are his reflections:

An in-depth LCA analysis can cost €10k+. VC funds don’t typically have that kind of money.

LCA consultancies are not hanging on the trees so in time-compressed DDs, it will most likely be hard to always ensure that you can get an LCA in time.

Even if you get an LCA consultancy in, then the process is time-constrained and requires close collaboration between the LCA analysts and the impact start-up founders. Benedikt would argue that such close collaboration is hardly achievable if outsourced to a third party.

You can’t build a thesis-driven investment approach in the style of Planet A with an outsourced science team

Planet A can follow the start-ups through their journey to help them understand where their impact lies and how they can improve.

Hard-to-abate vs Easy-to-abate 🔄

Planet A also invests in hard-to-abate sectors, being conscious that certain solutions in these sectors might take more time to scale.

If a sector is hard to abate then it means that it has less immediate economic returns, but Benedikt notes that as long as the solution can scale within Planet A’s fund lifetime then they can invest in hard-to-abate sectors.

Planet A believes that it is important to invest in both hard-to-abate and easy-to-abate sectors, as we will need both to decarbonize our economies 🌿

Benedikt and his team work with abatement cost curves to compare the most interesting solutions because it can ensure that they bet on the right tech and make cost-benefit cases across sectors. However, he believes that it cannot be the sole investment criteria as you will then never tackle the hard-to-abate sectors.

Source: McKinsey, 2017 (I use the old version of McKinsey’s abatement cost curves as I find it more intuitive and saying - check out the updated one here: McKinsey, 2021)