Most Emerging Managers Regret Their First Fund Structure - Here’s How to Get It Right (or Fix It)

Strategic Structure, Institutional Scale & Survival in a Competitive Venture Landscape

The venture capital industry is growing- but so is the competition:

Over 1,500 new VC firms were launched globally between 2020 and 2024, more than double the rate from the previous five-year period.

Preqin, 2024 Global VC ReportEmerging managers now account for 25–30% of total VC deal volume in early-stage funding rounds.

PitchBook, Q1 2025 Emerging Manager SnapshotHowever, only ~40% of new funds reach their second vintage, and fewer than 15% scale beyond €100M.

Invest Europe, VC Fundraising Benchmark 2024

Are you setting up a fund - or building an institution?

Will your structure scale - or stall at first close?

Are you ready for LP scrutiny, AIFMD audits, and 10x fund admin demands?

This masterclass isn’t just for those launching their first fund. It’s especially relevant for VCs who’ve already structured but now face new scale pressures, LP expectations or regulatory hurdles. If your current setup is struggling to scale - or if your second fund demands a more robust foundation - this session will give you the strategic clarity you didn’t know you needed the first time around.

Join us on June 25th, 1:30 PM GMT+1. Spots are limited to keep it interactive - don’t miss your chance to join live.

EUVC Community Members get 50% off. Join here.

❝ Already Structured? Here’s Why You Still Need This ❞

For VCs who’ve already launched a fund, this masterclass offers a second-chance lens: what did you overlook? What structure will you regret when scaling LP commitments, layering a continuation vehicle, or facing your first audit?

Most GPs don’t rethink structure until they hit friction - whether in fund two, onboarding institutions, or navigating secondaries. This session equips you with the frameworks and foresight to course-correct early, not expensively.

At EUVC, we believe that expanding access to venture doesn’t just mean more capital: it means empowering emerging fund managers with better knowledge, sharper structures and stronger networks from day one. Supporting VCs in making high-stakes decisions around fund setup and governance is precisely the kind of upstream leverage that strengthens the fabric of the venture ecosystem and drives long-term competitiveness.

As Christian Hillebrand, founding partner at Orbit Law, puts it:

The private equity and venture capital industry really helps to foster innovation. We often see VC and PE funds helping their portfolio companies to blossom, creating new ideas, jobs, technologies, etc. It is simply great to see how this can strengthen the economy as a whole.

Whether you’re structuring your first fund or realising the limits of your last one, you’ll face the same tension: simplicity may get you to first close - but complexity catches up. Many VCs discover too late that structural shortcuts inhibit scale, governance and long-term credibility.

From regulatory choices and GP-LP dynamics to lifecycle liquidity planning, structuring a fund is more than a legal task, it is also about strategy and longevity. As Christian Hillebrand, founding partner at Orbit Law, put it in a recent BVK Expert Talk:

Fund structures are advised ‘from cradle to grave’ - from initial concept, market practices, and acting as sparring partners, through the lifecycle of the fund until eventual liquidation.

Structuring Is Lifecycle Design

The fund structure is the foundational layer upon which all future operational, legal and capital activities will rest. It determines not just how capital flows, but also how power, responsibility and economics are distributed between the GP and LPs.

Emerging managers must confront early decisions on:

Jurisdiction (e.g. Luxembourg RAIF, Dutch CV, German KVG)

Entity type (limited partnership, GmbH & Co. KG, fund platform)

Governance rights (veto thresholds, key person, removal provisions)

GP/ManCo structure, including separation of economics and control

Getting this wrong does not merely cause inefficiency; it creates friction with investors, slows down deployment, and limits adaptability. As Christian notes elsewhere:

In the highly dynamic fund world, outdated structures not only cost valuable time- it simply takes longer for the machinery to get going.

Talentrocket.de

Regulatory Fluency Is Not Optional

While structure reflects your internal logic, regulation determines your external license to operate. The fund manager’s obligations under AIFMD, MiFID II, PRIIPs and national investment laws shape:

Who you can market to (professional vs. semi-professional investors)

Whether you need a passport, reverse solicitation or registrations

What reporting duties (e.g., Annex IV) and disclosures are triggered

Which distribution limitations or ESG-related compliance apply

Regulatory complexity is often underestimated by first-time managers. But non-compliance can invalidate LP commitments, delay closings or even shut down fundraising. Clarity at the beginning is essential.

Fund advisory, particularly in regulatory and supervisory law, is an area that is developing very dynamically.

Christian Hillebrand, BVK Expert Talk

Secondary Markets Reshape Structuring Priorities

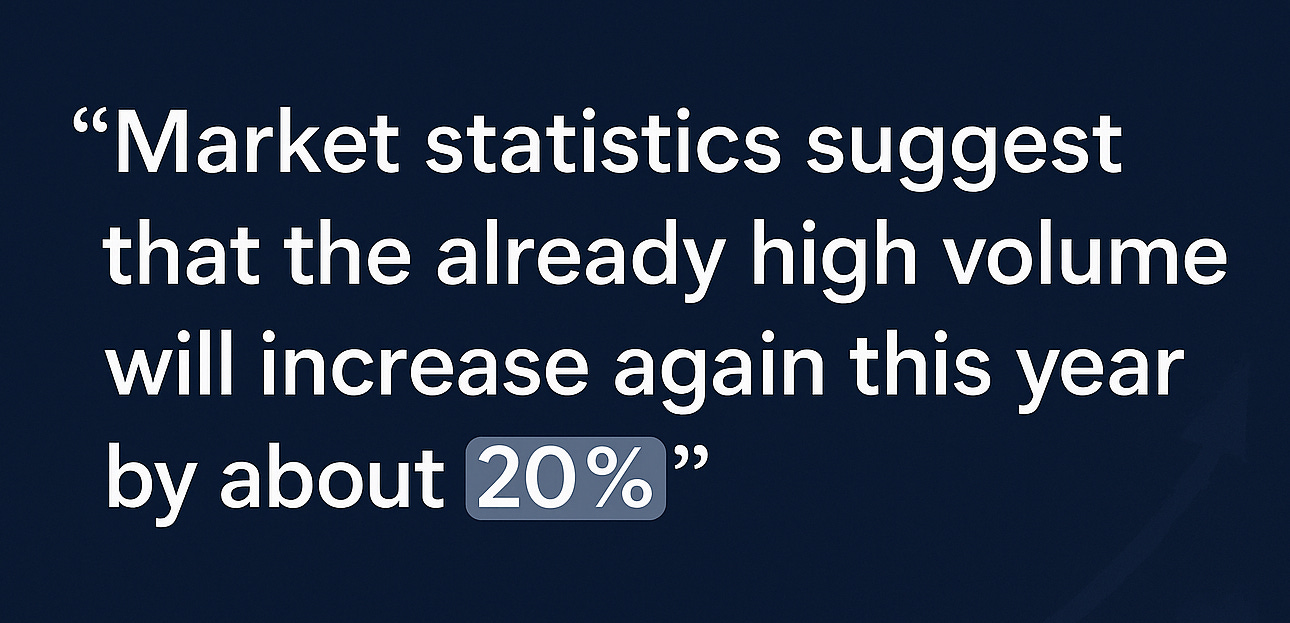

Fund structuring is no longer limited to the capital-raising phase. Liquidity planning is now an embedded expectation from sophisticated LPs. The rise of the secondary market, both LP-led and GP-led, demands that legal architecture support mid-lifecycle flexibility.

Secondary transactions have become more prominent… we now advise on both LP-led and GP-led secondaries, with a triangular structure that’s complex but exciting.

Christian Hillebrand, BVK Expert Talk

A few implications:

Transfer provisions must contemplate LP exits with clear GP consent processes

GP-led continuation funds should be feasible within existing LPA frameworks

Fund duration and extensions must align with secondary liquidity timelines

According to Christian, the market for secondary transactions reached $110 billion in volume in the previous year, with a 60/40 split between LP-led and GP-led transactions: a signal that structuring must now incorporate liquidity foresight.

Structural Simplicity Is Not Always an Advantage

It’s tempting for emerging managers to default to lightweight or “off-the-shelf” fund structures. While speed and simplicity may serve a small first close, they often falter under the pressure of institutional due diligence.

Key structural oversights include:

Ambiguity in key person definitions or decision rights

Inflexible capital call mechanics or reserve strategies

Lack of alignment in carried interest distribution over multiple closings

A fund must be credible, scalable and testable. It needs to accommodate growth, institutional participation, and regulatory audits without rework. That’s why structuring is best approached not as a compliance task, but as a strategic blueprint for the next decade.

Governance Is a Design Variable

Fund structuring also encodes power. Governance provisions, from LPAC roles to removal rights, shape how conflict is managed, how decisions are made and how trust is preserved across the fund’s lifecycle.

Emerging managers should be intentional about:

Decision thresholds for major fund actions (extensions, restructurings, co-investments)

Composition and binding authority of LPACs

Conditions for removal of the GP, suspension of fees or redistribution of carry

These aren’t just legal tools, they are risk frameworks. As fund sizes grow and the LP base diversifies, clarity and robustness in governance design become indispensable.

Conclusion: Structure as Strategy

Setting up a venture fund is not merely a legal exercise: it is a structural strategy for risk, growth, liquidity, and alignment. The fund's architecture will dictate its credibility with LPs, resilience during market shifts and viability for future vintages.

Christian Hillebrand captured it succinctly:

“Our day-to-day business is as broad as the fund world itself.”

In that breadth lies the reason to treat structuring not as a hurdle, but as the core discipline of fund creation. For emerging managers, structural fluency is no longer optional!

And that’s precisely why this masterclass matters.

Whether you’re facing fund setup for the first time - or facing the consequences of a past setup - the structural choices you make today shape your trajectory for the next decade. This is not just legal hygiene. It’s the difference between operational strain and scalable success. Emerging managers need more than templates - they need insight, clarity and a deep understanding of how structure shapes outcomes.

This masterclass is a chance to learn from the front lines - where fund theory meets fund reality. We’re grateful to host Christian Hillebrand, whose work with funds across Europe brings the exact kind of grounded, lifecycle-aware perspective that new managers can’t afford to miss.

Join us on June 25th, 1:30 PM GMT+1. Spots are limited to keep it interactive - don’t miss your chance to join live.

Your Call to Action: Join the Community

Joining the EUVC community connects you with a network of like-minded emerging managers, fund builders, and ecosystem enablers across Europe and beyond. Whether you're structuring your first fund, navigating regulatory waters, or raising from sophisticated LPs, you're not doing it alone. This is where questions get answered, lessons are shared, and relationships are built: with people who are in the arena with you.

👉 Not yet a member? Join the community now & gain instant access to this and all future masterclasses at exclusive member pricing- including full recordings, slide decks, curated resources, and our library of past sessions featuring Europe’s leading GPs and LPs. Plus, enjoy free access to our members-only AMA sessions with top-tier LPs and GPs and exclusive discounts to our in-person events.

💬 The EUVC community exists to equip European Tech Investors - LPs, VCs and ecosystem enablers alike - with the tactical knowledge and network to go from good to great.