Today we have Staffan Helgesson with us. Staffan is the founder of Creandum, a European early stage venture firm with no appointed headquarter but offices (or hubs as they call them) in Sweden, London, Berlin and San Francisco.

Creandum just turned 20 years and are investing out of their 6th fund which is a $500m fund to back founders and companies across Europe. In addition to Europe they invest in European diaspora founders in the US. The firm is a generalist investor but have organised themselves in six main verticals; Health, Climate, Technical SaaS, Application SaaS, Fintech and Consumer, where they spend most of their time.

Creandum has approximately $2 Bn under management and have done close to 150 investments over the years with notable investments including Spotify, Klarna, Trade Republic, Pleo, Bolt, iZettle, Cornershop, depop, Kahoot!, Taxfix, Kry and Factorial. At Creandum, Staffan leads the climate vertical and is also very active investing in Saas companies.

Scroll down ⏬ for episode chapters & core insights 👀

This episode is brought to you in partnership with Apiday

Apiday is the leading, all-in-one ESG platform for GPs. Apiday's philosophy is that ESG for portfolio companies must be easy and value-adding, making you a partner to your portcos, not adding reporting burdens. Impress your LPs and see why 1,000+ portcos, leading Article 9 funds and $100 billion of AUM all trust Apiday to manage ESG.

Chapters

00:00:00 - Introduction to Staffan and Creandum

00:01:52 - From Small-Town Origins to Silicon Valley Inspiration

00:03:49 - Loving Niche Sports and Venture Capital in Europe

00:05:47 - The European Investing Advantage & Time as a Solution

00:09:35 - Staffan’s Pivotal Moment

00:11:37 - The Importance of Bold Ideas and Drive

00:13:45 - The Importance of User-Centric Design and Delighting the End User

00:15:35 - Focusing on the Top Companies

00:17:34 - Combining Transformational Change and Hearing the Train

00:19:29 - Investing in the Future of Electric Vehicle Charging

00:21:14 - The Benefits of Electrification and the Future of EVs

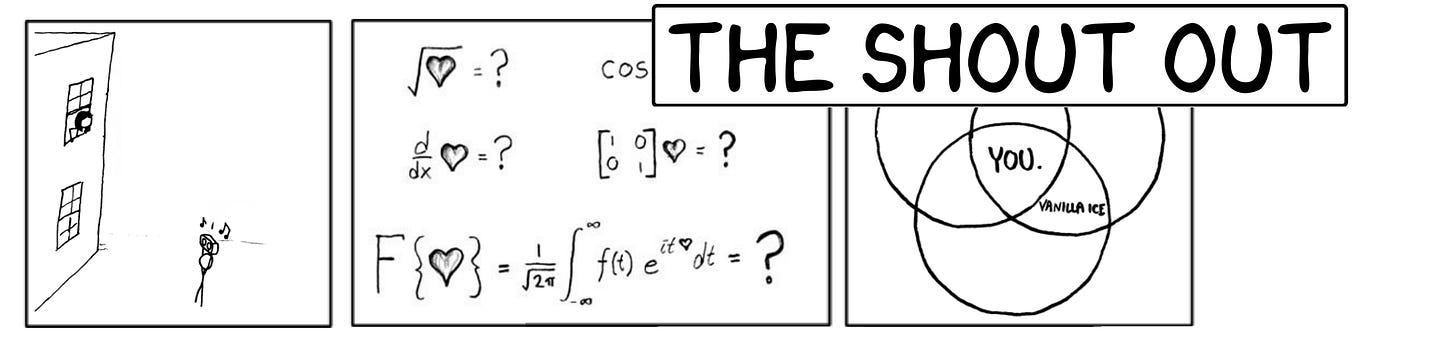

00:23:26 - Shout Out to Co-Investor Angel or LP

00:25:18 - Shout out to Creandum during a difficult time

00:27:14 - Building a Franchise

00:29:12 - Building a Firm for Institutions

00:30:59 - Sustainable Competitive Advantage in Venture

00:32:52 - Gut Feeling and Logical Analysis

00:34:46 - The Importance of Gut Feeling in Decision Making

00:36:58 - Approaching Tier One Institutions

00:39:10 - Europe's New Beginnings

I’d like to shout out to our Limited Partner Vintage out of Israel. They’re a fantastic combination of challenging you to be your absolute best (strategy and tactics) and at the same time provide a true value added function that allows you to enter almost any corporation you want globally, or do DD on companies you didn't think was possible. And they’re going through a very tough time right now.

I also want to shout out to my Creandum partner Fred Cassel who started as our first analyst 20 years ago and is today one of my partners. He makes me better every day. And in almost every meeting, he asks that final question when everyone else goes, damn why didn’t I think about that.

Q: What are the 3 biggest learnings from the last 10 years in your life?

When building the firm and Recruiting - go for DNA and motivation - then throw them into the deep end of the pool.

When investing Gut feeling is real, trust it (Spotify, Monta and Markus Villig at Bolt)

When owner of a company - Play the long game. Resist to play the short game (entrepreneur interactions, holding of companies etc, 3x vs 13x). 99/100 companies you don’t invest in will be out in the ecosystem sharing their experience of interacting with you.

Q: What advice would you give your 10 year younger self?

When investing, it’s not about the number of smart questions, it’s about the 1-2 things you really have to believe in. And those are usually about people with really big ideas.

Q: What are your top tips for emerging VCs across Europe who are fundraising?

Define your competitive edge (Plural - we’re operators) but don’t go into complicated thesis development how the world will look, it likely wont look like you thought it would.

Add institutions - 20 year long excel sheet. Private people cant plan their finances

Define what you’re building (solo, firm or franchise) - all models work.

Then perfect it.

Q: What’s the most counterintuitive thing you’ve learned in venture?

Kathryn Mayne from Horsley Bridge shared data from their 40+ years in venture stating that on average a 4x net fund will have more write-offs than a 3x net fund.

So, you need to take more risk - not less!

Q: What do you believe that most people around you disagree with?

There is little to no luck in business life in general. It all favours the prepared mind and hard working individual.

Upcoming events

📺 Virtual events we’re hosting

Winning with non-dilutive funding | Dec 11, 2023, 12:00 PM - 1:00 PM

Data-Driven Portfolio Modeling | Jan 17, 2024, 12:00 PM - 1:30 PM

The O.G. Roundtable of the Year | Jan 29, 2023, 12:00 PM - 1:00 PM

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg, Sweden

Odense Investor Summit | 📆 13 - 15 March | 🌍 Odense, Denmark

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany