Today we are happy to welcome Ambre Soubiran, CEO of Kaiko. A mathematician by training, she has spent the first decade of her career working in the equity derivatives and capital markets industry. Amber has a passion for world-changing technologies and is personally interested and invested in the digital assets space since 2012. Amber is currently the CEO of Kaiko, the reference market data provider in the blockchain industry. Kaiko is a global organisation with offices in NYC, London, Paris, and Singapore, servicing top-tier financial institutions and enterprises with reliable and actionable financial data.

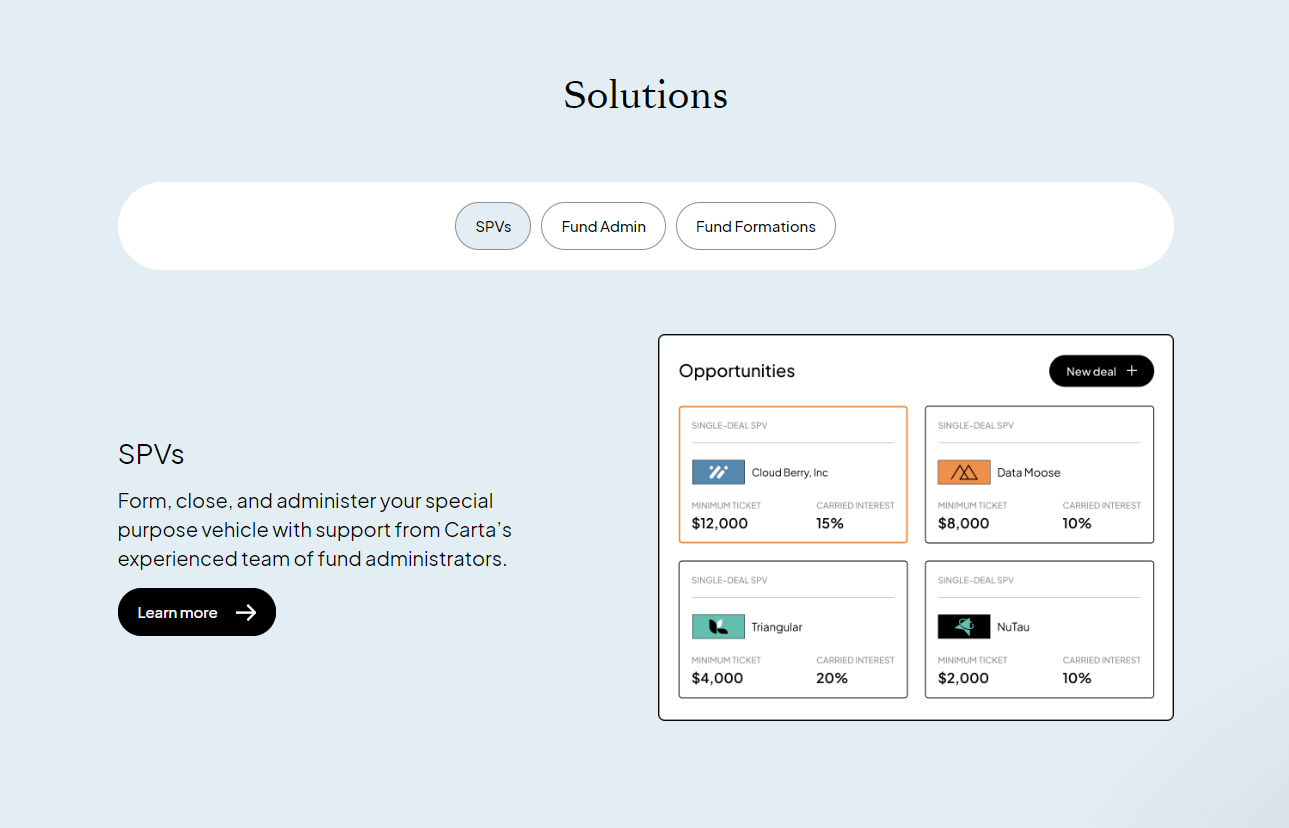

This episode was brought to you in partnership with … Carta

Carta is the easiest way to launch & run your fund and syndicates. It’s no secret that we at eu.vc are happy and heavy users of the Carta platform as it allows us to be creators turned angels without bogging us down in back-office hassle of investing.

For a very special treatment, go here to let the Carta team know you’re coming from the eu.vc community 🤗

Jump to the parts that matter most to you 👀

00:00:00 - Introducing our Guest, Amber in the Super Angel Podcast

00:01:52 - Discovering Crypto through Blogs and Newsletters

00:03:30 - From Banker to Startup Founder

00:04:51 - First Angel Investment

00:06:26 - The Story behind Kaiko

00:09:42 - Insects as Protein for Animal Feed

00:11:15 - The Value of Data in the Crypto Market

12:42:00 - The Genesis of a Business Partnership

00:13:54 - The Importance of Individuality in Founding a Company

00:15:19 - Tokenization of Real World Assets and the Future of DeFi

00:17:03 - Building a Financial Market Data Provider on Blockchain

00:18:39 - The Personal Benefits of Angel Investing

00:20:19 - Investment Strategy and Portfolio Allocation

00:21:54 - Diversifying Investments and Angel Investing Qualities

00:23:14 - Values and traits of successful founders

00:24:53 - Collaborating Opportunistically in Angel Investing

00:26:18 - The Joy of Being an Angel Investor

00:27:48 - Trusting Founders and Gut Feelings

00:33:46 - Tips for International Investments

00:35:22 - An Amazing Story and Tips from a Fanboy

1. Be curious.

Ambre believes that curiosity is essential for angel investors. She encourages investors to explore new opportunities and be open to new ideas. She also stresses the importance of listening to founders and understanding their vision.

2. Focus on the people.

For Ambre, angel investing is all about the people. She believes that the most important factors to consider when investing in a startup are the founder's team, their values, and their trustworthiness. She also emphasizes the importance of supporting founders through thick and thin.

3. Be agile and smart.

Angel investing is a risky business, so it's important to be agile and smart. Ambre believes that investors should be prepared to pivot and change their strategies as needed. She also stresses the importance of being a good human being and treating founders with respect.

Q: What’s the most counterintuitive thing you've learned since you started angel investing?

The best product doesn't always win. Marketing is often more important than the product itself. Ambre has seen many companies with great products fail because they couldn't get the word out. Conversely, she's seen companies with mediocre products succeed because they had brilliant marketing campaigns.

Q: What would be your top tips to angels wanting to do more international investments?

International investments can be tricky. Ambre advises angel investors to be careful when investing in foreign companies. She recommends speaking with a local tax expert to make sure the investment is structured in a way that minimizes taxes. She also recommends anticipating the case of a successful investment and making sure the legal structure is in place to handle it.

Q: What advice would you give to your 10-Year-Younger Self

You need to spend money to make money. Ambre believes that angel investors need to be willing to take risks. She encourages them to invest in companies they believe in, even if it means losing money on some investments. She also points out that angel investing is a long-term game. It can take years to see a return on investment.

Upcoming events

📺 Virtual events we’re hosting

Winning in The Secondaries Boom | 📆 Oct 31, 2023, 3:00 PM - 4:00 PM CEST

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg

GITEX Europe 2025 | 📆 23 - 25 May | 🌍 Berlin

Super Venture | 📆 4 - 6 June | 🌍 Berlin

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen