The landscape of venture capital is evolving, and Isomer Capital is at the forefront with its new fund designed to meet the dynamic needs of the European venture capital market.

We sat down with Joe Schorge and Omolade Adebisi from Isomer to talk through the market, the strategy and the future. Well-worth a watch as we open up the deck that raised the fund and tap the brains that incept and run it.

But let’s get the headline numbers in place:

100 M€ Fund dedicated to secondaries exclusively.

65-75% of dedicated to acquiring Limited Partner (LP) interests in existing VC funds.

An additional 15-25% is earmarked for direct secondaries in companies, providing crucial liquidity to stakeholders.

The remaining funds, up to 15%, are reserved for discretionary investments, which may include buying stakes or carry from general partners.

This strategic distribution of funds is a response to the current market conditions where many European VCs have yet to realize significant returns from their investments. These circumstances often necessitate liquidity solutions for personal reasons—such as purchasing homes or funding private education—or professional requirements like meeting General Partner (GP) commitments for raising new funds.

Typical ticket sizes range from €1 million to €10 million injecting much-needed flexibility and liquidity across Europe's venture capital ecosystem and broadening Isomer’s impact beyond the traditional fund of funds model to include any Europe-based fund or startup 💖

Hope you’ll enjoy the read, the watch and the listen 🙏

This episode is brought to you in partnership with Zero One Hundred Conferences, which organizes LP-GP networking events for PE & VC players in various European regions with a global outreach. In the last 8 years, they have hosted 49 events with 1700+ speakers, 6500+ investors, and 12000+ attendees.

Join the upcoming 0100 Conference CEE to meet 350+ LPs and GPs like 500 Global, CVC Capital Partners, EBRD, EIC, EIF, Erste Group, INVL Asset Management, LGT Capital Partners, MidEuropa, Molten Ventures, PFR Ventures, Schroders, and World Fund, to mention a few.

The Current Market Landscape and Liquidity Expectations

Over the last decade, the European tech sector has experienced a remarkable transformation, driven by robust investment that has fundamentally reshaped the landscape. This vigorous capital infusion has not only spurred innovation and growth but has also matured the market, creating an environment that is increasingly saturated. As a result, investors initially attracted by high growth prospects are now grappling with the dual challenges of a crowded market and the pressing need for viable exit strategies to realize their investments' value.

In this mature investment climate, liquidity has emerged as a paramount concern. Traditional exit strategies such as IPOs or acquisitions, while still viable, are being augmented by secondary transactions, which have become crucial avenues for liquidity. These transactions are not merely financial instruments but strategic moves that enable investors to manage and optimize their holdings dynamically.

Isomer Capital, with its profound understanding of the European venture landscape, is uniquely positioned to capitalize on these evolving market dynamics. Boasting a comprehensive network across many of Europe's most influential tech hubs and strategic acumen honed over years of active investment, Isomer adeptly navigates these complex waters.

The European VC sector has witnessed unprecedented growth, with the establishment of over 3,000 VC firms and the creation of more than 350 unicorns in the past decade alone. This growth has led to a historic accumulation of tech VC assets, reaching an all-time high and significantly expanding the stock of assets available for secondary transactions. However, the imbalance between extensive investment inflows and the scarcity of liquidity events has heightened the need for innovative secondary market solutions.

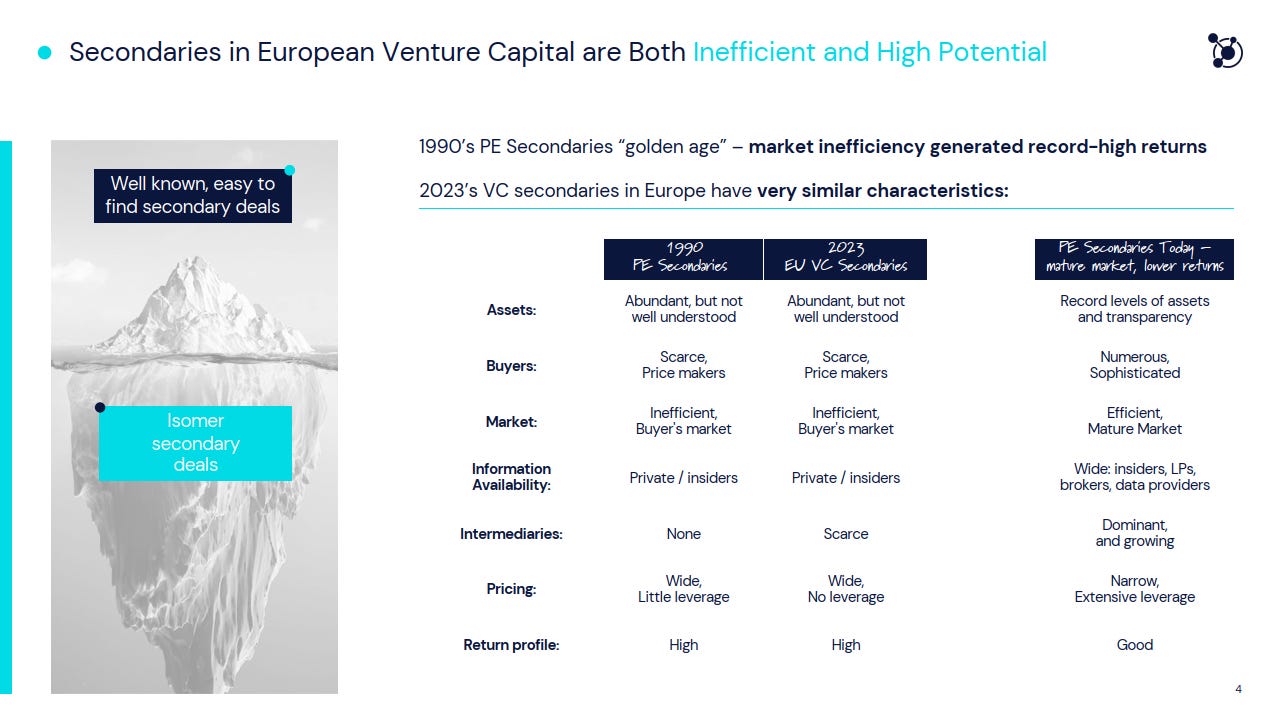

A Reflection of the Past: Learning from the 1990s PE Secondaries

The present landscape mirrors the past era where PE secondaries thrived on market inefficiencies, yielding record-high returns. Both epochs are marked by an abundance of assets that were not thoroughly understood, and a scarcity of buyers who had the leverage to dictate prices. The market's inefficiency, predominantly a buyer’s market, coupled with private information channels, constituted an environment ripe for significant returns. Back then, there were no intermediaries; the vast asset pricing spread opened gates to high return profiles. Today's VC secondaries, although slightly more advanced, share these foundational characteristics.

Capitalizing on Inefficiency

Isomer Capital finds its niche precisely within this labyrinth of market inefficiency. By leveraging proprietary insights and strategic acumen, Isomer navigates the complex secondary deals that lie beneath the "well-known, easy to find" surface deals. Much like an iceberg, the most substantial opportunities are not immediately visible; they require in-depth market knowledge and the ability to operate within an information asymmetry that Isomer Capital has skillfully mastered.

Strategic Symbiosis: Combining Information Access with Market Insight

At the heart of Isomer's operational philosophy is a strategic symbiosis between its access to proprietary market information and a deep understanding of secondary market dynamics. With a vast network linking over 1,600 European VC firms and more than 2,000 underlying companies, Isomer Capital actively shapes the market’s trajectory. This strategic integration enables Isomer to identify and act upon opportunities for liquidity and growth, distinguishing it within the secondary market.

Joe Schorge, Isomer’s managing partner, articulates the rationale behind the launch of their new €100 million fund focused on tech secondaries:

“As the market has grown, so too has the need for sophisticated liquidity solutions. We've always incorporated secondaries into our strategy, but the current market conditions present unique opportunities that our new fund is specifically designed to address.”

This statement underscores Isomer’s proactive approach to investment management, positioning the fund not only to react to market conditions but to anticipate and influence future trends actively.

Isomer Capital’s Secondaries Fund I is strategically positioned to benefit from the projected expansion of the secondary market. The amassed stock of assets, over $301 billion invested into European VC in the last five years, represents a vast pool of potential liquidity. With a conservative estimate suggesting that 3-5% of these assets will trade annually, the fund is poised to bridge the liquidity gap effectively. This scenario offers dual benefits: providing liquidity to existing investors and granting new investors access to mature VC-backed companies without the traditional early-stage risk profile.

Omolade Adebisi’s Strategic Vision and Expertise

Joining Isomer to help lead this ambitious initiative is Omolade Adebisi, whose recent induction brings a fresh perspective and a wealth of experience to the table. Her previous tenure at Coller Capital and her pivotal role in establishing a VC secondary fund in the MENA region have endowed her with unique insights into the mechanics and subtleties of secondary markets.

Reflecting on her new role, Omolade said on the pod;

Joining Isomer felt like aligning with a vision that’s set to redefine how liquidity is approached in the European venture ecosystem. It’s about building on a foundation that is already robust but also pointing it towards new directions that the current market conditions dictate.

And Joe added;

"We were really looking for something quite specific. There's a lot of people in the world who have done secondaries by now. The private equity secondary market is big and Omolade has worked for one of the biggest firms. But we were also looking for someting who was a fanatic about venture capital and tech. So to find that in the market, someone who has a skill and experience in secondaries, but then also shares this addiction, fascination, love for venture. That’s hard. So finding Omolade, was like just perfect. We’re really excited."

Her enthusiasm for this new challenge underscores a shared vision with Isomer—one that sees the secondary market not just as a necessity but as an opportunity to innovate and lead.

The Role and Impact of VC Secondaries

Venture capital secondaries play a pivotal role in the venture ecosystem, offering crucial liquidity in a landscape where traditional exit strategies may be unpredictable and protracted. Joe Schorge, in discussing the value of secondaries, emphasizes the strategic nature of these transactions:

"We've always incorporated secondaries into our strategy, but the current market conditions present unique opportunities that our new fund is specifically designed to address".

This reflects a growing recognition of secondaries not just as financial instruments, but as essential tools that facilitate the faster deployment of capital and accelerate the path to liquidity events. This dual-value proposition is increasingly attractive to both investors seeking exits and startups that require growth capital without further diluting equity.

The Mechanics of Venture Capital Secondaries

As show in the model above, traditional VC investment periods are extensive, often locking in capital for five to ten years or more. During this time, investors' funds are tied up, which limits their ability to seize new opportunities unless an exit event such as an IPO or acquisition occurs. Venture capital secondaries offer a vital alternative, enabling liquidity outside these traditional events.

Joe Schorge elaborates on the functionality and strategic importance of secondaries in the venture capital ecosystem:

"Secondaries are different than primaries in that you can only buy something that already exists. So you already know there's a group of assets there. That's what's available to buy".

This mechanism allows original investors to sell their stakes in venture-backed companies to secondary buyers, thus accessing liquidity ahead of formal exit events.

This transaction not only benefits the sellers by freeing up capital but also provides buyers with an opportunity to enter ventures at a more mature stage of their business cycle. As Schorge notes, this can lead to quicker returns than those typically seen with primary market investments:

"We're providing liquidity options in a market that's not liquid, and we're providing discrete, off-market quiet transactions, which is key to our approach and success".

This highlights the secondary market's role in providing both strategic exits for existing investors and value-driven entry points for new ones, enhancing the overall efficiency and dynamism of the venture capital market.

Isomer’s Partnership-Driven Approach to Secondaries

Isomer Capital's approach to venture capital secondaries transcends the conventional transactional dynamics, embedding a partnership model that enhances strategic value and fosters long-term growth. Joe Schorge, the managing partner, emphasizes the firm’s ethos: "Our aim is not just to provide an exit path but to be a partner that supports the ongoing growth and strategic repositioning of the entities we invest in". This philosophy is pivotal to Isomer's operations, orienting each secondary transaction towards long-term value creation and strategic growth rather than short-term financial returns.

Isomer Capital’s deep integration within the European venture capital ecosystem uniquely positions it to access a wide array of high-potential secondary opportunities. This strategic positioning enables Isomer to act as a gateway to promising currents of European technological innovation through a comprehensive mix of primary investments, secondary market transactions, and direct co-investments.

Isomer's Investment Framework: A Tripartite Pillar Strategy

Isomer employs a three-pronged investment strategy that

Fund of Funds: Through strategic fund investments, starting Isomer has built a diversified portfolio that provides a stable foundation for secondary market engagements.

Direct Co-Investments: With a keen eye for rapidly growing companies, exemplified by their existing direct co-investment operation, Isomer actively participates in direct investments that often lead to secondary opportunities.

Secondaries: With the launch of this fund but built on years of active investing in the secondaries market, Isomer reinforces their commitment emphasizing its strategic importance to Isomer's overall investment approach.

Leveraging Isomer’s Primary Market Presence

Isomer's prominent role in primary markets facilitates a seamless transition into secondary deal flows. By nurturing relationships through limited partner (LP) stakes and their established network, Isomer has refined its ability to source secondaries directly. This network and information exchange distinguish Isomer, allowing it to transfer knowledge and strategic advantages effectively. Below, to complete the picture, is an illustration of how the Isomer strategies fit together as a flywheel of European venture investing.

And to take us out in the usual stupid eu.vc style, cue the music 💥

🎓 Upcoming Academy Sessions

🌍 Virtual | 📅 Thursday, May 16 | 🕰️ 11:00 AM - 1:00 PM CET

An advanced session on creating a VC fund model assumptions sheet, focusing on defining Core Assumptions, Asset Development, and Equity Valuation Dynamics. Attendants will receive a template and work with this based on their own fund and learn how adjusting assumptions influence fund performance.

👋 Upcoming in-person events we’re hosting

There’s nothing we like better than getting Europe’s best and brightest together with good food, drinks, and conversations that go truly deep.

Fund Modelling Workshop & Mixer | 5th of June | 🌍 Berlin, Germany | Join waitlist.

European VC Awards | 4th of June | 🌍 Berlin, Germany | Get tickets.

📅 Upcoming virtual events

From time to time, a podcast is just not enough. Check out our roundtables and live events below.

🏆 Firesides with the winners of the European VC Awards

Fireside with the Newcomer of the Year Winner | 13/6, 12-1:30 PM | Register here. Hundreds of new VC funds come to market every year. But only ONE will win Newcomer of The Year. This is your chance to meet the winner firsthand.

Fireside chat with the Winner of the Hall of Fame | 25/6, 12-1 PM | Register here.

Hear firsthand from a true giant upon whose shoulders the European tech ecosystem stands tall.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

0100 Conference CEE 2024 | 📆 14 - 16 May | 🌍 Prague, Czech Republic

Iceland Innovation Week | 📆 15 - 16 May | Reykjavik, Iceland

EBAN Congress Tallinn 2024 | 📆 20-22 May | 🌍 Tallinn, Estonia

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany