The essential building blocks of a VC fund model - Part 4

by David Cruz e Silva, an operator turned angel LP and founder of eu.vc and Marc Penkala General Partner at āltitude

If you haven’t read the first parts of this series, you can do it here: Part 1, Part 2, and Part 3.

Final remarks:

Take it step by step and be granular.

When it comes to portfolio construction, don’t rush. Break your strategy into smaller, manageable steps. Create a teaser strategy, set a timeline, and make sure you stick to it- because the more granular you get, the better your chances of success.

Define realistic timelines based on how long your assets need to mature, and adjust your approach accordingly. You don’t need to swing for the fences every time, but know when to be aggressive and when to take a more measured approach.

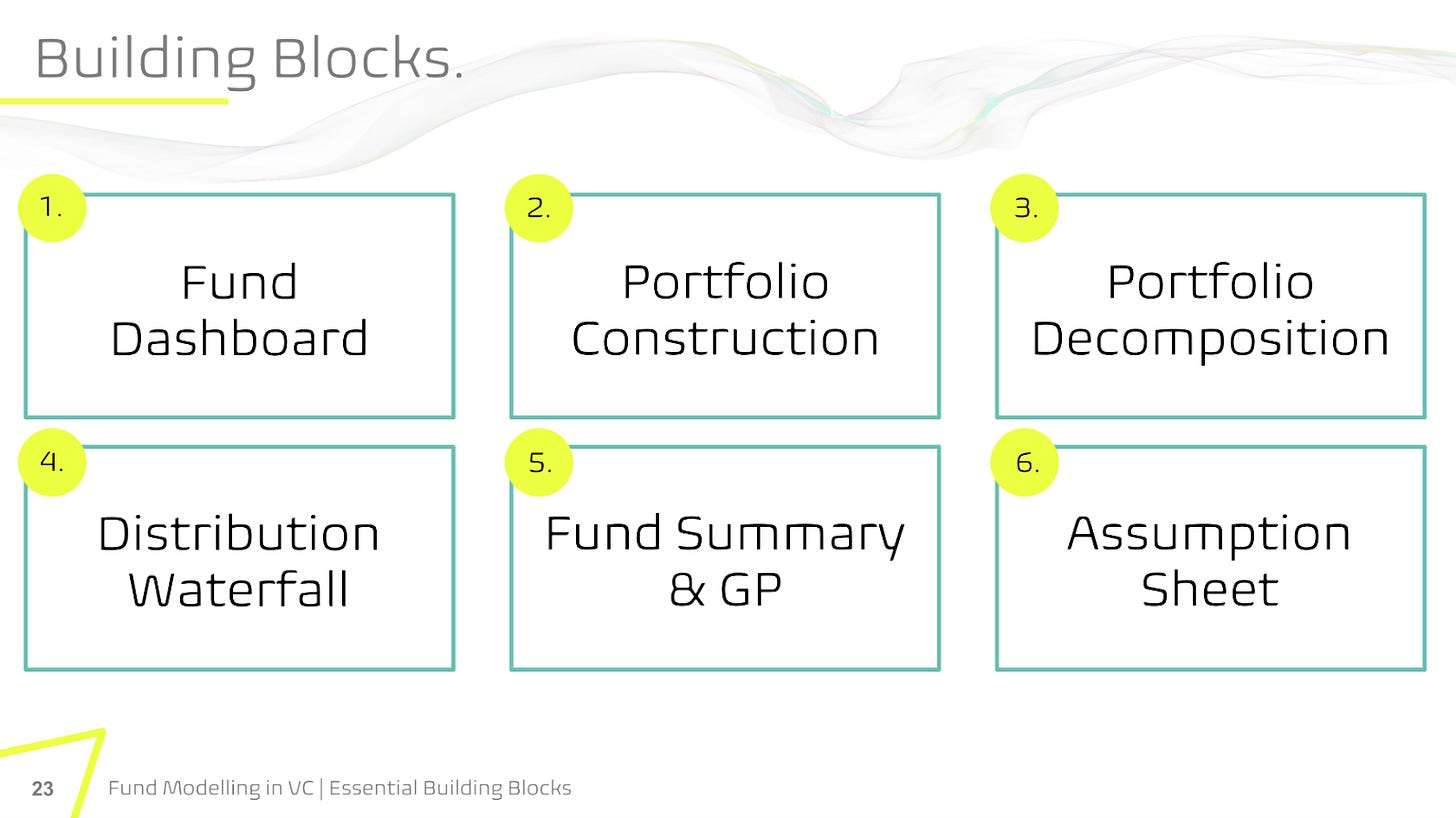

Use your energy to solidify and properly model your fund with the essential building blocks

Each block should be built on a solid understanding of your fund's strategy, allowing you to create a model that aligns with your unique vision for success. Don’t just model your numbers- model your future. Adaptability is key to long-term success in venture capital.

Be dynamic in your approach

Don’t get too comfortable with a single set of assumptions. Things will change, and so should your model.

Think of your fund model as a living, breathing entity that evolves with new data, market conditions, and portfolio performance. Assume realistic case scenarios and adjust over time to reflect the most accurate picture possible.

Funds Are Expensive Hobbies- Liquidity Is King

Running a fund isn’t cheap. Until the fund covers your costs, liquidity is everything.

So, ask yourself:

🔹 Which entity is covering what?

🔹 Do I have enough liquidity to keep things running?

🔹 What’s the absolute minimum I need to operate?

And remember, the key to getting your fund model right is consistency and attention to detail. Keep fine-tuning, keep learning, and most importantly, don’t forget: your fund model isn’t just about numbers- it’s the roadmap to your fund’s success.

Ready to take your fund modeling to the next level? Join the EUVC Community that offers an exclusive experience tailored for VCs and learn more about fund modeling from our learning sessions on:

Essential building blocks

Assumption sheet construction

Portfolio construction & decomposition