The Lowdown | 30.09.22 🗞️

The show & newsletter that wraps up the week in European Venture

Welcome to this week’s edition of The EU VC Lowdown 🗞️ The show that wraps up the week in European Venture with some of the key people making the headlines. Today, we’re gonna cover:

The EUVC Community tour at How To Web

Final close of the EUVC syndicate into Startup Wise Guys

MEMES & GIFs that had us ROFL

Freedom Convoy to Ukraine with Acrobator Ventures 💖

What Does the Post Crash VC Market Look Like?

Frontline’s “What founders want” survey

500 Emerging Europe’s Emerging Talent thesis

TNW’s article on how cybercrime is causing the global maritime industry to drown

Dan Bowyer’s great post on the conundrum of falling in and out of love with your startup

João Nune’s article on VC 2.0 and the revolution of machine learning & data driven VCs.

Don’t lie to me.

Get the Lowdown right in your ears 👇and don’t forget to subscribe 💗

Missed the EUVC Communty tour at How To Web? 🥂

In that case, we've missed you! But cry no more, we’re putting on an EUVC dinner in connection to Engaged & Disraptors in Prague on the 11th of Oct - Claim your seat here.

Some thoughts from the panelists

Panel: The State of Venture in CEE with Ondrej Bartos of Credo Ventures , Rumen Iliev of LAUNCHub Ventures & Stephane Ouaki of EIC (no hate, just couldn’t find him on linkedin - so no link)

Key quotes from the room:

"Last year was crazy. Too many funds, too many deals, not enough time. I think now we're back to doing what's prudent. And that's good for us."

"It's like we're friends again in VC, before we pushed people out of rounds” and another answered "you're welcome in my next bridge round" 🤣

"We're not necessarily less willing to fund risky businesses. But we are looking at slightly more and at slightly different things than before"

Panel: The Power of Networks with Dag Ainsoo of Startup Wise Guys & Marvin Liao of Diaspora Ventures

Key quotes from the room:

We ended up in a sauna and that turned out to lead to a deal that's just done a 56m round led by a16z

I do chase my team to make sure they follow up rather than just adding people on LinkedIn

Hiring, the classical VC fund value add, is entirely contingent on network"

with more than 300 companies in the SWG portfolio, its always about opening doors, connecting people, and facilitating the flow

Never forget the double opt in. It's about long term thinking. It’s common sense, but people forget common sense a lot…

Final close of the EUVC Syndicate into Startup Wise Guys → on Monday 💸

Speaking of exciting funds that have a chance at creating stellar returns 🤑 we just wanted to let you know that we're closing the Startup Wise Guys Challenger II syndicate on Monday. In other words - if you haven't yet gone through it, we've got some great weekend readings for you 📑🍷 👉 😀

Read on for the TL:DR below, check out our investment memo & tune in for some Spanglish serenading by Cristobal Alonso, CEO & GP of Startup Wise Guys on the EUVC pod links in the bottom 🎧.

TL:DR

Startup Wise Guys (SWG) is one of the most active early-stage investors in Europe with a strong footprint in the “New Europe” region (CEE / CIS countries). The accelerator program and the first fund was established back in 2012, in Estonia.

From a small team and accelerator in 1 city in 1 vertical, SWG has grown into a leading player in the European accelerator scene with 32 completed batches across 8 cities and 5 verticals, thus investing in more than 300 startups.

Challenger Fund II is the flagship fund that gives LPs exposure to 100+ of the pre-seed startups SWG accelerate during the 3 year investment period across SaaS, Fintech, Cyber and Sustainability in the Baltics, CEE, CIS & Turkey.

The fund will do 120 accelerator investments and 20 direct investments in companies outside of the accelerator. 30% will be invested in SaaS, 30% in Sustainability, 20% in Fintech, 10% in Cyber and 10% in other verticals.

In total, the Startup Wise Guys team has accelerated more than 300 startups with a follow-on rate of 50% - while the market average is 18% (Techstars clocking in at 34% and Y Combinator at 33%).

The POC fund of 800k€ launched in 2012 has a Net MOIC of 13x as of 31.03.22. The fund invested in 59 startups out of which 37 are still active.

Challenger Fund I of 8.15M€ launched in 2019 and has since invested in 115 startups. The fund is still actively deploying and MOIC is already at 1,75x - a solid performance for an accelerator fund of this vintage.

Notable investments include Ready Player Me (which has recently raised 56m$ from a16z resulting in a 2400x markup), Bolt, EstateGuru, Wolf3D and Fractory.

To review the deck & invest with us, hit this 👇

Aaand finally, tune in for some serenading by Cristobal here 🎧

#112 The Startup Memo: Cristobal Alonso on Fractory

#84 The memo: Startup Wise Guys, Cristobal Alonso

#49 Cristobal Alonso, Startup Wiseguys

New Funds on the Block

When at How To Web, one of the panels we hosted was with Bogdan Iordache from Underline Ventures and Mike Reiner from Acrobator Ventures on new funds on the block.

This topic does makes a ton of sense: Europe is experiencing a true boom in new funds.

Amazing, but also disconcerting.

At eu.vc we’re investing into VC funds.

Not as a traditional LP but by assembling syndicates of powerful ecosystem players to back the funds with capital and network, experience and skills.

This means we’re seeing funds as deal flow. Just as VCs see startups as deal flow.

And I must say: the breadth in quality is staggering to me.

On the one end - the good end - we’ve got teams like Bogdan and Mike. Both deeply embedded players in the European venture ecosystem with impressive track records.

On the other end, you’ve got #Instagram angels that’s hardly done a deal and almost seems to be trying to figure out the fundamentals of VC while fundraising.

So while new funds on the block is fundamentally a good thing, we’re also approaching a time where everyone seems to want to be a VC - and that’s not good for our rep as an industry.

MEMES & GIFs that had us ROFL

VC’s checking if their portfolio company finally gave up on them doing their pro rata in the bridge round:

When your big co competitor messages the same features that took you 1-2 years to develop.

Investors once an industry becomes cool

David Citron: VCs: "Just ask our portfolio founders; they'll tell you that our introductions, support and value add is pure magic"

Asking an investor how their portfolio is doing…

Freedom Convoy to Ukraine with Acrobator Ventures 💖

On the 28th of September, Joachim and Mike were bound for Lviv to attend the first real tech conference since the start of the war. This is what they did:

Instead of flying to Poland and taking a taxi or train to Lviv, we're driving hopefully two or three pick-up trucks loaded with laptops and other materials. Pick-up trucks are a key to mobilizing the (voluntary) army and laptops are used to teach kids and program drones.

We want to show our support as few people from outside of Ukraine are showing up and startups there are pushing hard to grow internally. We believe this can make a huge difference.

Joachim Laqueur, Acrobator Ventures

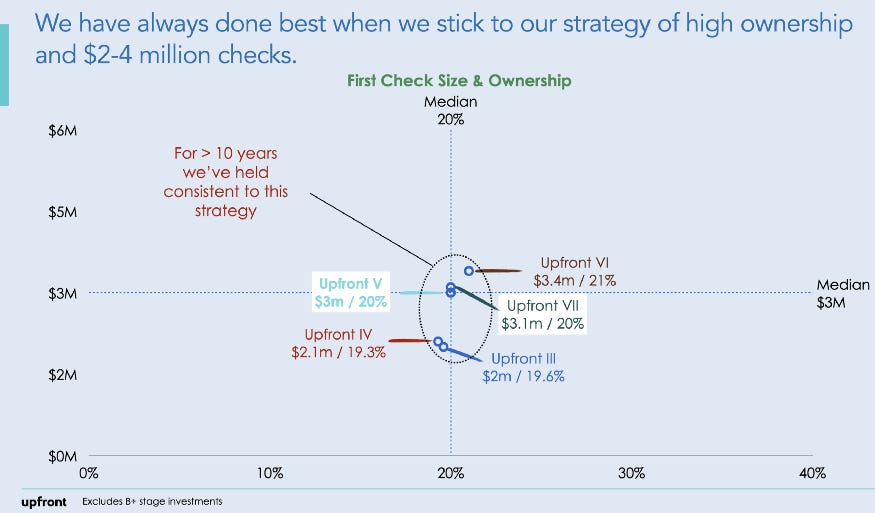

Point Nine raises new fund - and shows what consistency looks like 🏅

What’s more to say? Hats off to Christoph Janz and his team for building a pillar in European VC.

What Does the Post Crash VC Market Look Like?

Mark Suster put out a great analysis. If you don’t already follow his musings, do go ahead! Now let’s look at some key out takes from his conclusion:

And let’s land this on a beautiful quote from the article.

We’ve created more than $1.5 billion in value to Upfront from just 6 deals that WERE NOT immediately up and to the right.

The beauty of these businesses that weren’t immediate momentum is that they didn’t raise as much capital (so neither we nor the founders had to take the extra dilution), they took the time to develop true IP that is hard to replicate, they often only attracted 1 or 2 strong competitors and we may deliver more value from this cohort than even our up-and-to-the-right companies. And since we’re still an owner in 5 out of these 6 businesses we think the upside could be much greater if we’re patient.

And we’re patient.

Frontline’s “What founders want” survey

Frontline asked 200 founders what were the top 3 parameters they looked for in their pre/seed investor (assuming the deal terms were the same). Have a look 👇

As part of today’s Lowdown this led to quite a feisty discussion of the reality of value add. You should for sure tune in to hear Enis Hulli and Dan Bowyer making the lowdown live up to it's name 🙊

500 Emerging Europe’s Emerging Talent thesis

Enis Hulli gave us the story behind the 500 Emerging Europe thesis on “Emerging Talent” and wanted to give it proper day of light here:

As we move forward, the foundation of our strategy in Emerging Europe remains based on two major factors:

1. Talent

Central Eastern Europe, like Türkiye, has highly skilled engineers and developers, which makes the region a hotbed for IT outsourcing. As leveraging human capital is key to building globally competitive products, we believe tech companies from CEE are able to easily access and retain top-tier talent longer. Crucially, the number of people moving into these professions is growing, while tech giants such as DataRobot, Snowflake and Snap continue to build tech teams in Emerging Europe. It is a talent gold rush.

2. Value Chain Drift

Rather than trying to connect all the distinct regional startup ecosystems in Emerging Europe to each other— as you would in other emerging markets —here we are connecting founders to mature tech markets, notably Silicon Valley. We believe if a startup partners with an investor that can quickly help link its product to a more mature, early-adopter ecosystem, the probability of success can significantly increase. 500 Emerging Europe is the only seed investor in the region with a strong connection to Silicon Valley, uniquely positioning us to find promising entrepreneurs and guide them towards global value chain and funding streams–just as we’ve done in Türkiye.

We’ve said this many times, but damn do we believe in Eastern Europe, Enis Hulli and the whole team 💖 and we put our money where our mouth is and lead a syndicate into his fund 😍

TNW’s article on how cybercrime is causing the global maritime industry to drown

What a great article and space. So much going on in this space and Anonymous are making it all the more fun as always.

Dan Bowyer’s great post on the conundrum of falling in and out of love with your startup

Dan put out a great post the other day about falling in love - and out of love - with your startup. I’ll reproduce it here for you to have a think 👇

Falling in love with your startup. Again.

Can you? Should you? Do you need to?

As the days draw in, the rain gets colder, and sunshine is no longer our friend, I’m reminded of some pretty dark personal #founder days.

Starting up is hard.

At some point, usually towards the end of year 2, you hit a wall. Well I did.

I've experienced the #startup-love-fallout twice. Failing miserably to reconcile it the first time, and seriously losing out on what could have been a substantial business.

For the second I was taught one trick that got me through the darkest moments.

Falling in love, again.

Last week I spent time with a founder on the edge of throwing it all in and making sandwiches on the beach. My wife is in a similar conundrum with her business.

When I started my first #startup it was because of the content of the business. What it did - which was IT services. I wanted to help people use this magical tech stuff to do wonderful things.

I was doing it to fix a 'thing'. Which can be mundane like mine was, or solving climate change, enabling healthier lives, or fixing something else close to the heart.

All passionate lovely wonderful driving stuff.

But what to do when the #passion wanes?

And the reality of startup life really bites.

It's sometimes a fight to get up and look shiny in the morning. Eugh.

Once you stop blaming everything out-with, that fight sometimes turns inward and starts to poison the mind.WTF am I doing. You may hear yourself saying too often.

There has to be a better way.

Or at worst, how do I get out of this.

Here's what I shared with them both that helped me:

- Fall in love with the business of doing business. And worry less about the content. You don’t need that right now (but it will come round again).

- Learn the skills to be the best business person. It's an amazing skill to have.

It's art and science with a huge dollop of psychology. It’s amazing.

- As a side, you will learn so much about yourself and self awareness is king.

- With a renewed focus and direction on business - It energises and refreshes.

It's a simple mind hack.

A shift in attitude.

Also turning it into an adventure.

Being mindful that the transition from stressing the content to focusing on being a business leader is tough.

Not all founders make great CEOs and that’s absolutely fine. Larry and Sergey did ok.

You'll need help too:

- Join peer networks

- Take a coach, mentor or advisor (know the difference, and explore what's right)

- Read all the books, watch the videos, experiment and learn

The love is there. But it’s like a marriage and you have to work for it. Accepting that what first turned you on, will no longer.

But ultimately it will become much more meaningful.

Cue Louis de Bernières’s poem and get out your mandolin :)

Enjoy the volcanoes and then make your decision…

Fall in love, all over again. With the business of doing business.

João Nunes’ article on VC 2.0 and the revolution of machine learning & data driven VCs.

In today’s lowdown episode, we had a great talk about this article by João. Check out the TL:DR and go read it or listen to it on the show as you mow the lawn over the weekend 🏡

The benefits of Machine Learning (ML) & Artificial Intelligence (AI) in the VC investment process are now very clear and irrefutable.

AI will be involved in 75% of venture capital investment decisions by 2025.

The use of data and ML models for deal sourcing & screening is already widespread in the VC industry, whereas the same cannot be said about other steps of the investment process.

The VC investment process will most likely never be fully automated. The best results will be achieved by leveraging data to inform investment decisions through an “augmented approach”.

Don’t fucking lie.

Finally, let’s end on a cheerful message from David:

“Two weeks ago I get pitched an allocation in a hot deal (FYI it's a syndicate), but I needed to move quick. The exact words were "Would I be able to 100% confirm you and have you wire in the next 2 days if we can give you the allocation?"

Lo and behold, last night my co-founder gets pitched the EXACT SAME opportunity. More than 10 days after...

Not only does this hinder trust it paints a really bad picture for everyone else leading syndicates and the VC ecosystem as a whole.

Conclusion: Fuck you Mr. Syndicate Lead X and please, to all other syndicate leads, VCs or whatever you are: don't lie. Think long term and build trust relations.

We're building the go-to place to access the hottest European VCs at radically lower tickets than ever before - come join us! ✊

Listen to the European VC podcast episodes of the week 🎧