Firm Spotlight | Acrobator Ventures

Operator-led fund backing Eastern founders building global software companies

🎧 To get emerging VCs straight in your ears: Listen on Spotify or Apple Podcasts.

The EU🔵VC Investment Club invested in Acrobator. Join us to explore opportunities like this one.

This article outlines why the EUVC Investment Cub decided to participate in this investment opportunity. It is not, and should not be perceived as investment advice.

The Memo [TL:DR]

Acrobator Ventures is an operator-led fund backing Eastern founders building global software companies. The fund focuses on arbitrage opportunities in data-heavy B2B(2C) pre-seed/seed deals sourced by a combination of proprietary tech & insider networks in the tight-knit Eastern diaspora tech founder communities.

The mix between operator experience and AI expertise, allows the team to be a constructive partner and earn the trust of founding teams. This together with their data-driven, network-led, and market-focused approach, grants the team unparalleled access to these founders (aka initially undervalued, yet proven unicorn builders).

Track-record of 70+ investments over 15+ years in the Baltics/CEE/CIS region yielding a rarely seen 15.7x DPI, 57.9x TVPI. That’s the second-highest IRR in the Netherlands in 2021 according to Pitchbook. 🤯 Decacorn investment in miro.com. Follow-ons by Tier 1 VCs like Insight, Accel, TCV, and Iconiq.

Differentiated investment strategy focusing on early access by allocating significant capital to acquire defendable entry ownership positions. Retaining relevance across stages by allocating (super) pro-rata rights via SPVs.

The fund has been actively investing through the fundraise with called capital already marked-up by 2.1x.

We got the inside scoop about Acrobator from our good friend and mentor Joe Schorge, founding & managing partner of Isomer Capital 💕 Huge shout-out to Joe for this as well as his continued support of our mission at The European VC 🙏

Investors come from the founders and execs of Miro, Flowtraders and Booking.com & institutional investors like Team Europe and the highly revered European VC-focused fund of fund Isomer Capital.

The memo in your ears 🎧

Listen to our in-depth interview with Joachim and Mike on the EU🔵VC podcast

Intrigued? Join us in the EU🔵VC Syndicate ✊

The Memo - the long read.

1. Thesis & Strategy

Acrobator Ventures focuses on arbitrage opportunities in data-heavy B2B(2C) pre-seed/seed deals sourced by a combination of proprietary tech & insider networks in the tight-knit Eastern diaspora tech founder communities.

Let’s unpack this super rich statement further.

Arbitrage opportunities mean opportunities stemming from the fact that most founders from the Eastern Diaspora have limited access to Western capital when raising their first ‘professional’ capital and thus raise at a price discount in the early stages.

Data-heavy B2B(2C) means that team actively looks for platform plays that quickly scale. The team invests following the philosophy that quality data access and creation will be a key competitive advantage and should be evaluated as such.

Pre/seed means companies with post-money valuations from €2 to 15 million, typically with initial product-market fit, first revenues, an unfair advantage in terms of network, arbitrage potential, and access within its target industry, and highly scalable data-driven business models. Sweetspot of €750,000 per investment and a total investment limit per deal at €1.5 million.

Proprietary tech means that the fund gathers and scores data to support their investment decisions and assess the data access of the startups in the pipeline.

Insider networks means that the sourcing and evaluation of deals is heavily focused on the track record and validation of the team (e.g. serial entrepreneurs). This is possible by leveraging the team’s track record and reputation as successful entrepreneurs & investors in the Eastern European diaspora to access experienced founders.

Eastern diaspora means that 70% of investments are expected to go to Eastern European founders, whereas the remainder of investments can be in founders from anywhere.

Unicorn companies by members of this Eastern Diaspora count Miro.com, Affirm, Revolut, (Transfer)Wise, Bolt, Grammarly, People.ai, Telegram, Gitlab, Ring and many more.

What is more, the GPs of the team hold strong individual philosophies.

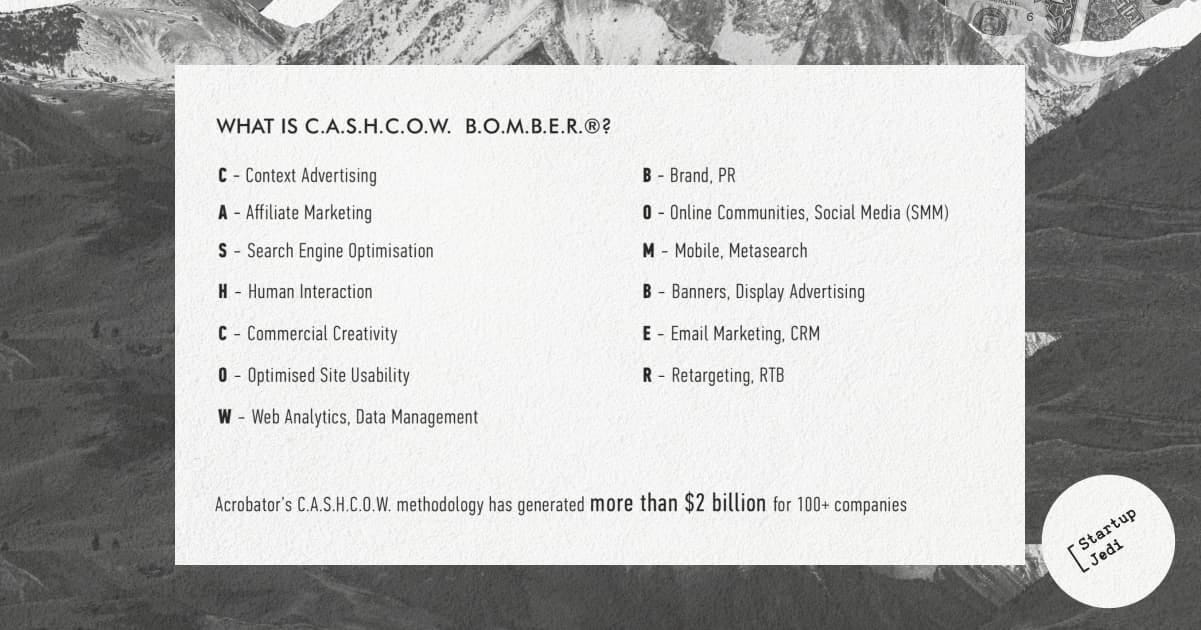

Bas Godska: Focuses on attracting and converting fundraising founders based on his own (co-)founder background and decades of entrepreneurial experience in the CIS. He is sought after due to his stellar reputation as an angel investor in the region, and his pre- and post-deal support based on his proven "C.A.S.H.C.O.W. B.O.M.B.E.R" growth methodology (cf. the section on value add for more details).

Mike Reiner: Focuses on seed-stage B2B platforms with clearly defensible data, very connected founders, and/or technical superstars. The pattern recognition of having evaluated thousands of startups and also building his own enables him to quickly evaluate founders’ abilities to scale and connect to industry experts.

Joachim Laqueur: Focuses on teams with unfair advantages or unique insight into their sector. His background in private equity and as an operator allows him to help founders to connect strategy and operational excellence such that they are much better placed to make it to their Series A.

Ramon Vigdor: Ramon believes that many industries, including VCs, especially at pre-seed stages, are falling behind in the usage of state-of-the-art technology. His experience in building 100+ SaaS and ML solutions doesn’t only help founders when scaling their tech, but also in having a perspective on future tech.

Unique deployment strategy utilizing co-investment vehicles actively

Acrobator aims for a 10% stake for a total investment of up to €1.5 million per deal (and up to 10% of the total fund in exceptional cases), but contrary to most early-stage funds, these positions are not expanded and protected from the main fund, but rather through follow-on SPVs (save for small bridge rounds).

The team thus seeks to deploy the fund’s full allocation to a target startup over a single round. Only in cases where the initial round size doesn’t allow for a significant enough check size or % ownership, the team reserves capital to deploy in the next round, up to €1.5 million in total.

(Super) pro-rata rights are always negotiated as LPs are offered co-investment opportunities in later rounds on a pro-rata basis. This will allow for LPs to significantly increase their position in individual portfolio companies over time. All co-investments run through SPVs created and managed by Acrobator Ventures.

Market deep dive

Acrobator builds on the thesis that technology will play an ever-increasing and accelerating role in our lives, especially artificial intelligence. Machine learning will increasingly become 1) a standard platform-enabler (similar to cloud computing) outperforming businesses that are not adapting quickly enough and 2) a clear opportunity to add an additional competitive advantage to businesses by using the newest techniques. Consequently, financing of the startups building these technologies of tomorrow will continue to require enormous amounts of capital for decades to come, making the sector focus equally enduring.

Countries like Poland, Armenia, and Georgia see a massive inflow of Ukrainian and Russian talent due to the current war. This Eastern Diaspora will continue to grow and at the same time strengthen those countries’ talent pools. Further, in Georgia and Armenia, the fund or its partners are members of influential angel and business networks. In general, Acrobator is very well positioned to leverage the accelerating opportunity of top Eastern talent targeting Western markets.

It’s thus important to stress that the opportunity is not only the current access of the partners to top quality Eastern founders, but also how to manage those networks and build robust processes and tools, so that Acrobator wins against the new eastern-focused funds/mandates of the bigger firms like YC, Techstars, and 500 Global.

Effect of the Russian invasion

Clearly, investing in the CIS, Baltics and CEE will require a team that understands the impact of Russia’s aggressive policies on the region. In the case of Acrobator, there are several reasons why we feel confident that this team will win big in the coming years.

First, let’s look at how the Acrobator team has built their investment thesis and strategy to limit the negative impact of whatever moves the cod-eyed devil might come up with:

Eastern Diaspora focus, i.e. founders from the CIS, Baltics & CEE, that operate worldwide. And have done so since 2011;

Solely invest software companies with Western entities (most being US companies);

No exposure to Russian capital on an LP-level;

IP and services running over Google or AWS (Amazon) cloud servers guaranteeing stable operations;

Data-intensive defensible strategies with $1 billion-plus exit opportunities.

Second, the Russian invasion has, in fact, only strengthened Acrobator’s thesis:

🛑 Russian-backed VCs will find it ever harder to get allocations on coveted deals.

🧲 Russian & Ukrainian tech entrepreneurs are even more inclined to build companies in the West.

🏆 Acrobator is virtually the only Western pre/seed fund with a local presence and strong ties to the Ukrainian, Russian, Georgian, and Armenian ecosystems.

A concrete expression of this is the durability of the team’s investments in Let’s Enhance and Respeecher. Both companies have some of their founders and teams in the West, and their companies are not reliant on local infrastructure or laws.

And to further substantiate this point, here’s a quote from one of Russiaʼs most respected tech founders:

“Speaking about the founders, even before any tensions, the majority of them strongly desired to go international, which presumes establishing non-Russian HQs and non-Russian funding due to limitations of the Russian market. Now their desire is for sure even stronger.”

Acrobator’s response to the invasion

Since the invasion, the Acrobator team have been in close contact with two of their seven portfolio companies, who have a part of their teams in Ukraine. Both Letʼs Enhance and Respeecher have put in place measures to protect their team members:

Salaries for February and March were advanced;

Apartments and offices were rented in Lviv (Western Ukraine, near the Polish border);

Employees moved and put in a position to relocate if necessary;

Cash withdrawn for acute needs.

The precautions taken have worked, and all team members are safe.

Further, and as you may know, Bas Godska and his wife Kseniya are personally affected by the war in Ukraine. Although they were fortunate enough to be in the Netherlands when the war broke out, many of their friends and relatives were not. In connection to a foundation Bas created to support Ukranians who have fled, Bas commented on the situation to Quotenet, a major Dutch media outlet:

A nice life, just outside Kiev, that was what we had. We lived in nature, with some animals, which was really nice. Until Putin invaded Ukraine.

Since the Russian invasion of Ukraine, something that he and his wife did not witness themselves due to a delayed flight, his life has also been turned upside down. With great speed, Bas started to bring relatives, friends and acquaintances to safety by bringing them to the Netherlands. Surprising to many, this sometimes turned out to be unexpectedly difficult.

You also have to deal with people who are old, who would rather say they have a bomb on their head than leave home and hearth. Which in turn has a social domino effect, because then their children don't want to go either. It's something you only know from tear-jerking movies, but now it's real. Heartbreaking.

To date, Godska and his wife Kseniya’s foundation has linked 679 Ukrainian refugees to host families in The Netherlands and donated € 752.639. If you wish to donate, you can do so here.

Join us to invest into amazing European VCs ✊

2. GP & Team

The team has invested together since 2016 and started building the formal foundation for Acrobator Ventures in late 2018. What is more, Bas even worked at the VC family office of Joachim’s family in the 90s, making the relationship and trust between them longstanding.

Ramon became involved in Acrobator in May 2019 as a technical advisor, but his involvement quickly went beyond mere technical due diligence calls. He pioneered the development of the firm’s ML strategy as an integral part of the fund’s long-term vision and he works with the team on deal flow, due diligence, operations and strategy.

Mike is the latest addition to the team. From the get-go, Joachim and Bas planned to add a partner with a strong background in investing across stages and a track record in Eastern Europe. So, they started building the business relationship with Mike in early 2021 as he was winding down his involvement at OpenOcean (a Series A fund based in Finland). As a result, Mike’s involvement increased steadily and has helped further professionalize the firm.

Bas Godska, General Partner

Bas Co-founded Travelata.ru, a leading Russian tour package aggregator. Besides CMO roles at various leading e-commerce players in Russia, Bas spent the past ten years in the Russian/Ukrainian startup ecosystem acting as an advisor, mentor, and angel investor. Bas is a part of influential Russian founder networks such as F4F and Shmit 16. He is often a speaker at local tech events and a jury panelist on accelerator demo days. Bas has made 20 angel investments since 2011, notably Miro.com, Harver.com, and Chocofamily. The portfolio generated over €50 million in cash returns on a €2.4 million investment with an additional €135 million in unrealized returns. Amazing 🤯

Joachim Laqueur, General Partner

Joachim started his career as an M&A/Corporate finance consultant in the Netherlands (SME buy/sell, business case development, and research), later as a turnaround advisor, and prior to starting Acrobator Ventures as an advisor for tech startups in Portland, Oregon (the Silicon Forest). The VC family office, set up in the early 80s, has been making investments across the globe with a special emphasis on Russia and the Republic of Georgia since the early ‘90s. Joachim has also co-founded and acted as finance director of a biofuel production company in Austria operating in the CEE and CIS. The pioneering waste-to-energy technology is still in use in multiple plants across Europe and Joachim raised more than €25 million in a combination of equity, senior debt, mezzanine, and subsidies for the company.

Mike Reiner, General Partner

In 2012 Mike co-founded and managed one of the leading European Accelerators: Startup Wise Guys investing in around 40 B2B deals. The accelerator started in Estonia and now has more than 275 portfolio companies, many of which originated in Eastern Europe. In addition, he co-founded City AI, an artificial-intelligence community in 80+ cities, and World Summit AI, one of the leading European AI conferences. Furthermore, he built up the venture capital network in EMEA for Amazon (AWS) and has been a regular speaker at conferences on topics such as artificial intelligence and VC. His personal investments include companies like Verbit (1B+ valuation). Most recently, he was a venture partner for early series A stage VC OpenOcean (fund by the MySQL and MariaDB founders) with a focus on data-intensive European software companies. His investments from 2012 to date are marked-up over 15x and two exits returned over 50x invested capital 🚀.

Ramon Vigdor, General Partner

Ph.D. in AI/ML at the Delft University of Technology in The Netherlands on top of electrical engineering and computer science degrees. After spending a few years teaching ML and physics, Ramon moved to the industry and took the role of CTO at Global Orange (an Amsterdam-based SaaS and ML development company). He designed, built, and supervised about a hundred projects, ranging from small startup applications to large-scale, complex, enterprise systems. Ramon headed both SaaS and machine learning teams at Global Orange as Chief Architect. He is a developer with vast experience in building teams and getting products from idea to large-scale production. He is passionate about building state-of-the-art AI systems that support, rather than bypass, humanity and the environment. Well-versed in assessing and advising tech teams, Ramon is an experienced manager & team builder, and has overseen multiple development teams (160 developers in total).

3. Track Record

The Acrobator team’s track-record holds north of 70 investments made over 15+ years in the Baltics/CEE/CIS-region yielding a rarely seen 15.7x DPI, 57.9x TVPI 🤯

This is obviously driven heavily by the decacorn investment in miro.com, but if this is taken out completely, you end up with a ±7x TVPI and a 6.7x DPI. So clearly, Miro skews the numbers a lot due to the extreme success of the company. But hey, this is VC 🤷♂️

Another exercise would be to 'normalize' the track-record by assuming equal investment amounts in all companies (say 250k). Since Wolf3D is a 600x TVPI and Chocofamily a 100x TVPI, and Vital Fields and Stepshots at 50x and 100x DPI respectively, such an exercise would dramatically increase the absolute performance of the track-record.

However you play the numbers on this team, there’s only one conclusion: performance has been outstanding, and we can’t wait to see them replicate it in a fund setup.

Join us to invest into amazing European VCs ✊

4. Unfair advantage

We believe there is a clear market opportunity here (see market deep dive above and track record). As such, deal sourcing is a key asset and this is the core advantage of Acrobator - they are the only Western pre/seed fund operating locally in CIS.

Founding partner Bas has built his reputation as an investor and entrepreneur for over twenty years, Joachim has invested in the region since the mid-90s through his family office and personally since mid-2000s. Further, Mike co-founded one of the leading European accelerators, Startup Wise Guys in 2012. Due to the origination of the Accelerator in Tallinn, Estonia, he traveled extensively in Eastern Europe and Russia to search for startups and establish networks.

The team knows the importance of networks, and thus has built and expanded on this by attending (as speaker, mentor or jury member) at key startup events and competitions throughout the CIS and beyond.

What is more, the CIS isn’t the easiest place for a new entrant to come in, requiring a good understanding of local culture, language, and ways of doing business - where introductions are heavily trust-based. The main competition is therefore from local pre/seed venture funds. Russian-backed funds will have an increasingly hard time being accepted. That, together with entrepreneurs wanting access to Western capital and markets, yields Acrobator a natural advantage.

Data & ML/AI as an advantage

To build a strong and enduring competitive advantage, the team employs and develops data-driven ML/AI strategies. Most Pre/seed VCs are very slow to adopt these because of the inherent complexities and lack of skills within the team. This, however, is the providence of Ramon who is an expert in state-of-the-art AI/ML, and Mike who founded an AI conference and global AI network. We believe they will be able to bring this strategy to fruition.

5. Value add

At Acrobator, the deal team oversees the investment until exit. Acrobator works with founders through periodic update calls focused on data, tech development, marketing, traction, finances, hiring needs, team development, and founder well-being. But as any good VC, Whatsapp is always open for founders to reach out for feedback on fundraising, marketing, recruitment, strategic and technical questions, and general founder support.

Partner involvement is most intense during the first six months after investment and again as the company ramps up towards a new financing round.

In most cases, no board of directors is created until the first equity round. Partners are expected to each have two to four board seats concurrently and as a pre/seed investor, the team does not expect to retain board seats after later series rounds (unless they keep defending pro-rata via SPVs or other strategies).

The C.A.S.H.B.O.W. B.O.M.B.E.R. framework

One of the leading success indicators of any startup is its ability to scale utilizing marketing and sales. Often, growth marketing knowledge is largely absent in a pre/seed company. It’s rare that competing funds have the tools and knowledge to add value in this part of building a business. Acrobator can leverage Bas and his advisory firm’s extensive knowledge and proprietary growth marketing methods to:

Assess the potential of deal opportunities;

Help portfolio companies with effective best practices and tools.

6. Terms & Fundraising

The fund is a Dutch coop, AFM & EUVeCa, which is one of the preferred structures and places of domiciliation in Europe (and same as two other funds invested in by The European VC Investment Club).

The fund term is 10 years with max 5 years of deployment.

The minimum LP commitment is €500k (note: for investors that go direct. The EU🔵VC Investment Club’s minimum commit is 1k€ ✊).

Management fee

Management fee: <2.0% fee (2.5% y1-4 down to 1.5%) with a 1% set-up fee (outside commitment) to set up the funds operations, specifically tech stack & team development. Recycling of management fees are allowed up to 125% on early exits in year 1 to 5.

LP co-investments are charged a 1% mgmt. fee and 10% carry.

Carry: 25% carry with step-up >4x net & a hurdle rate of 7% with catch-up.

Late-fee

Late fee 7% p.a. on called capital. There is a group of 7 investors who pre-funded the first four investments in 2020 (first closing was in May 2021). This group was rewarded for exclusion from the subscription fee. The underlying four investments (Respeecher, Let’s Enhance, Studyfree, Leapfunder) were already marked up when they went from the ‘warehouse’ into the fund in May 2021 and were entered at cost, providing the benefit to all LPs.

Fundraising

The EU🔵VC Investment Club joins in the final close.

7. Fund Model

Acrobator optimizes for outlier performance on investments, meaning the target return for an individual investment is +50x money on money return. As part of the due diligence process, return scenarios are modeled based on ownership, capital requirements, follow-on round mark-ups, dilution, and likely exit scenarios.

Due to the lower cost-base, Acrobator’s target investments can be expected to achieve significant development in their products, justifying a substantial and rapid markup as for their Western seed round (typically within 12-18 months of Acrobator’s investment). The established portfolio match - even surpasses - these expectations.

Acrobator strategy is to allocate enough capital over one (or at times two) round(s) to achieve a +10% ownership in the target startup. The total commitment to a single investment cannot be more than €1.5 million on average to ensure a diversified portfolio of ±20 companies and 10% of the fund is the max allowed exposure to a single investment.

The average holding period of an individual investment is targeted to be five to seven years from its seed round with pro-rata rights protected in the winners via co-investment-SPVs from the LP-base.

8. Governance & reporting

Operational decisions

All members of the team are involved in operational decisions as the team nurtures a culture of accountability and ownership with responsibility and ownership pushed down the line. Day-to-day operational and administrative decisions are made by Joachim in the capacity of managing partner and technical operations and development decisions are made by Ramon in alignment with Mike.

Mike and Joachim are responsible for the bulk of the portfolio companies (around 6-8 each, although not all of them will have board seats). Bas is responsible for those companies where there is the most emphasis on marketing (around 4-6) and Ramon is responsible for those companies where there is most emphasis on deep tech/AI/ML (around 2-4).

Investment decisions

The investment strategy is primarily managed by Mike and Joachim. In general, each partner focuses on their respective strengths throughout the deal process and decision-making.

During the due diligence phase, as the team is basically partner-level only, the partners take opposing sides to ensure objectivity and avoid group-thinking or hubris. Once the partners have reached a consensus (three votes out of four), deal terms are negotiated and the investment case is completed. It is the culture of the firm that everyone on the team, no matter how junior is encouraged to challenge prioritization of deals, time spent, conclusions, and potential investments.

Advisory groups

Advisory groups are formed for deal evaluation. These groups are twofold: i)a permanent small advisory group for monthly deal validation, and ii) deal-specific advisors to validate certain aspects such as market, tech, and legal, etc. Carry options can be allocated for the most senior and best-performing advisors after an initial trial period.

Investment Committee (IC)

There is no formal IC, although a provision is made in the Fund Agreement if the team were to install one.

Limited Partner Advisory Committee (LPAC)

An LPAC of five to seven members is permanently appointed after the final closing and seats will be allocated so that the LPAC represents all LPs evenly.

Join us to invest amazing European VCs ✊

Risk Warning Investing in venture funds, start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. The EUVC Investment Club is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via EUVC once you are registered as sufficiently sophisticated. This content is for informational purposes only and should not be considered investment advice.