Firm Spotlight | SMOK Ventures Fund II

Operator-led US fund investing in top serial founders of the CEE region

The TL:DR

📝 The executive summary

SMOK is an operator-led US fund investing in top serial founders of the CEE region

SMOK has delivered on its promise of connecting ecosystems with 80% of the money raised by portfolio startups coming other global investors

SMOK has risen to become the first-choice fund among serial entrepreneurs in CEE in less than two years of operation

Named one of the most active CEE seed funds in 2020, and the second most active in Poland (Vestbee reports)

GP team consists of Borys Musielak, Diana Koziarska & Paul Bragiel

💸 The financial argument behind our investment

With Fund I, SMOK demonstrated they can consistently attract the best CEE entrepreneurs and attract global investors to follow on these deals.

SMOK delivers a differentiated value-add of being a “for founders by founders”-fund that is highly connected to both the local startup scene and global venture scene via the Bragiel brothers.

The firm-building strategy will further strengthen SMOK’s dominance as one of the go-to funds in software & GameDev in CEE.

Fund II is an extension of the strategy employed in fund I which is on track to become one of Europe’s highest-performing funds.

♟️ The strategic argument behind our investment

It’s an explicit goal of SMOK to give LPs initial CEE-traction, making it a high priority for the team to work actively with EUVC.

Borys is one of the leading voices in Eastern European Tech making him a strong partner and entry point to the ecosystem. If you don’t already follow him on linkedin, we advise you to do so and check out his musings here.

Borys and Diana have demonstrated extremely high levels of collaboration towards us as well as their surrounding ecosystem ensuring us that they’ll be a great partner for knowledge sharing.

Our Analysis Framework

1. Thesis & Strategy

SMOK aspires to become the first-choice seed fund for serial entrepreneurs in emerging Europe by 2025. They will do this by:

Backing Poland’s tech entrepreneurs early. Advance their already-successful strategy to invest in Poland’s top tech founders at pre-seed by leveraging their strong reputation in the region and established community.

Leading top CEE seed investments. Tap their network of local angels and pre-seed VCs to invest in CEE-based startups during their seed rounds as lead investor, or major co-investor.

Helping raise rapid follow-on rounds. Connect CEE entrepreneurs with great seed and series A investors from Europe, Asia, and the US to help them grow faster.

Giving investors initial CEE traction. Aim for 10% of equity in pre-seed rounds

(across Poland) or seed rounds (CEE) and invest pro rata in the following rounds.

What’s important to note in this is that it’s very much a continuation of the strategy executed on in Fund I. Verticals remain to be primarily Software and Game Dev and geo remains to be firstly Poland, secondly Ukraine and the Baltics and to a lesser extent other CEE-countries.

Prepared for the next stage

Importantly, SMOK has prepared for the next stage of their journey. They’re already a team of 6 + the Bragiel brothers and they’ve worked like that for most of 2022 (only with Tomasz Koscielniak and Sasha being half-time) and they’ve both already led investments with us.

It's an exciting time and (importantly) Borys actually loves managing a team and has a history of having managed teams growing from 3 to 45 during the last 20 years at various jobs and companies he founded. In fact, one of the main motivations behind founding SMOK was to build a big multi-year project, not just a boutique shop.

Asked about their main challenge, Borys replies:

I'd say the team growth and management is a challenge, but definitely not the biggest one. I believe we're well equipped to be successful here both on the recruitment and managing site. I love doing both and I'm taking leadership there. The main challenges will be around building our brand in the most important CEE countries without losing our speed and other qualities that made us successful at fund 1. We have a plan here and EUVC is part of it. Together with ReaktorX for early dealflow, Diana's nomad VC life, the podcast and our activity in social media. But as ever, it's only a plan and the next few years will show how good we are on that front, which will be defining what SMOK becomes going forward.

Investment strategy evolution from Fund I to Fund II

Following the typical fund evolution, fund II will allocate more capital to follow-ons (60%) which aligns well with the increased financing risk that the VC market of ‘23 & onwards presents. We could also dive into a long debate here on the best follow-on strategy but will avoid it and leave it for another time when it’s the sole purpose. Suffice it to say that SMOK’s allocation to follow-ons is within standards.

By deal volume, the initial tickets will be split equally between pre-seed and seed, while 3/4 of the capital will be allocated in Seed. Given SMOK’s focus on serial entrepreneurs, this split makes sense as these founders often ‘skip’ the pre-seed round and raise at slightly higher valuations than your typical “diamond-in-the-rough”-founder.

Market deep dive

We’ve written quite extensively on the CEE in our firm spotlights on 500 Emerging Europe and Startup Wise Guys. So we’ll try not to repeat ourselves too much, but rather add to the existing body of knowledge.

First, we’ll argue for the rise of CEE - in case you’re not yet convinced. Afterward, we’ll explore Poland and then the Baltics + Ukraine.

The rise of CEE

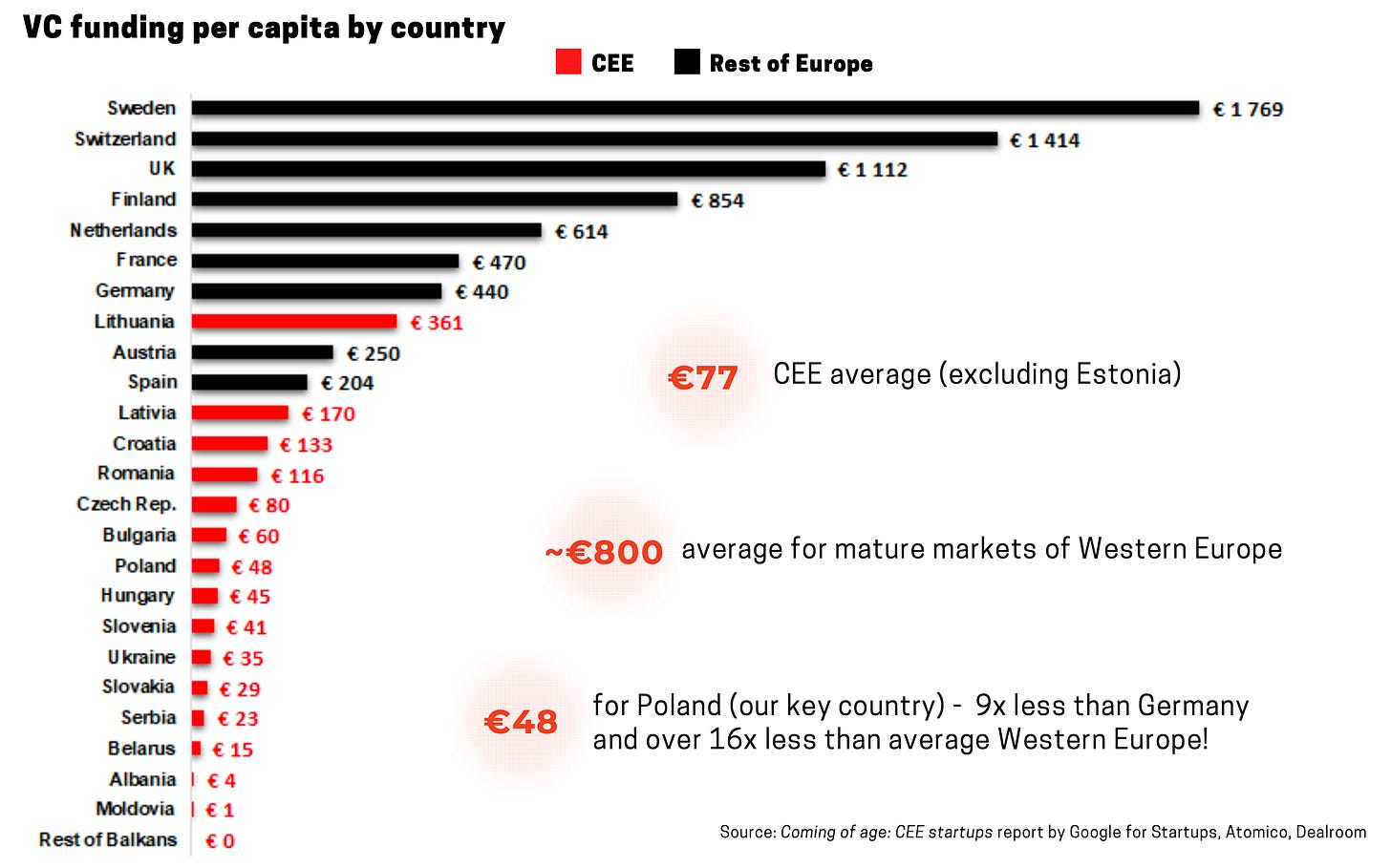

There’s no doubt about it. CEE is a scaling tech ecosystem representing dynamic growth in recent years and still unmatched potential to release. And the good, local venture funds stand to gain disproportionally from this as the CEE economies remain vastly underinvested 👇

According to a McKinsey study for the 2013-2020 period, investment per capita was 8 times lower than in The Big 5 (France, Germany, Italy, Spain, and the United Kingdom) and 13 times inferior to the digital Frontrunners (Belgium, Denmark, Estonia, Finland, Ireland, Luxembourg, the Netherlands, Norway, and Sweden). And especially the digital economy which SMOK targets is on fire 👇❤️🔥

As a proof point, companies founded in CEE now have a combined enterprise value of over €186 billion - up 19x since 2010.

Tech giants such as AVG, Skype or Allegro attracted the attention of international investors and activated the positive flywheel, posing the base for the next generation of fast rising successes such as Bolt, Rohlik, Zego.

Record Venture Capital investment

While we all know we’ve had quite a ride in venture in general, the growth of the region will make anyone look twice 👇.

And importantly: this is not only driven by mega-rounds - early stage investing is also booming with pre-series B funding having grown 2.1x in the first half of 2021 compared to the year before.

And of course, the Central Eastern European unicorn stable has grown too.

Poland under the hood

Looking at CEE, there are three countries that stand out: Estonia, Romania and Poland. Since 2000 these countries have created €32b, €27b, and €25b in startup value respectively (as of ‘21). Let’s look at the characteristics of Poland in detail.

Local market is saturated, but this created role models in making local startups global.

Over the last twenty years, Polish entrepreneurs have primarily built solutions for the Polish market. Polish eBay (Allegro), big web portals (Onet, WP, Interia), social networks (grono, NK), job search portals (pracuj, GoldenLine) or local marketplaces (Niania, Pomocni) were all huge local wins.

Now that most of these founders cashed in they started reinvesting into new startups via their own VC funds such as Innovation Nest, Protos VC and Hedgehog Fund. As there is not much room for expansion on the limited local market anymore, companies like ten square games, Booksy, Iceye, and Ramp (with the help of the aforementioned mentors) have taken the path to become global leaders in their niche markets.

European Union funding

The VC market in Poland is undoubtedly one of the strongest in CEE with over 50 active VC funds and thousands of active angel investors. This attracts founders of similar cultures from countries in the former Soviet Block that struggle to raise funding in their local markets - a trend only strengthened after the Russian invasion of Ukraine.

Recent programs by NCBiR and PFR have added another 500 million EUR to the Polish VC market and programs like these persist and continue to evolve to this day.

Availability of tech talent

Poland is a global leader in the quality of Ruby, Python, and Java programmers as well as algorithms in other software-related categories according to HackerRank (top 5). The engineers are world-class, but still significantly cheaper to employ than in Western Europe and the US.

So what’s to come for Poland in 2023? Read on below for part of Borys’ contribution to the “Startup Poland” report.

2023: A year of truth ahead for Poland

The year 2021 was a record year for investments in startups in Poland. During the same period, the world was also in a bull market and valuations that entrepreneurs had only dreamed of a few years earlier became a reality. At the beginning of 2022, both founders and investors were in for a rude awakening.

The financial crisis and the war in Ukraine did not go unnoticed in the Polish startup investment market. In the second quarter of 2022, we observed a virtual standstill in investments. Although there were quite a few announcements about new funding raised by startups, but these were mostly processes that were still started in 2021 or in the first quarter of 2022. The holidays were less active in terms of investment than usual. Most investors decided to wait out this period. What awaits us in the last quarter of 2022 and in the year ahead?

Entrepreneurs who optimised investment rounds for the largest possible (paper) valuations in 2020-21 now have a problem. And this does not only apply to large, overvalued technology companies like Sweden's Klarna, whose valuation has fallen by as much as 85% from USD 45.6 billion to USD 6.7 billion, but also to early-stage companies from Poland, which in the boom years sometimes raised funding at valuations of 50 times or even 100 times their annual revenues.

These startups, even if they have 'delivered' the assumed increases in revenues and other metrics, are now struggling to raise another round at a higher valuation. So they often turn to debt instruments like venture debt, do 'extension rounds' from last year based on 'convertible loans' or raise an equity round at a flat valuation. More and more companies are also aiming to get to 'break-even' faster at the expense of faster growth. It also doesn't help that most of the funds supported by NCBiR or PFR Ventures have their investment period coming to an end in the current year and quite a few of them have already spent all their money.

The year 2023 will probably be the year of truth for many startups. I expect a large number of bankruptcies, a further marketisation of valuations, but also more activity from foreign funds in Poland which have so far not found their way into the competitive funding market in our country. Private funds and funds raised in 2021 and 2022 in partnership with the European Investment Fund will also reap the harvest.

Less competition will mean lower valuations at the seed stage and therefore ultimately higher return for investors.

Baltics & Ukraine - and why SMOK have expanded to these countries.

In connection with Fund II and the expansion of their geographic focus, the team focused on optimizing for three factors:

Engineering talent pool,

Startup founding experience,

Proximity to Poland.

Ukraine, Lithuania, Latvia, and Estonia were obvious choices. Ukraine is as big as Poland in population and its engineers are famous worldwide and are already fueling the growth of Silicon Valley’s top companies. Recent developments have made Ukraine more difficult to navigate, but still a market to expect big things from in the coming decade.

The Baltic states led by Estonia are smaller markets but they are leading the globe in count of unicorns per capita with hallmarks like Skype, Playtech, TransferWise, Bolt, and Pipedrive (3.8 unicorns per million citizens).

SMOK has already invested in its first three Estonian startups, one in Latvia, and one in Ukraine, and has dozens of Ukrainian founders in the pipeline. The expansion east and north has been the natural move for SMOK.

If you’re passionate about building out the European Venture ecosystem we’d love to invite you to join us in our mission ❤️🔥

2. GP & Team

Now, before introducing the team, let’s get the story straight.

While the fund is focused on CEE & the core GP team is based there, the story of SMOK actually begins with:

It all started in Silicon Valley

As the Bragiel brothers are known for successfully launching seven venture capital funds in the US, Southeast Asia, Africa, Brazil, and the Nordics. Together, Paul and Dan Bragiel have invested in and advised over 250+ companies, including thirteen unicorns: Uber, Stripe, Unity, Zappos, Shipbob, Discord, Carousell, Carro, GoJek, Niantic, Virta, Roblox, and Playco. Their combined knowledge represents decades of high-impact investing through venture capital building, management and development.

The Bragiel brothers offer a full-cycle vantage point to investing, from angel stages all the way to successful exits.

Their Next Step: Create a VC firm that would gain early traction to Emerging Europe, the fastest-growing market within the European Union 🚀

Meanwhile in Eastern Europe

In 2014 Paul Bragiel introduced Borys Musielak (founder of Filmaster) to Samba TV which eventually resulted in the acquisition deal. This event marked one of the first significant exits of a Polish startup in the US, and the beginning of a long VC-building relationship between Paul and Borys (#bromance alert 🚨).

Borys Musielak & Diana Koziarska have built tech communities and educated generations of Polish entrepreneurs over the last 10 years. In 2016, they launched ReaktorX - a pre-acceleration program dedicated to bridging know-how from Silicon Valley and the CEE startup ecosystem. So far, over 200 founders have graduated from the program.

Their next move was to build a Venture Capital fund connecting the experience from Silicon Valley with globally ambitious tech companies from Emerging Europe.

And joining to help lead that effort is Sasha Yatsenko who has just been announced as Principal. Sasha has been one of the key figures in the Ukrainian early-stage startup ecosystem for nearly a decade. He helped build BRISE, a boutique pre-seed venture firm as a founding partner, where he invested in companies like Vochi (exit to Pinterest) and Finmap (1.2m funding raised from Presto, SID) and participated in the selection of startups for the Ukrainian Startup Fund.

True to SMOK style, Sasha was also named the most friendly Ukrainian investor by local founders and Ukrainian ecosystem builders in 2021. Before becoming a VC, he had his own web studio, travel agency and worked as Chief Digital Officer at dentsu Ukraine.

At SMOK everything is about culture. Culture defines who the team funds, who they work with and even who their LPs are. They have a long-term plan to become the go-to fund for founders all across Central and Eastern Europe and teaming up with Sasha will help them achieve this goal faster.

With that out of the way.

Let’s meet the team.

Also, make sure to check out this video to get a feeling of Borys, SMOK’s founding managing partner 👇

And now, if the above picture of Borys doesn’t convince you that Borys is a stand-up kinda guy who you can’t wait to tie yourself by the hip with for the next 10 years, make sure to catch some of his musings below 👇

Past years in review:

Selection of published startup investment theses

Thought leadership articles

10 Things Founders Say That Make Venture Capital Investors Pass

8 Slides That Will Land Venture Funding For Your Pre-Seed Startup

3. Track Record

SMOK Ventures rose to become the first-choice fund among serial entrepreneurs in less than two years of operation. A statement backed by rankings on Landscape VC and Vestbee report (1, 2)

Won the race for talent

The team has successfully managed to tap top entrepreneurs from Poland by investing in successful serial founders. They’ve achieved this by being fast to discover new opportunities, bringing their signature transparency upfront, and providing access to their global network of founders early.

Secured follow-on rounds

18 out of SMOK’s 24 portfolio companies have raised additional financing, 80% of which has come from global investors counting world-class VCs such as Y Combinator (USA), Colopl (Japan, leader in GameDev), Tencent (Hong Kong, also gamedev), Bitkraft (Germany, ditto), Supernode Global (UK, media), Verge (Singapore, health tech), Realty (UK, Proptech), Innoenergy (Netherlands, energy), Creandum (Sweden), EarlyBird (Germany), Paua Ventures (Germany), Klima (Spain).

A selection of blazing angels investing with SMOK counts Michał Kiciński (CD Projekt RED ), James Park (Fitbit), Aaron Patzer (Mint, Carbon Health) Niklas Hed (Rovio), and Ragnar Sass & Martin Tajun of Pipedrive as well as a number of Supercell veterans.

Tripled the valuations

Portfolio valuations grew 3x on average compared to pre-seed pricing, which the team, as mentioned achieved through tapping their network of top global funds and angels (cf. list above for a selection).

Got in at early valuation points

SMOK aimed for 10% equity in pre-seed rounds and invested pro rata in successive rounds to maintain the value of share appreciation and have managed to secure an average stake of 7%.

If you’re an angel, operator, founder, or expert in your ecosystem we’d love to invite you to join us in the EUVC LP Syndicate ❤️🔥

4. Unfair advantage

First, let’s establish that when we think about unfair advantage in VC, we think about two things:

Unique proprietary deal flow

Ability to win deals

And these can stem from many different things, such as:

An amazing established network (e.g., Acrobator Ventures are incredibly embedded in the CIS ecosystem)

A model that is notoriously difficult to build & execute (e.g., Startup Wise Guys have succeeded with their accelerator model to reach founders earlier than anyone else across multiple geos and Pacenotes have built a FoF to access the breakout companies of Europe’s tier 1 funds)

The natural place for us to start when looking at this is to check the competitive landscape 👇

Here, SMOK is positioned as a cross-CEE VC fund. Obviously, there’s overlap (and also more than this chart might lead you to believe). So SMOK’s relationship with these players is equally important. So we asked Borys what he thought about this:

A lot of the funds that you’ve invested in and that I know you know very well are good friends of ours. Some of them are our preferred Investment Partners. As an example, in Romania we probably wouldn't do a deal, if we haven't consulted Bogdan from Underline first. And if we did something in the Balkans, we probably would be chatting with 500. We talk to them a lot, especially now that they're present in Poland and Budapest. So I think it's going to be more a cooperation approach than competition.

And honestly, I don't think there’s going to be just one company. Just like in Silicon Valley, there’s a number of good firms that are really, really good. And there, especialy in the early stages, the funds are specialized and I think we’ll see that here as well as the ecosystem grows and matures. I can already see our sweet spot being that we’re closer to the engineering side of things, like Developer tools, GameDev, and AI.

So why do founders pick SMOK?

Well, there’s something to say about style. It might sound stupid and over-simplifying. But in the end, as is said so often it’s almost become dulling to hear: taking on a VC is like getting married. It’s meant to last for at least a decade. And just in picking your lifelong partner, style matters. Do I like this person? Does this person make me feel comfortable? Is there something that seems off?

Think about it in these terms:

You’re out there on the market, looking for your life partner to share your ups and downs with. Share your bed and household. And have children with.

And I wanna introduce you to Chrys, who’s incredibly smart, and a super hard worker with dazzling looks. By now, I’m sure you’re like this 👇

But there’s just one thing. Chrys’ integrity is a bit flawed at times.

Would you want that intro?

Probably not. Neither would a founder.

And here, the SMOK team wins big-time.

Rarely have I met anyone so intellectually honest, so ready to say what needs to be said, yet doing so without being unnecessarily harsh as Borys.

This attracts founders.

Rarely have I met anyone so ready to listen, ask questions and take the time as Borys.

This attracts founders.

Rarely have I met anyone who feels so “real” as Borys. And this - however stupidly simple it might sound - is an incredibly important trait for any VC to have.

This attracts us.

This part Borys won’t say himself. But he did put it like this:

I think it really just comes down to the point that when we talk to founders, they say to us “you’re regular guys!” and we are! Were engineers and founders. We’ve built communities in the startup space and I was, as an example, a python programmer for 10 years. It's just different when investors come with a different background, especially in the earlier stages. So yes. I do think that's a value for founders, that they feel they can talk to us and know that we've done this before.”

5. Value creation

So, Borys is wonderfully transparent. With founders and investors:

It's always best to ask founders themselves, but we do have some data. For example, on landscape.vc we are the number one VC fund in Central Eastern Europe based on reports by founders. But we also believe that we have the numbers to back up the claim that we've delivered on the promise of value-add.

Let’s look at those numbers for a bit:

18 out of 24 early investments have raised additional capital (note the industry benchmark to beat here is typically 50%)

80% of that additional capital has come from outside of the Central Eastern Europe region - mostly from the US and Asia.

These companies have tripled their valuations, even though 2021 wasn't that great in venture.

So how is SMOK able to do this? Again, let’s hear it from Borys:

I think it's best to use examples when you talk about value add. Everyone always says “Hey, we're going to get you to the next round, you're going to get to the customers, and we’re going to be super helpful and provide value, strategic advice and all that bullshit. But that’s just all so common that no one really believes that.

So let’s be concrete:

We've helped our founders raise capital, especially through Paul Bragiel’s network in such countries as the US, Singapore, Japan, across Scandinavia, UK, and Hong Kong. It’s important to say here, that his is the first time these international investors made investments into CEE-based companies. We also got two companies through Y Combinator, through the network and help of Dan Bragiel and the way he really working with those companies. Together, we helped the founders think very strategically about the decision to go for this ‘cos it really needs to make sense for the company. But once that decision was made, we connected them with the top founders and experts globally in countries they wouldn't otherwise have had access to.

We also help hire top talent to companies like hiPets. We helped them find both a co-founder and the first main product person and some of the most successful people in their industries. And we can do that across industries and geographies. We have very concrete cases where we’ve connected our founders to leading enterprise partners who then become investors.

So I guess Borys is super vocal about this value add?

Those are things we've already done. But when I talk to founders, I don’t promise those things. Instead I would only say that we use our network and that network is huge. No doubt it's unprecedented for Central Eastern Europe. I really don't think there is a fund with a network like ours considering Paul Bragiel and the vast ecosystem the team has built globally.

But at the end of the day, it's all in the founder's hands to really use that. Top founders are really good at picking the right time and the right people to reach out to get something from.

A matter of speed

Finally, we’ve referred to SMOK as a US fund. And that’s not because the team is there or the domiciliation of fund (it’s actually, technically speaking, a dutch domiciled fund). But because of the spirit, network, processes and philosophy. And there’s one thing that US funds are known for: Speed.

In a lot of Eastern European nations, it's still okay for investors to do three months due diligence and to be wiring half the commitment a year after signing the term sheet. This is really bad behavior. For us, it’s just natural that we take the US approach. Once we sign a term sheet, we want to wire the money in less than a month and usually within two weeks.

Of course, being quick to wire the money after signed term sheet is just a tiny part of speed. But it’s the first place to let speed fall out of your process if you’re not truly committed to speed as a philosophy. And consequently, also the perfect place to check if speed is truly core to the team or just borrowed feathers.

6. Terms & Fundraising

So, let’s start with the terms:

First close: 2022 H2

Size: 50M€

Mgmt fee: 2% p. a.

Carry: 20%

Timing: 5+5+2

Now let’s look at the fundraising strategy

Started fundraising in Autumn 2021, raised EUR 14M from 49 private investors from US, Taiwan, Poland, Slovenia, Czech Republic, Slovakia and Romania. Received verbal commitments from strong local and regional institutional LPs.

First closing was fully private at EUR 14M. Finalized in October 2022.

Second close is capped at EUR 50M with 2.5M EUR left to raise. The planned closing is the end of Q1 2023.

Now the interesting part.

We asked Borys: So why should LPs care about SMOK when there’s so many funds out there that we can invest in?

His reply was genius:

I don't want boring LPs. I don't want LPs that do it just for the returns. I want LPs that are entrepreneurs, friends, people who are like us, who care about the community in Central Eastern Europe and want to be part of something big. Of the big force that we’re building.

So it's okay if you don't invest, it's okay! Because if you don't, that usually means your culture, your way of thinking about venture is different to ours. And that's fine! I want this to be a bunch of people who believe in the common vision of how venture capital should work in Central Eastern Europe.

If you feel that makes sense, and if you don't think we’re complete freaks - and maybe even if you do feel we’re complete freaks, but you still want to do it - then we’re probably a good fit.

And this rationale is reflected in the super powerful LP base Borys and the team have built as it consists of the founders of top startups by Eastern European entrepreneurs including founders of two CEE unicorns. To put some names to the roster, it’s the founders of companies like Ceneo, Gamedesire, Picadilla Games, Divante, 7Bulls, K2 (Poland), httpool (Slovenia), as well as early employees of top US startups such as Datadog and Sumologic.